Summary:

- AT&T is executing a focused and disciplined strategy to optimize and grow core businesses, while competitors focus on M&A.

- Telecom industry tailwinds are improving, providing additional room for growth.

- DCF analysis generates a price target of $26, up from $24 in my previous analysis and 46% upside from current pricing.

jetcityimage

I am updating my ongoing analysis on AT&T, Inc. (NYSE:T).

I previously rated AT&T a buy for the following reasons:

- DCF analysis yielded a price target of $24, 40% upside from pricing at the time

- Sensitivity analysis on the DCF suggested a wide margin of safety

- The business had significant room to grow via strong fundamentals

- The dividend was solid and likely to grow

Since then, AT&T has returned more than 7%, largely in line with the S&P 500.

Looking through the data and reading between the lines of the most recent earnings call, I am more bullish than ever on AT&T. AT&T is executing on a focused and disciplined growth strategy to drive value from each customer in the most cost effective way. Contrast this with T-Mobile (NASDAQ:TMUS) and Verizon (NYSE:VZ) who are pursuing M&A, ridiculous spectrum purchases, and throwing darts at the wall to see what sticks.

Beyond the growth strategy, industry tailwinds are blowing stronger and long-run expectations are improving. In addition, DCF analysis yields a price target of $26, 46% upside from today’s pricing. With a solid margin of safety and improving fundamentals, I raise my rating from buy to strong buy.

Valuation And Sensitivity

I updated my ongoing DCF analysis for AT&T using the following drivers:

- Management delivers the mid-point on the as yet unchanged, 2024 guidance

- 7% discount rate assuming a current WACC of 6.5% as the rate will increase with AT&T deleveraging plan

- 1% long-run growth rate as a conservative estimate to hedge 6.5% market growth against AT&T’s scale and cost base

- 3% revenue growth through 2027, pacing behind the overall telecom market at 6.5% due to AT&T’s scale. 3% revenue growth is assumed to be achieved primarily with organic growth and fiber offsetting declines in copper and traditional business services

- 3% growth in expenses based on US inflation forecast at 2.40% for 2025 balanced against union considerations

This DCF analysis yields a price target of $26.07, 46% upside from today’s pricing.

T DCF Analysis (Data: SA; Analysis: Mike Dion)

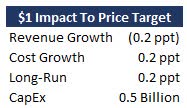

Sensitivity analysis continues to suggest a wide margin of safety for AT&T across revenue assumptions, cost assumptions, long-run rate, and capital investment.

T DCF Sensitivity (Data: SA; Analysis: Mike Dion)

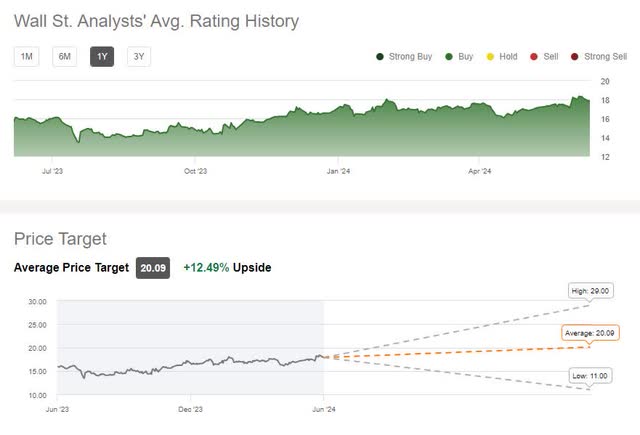

Wall Street continues to be bullish with over a year of buy ratings and an average price target of $20.09. While the average is below my price target, it sits nicely in the range from $11 to $29.

T Wall Street Rating (Seeking Alpha)

Focused Growth

AT&T is focusing on growing and optimizing its core businesses, while T-Mobile and Verizon distract themselves with M&A and new product lines. Here are some examples:

- T-Mobile announced the acquisition of US Cellular’s wireless business

- T-Mobile acquired Mint Mobile

- Verizon acquired Tracfone

- Verizon acquired Bluegrass

- Verizon is marketing another prepaid phone service on top of Visible and Tracfone, Total By Verizon

In addition, T-Mobile and Verizon have thrown questionable amounts of many at spectrum in order to support fixed wireless access.

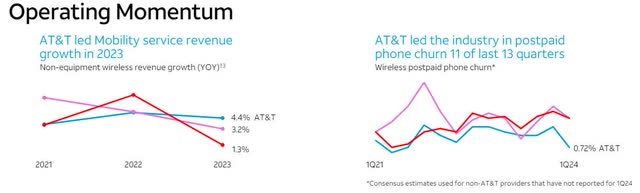

All of this while AT&T has doubled down on driving value from postpaid mobile and fiber wireline. On both fronts this strategy is working. AT&T has had the most consistent and now the highest growth in mobility revenue of the big three, and the lowest and most consistent churn in 11 of 13 quarters.

Mobile Business vs Competitors (T Investor Relations)

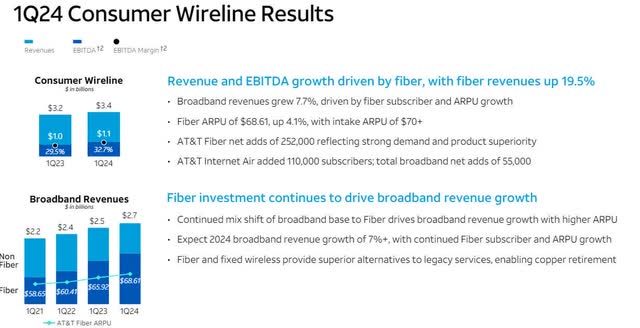

On the wireline side, AT&T Fiber and Internet Air have been able to not only offset copper declines, but actually grow the business both from a revenue and an EBITDA standpoint.

Consumer Wireline Business (T Investor Relations)

Management went into detail on this strategy throughout the last earnings call, emphasizing that they want to serve each locale with the highest value service. Overall, they believe that service is fiber, and they are using fixed wireless primarily as a way to transition customers from copper to fiber in a cost-effective manner.

Industry Tailwinds Increasing

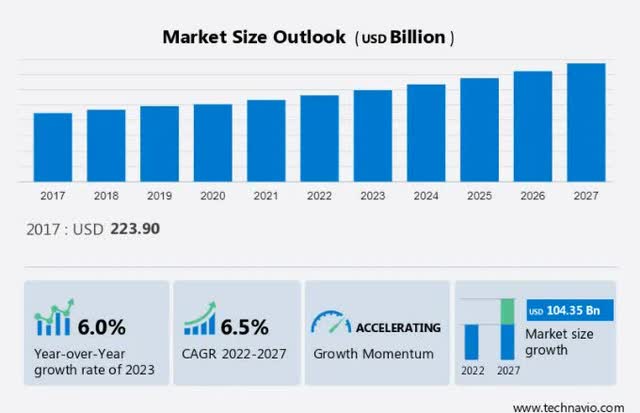

There has been an underlying belief that the telecom industry in the US was too mature to drive anything beyond inflationary growth over the long-term. However, from my last analysis to now, the CAGR expectation for telecom has actually increased and researchers believe growth momentum is accelerating. The 2022-2027 CAGR is now forecasted to be 6.5%.

Beyond the core telecom market itself, AI presents a great opportunity for telecoms both in their own operation as well as providing services for their customers. In the Q1 earnings call, AI was mentioned by management in both capacities and specifically called out as one of the factors accelerating deleverage.

AI Impact On Telecom (Veritis)

Note that I am only assuming the current trajectory of AT&T as well as management guidance in my DCF growth rates. Between the rise in market expectations and AI, there could be additional upside beyond my price target.

Downside Risk

The largest downside risk for AT&T is that they don’t generate sufficient return on their capital investments. With over $20 billion in annual capex forecasted for the near term, failure to deliver results will quickly weigh down cash flow and profitability. This is especially true for fiber installation, which is both AT&Ts growth business and a very high upfront cost.

The secondary (and connected) downside risk for AT&T is competitors using 5G fixed access to encroach on AT&T’s fiber territory. From my research, I do not believe 5G fixed access is competitive with fiber. That said, a critical mass of this service from both T-Mobile and Verizon could prohibit the growth that AT&T needs.

Verdict

AT&T has been focused on great execution and driving value from their core postpaid mobile and fiber wireline services while their competitors acquire companies and spectrum. This strategy has been paying off as key metrics remain stable while competitors falter and revenue and profitability grow in the core business.

In addition to the business strategy, industry tailwinds are improving as researchers raise expectations for growth in telecom and AI offers an additional opportunity for efficiency and services.

With a DCF generated price target of $26, 46% upside from today’s pricing and considering the factors above, I raise my rating from buy to strong buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.