Summary:

- Atlantica Sustainable Infrastructure plc announced a sale to Energy Capital Partners at a price of $22.00 per share.

- The purchase price represents a premium to Atlantica’s Sustainable price before rumors of the deal.

- We examine the deal valuation from AY and Algonquin Power & Utilities Corp.’s perspective and tell you why a slightly higher price is probable.

PM Images

We have written about Atlantica Sustainable Infrastructure plc (NASDAQ:AY) and Algonquin Power & Utilities Corp. (NYSE:AQN) several times previously. In both cases, we were generally skeptical of the fantastically rich valuations that bulls were ready to pay. This was primarily a symptom of yield-chasing, where the underlying asset-based valuations were being ignored in favor of high payouts. We pivoted to a more constructive stance in the case of AY at an adjusted cost basis of $22.47 using covered calls.

In the case of AQN, we made our first buy rating at $5.58 and stuck to it through our latest update.

So the risk remains that AQN loses this sale window, and we go into the next recession without the assets being sold. At present, we think this gets done and AQN escapes with the skin of its teeth. We are maintaining our Buy Rating with the $7.00 price target and will reassess if the sale does occur. We currently do not have a position here but do have one in AY, which we see as the lower risk play on a relative valuation basis. A sale for AY likely happens at a $25 plus price, and we think that is the better play here.

Source: Atlantica Sustainable Sale Looks Probable Soon.

The AY sale did get announced, albeit at a really poor price. Energy Capital Partners (“ECP”) will take it private at $22.00 per share. While the price is below the last close, ECP pointed out that it was well above the price where the market rumors started.

The purchase price represents an 18.9% premium to Atlantica’s closing share price on April 22, 2024, the last trading day prior to the emergence of market rumors regarding a potential acquisition of the Company. Further, the purchase price represents a 21.8% premium to the 30-day volume weighted average trading price as of April 22, 2024. The transaction values Atlantica at an equity value of approximately $2,555 million.

AQN has already agreed to vote its 42% shares in favor of this, so investors might be wondering if they even have a chance of getting more.

The Fundamentals – AY Point Of View

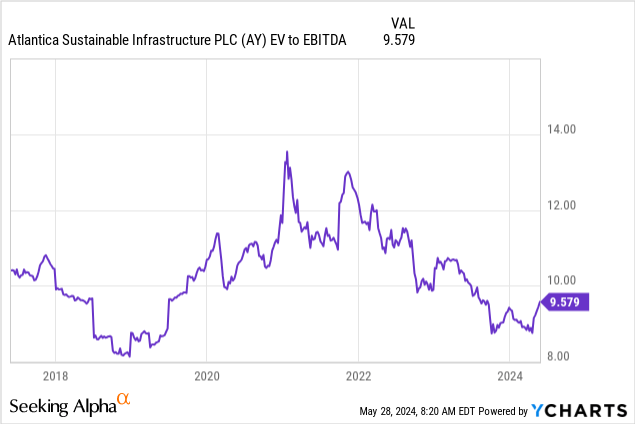

While we were disappointed with the AY sale price, the valuation was not the worst in the world. It only appeared that way to speculators who paid top dollar for this in the ZIRP (Zero Interest Rate Policy) bubble.

The buyout near 9.5X EV to EBITDA is fairly reasonable. One might have expected a slightly higher valuation, simply because credit conditions have eased so much since the October 2023 stock market bottom. There are certainly example of stocks trading far higher in this exact area, like Brookfield Renewable Partners LP (BEP). That one trades at over 17X EV to EBITDA and astute investors know that a 7 point difference in EV to EBITDA is far more than a 7 point difference in P/E multiples. But a lot of that premium valuation for BEP is driven by hydro assets, which command a far higher price. AY’s flexibility was also modestly constrained by a net debt to EBITDA of well over 6.0X. While this was not an existential risk, thanks to most of the debt being at project level, it did limit the ability of the company to grow in a high interest rate environment. Overall, this was an ok deal, but we will get to why we think there is a possibility of getting more, a little later in the article.

The Fundamentals – AQN Point Of View

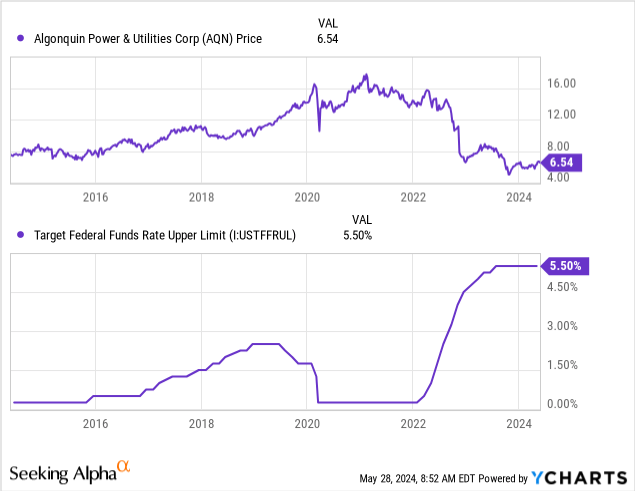

AQN had, of course, wanted to get this deal for some time. Its foray into buying every single asset in the name of growth had not really panned out once the support of ZIRP disappeared.

This was probably reinforced when their Q1-2024 results came out and once again AQN disappointed the bulls with a poor showing.

On a per share level, our first quarter adjusted net earnings per share was $0.14, an 18% decrease year-over-year. Our adjusted net earnings per share was down $0.03 year-over-year as continued growth in our regulated business was offset by an expected decline in our renewables business which was primarily due to our simplification efforts and the wind down of our development joint venture.

Source: AQN Q1-2024 Conference Call Transcript.

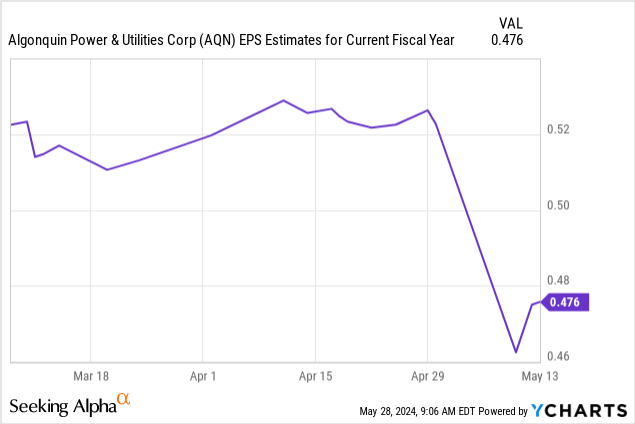

EPS estimates have once again fallen as the year has progressed and that growth fantasy gets pushed out for the third consecutive year.

This transaction should allow some deleveraging for AQN and simplify the story. The company also got a permanent CEO as the interim CEO, Chris Huskilson, was seen as the best fit for the position. On a purely regulated utilities setup, with a lower risk balance sheet, AQN could move as high as $8.00 to compete with valuation seen elsewhere in the utilities space. At present, the sale supports our view that the $7.00 price target can be reached relatively quickly.

Verdict

While this sale does not materially change what we knew a few weeks back, investors should not consider this a closed chapter. There is definitely a chance of a higher price for AY, even though AQN has signed off. One might assume, with 42% of the shares wanting the deal, why would there be any doubt? After all, 50% is within a stone’s throw away, and surely, there are those that bought near the lows who won’t be terribly disappointed with $22? Well, we require 75% and not 50% here.

Company Shareholder Approvals” means 1) the approval of the Scheme of Arrangement by a majority in number representing not less than three-fourths (75%) in value of the members or class of members (as the case may be) present and voting either in person or by proxy at the Scheme Meeting and 2) the passing of the Company Shareholder Resolution by members representing not less than three-fourths (75%) of the total voting rights of eligible members present and voting either in person or by proxy at the Company GM.

Source: 6-K.

The stock also opened a shade over $22.00 (at $22.16, down 5.38%). So there is likely a belief that there can be a sweetener here. It won’t cost the counterparty that much. Even if they pay an additional 10%, the amount will be marginal in relation to the enterprise value is mainly made up of debt. So some upside is quite probable. AY will also continue its dividend right into the close, so that adds to the total return profile. We hold some shares of AY and have sold the $25.00 covered calls for October 2024 as we did not believe we would get more than that in a sale. We are maintaining the position for now as we do not see substantial risk of the deal not going through.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AY either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

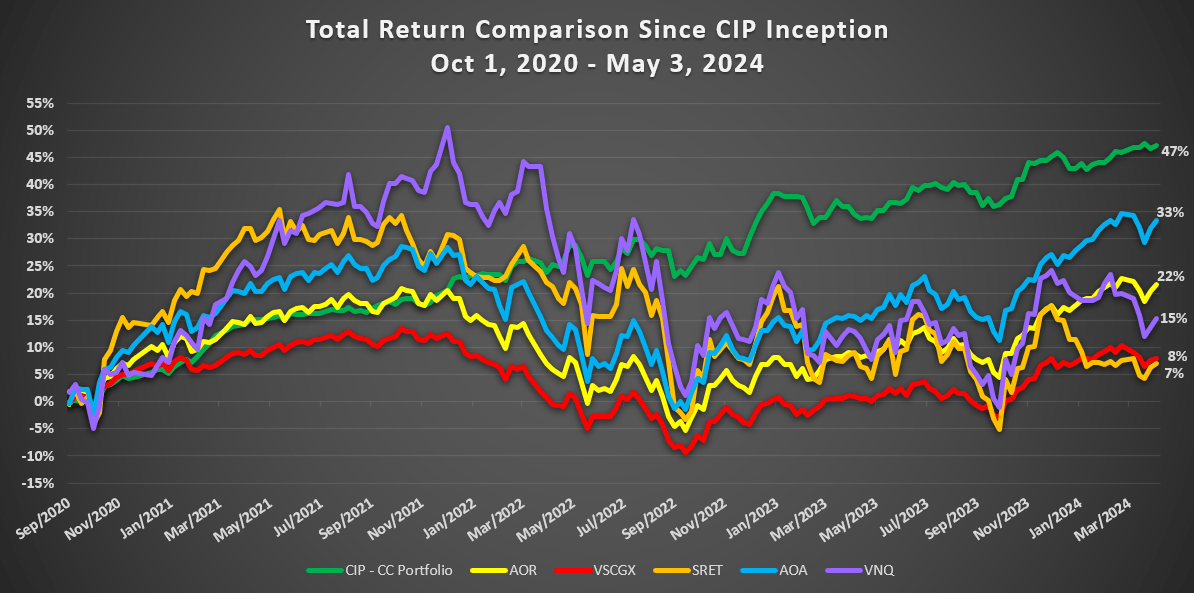

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.