Summary:

- AT&T provided quality Q4 results and the market reacted strongly to them.

- AT&T is poised to continue the modest growth into 2023 with a focus on paying down debt.

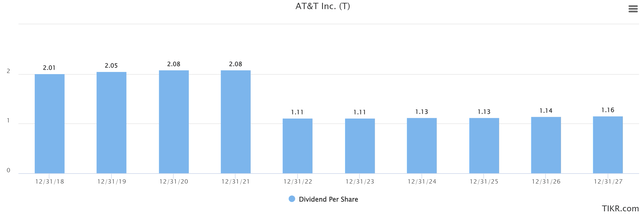

- AT&T did not issue a dividend increase, but I do expect to see one in 2024 at this time.

- AT&T looks strong technically, and there’s a clear path to $22.80 and beyond with clear stops.

Brandon Bell

Last week, we saw everyone’s favorite dividend darling AT&T (NYSE:T) release Q4 earnings. And they were relatively good! No, we didn’t get a dividend increase but what we saw is exactly what the company said we would be leading into the big split. AT&T has focused on paying down debt and cleaning up the balance sheet while growing the business and taking back market share from its competitors. It’s a good time to be a shareholder with a long-term view.

How Were The Results?

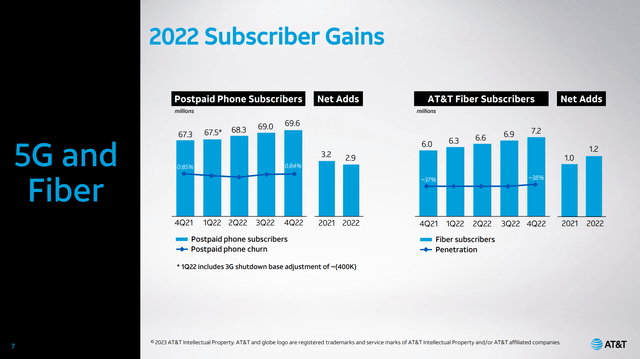

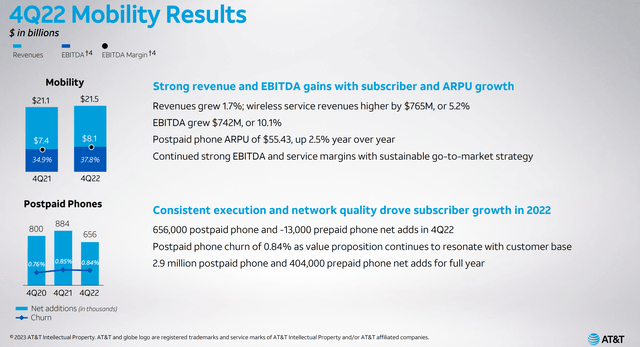

The Q4 earnings sent the stock up 3% in a single day, which is a huge day for AT&T. So what drove the stock up? Let’s dive right into it. We saw a Q4 Non-GAAP EPS of $0.61, which was a beat by $0.04. We did see a Revenue miss by $70 million, coming in at $31.3 Billion which was good for year-over-year growth of about 1%. Looking below, we can see that the subscriber growth remains positive year-over-year as well. While the net adds were smaller than in 2021 in the Postpaid Phone Subscribers, we did see growth on the Fiber side. The Fiber side earns more money as new users are paying about $70 per month. We did see an average revenue increase on the Postpaid side as well thanks to the return of roaming charges with travel being back more so than it was in 2020 or 2021.

As for the breakdown, we saw a net gain of 6.4 million wireless subscribers. Bringing the total up to 217.4 million at year-end. We saw 5.2% growth in wireless services revenues. Even with the inflation in costs over the last year we still saw margin growth which is easier said than done.

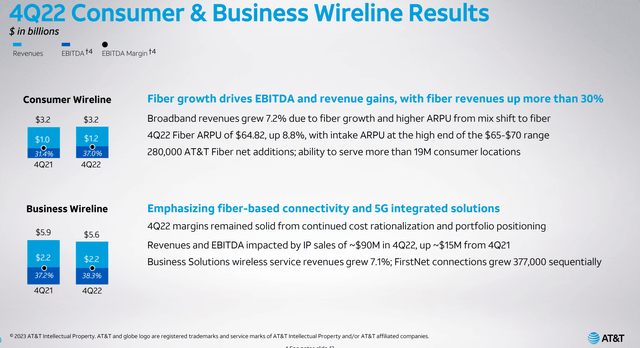

Similar story on the Consumer Wireline side of the ledger. We saw broadband revenues up 7.2% thanks to the Fiber growth I mentioned earlier. During Q4, broadband subscribers’ net losses were 43,000 with fiber broadband net adds of 280,000. Total broadband and DSL connections were down 200,000 over the year from 14.2 million to 14. That said, we saw margin growth in both Consumer and Business Wireline.

All of this is pretty good given the state of the general economy. They promised to be a leaner, more focused machine and that’s exactly what we are seeing. As for when the next dividend increase is coming, keep reading.

What’s Next? Where’s The Dividend Increase?

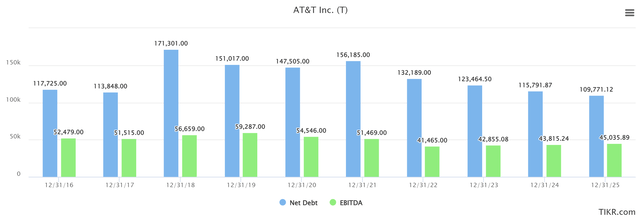

One of the major talking points in the release, at least from my perspective was the 2.5x net debt target. The question is when will we see that? As for 2023, the company is looking for Wireless Service Revenues to grow by 4%+ and Broadband Revenues by 5%+. The important number here is the free cash flow, which is expected to be $16 billion+. Now, these aren’t staggering numbers by any means. As mentioned, no one is buying AT&T for its explosive growth. But they are buying for the dividend. While the company did not lead on as to when that next increase will occur, the focus does appear to be on paying down debt, which is what they have stated it would be given the new form AT&T has taken on. Personally, I think this is great news.

Looking above, we can see both Net Debt and EBITDA graphed out. Quick math says that we are on pace to see 2.88x at the end of FY23′ and 2.64x in FY24′. I’m willing to bet we see the 2.5x number achieved in 2024. If that turns out to be accurate, that’s likely when we will see the next dividend increase. While it may not be the annual increase that shareholders are so used to, the yield will remain in the 5-6% range shareholders are accustomed to.

I did say in my last write-up that I expected an increase in 2023, however, after the earnings call, I’m leaning more so to 2024 at this point. That said, if we do continue to see good things over the next 6-8 months it’s not out of the question. The company seems to be laser-focused on the debt levels which I’m thrilled they are sticking to. So long as the yield stays above 5%, I do not think there will be too many complaints from the shareholders at this time. Reducing debt is the best move for the longevity of the company and the strength of the dividend program.

What Does The Price Say?

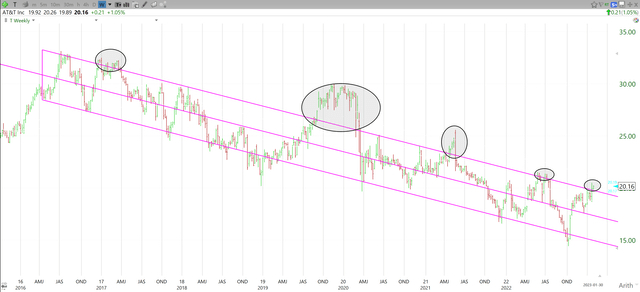

Either we are at the top, or we are breaking out. Back at the end of November when I wrote on AT&T last, I mentioned $20-21 being a target in the near term. Well, here we are! But, we are also just over the top line on the multiyear downtrend, so which way are we going from here?

Looking below, we can see the exact same picture I used in my previous article, but with the updated price action. I have not moved the lines. But, we have been here before. Several times. Including the better part of a year back in 2019-20. But we could never really get a positive trend going. Will this time be any different?

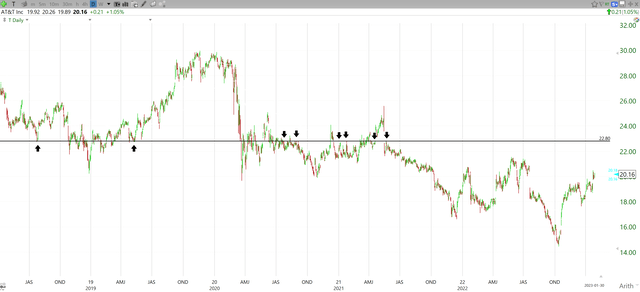

It’s definitely a time where you could get a little riskier with hopes of a big breakout, especially when you zoom in on the daily chart. Before I get into price targets, I will talk about the stop. Looking below we can see the 200-day moving average. The stock has a strong history of using this as a launch pad. Unfortunately, that goes both ways. But we have seen some promising action around the 200-day recently. We have had a few bounces right around, including a recent break, but the stock shot back up over the moving average and reacted positively off of it shortly thereafter. Now we have a 200-day sloping positively, along with a confirmed bounce. This is a great sign and allows for the stop to trail the 200-day moving average. I think you can confidently hold shares with a tight stop at $18.49. Thus allowing a far greater position size. Not only will this allow for greater returns, but also better dividend payments. Win-win across the board.

Next up for the stock? I’m looking at $22.80. Before we look to $25, this will be a pretty important level. This is the bottom of the large gap from May 2021 and that gap will get closed, but we could see some hard resistance at the $22.80 level first. This is about 13% from current levels, which is a pretty substantial move for a stock like AT&T considering we’re already up 9% on the year. Looking below, you can see that this has been an important level over the years and that’s not about to change.

Wrap-Up

As you can see, if you’ve been watching this stock for a while debating whether or not to jump in, now may be a perfect time. Yes, the stock is at levels we haven’t seen since last summer, but everything is coming together just the way they said it would. We can argue that the dividend should be increased all day, but as long as the excess cash flow continues to go towards debt and not acquisitions it’s all good in my books. This will allow for a much stronger and more sustainable dividend down the road, which is what we all want at the end of the day. As always, set your stops, but I think it’s as good a time as ever to park some cash in AT&T for the long run.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.