Summary:

- AT&T’s stock price has performed miserably over the last month and a half, falling over 20%.

- Despite the plunging stock price and rising dividend yield, we are even less likely to buy it today than we were previously.

- We explain why we think, even after the dramatic price drop, the stock still has room to fall.

Justin Sullivan

After AT&T (NYSE:T) reported Q4 results, we told investors:

We do not think it is prudent to buy the stock following the latest earnings report.

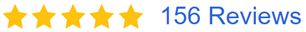

The stock’s abysmal performance in the three months that followed validated our wariness:

Then after Q1 results came out, we warned investors:

Don’t Walk, Run

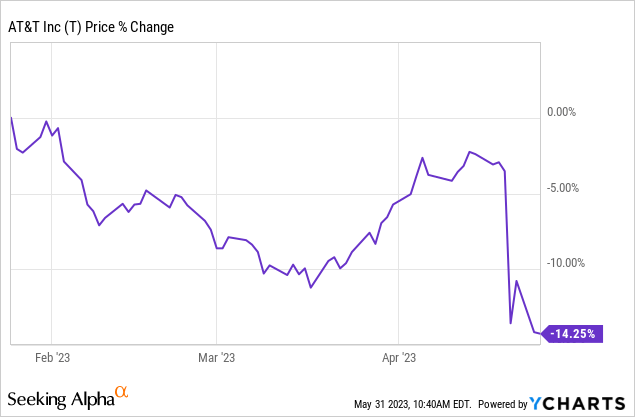

Once again, the stock has continued its relentless decline:

While T is definitely not a great company, as its long-term track record of delivering sub-par returns for shareholders, slashing its dividend, and piling up debt from ill-fated acquisitions clearly demonstrates, at a certain point, the plummeting stock price makes it a Buy, right? While this is true, we do not believe we are there yet. In fact, given that the declining share price largely just mirrors the declining intrinsic value of the company in our view, our likelihood of buying the stock is even lower today than it was previously when the stock was trading at a higher price. Here are two reasons why the more it drops, the more I don’t buy:

#1. Interest Rates Higher For Longer

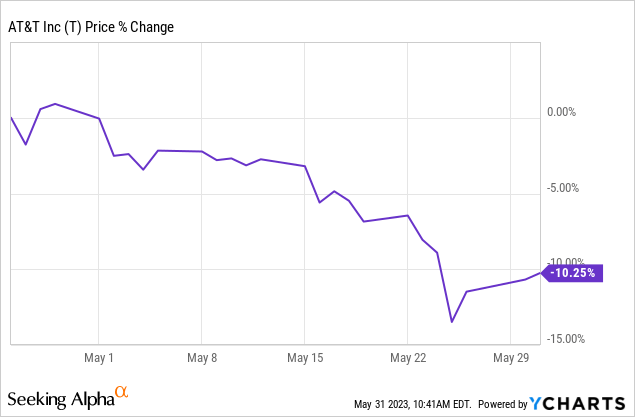

With economic growth, jobs, and inflation data flowing in that appears to be making a growing case against the Federal Reserve pivoting towards rate cuts, it looks increasingly likely that we are going to be stuck with interest rates at higher levels for longer. Why is this particularly bad for T stock? Two big reasons:

First, it is still heavily laden with burdensome debt. While management has been focused on using free cash flow to pay down debt – even spinning off the company’s growthiest business units and slashing the dividend in the process in order to accelerate debt reduction – the fact remains that they have as of yet only made a dent in it. If interest rates remain higher for a prolonged period of time, T will have to continue to aggressively pay down debt in order to mitigate refinancing risk that could cause its interest expense to blow up.

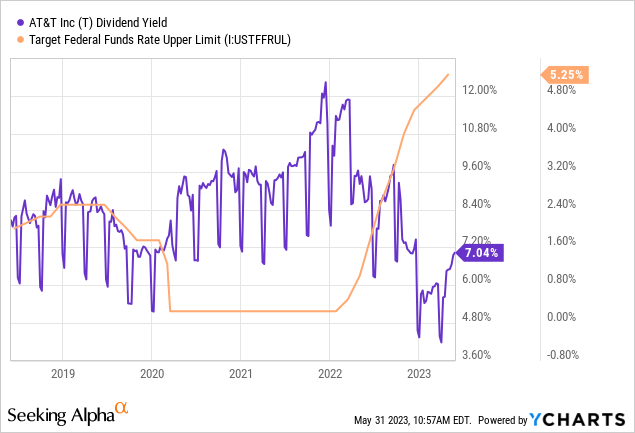

Second – and perhaps more importantly – T stock is increasingly viewed as a bond substitute. This is particularly true now that dividend growth appears to have slowed to a crawl if not likely to completely disappear in the near term while management grapples with tackling the debt mountain weighing on the company. Given that the Federal Funds rate is now above 5% and likely to remain in that range for the foreseeable future, T’s dividend yield is not nearly as attractive as an alternative for passive income.

Yes, its 7.2% yield is about 200 basis points higher than the Fed Funds rate. However, the spread between the two is near the lowest levels it has been in a long time.

Moreover, T’s reputation as a reliable passive income generator has taken a serious hit in recent years thanks to the dividend cut and its stagnating growth. As a result, the relative appeal of T’s yield has dropped, making us less likely to buy it than we would have been previously.

#2. T Stock Growth Deceleration

The other big reason why our likelihood of buying T has declined over time despite its stock price also falling is that its growth has dried up. The first big blow to T’s growth potential took place when they spun off their media business segment in order to focus on their core telecom business and to reduce the company’s leverage, while also trying to justify a pretty steep dividend cut.

While getting rid of debt was certainly a prudent move and it makes sense to split the two businesses in order to increase visibility for Mr. Market to better value them, it hurt the investment thesis for T overall. Prior to the spin-off, there was a viable growth story for the stock. While the dividend needed to be cut, at least at the reset dividend level, there was a compelling case to be made that the yield had a path to long-term growth thanks to the strong growth prospects from the media business, which was actually quite good.

Now, without the media business, T is left with a capital-guzzling and slow-growth telecom business that is already underwhelming the market with its ability to throw off free cash flow. Yes, individual business units are having some degree of success at the moment (for example, T’s mobility unit had a very strong Q1 by adding 424,000 postpaid phone subscribers). However, despite these success stories, free cash flow came in extremely low, even for a quarter where free cash flow is normally suppressed.

If T cannot improve its free cash flow generation over the remaining three quarters of the year, its ability to reduce debt will be restricted. This in turn will weigh on dividend growth, at a minimum. Already, analysts are predicting a measly 0.8% dividend per share CAGR over the next several years. With such weak growth potential, T is truly relegated to being a bond substitute.

Investor Takeaway

T stock’s seemingly chronic underperformance has some investors fooled into thinking it is an incredible buying opportunity right now. While there is certainly the chance that the stock bounces higher in the short-term, we see even less reason to buy it today than we did a year or two ago.

The spread between T’s dividend yield and the Federal Funds rate is at its lowest level in years, growth has all but vanished, and management is struggling to meet free cash flow guidance which in turn threatens its ability to effectively deleverage the balance sheet.

Given that the only reason to buy T is for the dividend, the company’s reputation as a dividend payer took a big hit with the recent cut, and the spread between its yield and the Federal Funds rate has narrowed so significantly, we do not find it to be a compelling buying opportunity at all today. This is especially the case when there are so many other opportunities in the market with similar or better yields and much stronger growth prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to our Portfolio and all our current Top Picks, feel free to join us at High Yield Investor for a 2-week free trial

We are the #1-rated high-yield investor community on Seeking Alpha with 1,500+ members on board and a perfect 5/5 rating from 150+ reviews:

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.

Start Your 2-Week Free Trial Today!