Summary:

- The original AT&T Inc. guidance holds just like management has been stating all along.

- The market finds management guidance more believable because this time there is cash flow improvement to back up management guidance.

- Cash flow and earnings are likely to grow far in excess of revenues as the refocusing and optimization efforts continue.

- Cash flow should improve significantly in the next fiscal year just from a lack of legacy obligations.

- The lead cable issue was addressed long before it became headline news.

Ronald Martinez

AT&T Inc. (NYSE:T) just reiterated for the umpteenth time that the original guidance is still on track. But the second quarter report actually backed up what management was stating in the eyes of the market. In fact, cash flow was unexpectedly robust in the eyes of the market after the first quarter seasonal weakness. So, Mr. Market relaxed somewhat. The stock price is likely going to perform better for the seasonally strong second half of the fiscal year until Mr. Market gets used to the cash flow pattern. Long term, though, the improvements have only begun to become apparent to the market.

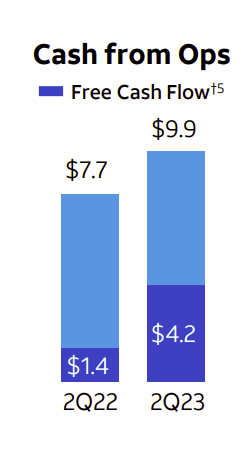

AT&T Summary Of Cash Flow Improvement YTD (AT&T Second Quarter 2023, Earnings Conference Call Slides)

Let us talk about a robust improvement. For those who have long stated that this business is not growing, management demonstrated, as shown above, that the business is not only growing rapidly, but there is also more progress to come.

There were considerable worries about this quarterly report when the new phone adds came in below market expectations. Even with those low net adds confirmed by the second quarter report, the “show me the cash” viewpoint wins by a mile.

The reason this is likely happening is that the company turnaround is in the early stages. Therefore, there is “low hanging fruit” that will likely overshadow any perceived setbacks or stumbles. It could well be a few years before an actual “not so good” announcement slows profitability progress.

Margin improvement will only get you so far. Eventually it is just about impossible for earnings and cash flow to grow faster than sales. But in the beginning, it is very possible for this company to show per share growth far beyond the imagination of the market simply because the company was unfocused on a scale I rarely see. When that happens, there is often a lot of easy optimizing to do that can actually last a few years.

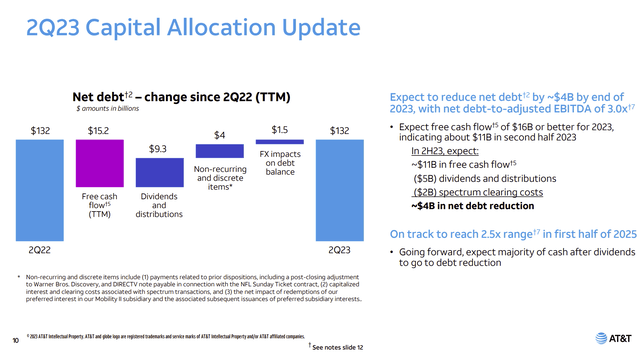

Debt Progress

Here is where the “fine print” gets a lot of investors. The cash flow part was great. But management had to explain the debt situation yet again because there is a tendency to deny that the cash flow and free cash flow is “real” unless it shows itself as less debt.

AT&T Cash Flow Effect On Debt And Remaining Obligations (AT&T Second Quarter 2023, Earnings Conference Call Slides)

Despite the fact that management has a slide during the quarterly presentation and spent still more time explaining the slide during the conference call, there will be doubters. There are those that just do not accept the fact that there were obligations not on the balance sheet that had priority over debt repayments. This is actually a common situation when there are divestments and a turnaround strategy with the remaining core businesses.

Management explained yet again the situation with the first quarter. This time, at least, there was no one questioning management’s assertions about the first quarter payments that will not recur throughout the year. But they will be back for the first quarter of the next fiscal year.

Leaving a business by selling the division sometimes leaves contingency payments that must be dealt with in the future. That appears to be the issue here. Management did state that many of these issues are now complete. In many ways that means “automatic” more free cash flow and cash flow beginning next year. For investors, a predictable improvement often means you can take advantage of market worries because you know certain expenditures will not be there next year.

The market has long fretted over the history of this company. But the cash flow and free cash flow improvement for the next fiscal year is largely “baked in” before any more operational improvements contribute to an even better cash flow comparison. The likely result of this is going to be a comparable cash flow increase in the next fiscal year similar to what happened this quarter. In the meantime, Mr. Market is clearly worrying that the market cannot deliver something as simple as “no more expenses.”

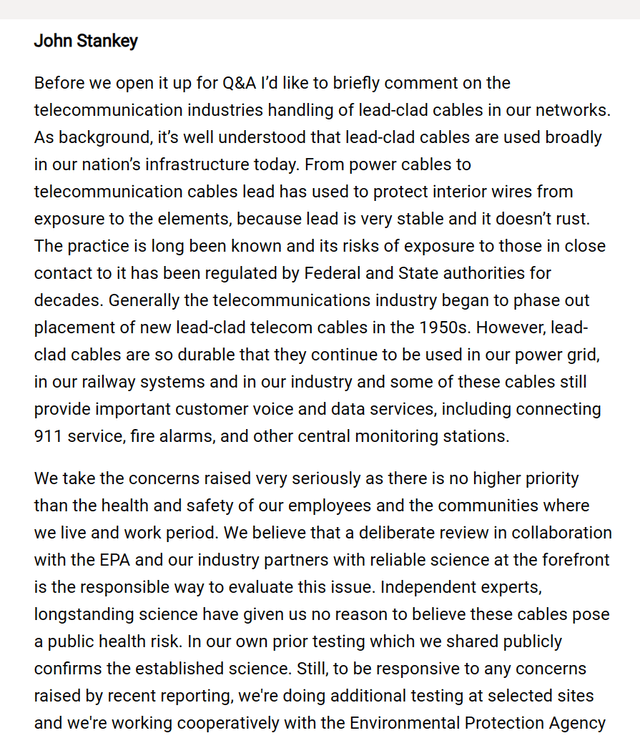

Lead Cables

This has to fall under the heading of “alarmist reporting.” Most of us who came out of industry know that things like this are monitored because there have been some very significant events in the past that have already resulted in steady monitoring of the situations.

AT&T Response To Lead Paint Controversy (AT&T Second Quarter 2023, Earnings Conference Call)

This is probably the main part of the company response. But what you are seeing is that the company and the government have been working on this issue for some time.

One of the differences with lead is that it usually takes ingestion over a period of time to cause issues. I lived in Maryland, which has one of the most comprehensive lead paint laws in the nation. Lead paint poisoning and related issues happen over time, and it takes a quantity of the stuff to do damage. Actual lead paint poisoning cases were rare, and limited to extreme situations that often made the newspapers. The Maryland laws are specifically aimed at making sure someone does not eat something containing lead. It does not happen just because you touch it. I was used to the monitoring of this issue for some time. It is not new. So, it is no surprise that the Federal Government is already monitoring the situation.

That makes this a lot different than things that can be touched or accidently inhaled (thereby causing health issues). It still needs to be dealt with sensibly. But there is no reason to eliminate cables that are working fine and not causing harm.

The likely liability on this issue will be spread out over some years if it even exists at all. As management has stated, there are a fair number of cables that were already removed, and the new cables have been put in for decades that do not have the lead issues. This issue is unlikely to be a “game changer” given the information available. But it is worth monitoring in case the situation changes materially.

Key Takeaways

Management is likely to be able to report significant improvements for some time to come. The company was amazingly unfocused before the turnaround began. Luckily for investors, the focus upon remaining business lines began before the noncore businesses were sold off or otherwise dealt with.

Because AT&T is so large, this turnaround process is likely to result in years of earnings and cash flow growth that exceeds revenue increases. Clearly the market does not buy the improvements so far. Therefore, investors can take advantage of the market doubts, realizing that once the market gives credit to the turnaround, this company will likely receive a higher valuation.

Investors can tell there will be significant cash flow improvement simply by knowing that some legacy obligations have now been completely dealt with. So, a significant financial improvement next year only requires routine execution by management. Any more operational improvements will be “icing on the cake.” Therefore, it looks like the next fiscal year will show some big cash flow improvements as well.

Management could have cut the dividend more and made some debt progress early on. But this management chose not to do that. However, the goal to reach satisfactory debt levels in fiscal year 2025 appears to be reasonable. Keep in mind that patience is not the market’s strong suit. So, the investment “ride” to 2025 could be bumpy. It could also be very profitable.

This stock is a strong buy consideration because AT&T has a lot of assets and size to compete with. Turnarounds involving a company like this typically far exceed the market expectations because the market typically expects “more of the same.” By the time the market realizes that a turnaround to better profits has been underway, the process will be nearly complete.

Usually, a turnaround often promises some unusually large capital gains in the beginning of the process. Many investors wait to see those gains before they get in. AT&T Inc. stock is clearly down from the last sale of assets to Warner Bros. Discovery, Inc. (WBD). There is every chance that the improvements management is now working on will provide a good return from that price let alone a better return from the current price. It has happened before many times.

There is always an execution risk in that AT&T Inc. management could lose focus and go “off the tracks” yet again. But right now, that appears to be unlikely.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualification.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

I analyze oil and gas companies, related companies, and AT&T in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies — the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.