Summary:

- I have been bullish and invested in AT&T since late December last year.

- The run-up in T’s price introduces a concern about exhausted upside.

- Looking at the fundamentals, I see a clear case for remaining bullish.

- In this article, I explain why I am maintaining the buy stance here.

LindaJoHeilman/iStock Editorial via Getty Images

December last year, I issued a bull thesis on AT&T Inc. (NYSE:T) arguing that the then-current dividend as well as the overall investment case from a total return perspective seem attractive enough to warrant a buy.

There were three fundamental drivers behind this:

- Depressed multiples at levels that are characteristic for companies with inherently volatile cash flows.

- Improving free cash flow generation due to a more balanced CapEx agenda in combination with growing business results.

- Enhanced sustainability of the dividend stemming from point two above as well as the relatively recent dividend cut.

While articulating the buy, I specifically highlighted that T definitely deserves an extra discount from its past mistakes in destroying parts of the shareholder value through sizeable but poorly performing M&A transactions. In the efforts to grow horizontally and vertically, T assumed considerable amounts of debt, which have really not been covered by the additional cash generation from, say, the entry in media business via Warner Media. On top of this, the recent dividend reductions do not introduce comfort for investors either, which, in turn, should be reflected in the valuation metrics accordingly.

With that being said, it is clear that the decision to go long T back in late December last year has paid off. Since then, T has registered a total return performance of ~ 16%. Plus, after T circulated its Q4, 2023 earnings deck, I made a follow-up article by specifically dissecting the earnings dynamics, and still recommending a buy.

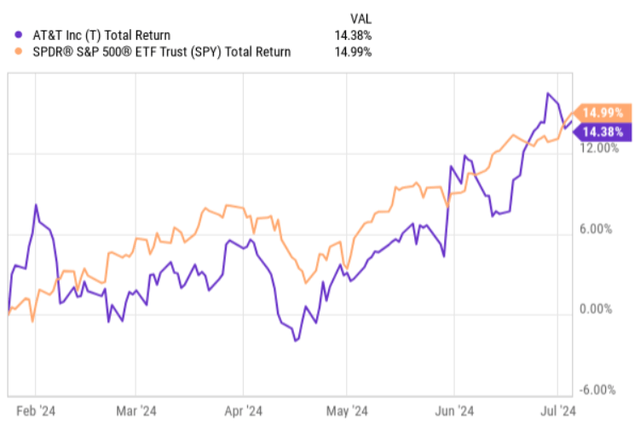

As we can see in the chart below, T has continued to deliver sound returns after the issuance of Q4, 2023 and Q1, 2024 earnings report. In fact, the recovery process has been so strong making T’s total performance almost exactly in line with that of the broader (growth focused) market.

Now, after seeing this that T has managed to recover a bit and also, there is a Q1, 2024 deck out there, let me know elaborate on why, in my opinion, investors should still hold on to their long positions in this stock.

Thesis review

All in all, T’s price recovery could be deemed fully justified and supported by a continued momentum in improving the underlying fundamentals.

Before I explain this in a bit more detail, let me quickly plot the bear case.

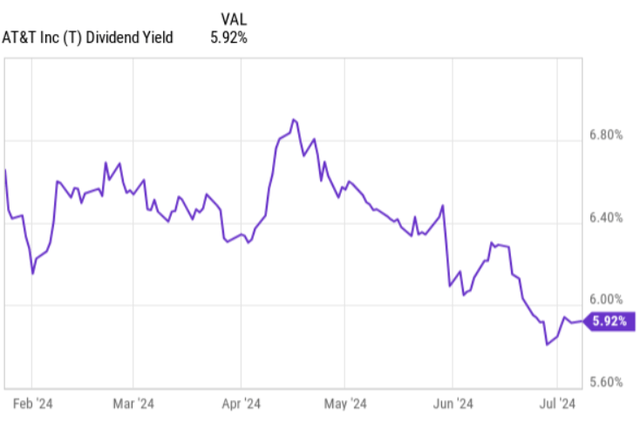

As most of T’s returns so far have been driven by the price appreciation component, the dividend yield has decreased accordingly. The yield has dropped from around 6.5% to 5.9%, which makes the stock a bit less attractive for yield-seeking investors.

Also, the TTM P/E ratio has increased from 8.8x to circa 10x. Plus, the fact that T has correlated so strongly with the S&P 500 raises the question of how sustainable it is and when this trend could break.

However, here is the thing.

The Q1, 2024 earnings came in strong, indicating a gradual strengthening in almost all of the major business lines. In terms of the top-line, the Q1, 2024 mobility service and fiber revenues were up by 3.3% and 19.5%, respectively, relative to the same period last year. However, the business wireline segment, as expected, decreased by circa 8%, thus rendering the total sales for Q1, 2024 flat.

While the top-line dynamics were stable, the real improvements could be noticed in the bottom-line elements, with T being able to achieve a margin expansion in almost all of the key business lines. For example, the total adjusted EBITDA ticked higher by 4.3%.

The commentary in the recent earnings call by John Stankey – Chief Executive Officer – provides a nice color on how T has been focused on enhancing its operating leverage to drive the margin expansion, which really is the key sauce to create value in a mature telco business.

The continued adoption of AI is not only helping us make progress on this goal, but also benefiting our employee and customer experiences. This focus on efficiency is translating into improved operating leverage despite continued elevated inflation. You can see this in our cash operating expenses, which were down year-over-year in the first quarter contributing to adjusted EBITDA margin expansion of 170 basis points.

Another important element that is worth underscoring here is T’s free cash flow profile, which has finally stabilized at levels where the management can really start executing on the plans to deleverage the business.

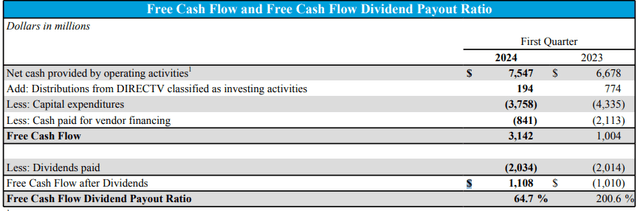

The table below indicates, during Q1, 2024 retained about $1.1 billion in fresh liquidity after making the necessary CapEx and dividend distributions.

Financial and Operational Schedules & Non-GAAP Reconciliations

As a result of the FCF retention, we can already now see progress in how T optimizes its balance sheet. The Q1, 2024 ended with a net debt to adjusted EBITDA of 2.9x, providing a nice trajectory of meeting the communicated target of 2.5x in Q1, 2025. In the meantime, as T pays down part of its outstanding debt (although we have to consider that part of the balance sheet optimization revolves around growing the adjusted EBITDA generation), we should expect a lower pressure on the interest expense front. During the quarter, the cash paid for servicing the debt (without amortization) increased by ~5% (compared to Q1, 2023), which goes hand in with T’s well-laddered debt maturity profile. Yet, given the focus on debt reduction and the presence of nicely distributed debt maturities, we should not assume a meaningful pressure on T’s cash generation from higher interest costs.

Instead, in my opinion, we could slowly start factoring in a potential dividend increase, especially starting from the next year, when the leverage target is expected to be met. It is clear that maintaining a FCF dividend payout of ~ 65% for such a well-established business in a structurally mature industry does not make sense provided that the capital structure in the right balance.

Moreover, in the same earnings call the comment by John Stankey about dividend stability gives an additional layer of confidence that the financial risk will be managed, and the incremental dividend hikes will also be balanced:

I would give you some characterization right now, as we’ve worked really hard over the last couple of years to ensure we protect the dividend. And I think you’ve seen that we’ve done that, and we’ve put ourselves in a really strong financial position. That’s paramount and important to us, as we move into this.

The bottom line

In my opinion, T has arrived at a point in its strategy, where it has finally delayered enough to focus on improving the operational performance of its core businesses, while directing surplus cash generation towards balance sheet optimization. The recent financial data confirm this, where the adjusted EBITDA continues to slowly but surely tick higher with the leverage profile gradually converging to 2.5x target level by Q1, 2025.

These dynamics should justify the recent run-up in T’s share price, as well as render the overall investment case attractive, especially from a dividend investor perspective. While the current yield is not the highest it has been for T, we have to consider the dividend hike potential starting from Q1, 2025 when the capital structure is expected to be at its optimum. Meanwhile, if T continues to register 3-5% in EBITDA growth (which is likely given the CapEx spend and focus on improving operating leverage), experiencing a further upside in the share price should be a realistic scenario.

As a result of this, I remain bullish on AT&T Inc.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.