Summary:

- AT&T has lost about 25% of its market value this year due to various negative factors, prompting a reevaluation of its stock value using different dividend discount models.

- The valuation scenarios suggest a fair value range of $10.8 to $12.7 per share, which does not necessarily indicate a sell, as potential improvements and growth are not captured in these calculations.

- Compared to Verizon Communications, AT&T’s stock is less attractive due to lower profitability and efficiency metrics, less favourable liquidity ratios, and worse sentiment.

- We maintain our “hold” rating to see how the uncertainties develop in the near future.

FactoryTh/iStock via Getty Images

Introduction

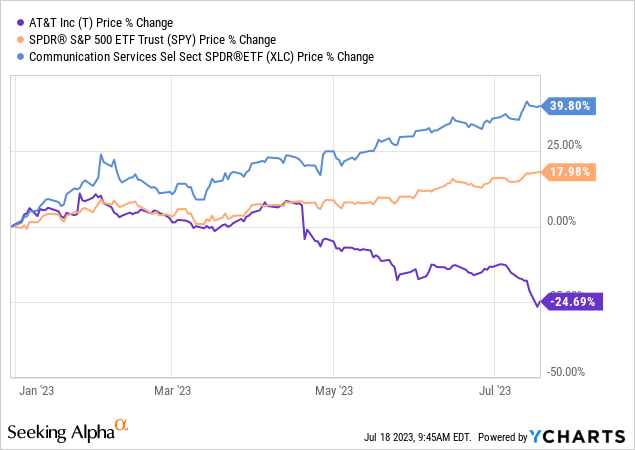

AT&T Inc. (NYSE:T) provides telecommunications and technology services worldwide. Recently, the firm has been in the spotlight for several reasons, most of them being negative. As a result, year-to-date AT&T has lost about 25% of its market value, while the broader market has gained 18% and the communication services sector has gained almost as much as 40%.

In the recent past, news concerning rating downgrades, disappointing subscriber growth and issues related to lead cables have been consistently driving the stock lower. These headlines have attracted the attention of many investors, who are wondering now, is it the right time to start a new position or add to an existing one?

We will try to answer this question today, by valuing the stock using different dividend discount models. We will be combining these with scenario analysis to come up with a range of possible and likely fair values.

We have already published an article on T in July 2022, and back then, we have rated the firm’s stock as “hold”, because of their long-standing commitment of returning value to their shareholders in the form of dividends. At that time, we have calculated the stock’s fair value to be in $16 to $23 per share assuming a required rate of return of 8% and a perpetual dividend growth rate of 1% to 3%. As the stock was trading at $20 per share, we believed it to be roughly fairly valued. Since then, the stock price has declined by 33%.

Today, after the months-long decline in share price, we once again came up with a neutral rating, due to the valuation and the potential risks in the near term related to subscriber growth and the lead cables allegations. So let us dig deeper into how we established our rating.

Valuation

Just like previously, we will be again using dividend discount models to estimate the fair value, but first, we will update our assumption with regard to the required rate of return, and then come up with a set of scenarios, based on different dividend growth.

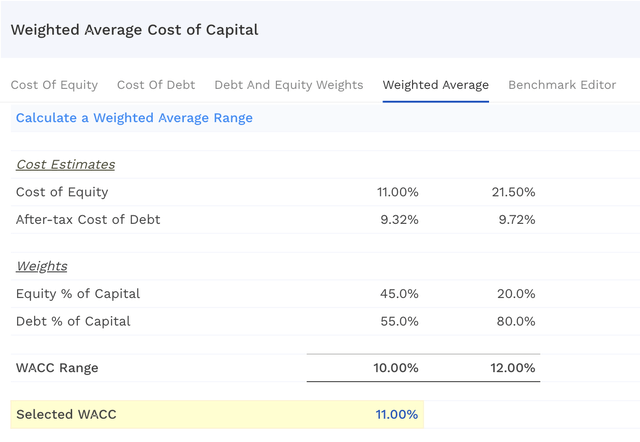

Why is it needed to update the required rate of return? When the macroeconomic environment changes along with the company’s financial situation, the cost of capital can change significantly. For example, increasing the amount of debt on the balance sheet may increase the cost of future debt financing as well as the cost of equity. Risks related to ESG factors may also lead to higher costs. The Fed’s actions and decisions related to interest rate hikes also play a crucial role. So it is important that when we update our valuation model, the latest cost of capital estimates are accounted for so that we can come up with a reasonable required rate of return.

Weighted average cost of capital (finbox.com)

According to the latest estimates, the firm’s weighted average cost of capital is about 11%. We will be using this figure as the discount rate in each of the following scenarios.

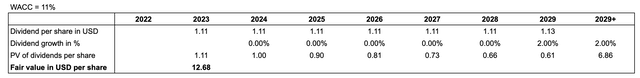

Scenario 1

In this first scenario, we assume that T will continue to pay its current dividend for the upcoming 5 years, without any increases, but from 2029 the firm will increase these payments by 2% annually in perpetuity.

These assumptions result in a fair value of $12.7 per share, representing a roughly 10% downside from the current level.

So what are the reasons behind our assumptions?

- In the near term, T will keep struggling with subscriber growth and increased competition.

- The worries about the lead cable issue also materialise and significant additional costs will be incurred to replace these cables or settle claims related to them.

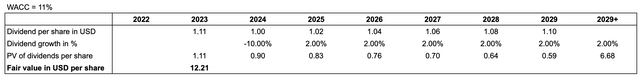

When looking at the latest financial statements, specifically the cash flow statement, we can see that the firm has generated enough free cash flow to cover the dividend payments.

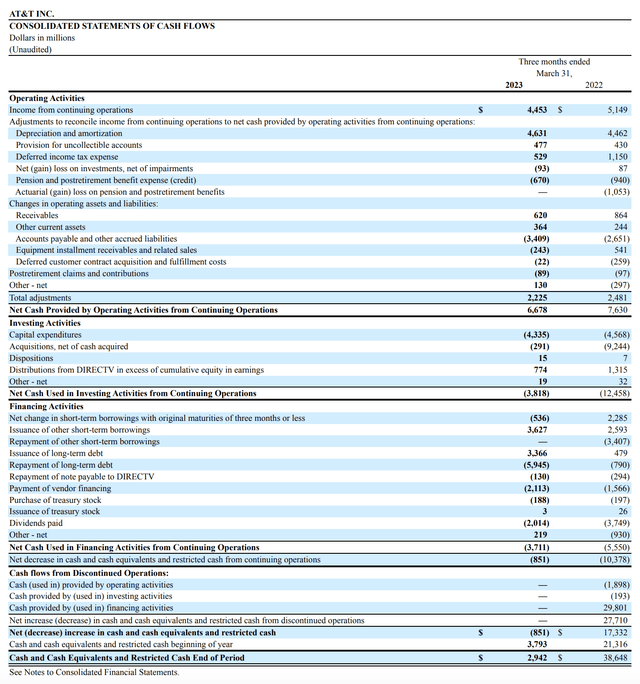

Scenario 2

In this case, we are even more pessimistic, and we assume that T will not have enough free cash flow to cover its dividend payments in the coming years. If we refer back to the cash flow statement above, we can see that T is currently above to cover the dividends with its free cash flow, but if the CAPEX jumps significantly due to the lead cable issue, the dividend may be in jeopardy. Although T has already reacted on the issue with a statement disagreeing about the WSJ allegations, we still see it as a substantial risk in the near term.

This means that we will include a dividend pause for the next two years, then dividends are continued in 2026 at the current level, without any increase, and lastly, from 2029 onwards, we once again use a 2% perpetual growth rate.

These assumptions result in a fair value of $10.8 per share, representing a roughly 23% downside from the current levels.

In our view, these estimates are likely to be overly pessimistic, and we do not expect the firm to pause dividends in the near term. Of course, if a substantial portion of their infrastructure needs to be changed, even these estimates may be too high. Before starting a new position, investors definitely need to consider this risk and its probability of occurring.

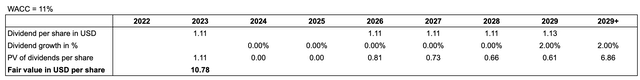

Scenario 3

In this third scenario, we also appreciate the headwinds and expect the dividend may need to be cut by 10% in 2024. However, from then onwards, we already assume a perpetual growth rate of 2%.

These assumptions result in a fair value of $12.2 per share, representing a 13% downside from the current price level.

So what does this fair value range from $10.8 to $12.7 mean? Does it mean that you should be selling?

Definitely not. These scenarios are to illustrate how much the dividends only may be worth in different situations. An improving macroeconomic environment, increasing EPS, multiple expansions are not directly captured in these calculations. We believe that, at this point, T’s stock is not a sell.

Comparison to Verizon Communications

We have recently published an article about Verizon Communications (VZ), so we have decided to add a brief comparison before concluding our article. In that article, we have rated VZ’s stock as a “buy” due to its attractive dividends, dividend growth, and valuation. If we compare the two firms, we are more in favour of VZ. The primary reasons for this:

- More attractive valuation based on the dividends, representing lower downside risk than T’s stock at the current valuation

- Better profitability and efficiency metrics

- Better liquidity ratios, including both quick- and current ratios

- Better sentiment around the stock, including news about stronger subscriber growth

Conclusions

The recent negative sentiment around T’s stock has kept pushing the stock price lower, eventually reaching the lows of several decades. While the uncertainty around subscriber growth, lead cables, and competition is high, we believe that the current valuation already captures many of these impacts.

Our scenario analysis mainly focused on further downside risk, indicating fair values between $10.8 and $12.7 per share. This however does not mean that the stock is a “sell” at the current levels. Many potential tailwinds are not captured here, including the potential improvement of the market environment in the near- to mid-term, potential EPS growth or multiple expansions.

In comparison to VZ, we are more in favour of VZ, and we have provided a detailed view on the reasons in our previous article.

For now, we maintain our “hold” rating on T to see how the uncertainties develop in the near term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. This article has been co-authored by Mark Lakos.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.