Summary:

- AT&T stock has generated very disappointing results for investors who have been lured in by its juicy dividend and free cash flow yields.

- T stock looks cheaper than ever thanks to its terrible year-to-date performance.

- However, we believe T stock continues to be a bad investment and share three reasons why.

Inside Creative House/iStock via Getty Images

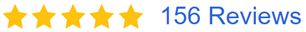

AT&T Inc. (NYSE:T) stock has generated very disappointing results for investors who have been lured in by its juicy dividend and free cash flow yields. For example, since the beginning of 2020 (a ~3.5-year span), the S&P 500 (SP500) has delivered a solid 43.31% total return, while T has delivered -28.86% total returns even when accounting for its high dividend payout:

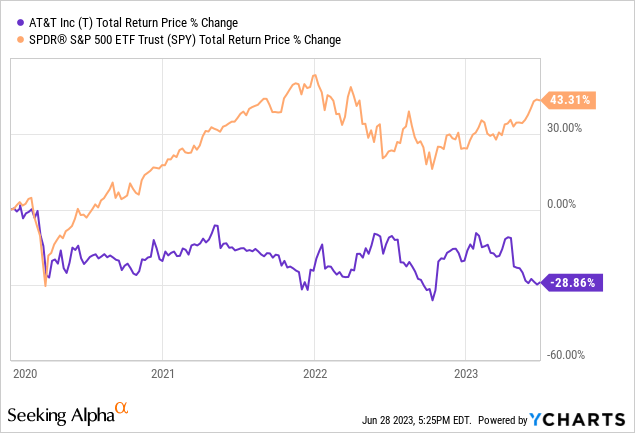

Given its abysmal recent performance, T stock looks cheaper than ever, once again luring in many fresh investors with its juicy yield:

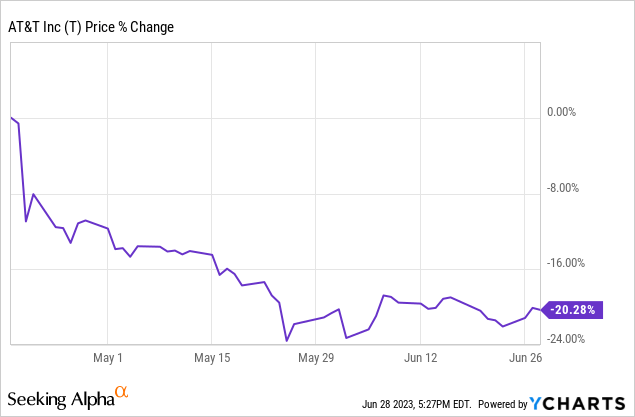

This is clearly evidenced by the slew of bullish articles being published on T stock lately:

T Stock Analysis (Seeking Alpha)

However, we believe T stock continues to be a bad investment and share three reasons why in this article:

#1. T Stock Has Amazon Risk

First and foremost, if T stock had one thing going for it, it was that its core business model was stable and dependable. It may not grow very fast (more on that later), it may not deliver attractive returns on invested capital, and it may not even deliver market-crushing returns, but at least investors could sleep well knowing that it would be resistant to disruption and significant outside competition.

Well, Amazon.com, Inc. (AMZN) has since seriously threatened that notion thanks to a recent report that they are considering entering the mobile services sector by leveraging their Prime membership network to offer discounted cell phone service subscriptions. This of course would be a very tough blow for T to overcome as it would undoubtedly lose a significant amount of its customer base to AMZN in such a scenario, further pressuring their already heavily leveraged balance sheet (more on that later). Moreover, AMZN would undoubtedly have too many resources for T to fight against given that its market cap dwarfs T’s, its balance sheet is in much better shape, it can attractive much higher levels of talent than T can given its reputation and involvement in cutting edge technology and business innovation compared to T’s well-deserved reputation as a bureaucratic stale old utility-like stalwart.

AMZN also has a track record – with a few exceptions – of excelling at disrupting the industries where it gets involved and has proven to be extremely effective at pillaging and ultimately destroying inefficient, bloated industry stalwarts. T fits that description to a tee (pun intended).

While AMZN’s entry into the mobile services sector is not a given at this point, the fact that it is a growing risk should put fear into every T investor. Such a scenario playing out could well mark the official beginning of the end of T. The dividend would likely be on the way out at a minimum, as T would be forced to slash pricing in order to stay competitive and pour every spare dollar into debt reduction. As a result, T deserves a valuation discount to compensate for its growing AMZN risk.

#2. T Stock Is Facing Growth Headwinds

T is also facing serious growth headwinds at the moment without even accounting for a potential AMZN headwind. Between the loss of their media business, their burdensome balance sheet, high dividend payout obligation, and capital-intensive low-ROIC core business, T is having a hard time generating meaningful growth.

Analysts share this concern, with them projecting a meager 1.2% revenue CAGR and 1.2% normalized earnings per share CAGR through 2026. The dividend faces an even less optimistic growth outlook with just a 0.8% CAGR projected through 2026.

Given rising interest rates that increase its cost of capital, high inflation rates that increase its costs, persistently stiff competition in the sector – especially with T-Mobile’s (TMUS) merger with Sprint making it even more competitive with industry powerhouses T and Verizon (VZ) – and T’s high capital intensity and extremely weak 3.7% TTM return on assets, it is hard to see how T manages to accelerate its growth rate beyond ~1% for the foreseeable. Given where inflation currently is and appears likely to remain for the foreseeable future, T is actually shrinking in real terms. This puts the entire burden on the dividend yield and potential valuation multiple expansion to deliver satisfactory total returns to investors.

#3. T Stock Has An Unimpressive Total Return Proposition

Unfortunately for T investors, despite the sell-off in the stock price this year, the valuation is still not compelling enough to make it attractive from a total return standpoint. Yes, the 7.1% dividend yield is very attractive and unlikely to be cut anytime soon (barring an AMZN entry into the industry). However, that is where the good news stops.

Assuming it can hold its current valuation multiples steady and can continue to squeak out ~1% annualized earnings per share growth, it can deliver a market average 8% total return CAGR. However, it may not be able to do even that. Its EV/EBITDA of 6.68x remains above its historical average of 6.41x despite interest rates being on the higher end and expected growth rates being on the lower end of where they have been during that time span.

As a result, it is hard to make the case for multiple expansion moving forward and a case can actually be made for further multiple compression. We therefore see 8% per year as the likely total return ceiling, with multiple scenarios potentially leading to lower returns than that moving forward.

AT&T Inc. Stock: Investor Takeaway

T has an abysmal track record of dividend cuts, ill-fated acquisitions, and massive total return underperformance. Moreover, it has a heavily leveraged balance sheet that is forcing management to allocate excess cash towards improving it. Its free cash flow generation in Q1 significantly underwhelmed expectations, calling into question management’s ability to deliver on their guidance for this year. Its business has poor economics, with chronically high CapEx needs and extremely low returns on assets.

It is also growing slowly and facing stiff headwinds from competition, inflation, and rising interest rates. Now it also faces the prospect of a mortal threat from AMZN potentially entering the arena.

To top it all off, its total return potential is unimpressive at best and poor at worst. Yes, the dividend is attractive and sustainable (for now). However, with so many other great high yield opportunities available today, AT&T Inc. by comparison looks like it is still a bad investment.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!