Summary:

- AT&T Inc. stock has run up substantially on free cash flow recovery and lower interest rates.

- A continued erosion of earnings and a more cautious-than-expected Fed could hurt AT&T stock in the coming months.

- Due to these risks and the stock’s rich valuation, I rate T a Sell.

wdstock

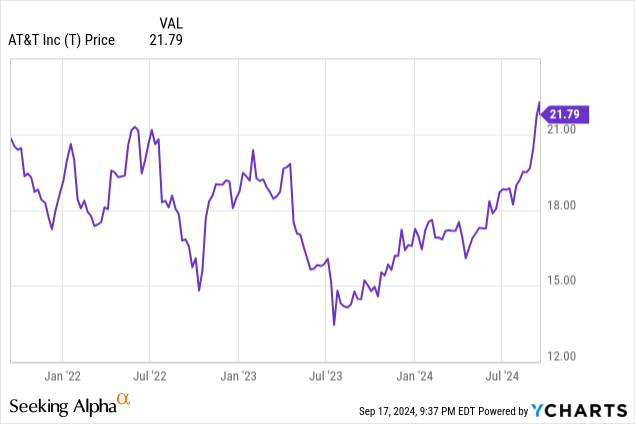

AT&T Inc. (NYSE:T) shares have seen some relief over the last 12 months as shares have rebounded off lows not touched since the dot-com crash in 2002. Driving these gains have been improvements in free cash flow after some dismal quarters and the slow march towards interest rate cuts, which has made the stock’s dividend yield more attractive and the company’s debt less frightening. However, despite these positive recent developments, I think shares are due for a correction following the Fed’s interest rate cut due to poor overall earnings trends and a hot economy that could preclude further interest rate cuts in the near-term.

Time To Cut And Run

The last time I covered AT&T was in April 2023 when the stock was trading for around $18. In that piece, I presented a fairly bearish assessment of the stock and its near-term future. That article can be read here. Free cash flow was plummeting, interest rates were rising, management was floundering, income investors were still mad about the dividend cut, and the overall outlook was bleak. Shares proceeded to fall another 20%+ before hitting $14 per share in mid-2023.

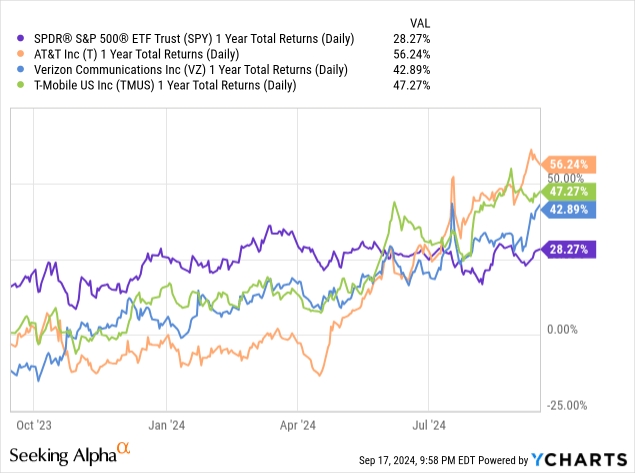

But since that point, T has been among the best performers in the market, outpacing the S&P 500 by almost double and handily beating rivals Verizon (VZ) and T-Mobile (TMUS):

The primary drivers of this turnaround have been a recovery in free cash flow, the cooling of inflation leading the Fed to signal rate cuts, and a reduction in the company’s crushing debt burden.

After reporting $14.1 billion of free cash flow in FY2022, AT&T reported a massive $1.6 billion miss in Q1 2023 FCF ($2.6 billion estimate -> $1 billion actual), but reiterated guidance for $16 billion in FY2023. Many were skeptical, myself included, that the ground could be made up, but the company did eventually achieve $16.8 billion in FCF, and better yet, guided for between $17 billion and $18 billion for FY2024. Shareholders rejoice! Pair that rebound with an increasingly dovish Fed, making T’s yield more attractive and its debt less of a weight, and the stock has rocketed higher.

While AT&T has done well to dig itself out of the hole (that it dug for itself with poor management decisions and horrid M&A deals, mind you), I think the stock at current levels has become too rich based on expectations that are a little too optimistic.

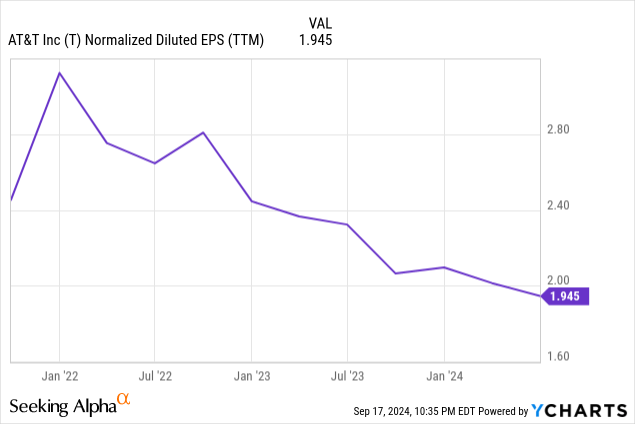

It’s true that FCF has rebounded from the lows of 2022, but the company is still seeing an erosion in earnings that should be of concern to investors. Obviously, it’s cash that pays the dividend and pays down the debt, but capital spending can only be massaged so much to generate cash if net income is declining:

So while everyone is celebrating the return from FCF hell, it’s a bit alarming that none of this improvement is coming from an actual earnings recovery. In fact, AT&T is generating more cash despite this persistent earnings decline. As AT&T itself noted in its last earnings call, $1 billion of the Q2 FCF bump can be attributed to a reduction in “vendor financing”. Getting into the weeds here is out of the scope of this article (additional reading here for those curious for more details), but essentially, vendor financing is a form of loan that vendors provide to AT&T which doesn’t appear on the latter’s balance sheet.

For a company as laden with debt as AT&T, it’s not difficult to see why this might be an attractive sleight of hand. However, when the company’s Q2 FCF grew by $400 million YoY, but without the $1 billion reduction in vendor financing that number would be a loss of $600 million YoY, it’s easy to become less impressed by the FCF recovery.

To be clear, I don’t think there is anything nefarious going on here, every company uses accounting tricks to make financial statements look better. However, when I see investors clamoring over FCF growth that is significantly aided by a reduction in “vendor financing” while real earnings plummet, forgive me if I’m skeptical.

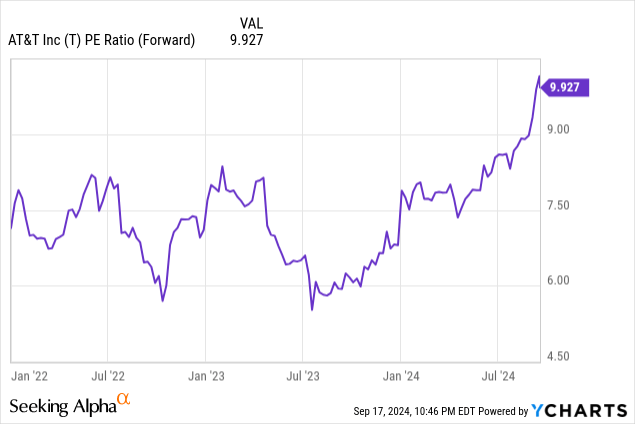

The market has apparently been impressed by these results regardless as, in response, T shares have been rising, and valuation multiples have been rising alongside it, as the forward P/E ratio shows:

So to recap: earnings continue to trend down, FCF is rising in part due to reductions in debt-but-not-debt vendor financing, and the stock’s valuation is well into multi-year high territory? This does not sound like an attractive blue-chip yield stock to me.

Perhaps there is another reason investors are optimistic: interest rates. Put fairly simple, high-interest rates are bad for T for two main reasons:

1) Higher interest rates raises the risk-free rate, making T’s dividend yield and potential volatility more unattractive.

2) AT&T’s massive debt pile becomes harder to service and pay off when rates are high.

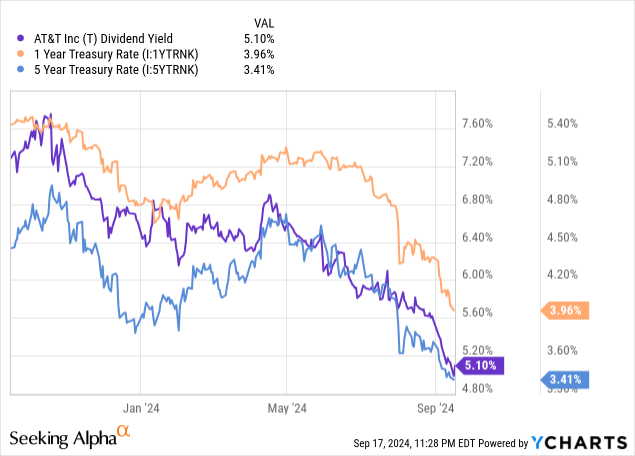

For example, T’s current forward yield is around 5%. Treasuries, which have been yielding fairly close to this value, are now slated to decline when the Fed cuts interest rates on Wednesday. This will reduce the risk-free rate and make T shares more attractive for those hunting for yield:

As you can see, as treasury yields have gone down, AT&T’s yield has dropped along with it due to the appreciation of the company’s stock. There are, of course, other factors in play. The stock market in general tends to rise with a reduction in rates, but, in my opinion, there is certainly an element of yield shopping here that has made T shares more attractive over the last 12 months. If interest rates continue to drop, I expect this trend to continue.

Another interest rate impact is on AT&T’s debt, which sits at an eye-watering $147 billion: a reduction in interest rates allows AT&T to re-finance at lower rates and stave off investor fears of getting crushed by interest payments.

So a dovish Fed means T is set to continue moving higher as debt becomes easier to service and T’s dividend yield becomes more attractive, right? Not so fast.

While the Fed will assuredly be cutting rates Wednesday, the magnitude of the cut and the probability of future cuts remains highly uncertain. Odds currently put a 25 bps rate cut at 35% and a 50 bps rate cut at 65% as the Fed seems satisfied that inflation has been thwarted for now (personally I am leaning towards a 25 bps cut as the most likely option) but there are no guarantees of deep rate cuts moving forward. The economy remains hot and continues to beat GDP estimates, inflation remains sticky, and the labor market remains strong. By all accounts, a cut here would be a precautionary measure and, depending on how the economy reacts, could preclude further cuts or at least slow their implementation. Add it to the pile of T risk factors.

Investor Takeaway

The market appears to be pricing T like a low-rate environment is imminent, but I don’t think this is necessarily the case. Any deviation from that expected momentum could cause the stock to drop or become volatile, especially with FCF being buoyed by dubious reductions in capital investment and core earnings continuing to decline.

When you consider these risks with the stock’s valuation rising ever higher, I don’t see how T offers a favorable risk-reward profile right now. I’m sure income investors will be content to hold here despite the risks, but, due to the outsized valuation and operating woes with no end in sight, I think a price correction is imminent.

Due to these risks and the company’s continued failure to turn around its core operating results, I am rating T a Sell.

Thanks for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.