Summary:

- AT&T is delivering its wireless and fiber broadband strategy, but the capex required is slowing free cash flow growth in 2024.

- FCF is still sufficient to pay the dividend and cover all debt due in 2024.

- The company looks able to hit its leverage target in 1H 2025, which, along with lower capex, will finally allow for a dividend raise.

An investor waiting for AT&T to declare a dividend increase fstop123/iStock via Getty Images

Delivering Fiber Broadband Strategy Takes Time

Watching a stock like AT&T (NYSE:T) go nowhere for several years has tested the patience of many investors. If they would focus on the strategic priorities rather than the share price, they would see that the company is delivering what they set out to do following the spinoffs of non-core businesses. AT&T’s capital spending program is also heavier than competitors due to the strategic decision to deliver most broadband services via fiber, rather than fixed wireless internet. While this is a short-term headwind to free cash flow, it will pay off over time as fiber is more scalable to cover future growth in subscribers and data usage. In the mean time, investors are paid to wait with a fully covered 6.7% dividend yield.

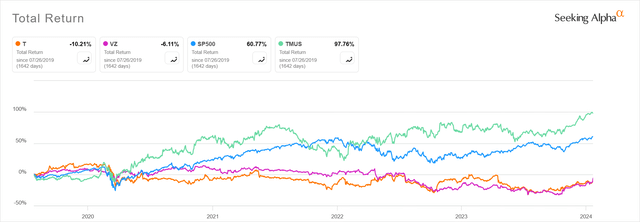

I have been covering AT&T’s quarterly earnings for almost 5 years here on Seeking Alpha. During that time, it’s delivered a negative total return, like its closest competitor Verizon (VZ) while T-Mobile (TMUS) has given investors nearly a double. If including the value of the Warner Bros. Discovery (WBD) shares received in the 2022 spinoff, AT&T’s total return has been about flat.

Ever since the WBD spinoff and the partial sale of DirecTV, AT&T has focused on a simple 3-part strategy: grow the wireless and fiber businesses, reduce costs, and improve the balance sheet. The company is delivering on these goals, but progress has not been fast enough for investors, resulting in the languishing share price performance.

I rated AT&T a Buy last quarter because the 2023 free cash flow guidance raise provided some tangible evidence that the strategy was paying off. Since then, the stock has provided double-digit returns.

The company exceeded the raised free cash flow guidance, but recently released 2024 guidance that showed less FCF growth than I expected. This does not change my thesis, but does reinforce the notion that it will take another year or so to play out.

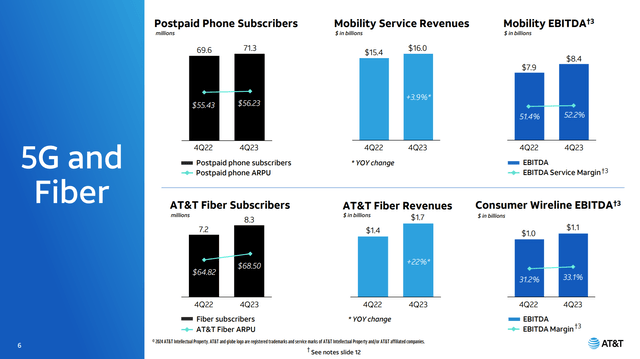

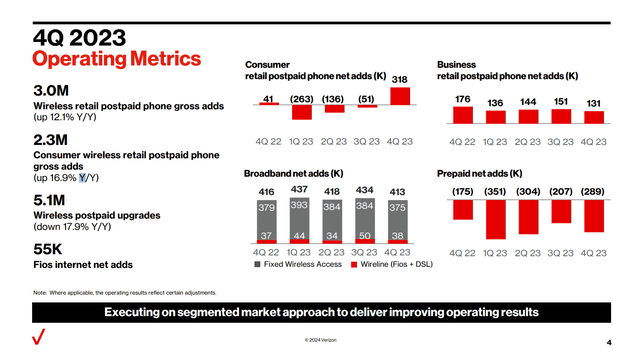

Fourth quarter and full year 2023 results actually show decent operational and financial performance. In wireless, the company had net additions of 1.7 million postpaid phone subscribers for the full year, in contrast with just 0.4 million at Verizon. The small Latin America segment also has decent growth with improving margins. It turned EBITDA positive in 2022 and should soon have positive operating income as well. On the broadband side, AT&T added 1.1 million fiber customers during the year, but this was offset by an equal number of non-fiber customer losses. The fiber customers generate higher revenue per user, so the consumer wireline business overall grew EBITDA by about 10%. Offsetting these positives is an expected decline in the Business Wireline segment, which looked worse than trend in 4Q23 due to one-time gain from selling intellectual property in 4Q22. Putting it all together, the company grew full year revenue by 1.4% and adjusted EBITDA by 4.6%. This was better than Verizon’s full year results of -0.3% revenue decline and -0.6% adjusted EBITDA decline. AT&T’s free cash flow improved by 18.6% to $16.8 billion. This was above the improved guidance the company provided last quarter. This result was less than Verizon’s free cash flow improvement of 32.6% to $18.1 billion, however. Verizon’s capital spending dropped much more than AT&T’s last year.

There appears to be one key part of AT&T’s strategy producing this drag on free cash flow growth relative to its competitors. This will continue to impact performance in the short term but could pay off later, requiring investor patience. Verizon and T-Mobile have decided to focus on Fixed Wireless Access as the main delivery mode for broadband. FWA requires less capital spending to implement and can be rolled out faster to customers. This is where Verizon has a big current advantage. Verizon added 1.5 million FWA broadband subscribers in 2023, but these were not just offsets from older technology as with AT&T. In fact, Verizon still added 0.2 million Fios and DSL subscribers last year.

AT&T management still maintain that fiber is the best way to deliver broadband to a fixed location because it lasts a long time and is easier to scale up for higher data usage in the future. Nevertheless, it requires more investment up front. As CEO John Stankey said on the earnings call,

I obviously believe that we should not be at the sustained levels of investment that we’re at right now for ever. Our point of view is, we’re building infrastructure that’s sustainable infrastructure that will build a franchise that will last for many years to come. The fiber investment is a hard one to do at the front end, but it’s an incredibly durable investment. The depreciation levels on this go out a long time for a reason. And the beauty of the technology is, improving capacity on it is a relatively light lift incrementally once you got the glass in the ground.

AT&T has become a bit more flexible as they see their competitors gain broadband share. They now offer their own FWA product called AT&T Internet Air and are investing in Open Radio Access Network technology to help the wireless network deliver more FWA service. However, this spending on ORAN and fiber increases capex (impacting FCF) and depreciation (impacting operating income), putting a drag on 2024 guidance relative to investor expectations. Recall at the time of the WBD spinoff, AT&T expected to deliver $20 billion FCF in 2023. It now looks like they will not reach this level in 2024 either, and impatient investors are punishing the stock, down 3% on the day of the earnings release.

Disappointing 2024 Guidance

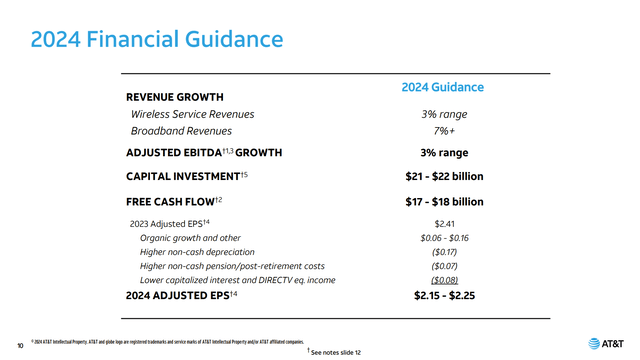

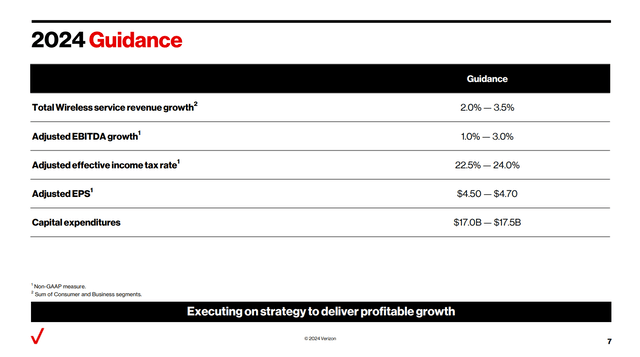

Initial guidance for 2024 shows slowing growth. Wireless service revenues are expected to be up 3% (compared to 4.4% growth in 2023). Broadband revenues are expected to be up at least 7%, after growing 8.1% in 2023. Overall company EBITDA is expected to grow 3% this year, vs. 4.7% in 2023. While growth is slowing, the wireless service revenue and EBITDA growth levels are at the top of the range of what Verizon is forecasting for this year.

AT&T capital investment is expected to be $21-$22 billion in 2024, down about $2 billion at the midpoint from the 2023 actual value of $23.6 billion. Verizon capex is expected to be only $17-$17.5 billion, down about $1.5 billion from last year’s actual.

The higher capital intensity at AT&T is driving the low free cash flow growth, only up 4.2% at the midpoint from the 2023 result. With this low growth, AT&T shares could continue to get punished by investors in 2024. The quarter-to-quarter FCF delivery is expected to be a little smoother this year, but still weighted 40% in the first half and 60% in the second half. That implies FCF of just $3.5 billion in 1Q which, even though on plan, could produce a free cash flow freak out like we saw when 1Q 2023 results were released. Those investors who do want to try bottom fishing may want to wait one quarter before buying.

AT&T has a good chance of delivering the FCF guidance, as the capex and FCF guidance on the slide above implies operating cash flow of $38 – $40 billion. The company delivered $38.3 billion operating cash flow in 2023, plus DirecTV cash dividends of $2 billion. While the DirecTV dividend will be down slightly, it is hard to see operating cash flow going down with 3% EBITDA growth.

The Dividend Is Still Safe, Just Not Growing Yet

Free cash flow at the midpoint of guidance is $17.5 billion for 2024. The $0.2775 quarterly dividend will use $8 billion of cash. There is $9.5 billion of debt due this year. Following the offloading of debt onto WBD at the time of the 2022 spinoff, the company has been painfully slow to pare its debt further. This was mainly due to the need for spectrum investments of $10.2 billion in 2022 and $2.9 billion in 2023. Without the need for further spectrum licenses, AT&T can now apply its free cash flow after dividends to debt reduction. AT&T ended 2023 with $128.9 billion of net debt and EBITDA of $43.4 billion for a leverage ratio of 2.97. (Verizon was at 3.05 leverage when calculated on a consistent basis.) This is an improvement of just $3.4 billion in debt from the end of 2022, when leverage was 3.19. Looking forward to 2024, guidance is for EBITDA of $44.7 billion. If the company indeed pays down all the debt due this year without refinancing, net debt will be $119.4 billion and leverage will be 2.67 at the end of 2024.

The desire to hit this leverage level, on the way to the stated target of 2.5 leverage by the first half of 2025, will constrain AT&T from any dividend increases this year. After that point, lower capex and the reduced need to pay off debt will allow more capital return to shareholders. Long-term, management expects capex requirements to be around a “mid teens” percentage of revenue. That means if sales are $125 billion, capex would be $18.75 billion, about $2.75 billion lower than the 2024 plan. That alone would free up $0.095 per quarter for dividend increases (34% above the current level). Applying cash toward dividends or buybacks instead of further debt reduction after reaching the leverage target is also a possibility. The company will look at interest rates, the share price, and opportunities for growth capex in deciding how to use this cash. Unfortunately, I think we have another 18 months to go before AT&T is in a position to consider a dividend increase. More patience is required.

Valuation And Peer Comparison

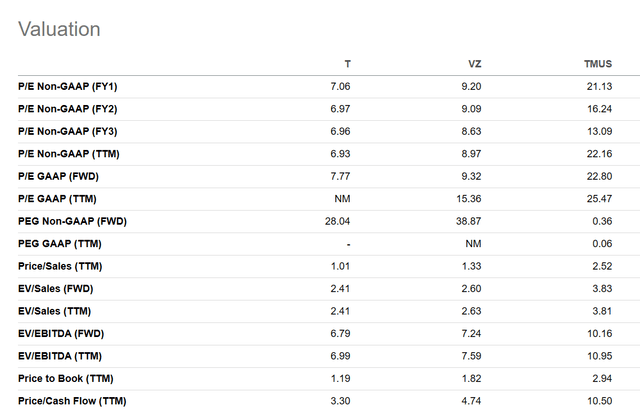

Updating the comparison from last quarter’s article, AT&T’s discount to Verizon has widened to 23% on a forward P/E basis, compared to 12% last quarter. AT&T P/E remains around 2/3 cheaper than T-Mobile (TMUS) on current year earnings, but this gap narrows in the out years because of T-Mobile’s perceived faster growth. AT&T is now 6%-8% cheaper than Verizon on an EV/sales and EV/EBITDA basis, compared to being valued the same last quarter.

The wider discount for AT&T does not seem warranted considering AT&T’s slightly better revenue and EBITDA growth projections for 2024. Verizon currently has lower capex and better free cash flow growth, but I expect this to reverse once AT&T has completed its fiber buildout. The problem is, I thought this would have already happened by this year, so I can understand if investors are suspicious of it happening even in 2025. Until it becomes clearer that the company will deliver results, I don’t see the share price moving much, but with good news, I maintain last quarter’s price target of $20 which implies AT&T P/E equalizing with Verizon. Last quarter, this price target was based on free cash flow reaching $20 billion and a price/FCF multiple of 7.2. Given the lower FCF guidance for 2024, I now expect the price target to be reached in 2025.

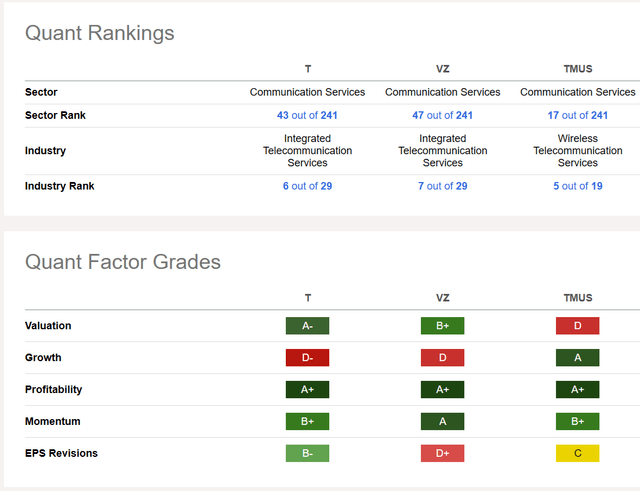

Looking at Seeking Alpha’s Quant Ratings, T continues to be ranked slightly higher than VZ, with an edge on valuation and EPS revisions. Both are still disadvantaged to T-Mobile on Growth. T-Mobile’s Growth rating benefits from not having the declining legacy wireline business, but the D Valuation rating suggests that paying 3x the P/E for T-Mobile compared to AT&T means you could be overpaying for that growth.

Risks

AT&T management seems to share my optimism for a healthy economy this year, based on SEO John Stankey’s comments on the earnings call.

We haven’t seen anything with the consumer that suggests they’re not paying their bills or not in a position to continue to buy services from us. We certainly don’t see anything in business formation right now that causes us any degree of concern at this juncture. So by and large, I think we feel like we’re in a pretty good place moving into 2024, absent what I would call big exogenous variables in the global system that occurs. We feel like policy will probably line up pretty well.

If the company has a healthy economy built into its plan, then any significant slowdown in the would likely cause results to come in lower than plan.

A couple of government programs were discussed on the call. While the customers served by these programs likely produce lower than average revenue per user, they could still impact AT&T’s decisions on how they will serve these markets and how the company will spend capital. The first is the Affordable Connectivity Program, or ACP, due to end in February. It is basically a $30 per month subsidy for internet service which could impact demand negatively once it ends. The other program is BEAD (Broadband Equity, Access, and Deployment) which came out of the 2021 Infrastructure and Jobs Act. It allocates $42.5 billion to the states and territories for broadband deployment, but without any federal management. Each state may use the money differently, resulting in the need for AT&T to have 50+ different contacts to participate in the projects.

Finally, the Wall Street Journal resurfaced the lead cable issue again this month, but management again made no mention of it on the earnings call and no analysts asked any questions about it. According to the company, less than 10% of the legacy copper network contains lead-clad cables, and most of these are underground or in conduit where they do not pose a serious exposure risk.

Conclusion

AT&T continues to deliver its focused 5G and fiber growth strategy, with results showing up in subscriber growth. The company exceeded its 2023 free cash flow target but forecasted weak FCF growth in 2024. This is due at least in part to the higher capex costs of the fiber program compared to the fixed wireless solution being rolled out by the two main competitors. Impatient investors have punished AT&T stock, widening the discount compared to Verizon almost by almost twice as much as it was one quarter ago.

Nevertheless, AT&T can easily pay its 6.6% dividend this year with cash left over to pay off the debt due without needing to refinance. Capex will come down eventually, and when it does, AT&T will be in a better position than its competitors on further growth of broadband services, thanks to fiber’s better scalability. Lower capex, along with reaching the 2.5 leverage target in 2025, will allow for increased dividends and a likely recovery of the share price to the $20 area, if investors can be patient for a while longer.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.