Summary:

- We were aggressive buyers of AT&T Inc. stock sub $15 but were asked plainly “if we were wrong to sell at $19?”.

- The concept of a house position for future gains is considered.

- Recent developments include potential DirecTV-Dish merger talks and new labor agreements, which could positively impact future operations and reduce debt.

- Despite AT&T’s significant debt burden, the company aims to reduce net debt-to-EBITDA to 2.5x by 2025, ensuring financial stability and dividend security.

- At the end of the day, you need to ask yourself what is best for your specific situation.

Pakin Jarerndee

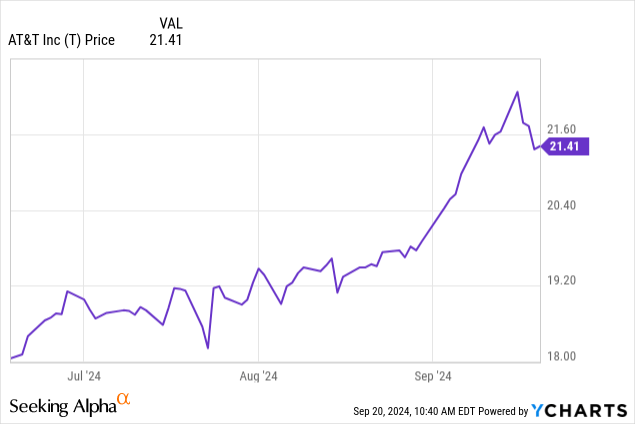

As you may be aware if you follow our work or are a member of our investing group, we were aggressive buyers of AT&T Inc. (NYSE:T) sub $15. We were asked plainly by a member if “it was wrong to sell the stock at $19?” The answer to this is simple. If you bailed out entirely, then yes, given the recent price action, then “it was wrong” in the sense that you missed more upside.

We believe no one gets hurt taking a profit. That said, this is why we embrace our approach to trading, which is when we have rapid trading gains in massive well-established companies, we like to move to a house position. That is, in the case of AT&T, when the stock passed our $19 price objective on the trade, we backed out of the initial investment, and let a portion of the profit margin run as a long-term hold. Thus, while we could have earned more by hanging on to it all, we also do not risk holding it and seeing it swing back to losses. The house position could run to zero, and we still made out. Obviously, we do not expect that.

With AT&T, we plan to hold these shares for an investing lifetime, collecting future dividends, spinoffs, gains, etc. And in the few short months since locking in those gains and moving to a house position, shares have added another 15%. However, we are capturing that with a house position, and with the bountiful yield, letting that profit run and reinvesting the dividends is a real wealth-building tool. This is the approach we take to build wealth for those in our group. And we stand by it. So no, it was “not wrong,” it was wise as the funds from the trade were moved into other fruitful opportunities.

That said, AT&T stock, despite the run, remains reasonably valued, is returning to modest growth, and continues to see cash flow strength. We think you stick with it, but nothing wrong with considering taking some profit.

Performance remains strong

We previously covered the recent earnings in some detail, but we will reiterate just a few of the highlights to lend evidence to our assertion that things are improving. Revenue in Q2 was $29.8 billion, although this missed analyst consensus by $180 million. Mobility revenues were up 0.8% from Q2 2023, and we liked the service revenue growth of 3.4%. This was the result of both subscriber and postpaid ARPU growth, but we have been seeing lower equipment revenues on lower sales volume. We think a key strength was that prepaid and postpaid adds were strong, coming in at 35,000 and 419,000, respectively. Postpaid churn was also quite low, at just 0.70%.

Further, AT&T reported 239,000 fiber net adds, which is 18 straight quarters with more than 200,000 net fiber adds. And we think Q3 will also surpass the 200,000 mark. One negative continues to be business wireline, where revenues were down again 9.9% year over year, primarily due to lower demand.

The final thing we will mention regarding performance is related to the dividend. Folks, the dividend is well-covered, and there is room for future hikes. AT&T generated a strong free cash flow of $4.6 billion in the quarter. With $2.1 billion in dividends paid out in the quarter, the dividend payout ratio was below 50% (hitting 45.9%), which translates to a massive margin of safety on the dividend.

Recent developments

There have been recent developments here to consider. The biggest development in our opinion is the possibility of DirecTV possibly combining with Dish Network, run but EchoStar Corporation (SATS). We have been in and out of AT&T for years before moving to a house position. Followers of the AT&T saga may recall that the company spun off DirecTV as part of a deal with TPG Inc. (TPG) in 2021. It was a deal that valued the company at $16 billion and was interpreted poorly given the price tag the company paid for it. A disaster really.

As part of the spin, operating control of the satellite provider and its U-verse and AT&T television operations were given up, but AT&T held on to a 70% financial stake. Options had been explored for this stake. According to reports, AT&T and its partner TPG Capital are in talks to merge their DirecTV service with Dish. If this pans out, it would be the largest pay-TV provider in the United States. However, this would be a second attempt, as a few years ago the companies tried to merge. It was blocked by regulators in the U.S. Right now, it is just talk, if not speculation, but a development to keep in mind.

In a recent conference, the impact of some 15,000 workers being on strike was brought up. The biggest impact is the levels of installations in the Southeast would take a hit. However, the CFO stated that “we don’t expect this to have a material impact on our financial results for Q3.” However, earlier this week, a deal was reached with these workers. This was a deal with the CWA, and the new agreement covers these nearly 15,000 employees in the Southeast. Most of the workers are technicians, call center workers, machine operators, and other customer service roles. The impacted workers are across nine states.

Separately, AT&T also reached a new agreement with 8,400 employees in the West. The full deal should be ratified in the coming weeks. So, while this will come with added wage costs and health insurance premium costs, it ends the strike and installations and should help boost adds in the impacted regions.

Ongoing risk is AT&T’s debt burden

It is worth mentioning in any column on AT&T Inc. stock that the debt is the biggest risk here. A good chunk of cash has to go to debt servicing. And while debt has been chipped down by selling off assets and making payments, bids on spectrum auctions and infrastructure investments to be made will ensure that the company remains debt-laden. Total debt was $130.6 billion at the end of Q2, and net debt was $126.9 billion. With that said, the company expects net debt-to-EBITDA to hit the 2.5x leverage range in the first half of 2025, the lowest it has been in years, which is positive.

Looking ahead

Settling out the strike is a positive, even though there would have been “no material impact.” That does not mean there was no impact. The potential merging of DirecTV and Dish is a new development, but it was previously blocked. Such a deal would help to raise cash and chip down debt, we would surmise. As we look ahead to the rest of this year, we are looking for wireless service revenue growth in the 3-4% range. Capital investment will be in the $21-$22 billion range, while cash from operating activities should be around $40 billion. For the year, free cash flow will be in the $17-$18 billion range, which means the dividend is secure.

When it comes to whether it is right or wrong to take profit, we think having a house position is a good balance, locking in sizable trading gains but being exposed long-term to future dividends, spinoffs, and gains. At the end of the day, investors and traders need to do what is best for their needs and financial goals.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You can never WIN if do not BEGIN

Get more with our playbook to significantly grow your wealth by embracing a blended trading and investing approach at our one-stop shop.

Our prices go up October 1st by $150 per year. But act now, beat the price hike, and we will knock off an extra $200. Get direct access to our fund traders today, and start winning now.

We invite you to try us out, with a money back guarantee if you are not satisfied (you will be). You won’t be disappointed when the gains roll in.