Summary:

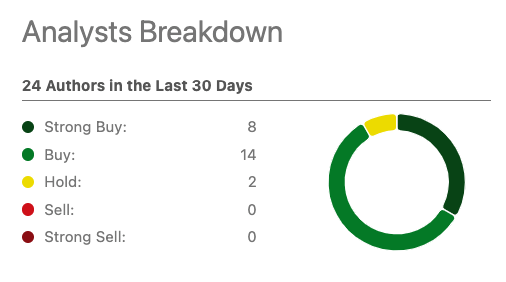

- Since the start of 2024, AT&T has received an overwhelming positive Buy rating on Wall Street and other Seeking Alpha analysts.

- It is necessary to have a bit of a contrarian view for a mature company like AT&T whose business model is unlikely to change in next few years or even decades.

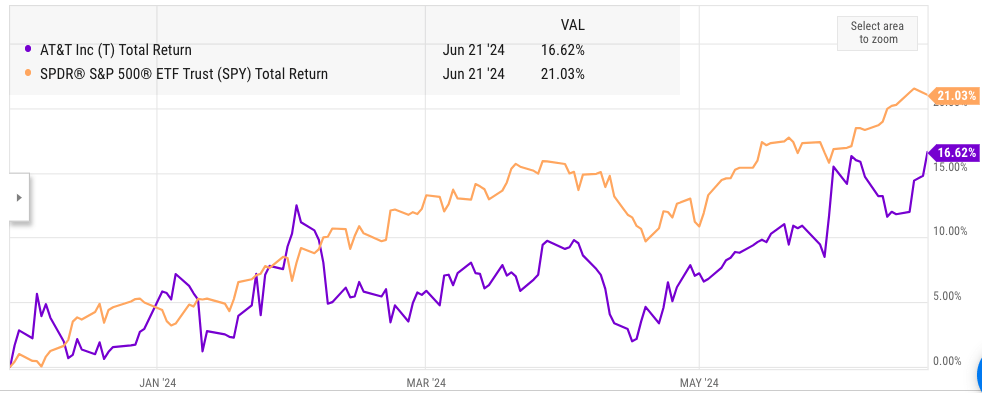

- Since my last Sell rating at end of 2023, AT&T has shown strong total returns of 16.6% but these returns have easily been overshadowed by S&P500’s 21% total return.

- AT&T remains a value trap for long term investors and the recent improvement in FCF has been possible due to curbing of network investments.

- After the recent rally, investors should question about the future upside potential and the possibility of AT&T beating or even matching the returns of S&P500.

jetcityimage

AT&T (NYSE:T) stock has received a very strong bullish outlook from a majority of analysts on Wall Street in the last few months. Even on Seeking Alpha, the sentiment has been very bullish. In the year to date, there has been only one Sell rating for AT&T stock on Seeking Alpha while there have been dozens of bullish ratings. However, it should be noted that AT&T is a very mature company and its business model is not going to give any new surprises. We have seen Meta (META) give massive returns since hitting the bottom in 2022 with the help of cost cuts and better use of tools to improve ad sales. AT&T cannot do either and any increase in revenue or decrease in expenses would be very modest.

My previous article in late Novemeber 2023 looked at the positive results of AT&T in that quarter but I gave the stock a Sell rating due to longer-term challenges. Since then, AT&T stock has reported 16.6% total returns which has been overshadowed by the 21% return of S&P500 during that period. AT&T gave a better dividend yield of close to 6.8% when the previous article was published as compared to 6% it gives currently.

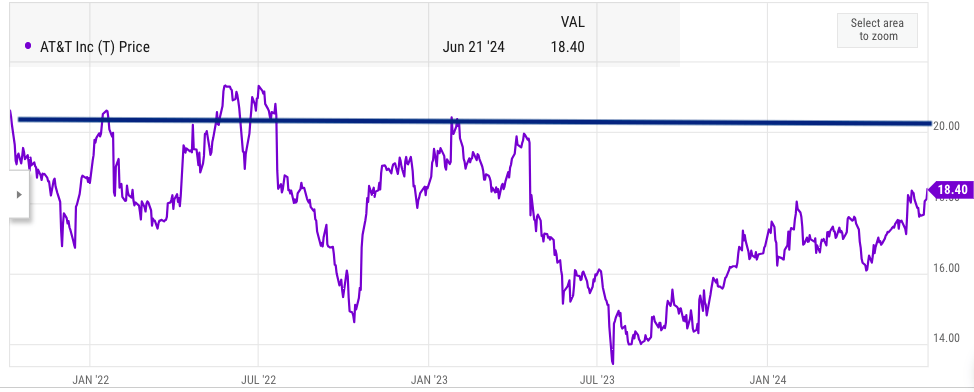

Investors need to question about the future upside potential for AT&T stock after the recent rally. The stock is close to the $20 level which it has not been able to break out of for the last few quarters. Most of the positive news about FCF improvement has been absorbed by Wall Street and it is not clear how the management can give another big positive surprise that can help the stock. I believe the stock could significantly underperform S&P500 in the next few quarters as some of the investors balk at lower dividends and others take out the profits after the recent rally.

AT&T fundamentals are a mixed bag

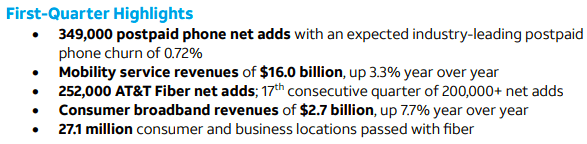

AT&T’s recent first-quarter highlights showed several positive numbers. The postpaid churn metric was quite good at 0.72% and AT&T Fiber net adds was 252,000. This was the 17th consecutive quarter of 200,000+ net adds. The consumer broadband revenue of $2.7 billion was also up by 7.7% year over year.

Company Filings

Figure: First-quarter highlights of AT&T. Source: Company Filings

Company Filings

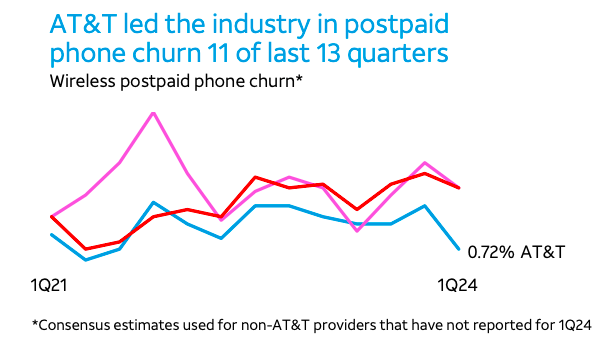

Figure: Low churn rate of AT&T compared to competitors. Source: Company Filings

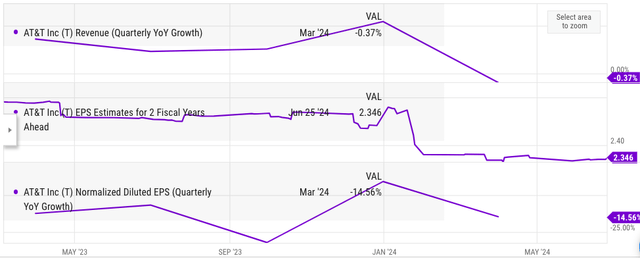

However, all these numbers got hidden behind some of the key metrics like revenue and EPS growth. The forward EPS estimates of AT&T have also fallen which shows that Wall Street does not have a lot of faith in the company’s ability to expand the bottom-line.

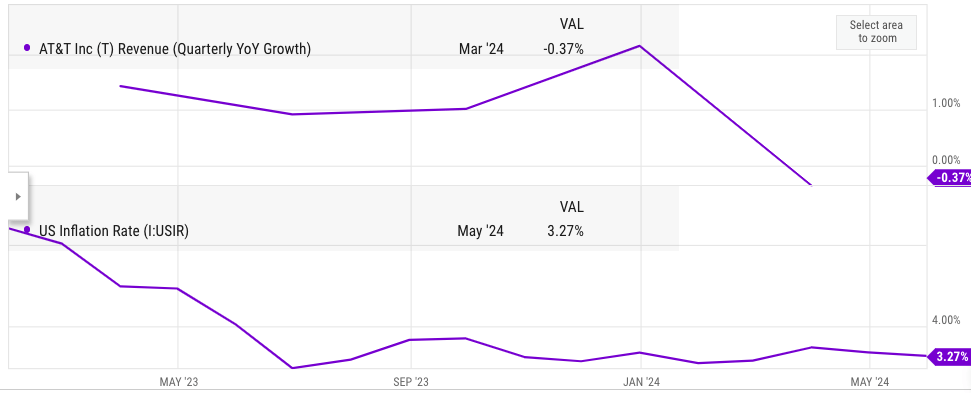

Ycharts

Figure: Key metrics of AT&T in the recent quarter. Source: Ycharts

We are in a high inflationary environment. AT&T should have been able to show reasonably good revenue growth in this situation. However, the company showed a YoY decline in revenue growth. The EPS also declined by 15% compared to the year-ago quarter. There has also been a significant dip in the EPS estimate for 2 fiscal years ahead.

The low churn rate in postpaid is certainly important and mobility service growth can be viewed positively. But the core issue is that these factors should move the needle for the core revenue and EPS metric. If this does not happen in the next few quarters, it would be very difficult for AT&T to sustain the current momentum.

The free cash flow was $3.1 billion, up $2.1 billion YoY. However, this increase has largely been due to a decrease in capital investment instead of an increase in revenue base. Despite these positive numbers in the recent quarter and the previous quarter, the stock is still lagging behind S&P 500 in terms of total returns.

AT&T is still behind S&P500

Ycharts

Figure: Total returns of S&P500 and AT&T since the last article. Source: Ycharts

Since my previous thesis in late November 2023, AT&T stock has reported good bullish momentum but it has still lagged behind the broader S&P500 in total returns. The recent rally in AT&T can be looked at as its good fortune where Wall Street has maintained a bullish sentiment overall for the last few quarters. However, the real test will be when this bullish run stops in S&P500. Will AT&T manage to outperform S&P500 after its already long bull run.

A contrarian view might be necessary

AT&T’s business model is very mature and we are not going to see any major surprises unless the management announces imprudent acquisitions similar to last decade. In this highly stable business model, it should be very difficult to have a very bullish sentiment. However, the recent rating by most of the analysts on Wall Street suggests a strong bullish opinion. Even on Seeking Alpha, there has been only one Sell rating year to date out of several dozens of theses published.

Seeking Alpha

Figure: Recent ratings of analysts on Seeking Alpha. Source: Seeking Alpha

Investors should retain some contrarian opinion for a mature company like AT&T. This can help them pick up the ideal entry point and avoid getting into the stock at close to its peak.

Ycharts

Figure: Comparison of AT&T YoY revenue growth and US inflation. Source: Ycharts

AT&T’s YoY revenue growth has lagged the broader US inflation rate significantly for a long time. This shows that the company does not have the pricing leverage to match the increase in overall living costs. It is unlikely that we will see a change in this trend due to the current competitive environment. This makes it difficult for AT&T to deliver revenue growth which can cause a big inflection in stock price.

Stock reaching close to its peak

Ycharts

Figure: AT&T stock price movement in the last few years. Source: Ycharts

Over the last three years, AT&T stock has not been able to break out of the $20-$21 level upper limit. It is possible that the stock becomes less attractive for dividend investors at $20 range which limits any further bullish rally in the stock. After the recent bullish run, AT&T stock is very close to $20 upper range. As mentioned above, it is highly unlikely that the management can show big surprise in some key metrics which can help the stock continue with its bullish run.

Investors looking for a big inflection point for AT&T might be disappointed. The dividend yield is already very close to 6% and could soon fall below this level. The management had earlier announced that they would focus on reducing debt. This limits the possibility of a dividend hike as the company is already paying over $8 billion in dividends.

After the recent bullish run, AT&T will find it very difficult to exceed or even match S&P500 returns over the next few quarters which makes the stock a Sell at the current price.

Investor Takeaway

Since my last thesis in late 2023, AT&T stock has shown 16.6% total returns but this has been beaten by S&P500 which showed 21% total returns during this time. Even during one of the best bullish runs by the stock, it has not been able to match the returns of the broader index. An overwhelming number of analysts are bullish over AT&T which can be seen as a warning sign for a mature company like AT&T. We are highly unlikely to see any surprises from AT&T in terms of revenue growth or profitability due to its business model.

The stock is already close to its recent peak of $20 and the dividend yield will likely dip below 6% making the stock less attractive to dividend investors. While the recent bullish rally has been promising I believe caution is required at the current price. These factors make the stock a Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.