Summary:

- Maximizing your income per dollar invested can create a portfolio that outpays your income needs.

- Don’t aimlessly pile on risk, do the research to increase safety.

- We look at thousands of ideas and invest in only the best.

RBFried/E+ via Getty Images

Co-authored by Treading Softly

Buying food at a discount is always nice. More healthy calories per dollar spent.

Buying gas at a discount is always nice. More miles per dollar spent.

Buying income-generating investments at a discount is always nice. More income per dollar spent.

Interestingly, most investors readily agree with the first two statements but disagree with the last one. Most investors don’t like to buy cheap discounted stocks because they’re worried what has fallen will fall further-thinking more like a momentum trader than a long-term investor.

This mindset often leads individual investors to buy high and sell low, generating market-trailing returns over the long run or, worse, losing money entirely.

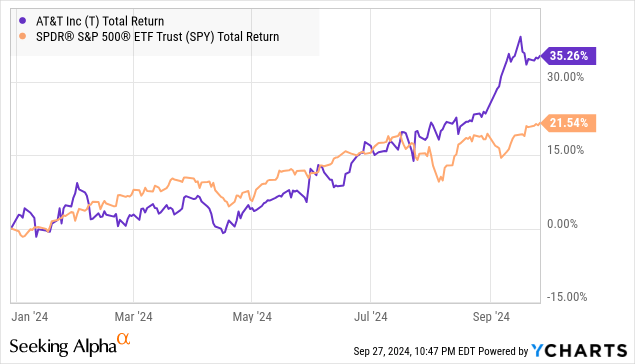

I love market-beating returns, and AT&T (NYSE:T) has been having a great year, handsomely outperforming the S&P 500 while delivering steady qualified dividends to shareholders.

After seeing a year-to-date outperformance, the question becomes whether the company can maintain that performance over the long haul.

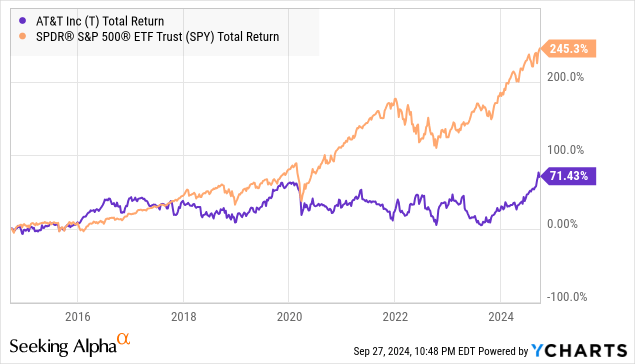

It can be easy to forget that when a company beats the market one year, it may have come after decades of market trailing performance:

So, even with phenomenal year-to-date performance, I want to look at this company to see if it remains extremely cheap compared to its peers.

Let’s dive in!

Telecoms Are Moving To The Future

AST SpaceMobile (ASTS), a Texas-based satellite designer and manufacturer, is the talk of the town after successfully launching five of its BlueBird satellites. The company is working on its next satellite iteration that includes larger antennas to support greater network coverage per satellite and higher data speeds. ASTS has filed with the FCC for an additional 243 satellites to be put into orbit.

Verizon (VZ) and AT&T, yielding 5.1%, have invested considerably in ASTS to have their satellites power broadband services and provide voice, data, and video services via traditional cellular spectrum in the 850 MHz band. This is known as the direct-to-cellular device model and presents the next chapter for wireless telecom operators to expand the geographic footprint of their 5G offerings. The broadband capabilities of satellite-based connections also have the potential to support high-throughput enterprise applications like SD-WAN services.

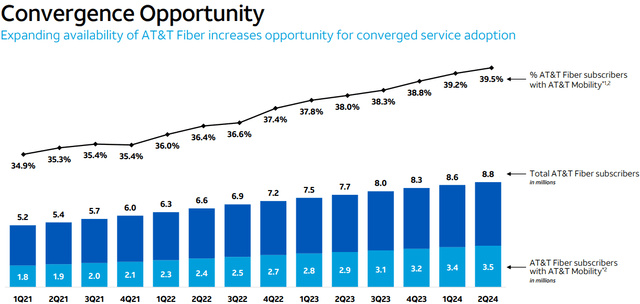

Much of AT&T’s strong financial performance in Q2 is attributed to the increased focus on cross-selling across its offerings. The telecom company has an impressive status of having nearly four out of every 10 AT&T Fiber households being wireless customers. Source

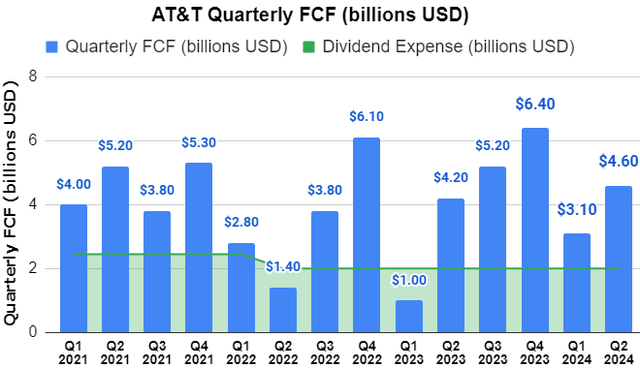

During 1H 2024, AT&T generated FCF (Free Cash Flow) of $7.7 billion (up 48% YoY) while spending $4 billion on common stock dividends. This leaves over $3.7 billion of FCF after dividends for the company to reinvest into the business and reduce debt.

AT&T maintains an investment-grade BBB+ balance sheet with a net debt to adjusted EBITDA of 2.9x at the end of June 2024. The company aims to achieve over $2 billion in run-rate cost savings by mid-2026 and is on track to reach a leverage ratio of 2.5x in 1H 2025.

Over 17,000 AT&T internet service technicians, customer service reps and other related workers in nine states walked off the job after talks stalled last month between the company and their union (Communications Workers of America). AT&T projects $21-22 billion of capital expenses in FY 2024, indicating significant buildout activity. Three weeks of worker strikes in nine states can result in a significant slowdown in infrastructure buildout efforts, not to mention the dissatisfaction of customers who may be facing service disruptions. But despite this, CEO John Stankey has reaffirmed the FY 2024 guidance for 3% YoY revenue growth and 7% YoY broadband growth. The company expects adj. EPS between $2.15 – $2.25, placing its annual dividend at a 51% payout ratio.

After years of diligent infrastructure investments, AT&T is experiencing a gush of FCF, projected to be $17-18 billion for FY 2024. We expect the company to get back to growing its dividend after reaching its target leverage ratio of 2.5x early next year.

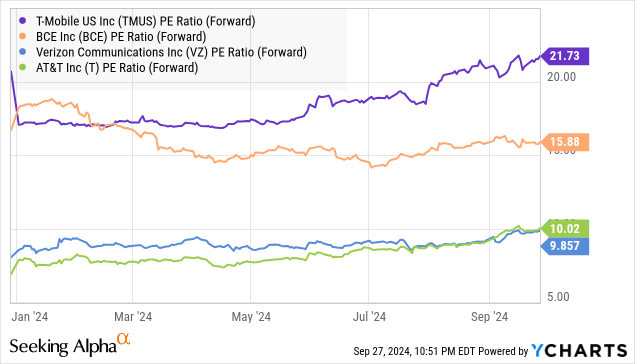

One may wonder why AT&T, at a 5.1% annual yield, makes a good investment. For starters, this company trades at a 10x forward PE, which makes a terrific bargain in a euphoric market. Secondly, we expect AT&T to have lower capex and higher FCF in FY 2025, which will continue to fuel its valuation improvement. The company’s 50% payout ratio indicates a highly conservative capital return policy, with adequate room for payment raises in the years ahead. Finally, telecom is a necessary service in an increasingly digital economy. The U.S. has very few players who dominate the market, and in recession or no recession, consumers will only be increasing their business with the operators.

Conclusion

When compared to major North American telecom peers such as T-Mobile (TMUS), VZ, and Bell Canada, aka BCE (BCE), AT&T is trading at a significantly lower forward PE ratio, aside from VZ:

This means that, even though it has had market-beating returns so far this year, AT&T remains significantly discounted compared to peers while providing a nice 5% QDI dividend payment. This is the kind of holding that would be well at home within a taxable account, where you can receive qualified dividends that enjoy preferential tax treatment while also expecting continued capital gains in the future. If the yield becomes unattractive enough, you could readily sell it and rotate to another opportunity in the market.

When it comes to the market and retirement, my goal is to maximize the income that I generate per dollar invested in the market. I do this by finding attractive investments that provide strong income today and have a bright outlook for the future. I don’t sort the market based on what has the highest yield and blindly put my faith in those investments; those are usually at their weakest fundamental health points. I do limit the bottom end of my portfolio’s yield and take the time to do the research, examining thousands of different opportunities. The result is our model portfolio of High Dividend Opportunities, which houses over 90 ideas. You can create a portfolio of your own that generates high levels of income for your retirement today, with strong prospects of income growth in the future. Maximize your income per dollar invested and enjoy the best retirement possible; that’s the beauty of my Income Method, and that’s the beauty of income investing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Treading Softly, Beyond Saving, Philip Mause, and Hidden Opportunities, all are supporting contributors for High Dividend Opportunities. Any recommendation posted in this article is not indefinite. We closely monitor all of our positions. We issue Buy and Sell alerts on our recommendations, which are exclusive to our members.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

High Dividend Opportunities, #1 On Seeking Alpha

HDO is the largest and most exciting community of income investors and retirees with over +8000 members. We are looking for more members to join our lively group! Our Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple and straightforward.

Invest with the Best! Join us to get access to our Model Portfolio targeting 9-10% yield. Don’t miss out on the Power of Dividends!

We’re offering a limited-time 17% discount on our annual price of $599.99 plus a 14-day free trial via this link only: