Summary:

- AT&T’s stock valuation was updated using a dividend discount model, yielding fair values between $16 and $26 per share based on different dividend growth scenarios.

- Key concerns include AT&T’s significant debt and the impact of interest rate changes on refinancing costs and dividend growth potential.

- Compared to Verizon, AT&T is less attractive due to less consistent dividend growth, despite being a viable dividend investment candidate.

- Upgraded AT&T’s rating from “hold” to “buy” based on improved valuation, latest quarterly results, and potential for dividend sustainability.

Huber & Starke

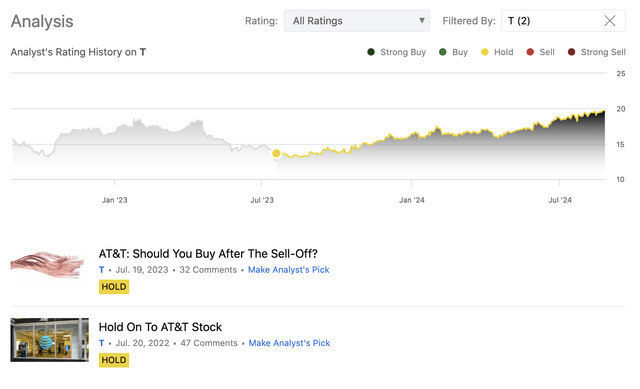

AT&T Inc. (NYSE:T) provides telecommunications and technology services worldwide. We have been covering T since July 2022, with our latest writing published in July 2023 – coinciding with the issues related to lead cables.

Both times, we have highlighted that we liked AT&T’s stock for its dividends and its valuation, but we have identified several concerning factors that have prevented us from issuing a “buy” rating. These factors were: disappointing subscribed growth, negative sentiment, and poor historic performance during times of low consumer confidence. The high amount of debt on the balance sheet – which is not necessarily unusual for companies in this industry – has also caught our attention, especially considering the current interest rate environment.

The aim of our article today is to give an update view on the valuation, using the same dividend discount model that we have used in our previous writings. As we have recently published an article on Verizon Communications (VZ) we will also do a small comparison between the two firms, highlighting why we like on over the other.

Valuation update

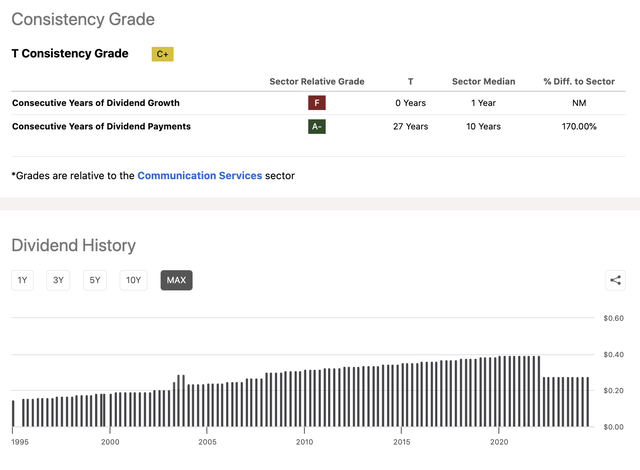

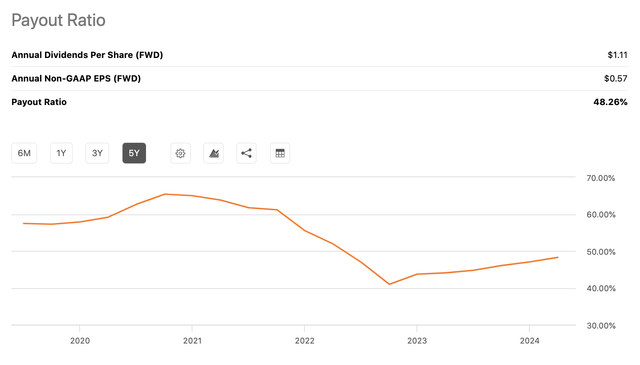

Our previously chosen method of valuing T’s stock – a dividend discount model – remains valid and justifiable until now, and therefore we will be using it once again to value the firm. The company remains in the mature growth phase, and it has also kept on paying quarterly dividends, as it has done so for the last decades. T currently pays a quarterly dividend of $0.28 per share, corresponding to a yield of 5.6% at the current share price.

Based on the payout ratio and the firm’s free cash flow, these payments also appear to be safe and sustainable.

The two main input parameters of our model that need to be updated are the dividend growth rates and the required rate of return.

In our previous analysis, we have created three different scenarios resulting in fair value estimates of $11 to $13 per share, assuming a required rate of return of 11% and various dividend growth rates in the near term and in perpetuity, ranging from 0% to 2%.

Today, we will have to check whether these assumptions made in the past are still valid or not.

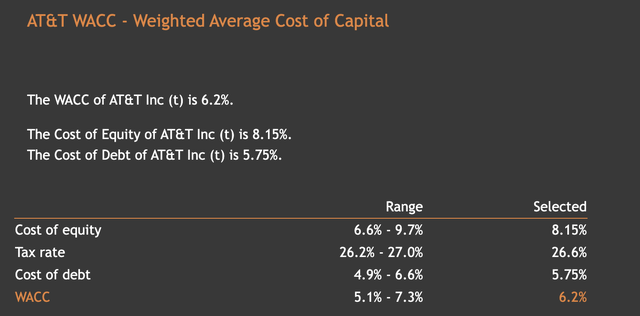

Required rate of return

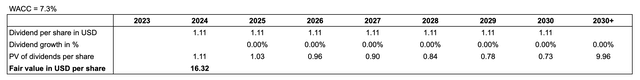

Just like before, we will be using the firm’s weighted average cost of capital (WACC) as our required rate of return. According to the latest estimates, it is in the range of 5.1% to 7.3%. To stay somewhat conservative with our calculations, we will be using the higher end of the range, 7.3%.

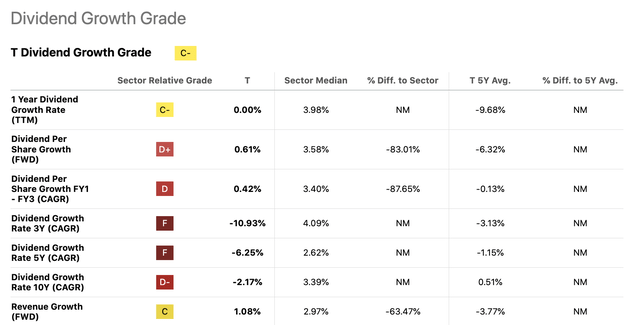

Dividend growth rate

The dividend growth rate remains a tricky question. Normally, we like to use a firm’s long-term dividend growth rate for our calculations; however, this approach is not applicable for T, since the business has changed substantially after the spinoff of Warner Bros. Discovery, Inc. (WBD) in 2022. The dividend has been cut then, and has not been increased since that time.

For this reason, we once again will use different scenarios to come up with a range of realistic fair values for T’s stock.

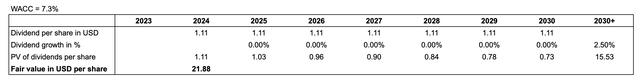

1. Scenario

In our first case, we assume that the firm will not increase its dividends at all until 2030, as it has not increased since 2022. Thereafter, we assume a perpetual growth rate of 2.5%, which is thought to be in line with the overall growth of the economy.

These input parameters yield a fair value of $22 for T’s stock, roughly 10% above the current share price.

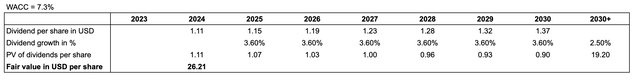

2. Scenario

For our second case, we will assume that T will commit to increasing its dividends once again, and the rate of increase will correspond to the firm’s free cash flow growth rate, which is 3.6%. This growth rate will be used also only in the near term – until 2030- and from then on, we will be using 2.5% in perpetuity.

These assumptions result in a fair value of $26 per share, or about 30% higher than the current share price.

3. Scenario

If we want to be somewhat more pessimistic, we can assume that T will not increase its dividend ever again, keeping it at the current rate forever. This assumption would result in a fair value of $16 per share, or 20% lower than the current share price.

We believe that the first two scenarios are more likely, especially when we consider the latest quarterly results of T, which included:

- 419,000 postpaid phone net adds

- 239,000 AT&T Fiber net adds

- A 3.4% increase in Mobility service revenues, reaching $16.3 billion

- A 7% increase in Consumer broadband revenues, reaching $2.7 billion

- Attractive guidance of Broadband revenue growth of 7%+, Wireless service revenue growth in the 3% range.

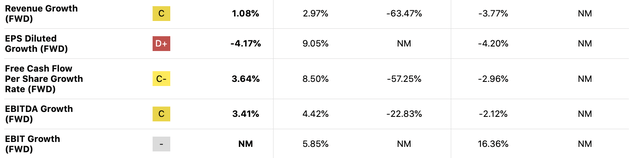

All in all, T appears to be an attractive dividend investment candidate from a valuation point of view. Before we move on to our next section, there is one more thing that we would like to point out, which could have an impact on the valuation in the coming years, and this is debt and interest rates.

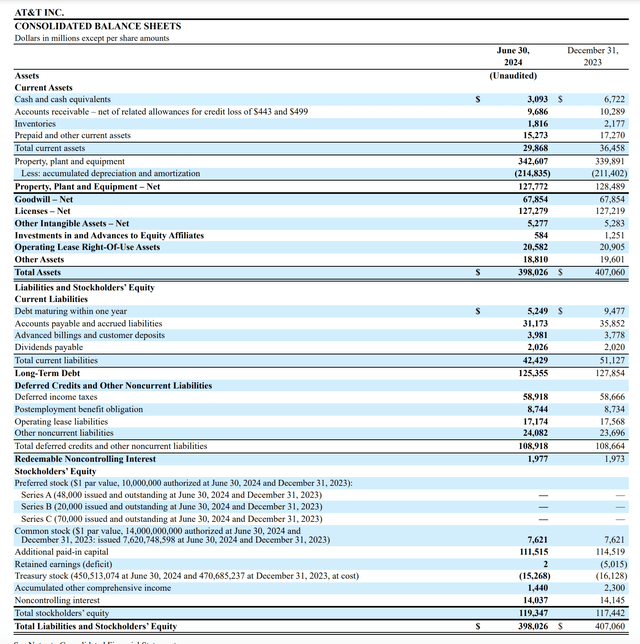

T has significant amounts of debt on its balance sheet. As this debt matures, a significant part of it will likely need to be refinanced. Depending on how the Fed’s strategy on interest rate cuts will develop, the refinancing can get more (or less) expensive.

If the Fed is cautious with lowering interest rates, it could lead to lower fair values than we have estimated before. Higher interest rates mean higher cost of refinancing, leading not only to higher interest expenses, but also to a higher cost of capital, negatively impacting our fair value calculation from two sides – worse ability to increase dividends and higher required rate of return.

On the other hand, if the Fed cuts interest rates at a relatively high pace, refinancing could turn out cheaper, positively impacting both the firm’s ability to increase its dividends and also the cost of capital.

These developments need to be closely monitored when some plans to hold T’s stock in their portfolio.

Comparison to VZ

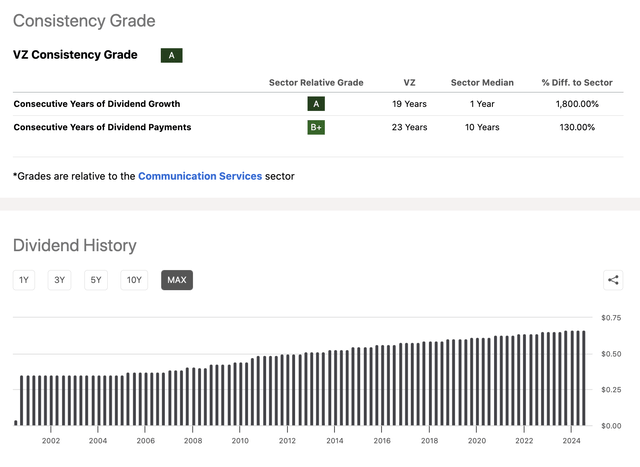

As we have recently published an article on VZ, it makes sense to look at the two companies next to each other. In our view, VZ proves to be the more attractive investment candidate for the two reasons:

- More attractive valuation, with higher upside potential, based on a dividend growth model

- More consistent dividend growth over the last decades

Taking into account that VZ’s yield is also significantly higher than that of T’s could also be considered as a plus.

Conclusions

Today, we have updated our valuation on T’s stock using a dividend discount model. We have created three different scenarios, with different dividend growth rate assumptions, which yielded a fair value for AT&T’s stock between $16 and $26.

We have highlighted the importance of debt and interest rate developments on the firm and on our calculation as well, pointing out that higher interest rates could have significant negative impacts, while lower interest rates could have significant positive impacts.

We have compared T to VZ, and because of the more consistent dividend growth, the higher yield, and the more attractive valuation, we found VZ to be the better investment candidate.

This does not mean, however, that T does not have a place in one’s dividend portfolio. We find T’s stock also attractive based on both the latest quarterly results and also its valuation.

For these reasons, we believe a rating upgrade is justified from “hold” to “buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Past performance is not an indicator of future performance. This post is illustrative and educational and is not a specific offer of products or services or financial advice. Information in this article is not an offer to buy or sell, or a solicitation of any offer to buy or sell the securities mentioned herein. Information presented is believed to be factual and up-to-date, but we do not guarantee its accuracy, and it should not be regarded as a complete analysis of the subjects discussed. Expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.