Summary:

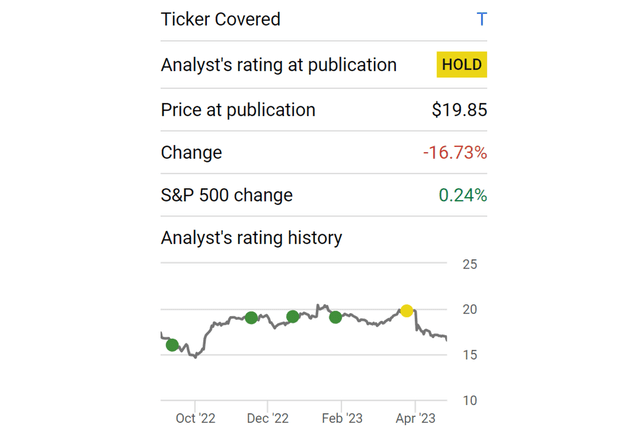

- I have been a long-term bull on AT&T till about a month ago (and wrote an article to downgrade it in April).

- This article provides an updated assessment of the stock given its large price correction (about 17%) since my last article.

- My conclusion is that I, unfortunately, still see more downside risks than upside risks, despite the price correction.

- It’s OK to play with a knife. Just don’t try to catch it while it’s still falling.

OlekStock

Thesis

I have been a long-term bull on AT&T (NYSE:T) and have been arguing for a bull thesis on SA since early 2022 (when its prices were in the ~$16 range). And of course, it is pleasant to see its robust price advancements since then. However, as a value investor (instead of a momentum investor), higher prices always weaken, not strengthen, my bull thesis. Furthermore, at the same time, the safety of its dividends has been gradually deteriorating and now is on the borderline.

These developments finally led me to conclude about a month ago that it has reached its full price potential under current conditions. I wrote an article to downgrade it and suggest investors consider trimming their T position on April 12 (see the screenshot below). Thanks to pure luck, the article was published almost exactly at the peak of its stock price. And the stock prices have collapsed by almost 17% since then.

The goal of the above background is not to pretend that I have cracked the dark art of market timing. My readers know that I’m always the first one to confess that I do not have, and will never have, such an ability.

Though I do have two key points to make by summarizing the above background. The first key point is that we do not need perfect timing to be profitable. My experience (which is the same as many other successful investors’ experiences) is that a good sense of getting things DIRECTIONALLY right is enough, and more often valuable than getting the perfect timing (if that is feasible at all).

Piggyback on to the first point, the second point is the central thesis of this article. Given the overall direction of things at T, I am still seeing more downside risks than upside risks even after the large ~17% price correction. In the remainder of this article, I will elaborate on this thesis by examining its valuation risks, financial strength, and operational challenges.

Valuation risks

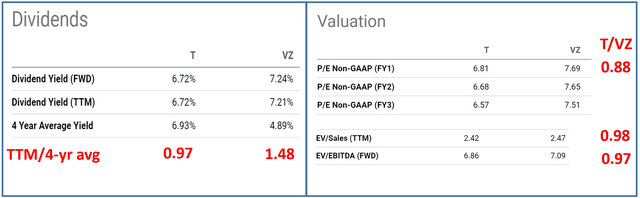

The combination of T’s price appreciation over the past ~2 years and its weakening fundamentals recently have led to an absurdity in my view. T’s fundamentals are weaker than some of its peers like Verizon (VZ), yet it is now priced as expensive (or even more so by some metrics). We will get to the fundamentals a bit later. Here let me just focus on the valuation part.

As seen in the chart below, the forward price-to-earnings (FY1 P/E) ratio is 6.81x for T, which is about a 12% discount from VZ. Not a huge discount to start with.

Then we will have to bear in mind that T carries more leverage than Verizon. Thus, leverage-adjusted valuation metrics are more appropriate here. Once adjusted for leverage, the valuation gap disappears almost entirely as seen. For example, T’s EV/EBITDA) and EV/sales ratio are within 2% and 3% of Verizon’s ratios, completely within the margin of uncertainties.

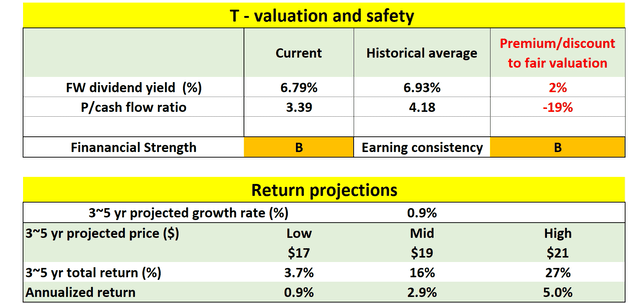

In terms of the dividend yield, the absurdity is even more drastic. As seen, T’s TTM dividend yield of 6.72% is BELOW its four-year average yield of 6.93% by about 3% in relative terms. While in contrast, VZ’s yield of 7.21% is substantially above its 4-year average (by 48%). Admittedly, the four-year average yield for T is biased because of its recent spinoff of WarnerMedia and the dividend cuts associated with it. However, as argued in my early article, the safety of its dividends has deteriorated recently and now sits only on the borderline. As a result, I see a non-negligible risk for T to cut its future dividends again.

We will move on to address T’s operational challenges next.

Source: author based on Seeking Alpha data.

Operation Challenges

Reading through recent coverage on T, I get the impression that both bulls and bears acknowledge the many headwinds facing T. So here rather than retreating these issues, I would just add a perspective that is not often discussed in other SA articles published so far. I will analyze its operational challenges from the perspective of its inventory management.

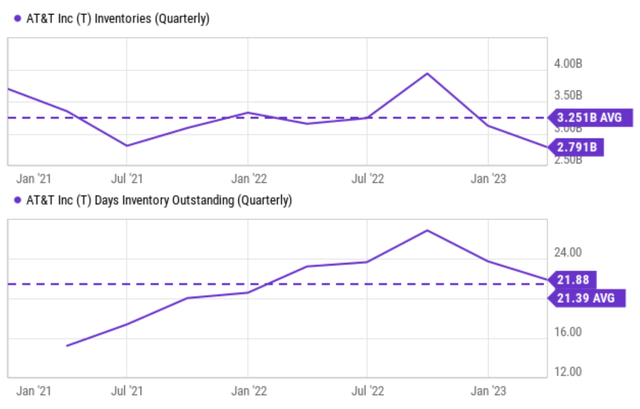

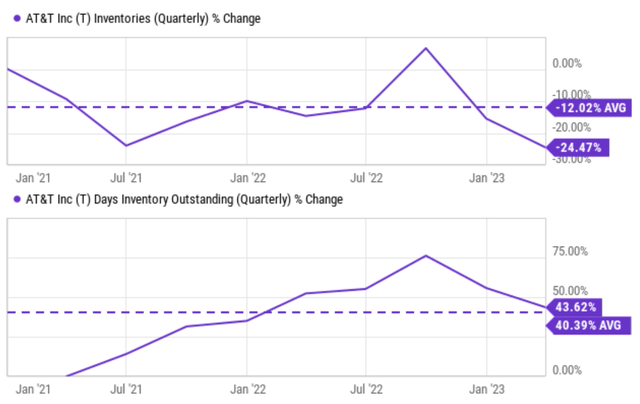

The next chart shows T’s inventory in dollar amount (top panel) and in days of outstanding inventory (“DOOI”). I see a divergence here in the recent 1~2 quarterly: the dollar amount has fallen more quickly (to be below its historical average) than the DOOI (which is still above its historical average). The second chart, which expressed these changes in %, illustrates the divergence more clearly.

To me, this divergence can only be explained by the following possible reasons. And I view all of them to be problematic. Furthermore, clearing a sizable inventory will take time, and most likely be coupled with reduced prices. Thus, I foresee these issues to persist.

- A below-average inventory in dollar amount could be caused by the following factors: A) clearing inventory at reduced prices, B) write-off of inventory (e.g., due to obsolescence and perishability), and C) of course, the good scenario of robust sales. Given the recent market conditions and the divergence between the dollar amount and DOOI, I think we can safely rule out possibility C.

- An above-average DOOI indicates that a business is taking a long time to sell its inventory compared to the average for its industry or historical performance. This can suggest potential issues in inventory management, such as overstocking or slow sales. A higher DOOI also means more capital is tied up in inventory, which can impact a company’s cash flow.

Source: Seeking Alpha Source: Seeking Alpha

Other risks and final thoughts

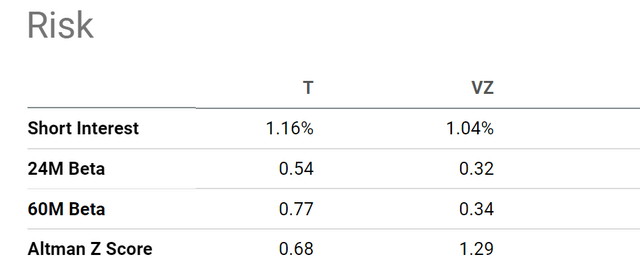

In addition to the aforementioned challenges, investors should also be prepared for greater price volatility when investing in T. As seen from the next chart, T’s beta is approximately 1.7x to 2.2x higher than VZ’s over the past 2-year to 5-year window. We’ve touched on T’s weaker financial strength earlier. And the Altman Z Score is shown below further accentuates this point. This is a metric that assesses a company’s financial health and the likelihood of bankruptcy. Higher scores indicate lower bankruptcy risk. As seen, the Altman Z Score for T is 0.68, only about ½ of VZ’s score of 1.29, which suggests a higher risk of financial distress.

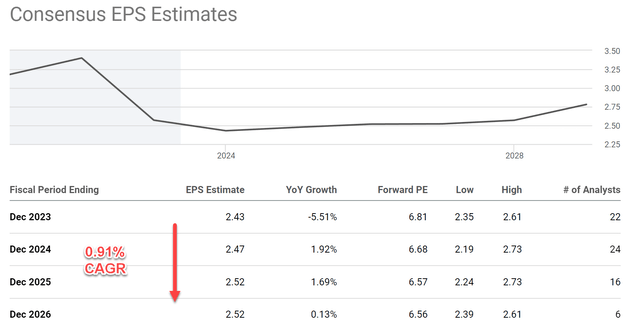

Upside risks. Despite all the challenges, consensus estimates do project slow growth ahead, at an annual growth rate of about 0.91% CAGR as seen below. And T’s valuation is indeed compressed on an absolute basis. Its P/cash flow ratio currently hovers around 3.4x only, substantially below its historical average of 4.18x by ~19%. A combination of profit growth and valuation expansion could lead to a positive return. As shown below, my estimate for the best return scenario is about 5% per annum with a dividend included.

However, I do not feel such a return profile to be attractive given the risks involved. My concluding thought is that the downside risks are currently the dominating forces, and far outweigh the upside risks.

Source: author based on Seeking Alpha data. Source: author based on Seeking Alpha data.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond markets.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.