Summary:

- The market reaction to seasonally better cash flow may indicate low market expectations.

- The stock downside risk still appears to be fully priced in.

- The market struggles to agree with management on cash flow patterns, even though the pattern is now similar to the pattern at Verizon.

- The lower capital budget and rising free cash flow may represent smarter capital budget decisions combined with more conservative assumptions about depreciating that equipment.

- Cashless profits can indicate aggressive, but allowed, accounting.

Sundry Photography

AT&T (NYSE:T) stock responded positively to the second quarter as cash flow again relieved fears that the first quarter really was seasonal, and the second half of the fiscal year would again have the major cash flow contribution. But this misses out on the main idea of management increasing efficiency and profitability. The market still has doubts about some very basic management forecasts. This indicates very low market expectations for the company. For investors, that means a lot of downside risk is still priced into the stock despite the recent price rise while the upside potential is something the market is clearly not ready to consider. But when the market lets go of the past and decides that this management is to be taken “at its word”, the revaluation of the stock could prove to be a surprise. No promises of course.

The last article noted the cash flow improvement in the first quarter. But that improvement did not continue in the second quarter for reasons management listed. Timing and all kinds of things can do that to quarterly results. That does not mean that the full year forecast “went off the rails”. It does mean that the reasons listed need to be evaluated by an investor for reasonableness as well as the conditions under which the assumptions hold.

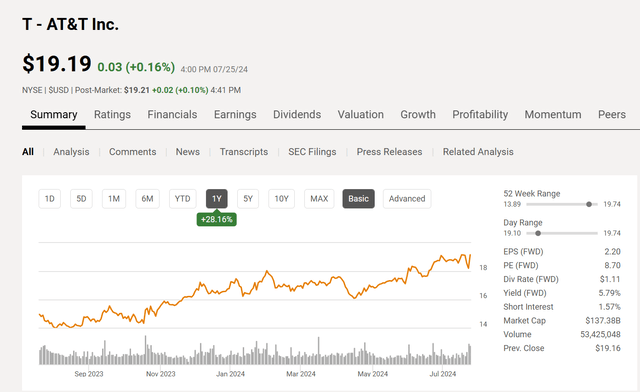

Stock Price

As grudging as Mr. Market is, this stock price has been “on a roll” since roughly November of last year.

AT&T Common Stock Price History And Key Valuation Measures (Seeking Alpha Website July 25, 2024)

For some reason, the market is having trouble agreeing with management that the cash flow pattern here will be similar to the cash flow pattern at Verizon (VZ). The issue would appear to be that the company is now in a business similar to Verizon without all that other “stuff”. It therefore behaves differently in terms of earnings than it did with all those subsidiaries that are now gone.

This management therefore does not have the standing in the eyes of the market that Verizon does because of the changing business composition.

The rising stock price is likely to indicate a building confidence in management guidance. However, the stock price may still be weak after the first quarter report next year as the market continues to fret somewhat over management’s ability to again produce its guidance after a seasonally weak first quarter cash flow. Now that effect should lessen each successive year as management produces until it disappears.

Let Us Talk Cash First

I am a big believer in the cash flow statement and related statements. Put me down as “being from Missouri”. If I do not see the cash, then as far as I am concerned, I do not see the profits. In this case, I am impressed with the fact that profits are down somewhat compared to the previous fiscal year, but the cash flow at the six-month year-to-date period appears to be holding up rather well. This may mean that management is making some conservative choices about expenses and depreciation. As an investor, you want those conservative choices.

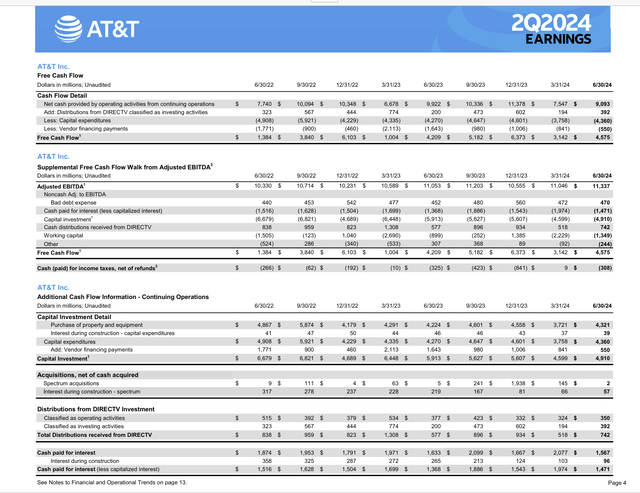

AT&T Second Quarter 2024 Cash Flow Trending Information (AT&T Second Quarter 2024, Supplemental Trending Reports)

As shown above, the GAAP cash flow number is holding up pretty well at the six-month year-to-date period. Quarterly fluctuations are not all that unusual.

What is amazing to me is the free cash flow comparison at the year-to-date period given the drop in DIRECTV contributions. That appears to be largely made up with the lower vendor financing payments and the lower capital expenditures as well. So, at the six-month year-to-date comparison, free cash flow is holding up rather well.

This would imply to appear that the efficiency improvements management is putting in place are finally beginning to have an effect. Obviously, it is going to take more than this for that to be a permanent explanation. But management may be on its way to meeting at least one of its goals.

Depreciation Choices

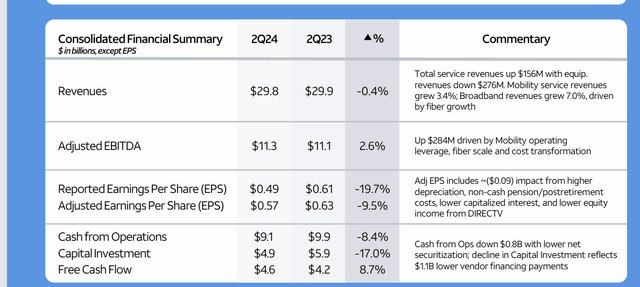

When you see the comparison below, free cash flow is inching up for the quarter.

AT&T Second Quarter Financial Highlights (AT&T Second Quarter 2024, Highlights Presentation)

Free cash flow continues the trend from the second quarter in that it is improving despite the GAAP number going down. The main non-cash charge that could account for that would be depreciation combined with capital investment decisions. On the one hand, the management is getting smarter about the investments made. On the other hand, they are taking a conservative reporting idea (which is allowed) so that more cash flow is protected by depreciation and more cash flow backs up whatever GAAP earnings are reported.

There are two main accounting schools of thought. One part of the accounting world does not report anything that cannot be explained to the income statement. But then that item likely ends up on the balance sheet (and all that that means with a questionable asset amount). Within reason, this is aggressive income reporting that is allowed by GAAP much of the time.

The other line of thought chooses the most conservative assumptions about any equipment. In a time of technology changes, that conservative idea often turns out best because technology can unexpectedly make assets obsolete with little to no warning. AT&T definitely has to deal with advancing technology.

Of course, there are all kinds of mixtures in-between these two ideas.

In summary, this management seems to be heading in a much more conservative reporting direction for the future. Accounting allows for more subjectivity than many would believe.

Summary

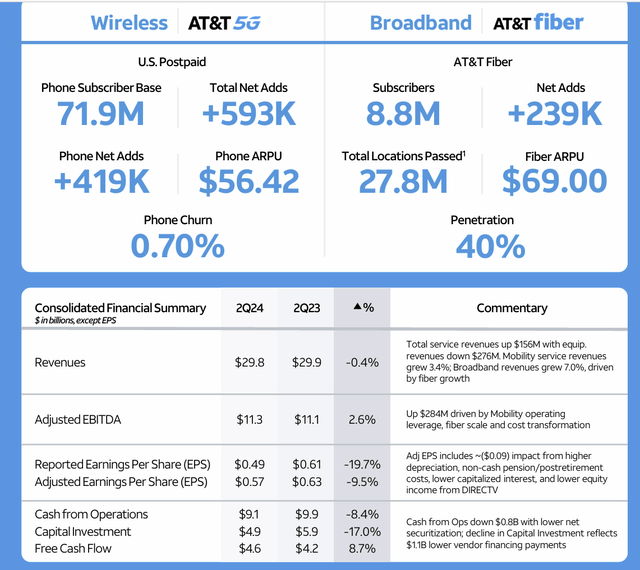

AT&T appears to still be in transition from a telephone company (as in the landline business) to a far more modern company (wireless and internet for example). The older business provides cash flow to expand into the newer businesses that are the future of the company.

AT&T Second Quarter Business Highlights (AT&T Second Quarter 2024, Highlights Presentation)

Clearly the new business is growing. What should begin to happen soon is that the older declining business will become less significant to quarterly and annual reporting. With revenues holding the way they are and a slight climb in EBITDA, that may be where we are now.

Once the company gets past that part where the old business is of equal importance to the new business when it comes to reporting earnings, then this should transition to a growth and income play.

In the meantime, the advancing free cash flow would appear to mean that management is getting smarter about the capital investments by demanding a higher return. On the other side, management is making conservative assumptions about those same capital investments.

So, the big picture would seem to indicate that free cash flow should continue to grow as the company-wide efficiency drive continues. That continues to make this stock a strong growth and income idea for conservative investors.

The yield on the stock is nearly 6% (as shown earlier in the article). Since most investors report an 8% annual return, then all the stock price must do is average a 2% annual return for an investor to meet that average return most investors report. This stock is likely to do far better than that as the company transformation continues, and it should do that with considerably less risk than many other ideas out there.

Risks

Any perceived turnaround progress made is no assurance that the progress will continue in the future. A loss of a key person or a technology change can derail even the best and most thorough plans.

Continued progress with the debt ratio as it now heads below 3.0 is not assured. This business is far more predictable and steadier than many that I follow. But that can change for unforeseen and unpredictable reasons.

AT&T can at any time lose its competitive position if management gets careless.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.