Summary:

- AT&T has been making progress in deleveraging its balance sheet and growing its customer base.

- The company had a slow start in 2024 but added new subscribers and expanded its fiber footprint.

- AT&T is a solid value and dividend play, with a high dividend yield and potential for future growth.

J. Michael Jones/iStock Editorial via Getty Images

AT&T (NYSE:T) has been making great progress in deleveraging its balance sheet and growing its customer base in recent years. While not everything has gone smoothly for AT&T after the Time Warner debacle, it seems that the company overall has been moving in the right direction in the last few quarters and has a solid chance of achieving its financial goals for 2024 despite the relatively slow start of the year. As such, I continue to be optimistic about AT&T’s future and hold a long position in the company.

Recovery On The Horizon

In October, I wrote an article titled AT&T: Buy Alert, in which I noted that even though the company’s shares have struggled to gain momentum in 2023, the business itself remained a great value and dividend investment as the management was on track to achieve their targets for the year. Since that time, AT&T’s stock has generated a total return of ~20%, and I believe that the company will likely continue to create additional shareholder value given the latest developments that will be highlighted below.

While AT&T had a slow start in 2024 mostly due to the decline in mobility equipment revenue that resulted in the overall revenue decline of 0.4% Y/Y to $30.02 billion, the future still looks promising for the company.

After fully unwinding its mega-merger with WarnerMedia and focusing solely on its core competencies, AT&T was able to gradually expand its fiber footprint and scale the number of subscribers that use its communication services. In Q1 alone, the company added 252,000 new fiber customers, added 349,000 wireless phone subscribers, and the management seems to be confident that this trend of further subscriber growth will continue. Given that AT&T’s recent Internet Air service, which was launched last August, was able to add over 200,000 new broadband subscribers in less than a year, it appears that the company’s products indeed remain in relatively high demand and further subscriber growth is possible.

Therefore, after years of missteps it seems that AT&T is finally moving in the right direction and focusing on its core competencies after unwinding its stake in WarnerMedia was the correct call after all. Even though AT&T had a slow start to the year, there’s a possibility that with the continuous addition of new subscribers it will be able to improve its performance in the second half of the year and once again reach its fiscal goals.

On top of that, it’s important to understand that AT&T is a solid but boring value and dividend play. The company is expected to barely improve its top line and is not going to disrupt any industry or grow at the rate of a major tech company or an AI unicorn. Despite this, AT&T is expected to compensate for this lack of aggressive growth with a solid dividend payment that makes it worth it to acquire its shares in the first place.

As of now, AT&T offers a dividend yield of 6.3%, and it’s realistic to expect that the dividend payment might increase in the future thanks to the improvement of the company’s balance sheet. Despite having a high debt burden, AT&T’s total debt has been declining for four consecutive quarters, while its accounts payable in Q1 were the lowest in the last two years. Such a deleveraging was possible thanks to the execution of the cost-cutting plan that was set a few years ago after the Time Warner debacle. If the company continues to retire more debt, we should expect a higher EPS as a result of lower interest expenses, which will make it possible for AT&T to ensure the safety and sustainability of dividend payments at a decent yield.

Given that AT&T expects to generate $17 billion to $18 billion in FCF in 2024, it’s safe to assume that the deleveraging will continue and make it possible for the company to create additional shareholder value along the way.

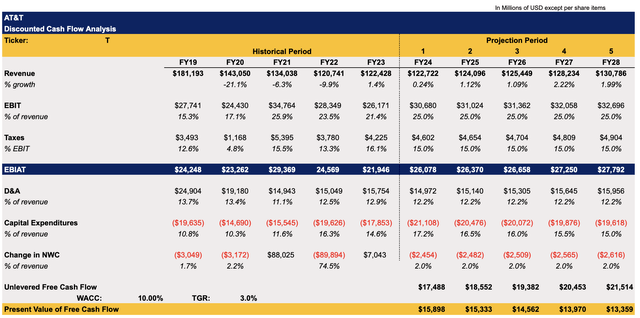

Considering all of this, I’ve made a DCF model that makes it possible to figure out whether AT&T is a decent investment at the current price. The revenue assumptions in the model closely correlate with the Street expectations, while assumptions for most of the other metrics closely correlate with AT&T’s historical performance. While some might think that the top-line growth rate is too small, it’s important to once again understand that AT&T is a standard telecommunications firm that operates in an industry known for high spending, relatively slow growth, and increased competition. This is the main reason why investors shouldn’t expect any aggressive growth rates anytime soon. For comparison, AT&T’s major peer Verizon (VZ) is also expected to grow at a relatively small rate as well.

The CapEx assumptions for FY24 are in-line with the management’s expectations. The terminal growth rate in the model is 3%, while the WACC is 10%, which is relatively high due to the company’s great debt burden and the relatively high-interest rate environment that makes it more expensive for AT&T to service its debt.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

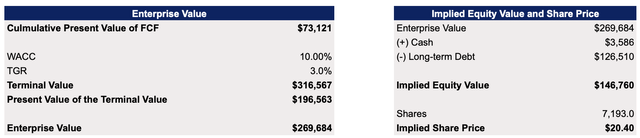

This model shows that AT&T’s enterprise value is $269.7 billion, while its fair value is $20.40 per share, which indicates that the company’s stock trades at a discount and has more room for growth from the current market price.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

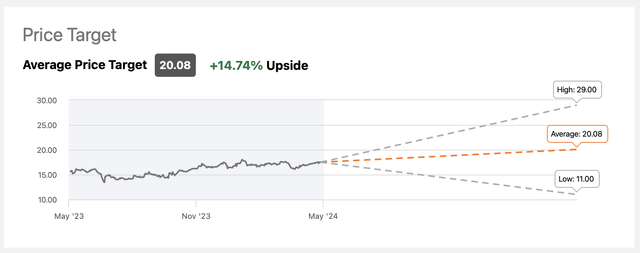

The street at large also agrees with the idea that AT&T is undervalued, as the current consensus price target is ~$20 per share, above the current market price. Considering this, I decided to stick with my BUY rating for AT&T’s shares, as the upside is still there.

AT&T’s Consensus Price Target (Seeking Alpha)

Major Risks To Consider

While AT&T appears to be a relatively safe and attractive investment at the current price, the company nevertheless is exposed to several risks that are outside of its control.

First of all, the potential rise in food and energy prices due to the probable extension of oil production cuts by OPEC+ could prompt the Federal Reserves to stick with higher rates for a longer period. Under such a scenario, higher rates make it more expensive for AT&T to refinance its maturities. As of now, AT&T has a debt with maturities all the way until 2097. While the overall debt situation is manageable for now, any refinancing at the current higher rates will lead to higher interest expenses that could derail all the financial progress that was achieved in recent years.

Therefore, as long as the macro environment is not significantly improving and the Federal Reserve sticks with the policy of keeping higher rates for longer, AT&T will constantly be at risk of paying greater interest expenses if it decides to refinance its maturities.

The Bottom Line

While being exposed to things that are outside of its control is the biggest downside of AT&T, the company nevertheless has greatly improved its balance sheet in recent years, which gives it some room to breathe in the current situation. As of now, it looks like AT&T is moving in the right direction despite all the challenges and the potential further expansion of its customer base will likely help the company achieve its financial goals for 2024 despite the weak start of the year. Add to all of this the fact that the company is undervalued and offers a decent yield, and it becomes obvious that AT&T should be considered a decent investment for value investors at the current price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.