Summary:

- AT&T’s common stock price is advancing as the management strategy gains traction with the market.

- The stock’s forward price-earnings ratio is currently around 10, indicating it is undervalued compared to the broader market.

- A price-earnings ratio of 13 is achievable as the company transitions to a growth and income play.

- The stock has seen one of its best annual performances as the free cash flow pattern appears to be confirmed.

- The positive free cash flow comparison year-to-date is still largely due to the first quarter comparison.

hapabapa

Back on April 8, 2022, Warner Bros. Discovery (WBD) announced that the sale of the units from AT&T (NYSE:T) to the new company had closed. Ever since that announcement, the company has been refocusing operations for greater efficiency and more profitability. The last article noted that the market really was not crediting management for progress made to the extent of the progress made. The continuing rise of the stock price would seem to indicate that more market pessimism is abating. But if you believe that management sold the divisions to Warner Bros Discovery to increase the ongoing value to shareholders, then the stock price has more to go.

Stock Price Action

With any major event, the bad news, usually in the form of write-offs, comes first. The refocusing effort, especially with large companies, takes some time to show.

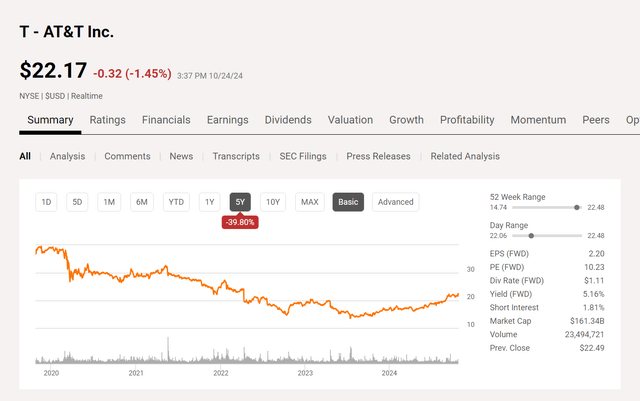

AT&T Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 24, 2024)

From the chart, the stock price dropped from the low $20’s to a post spinoff value of roughly $19 (back in April 2022 on the spinoff date). Only recently did the stock price get back to that range.

Clearly, the initial effort to refocus the company spooked Mr. Market. Now that things have been underway for some time and there is evidence of some success, the market is restoring some of the value to the company stock price. But notice that the forward price-earnings ratio is still only about 10. That is a dirt-cheap ratio compared to much of the market.

As the company carries out its plan to become a growth and income play, a price-earnings ratio of 13 would not be all that optimistic to expect. Of course, Mr. Market wants some proof of that strategy.

Cash Flow

The stock performance is closely linked to free cash flow. The new pattern has been a big fourth quarter cash flow that is associated with many retail type businesses. Since this company sells cell phones, that qualifies as retail. This is a big difference from the old phone business, where really no one thought of buying a landline phone for a gift.

This stock has actually had one of its best annual performances in some time. The reason is that the new cash flow pattern was not believed. As one of my older articles noted, the first quarter benefitted from a giant positive free cash flow comparison.

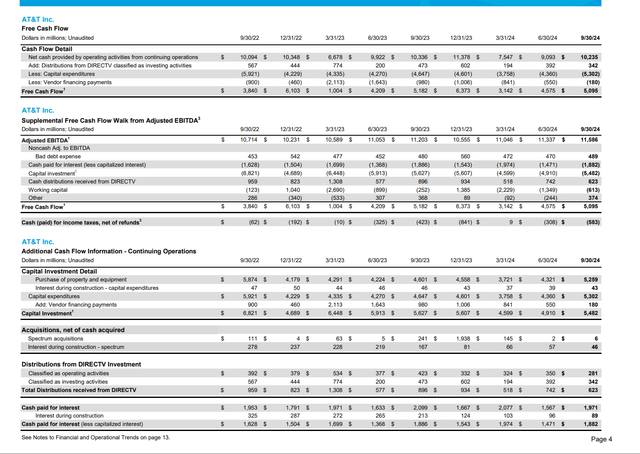

AT&T Free Cash Flow Trend And Material Details (AT&T Third Quarter 2024, Trending Schedule)

Note that the last two quarters of free cash flow had flat comparisons (roughly) with the previous fiscal year (same quarter). So far, capital expenditures have held steady.

But given that management has guided to a front-end capital expenditure, it is very likely that capital expenditures will be down for the fourth quarter and fiscal year. This is important because the company did have to play “catch-up” and therefore either should grow more for the same level of capital expenditures in the future or spend less for long-term assets.

Note that capital investments in the EBITDA calculation are already heading down. That is probably good news for future free cash flow calculations, as long as it continues.

Year-To-Date contributions from DIRECTV are down. That should mean that cash flow improvement is coming from company operations to at least make up for this gradual decline.

What appears to be the most interesting is that Mr. Market is far more interested in the sizable third quarter cash flow that mimics the pattern of the last fiscal year. It is not so much the positive year-to-date comparison as is the pattern repeating as management has been confident it would.

This would seem to imply that the refocusing process is going rather well and is likely to enable the company to show cash flow growth until earnings from the growing businesses overshadow the declining businesses on a permanent basis. After all, there was a non-cash impairment charge that the market did “not even blink about” which is a bit unusual for this market.

In the future, fourth quarter business is likely to dominate first quarter cash flow. If that fourth quarter business becomes large enough relative to the first quarter, the first quarter cash flow comparisons could gyrate depending upon how good the fourth quarter comparison was each year.

Overall Summary

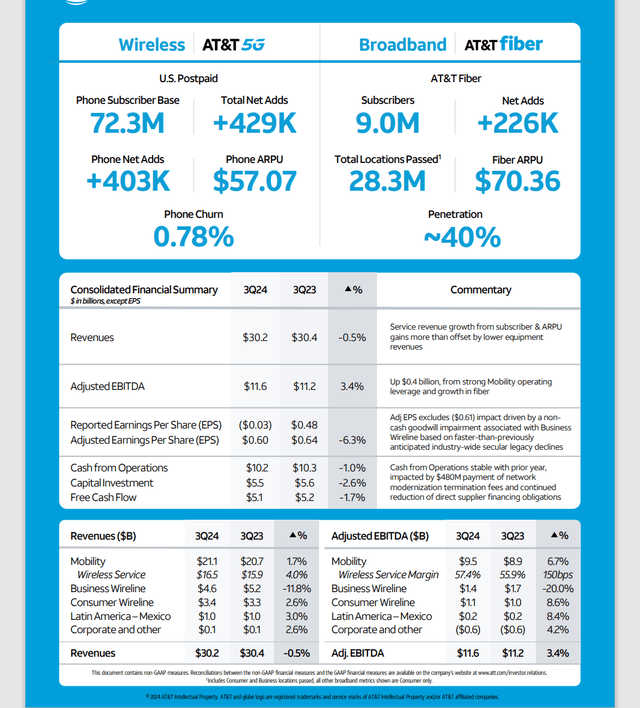

Overall, the summary picture was a maintenance picture that was slightly on the negative side.

AT&T Summary Of Third Quarter Results (AT&T Third Quarter 2024 Highlights Release)

The overall financial picture is still one of where the declining businesses still cancel out the growth shown at the top in the company summary. At some point the refocus efforts will “max out” and no longer help the company post better cash flow or EBTIDA (as shown above). But with large companies like this one, that refocus effort could get the company through a few more years of positive comparisons that the market cares about.

Nonetheless, it would be wise to not expect a smooth transition from the refocus efforts to the growth story dominating. One can always hope though. If it does happen, then that is definitely better for the stock price. But such transitions are never guaranteed to be smooth.

Summary

The “Business Wireline” decline is a bit faster than expected. This has slowed the transition to overall revenue growth, as shown above. What is getting the company through that decline is the refocus efforts that are resulting in less capital expenditures and probably less expenses as well. With a large company like this one, the refocus efforts could show overall positive results for some time to come.

The stock price is finally responding to the efforts of the company to basically transition to a cell phone carrier. After years of subpar results, the improvement is finally beginning to show for investors.

The stock remains a strong buy on the idea that this company will continue to move towards a growth and income story. The market is beginning to finally worry a lot less about the dividend and debt repayments as cash flow grows.

Similarly, the debt ratio is slowly coming towards the management goal. It will be interesting to see how the future unfolds for this industry. But this is a management that made a very rare and successful transition to the modern industry from the old landline industry.

Many times, when something like this happens, the old industry disappears, and new companies take the place of the old-established names. Clearly, this established giant has some competition. But it is also clear that AT&T is here to stay once again.

The transition did have missteps that cost shareholders. But the company is now in a position to make up for those missteps. For new investors, that means there is a decent return ahead with lower than usual risk due to the company size and geographic diversification.

Risks

This company had quite a transition due to the invention of the cell phone. Another future technology innovation could usher in more transitions in the future. There is nothing on the horizon now. But technology advances rarely give much warning. Therefore, management needs to stay vigilant.

Maintaining an adequate competitive edge in the industry is far from guaranteed in the future. Previous management became complacent and overestimated their capabilities. That led to some losses and shareholder consternation. Now the company appears to be back on track. But there is no assurance that management can remain focused in the future.

The loss of key personnel could materially set back the future of the company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T WBD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation for the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits its own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.