Summary:

- AT&T has 6.3% Dividend Yield.

- Its TV and Media business units have been divested.

- Fiber and cellular 5G are the focus. Fiber expansion offers a growth opportunity.

- Pullback in price marked an attractive entry point for dividend-seeking investors.

Ronald Martinez

Investment Thesis

AT&T (NYSE:T) is a telecommunications company that offers wireless and wireline services to over 100 million domestic customers.

The company has had sustained efforts to streamline its business, including spinning off AT&T TV, Warner Media, and DirecTV. Fiber expansion and streamlined business combined with cost improvements of $6 billion in run rate. However, we do have concerns about the debt level and the company’s ability to reach its FY25 goals. AT&T offers income generation and an option on the expectations that a streamlined business will produce better profitability which should drive near-term earnings improvements even though the secular long-term growth potential is very modest.

Estimated Fair Value

EFV (Estimated Fair Value) = E24 EPS (Earnings Per Share) times PE (Price/EPS)

EFV = E24 EPS X P/E = $2.50 X 9.0 = $22.50.

This is a relative PE of half the broad market multiple.

|

E2023 |

E2024 |

E2025 |

|

|

Price-to-Sales |

1.01 |

0.99 |

0.98 |

|

Price-to-Earnings |

7.1 |

6.93 |

6.80 |

Business Overview

|

Service |

Revenue ($ Billions, 1Q23) |

Change Year-Over-Year |

|

Wireless Telecom |

$20.6 |

2.5% |

|

Wireless Services |

$15.5 |

5.2% |

|

Business Wireline |

$5.3 |

-5.5% |

|

Consumer Wireline |

$3.2 |

2.5% |

|

Other (Corporate, LATAM) |

$1 |

|

|

Total |

$30.1 |

1.4% |

AT&T operations now focus on communications, including wireless services, consumer and business wirelines. Currently, consumer wireline has roughly 30 million home passes, with 5G mobile network coverage reaching 288 million people.

AT&T in recent years, has seen 2 major spin-offs. In FY22, WarnerMedia was separated off and combined with Discovery to form Warner Bros. Discovery (WBD). Additionally, AT&T combined AT&T TV and DirecTV and spun it off as a combined streaming service in FY21.

Expansion

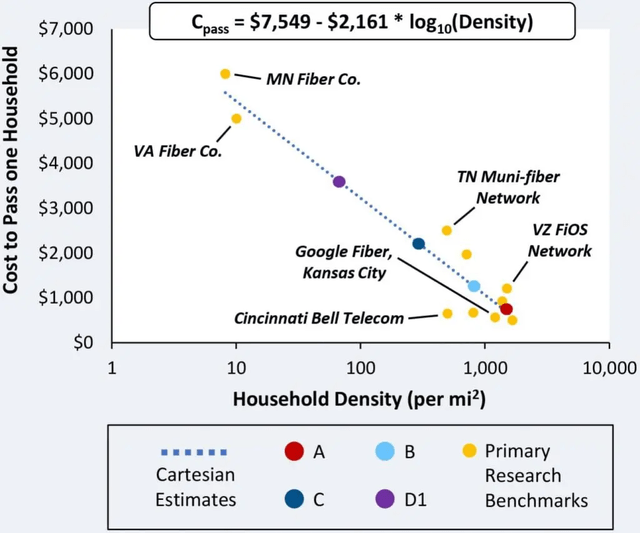

AT&T is replacing much of the old broadband copper cables with its Fiber network to improve customer connectivity. This will be an expensive process. Depending on the area, it can cost roughly $70,000 per mile depending on density.

Fiber provides higher speed and lower maintenance costs than old copper lines. This is largely due to Fiber’s longer life cycle and improved durability post-installation. In 1Q23, AT&T added 247,000 fiber customers and increased its market opportunity by additional 600,000 homes that were passed by ATT fiber. New adds were higher than expected, driving an ARPU (average revenue per user) increase by 9% to $65.92. Current fiber penetration is expected to be around 38% across the 19.7 million sellable consumer locations. AT&T has targeted 30 million Fiber locations by FY25 and is expanding at 2-2.5 million additions yearly.

Fiber Optic Network Construction (Dgtl Infra)

To aid in the Fiber expansion, AT&T will form a wholesale Fiber-optic reseller outside of AT&T’s traditional footprint. The Joint venture will be funded in conjunction with BlackRock’s alternative infrastructure business and will operate under the name Gigapower. Initial plans are 1.5 million additional consumers outside of ATT’s traditional footprint. Specific details are not yet available on the joint venture, but AT&T plans to focus on underserved areas outside of its existing wireline footprint.

The JV and existing Fiber expansion operations will be able to take advantage of the $42.5 billion FCC incentive program called BEAD (Broadband Equity, Access, and Development program). This fund will be distributed to states by a need-based system, with the first recipients expecting to take RFPs (request for proposal) in 3Q23.

Risk

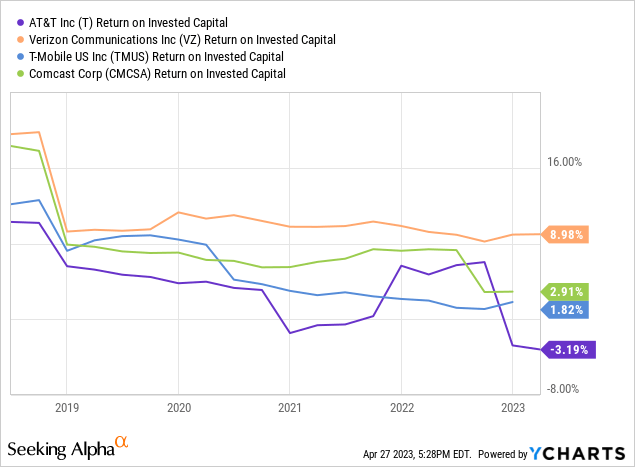

AT&T is a big company with a significant asset base but trails its peers regarding ROIC (return on total invested capital). While Telecom is a sector with razor-thin margins and high regulation, AT&T has consistently underperformed peers on ROIC

YCharts

While this number and the recent FCF (Free Cash Flow) shortfall could indicate capital-intensive projects without much short-term incremental cash flow, it could reveal a problem in management if the trend continues over the long term. With the shedding of Warner and DirecTV, this FCF reduction is likely a temporary setback.

AT&T has a large balance sheet with net debt of $128.4 billion. This level of debt is notable, considering the increases in interest rates and the reduction in FCF in 1Q23. In FY23 and FY24, management expects to decrease net debt and reach a target of 2.5X debt-to-EBITDA by FY25. Per the 1Q23 earnings call, most debt is financed at a 4.1% interest rate. In addition, much of the debt is not due until past 2036 giving plenty of flexibility and no debt repayment issues over the near term.

Outlook

1Q23 saw revenues increase 1.4% year over year, with expenses being flat year over year. The expected FCF was $2.5 billion, and AT&T only delivered $1 billion. This significant shortfall was caused by higher capital expenditure than expected. Management says that this fall was expected given several factors, such as device payments ending, usually the lowest new device volume in 1Q, and performance-based incentives being paid out in 1Q23. The company still expects a FY23 total FCF of over $16 billion, which is heavily back-end weighted. This would indicate record strength in Fiber expected for FY23. In addition to this FCF shortfall, AT&T has added roughly $3 billion in net debt in the trailing twelve months. Management says this year will be a down net year and expects to pay off debt as FCF comes in the latter half. Also, management states that the dividend will increase as credit quality improves and the debt level is reduced.

One of the company’s long-term initiatives is to generate roughly $6 billion annually in run-rate cost savings. Coupled with targeted incremental margin expansion, the net debt-to-EBITDA ratio of sub-2.5x by FY25 is realistic in our opinion. AT&T has a net debt of $128.4 billion, equating to a debt-to-EBITDA ratio of 3.2x. EBITDA is up by 8% in 1Q23. Additionally, the operating margin has increased 220 bps year over year, but adjusted quarterly EPS is down by $0.03 to $0.60. This drop in EPS was expected due to spin-offs.

AT&T certainly has a high dividend with its 6.3% yield. However, ATT has numerous challenges to address to grow its EPS and dividend. Execution will be critical to improving the balance sheet, hitting Fiber expansion targets, and increasing FCF to promised levels.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.