Summary:

- AT&T’s refocus on its core telecom business has led to growth in wireless subscriptions and a robust expansion in the fiber segment.

- Q4 earnings are expected to reflect a decline in EPS, but the company’s strong momentum and low valuation make it an attractive investment for income investors.

- AT&T’s growing FCF and focus on deleveraging lower the risk on its balance sheet, and its dividend coverage of 2x is very safe.

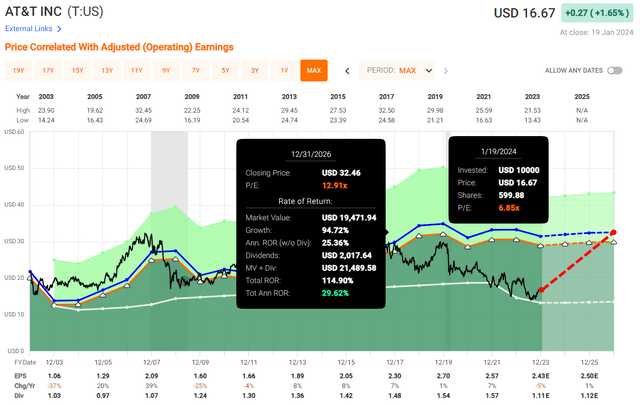

- At 6.85x blended P/E, 53% below its 20-year average, there’s a margin of safety, though a return to the mean isn’t assured.

PAU BARRENA/AFP via Getty Images

AT&T Inc. (NYSE:T) usually grabs the attention of investors looking for income. It’s no surprise, considering the company is currently dishing out an enticing 6.66% dividend, drawing in investors hoping for a steady income and maybe a boost in the company’s valuation back to its historical average. This could potentially lead to significant returns, especially if the stock is trading at a blended PE of 6.85x today, roughly 53% below its 20-year average of 12.91x.

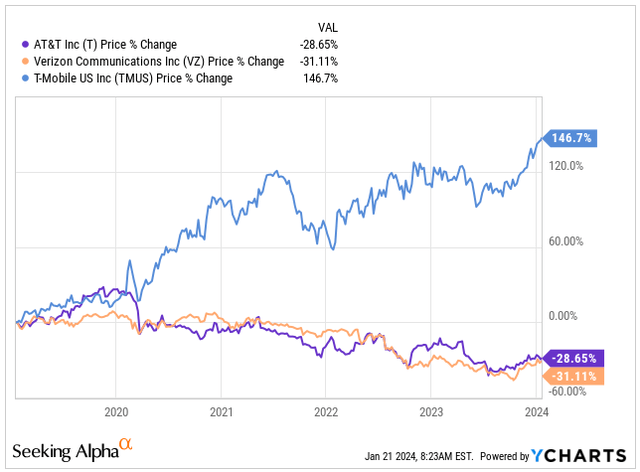

However, telecommunication companies, including AT&T and its main rival Verizon (VZ), haven’t been in the spotlight much in recent years. The exception is T-Mobile US (TMUS), which is on a fast growth track.

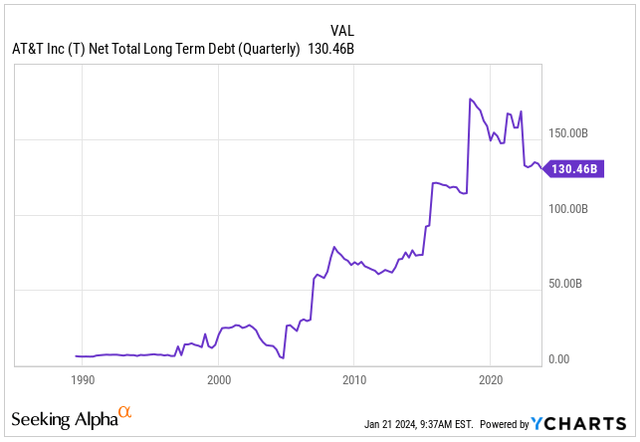

The challenge for AT&T revolves around its substantial $126.7 billion long-term debt, acting like a weight that’s dragging down the business. Additionally, earnings growth is expected to stay relatively flat for the next three years, and there’s the looming concern of potential legal issues related to the lead cable public health crisis.

Price Development (Seeking Alpha)

That being said, AT&T is set to report its Q4 earnings this Wednesday.

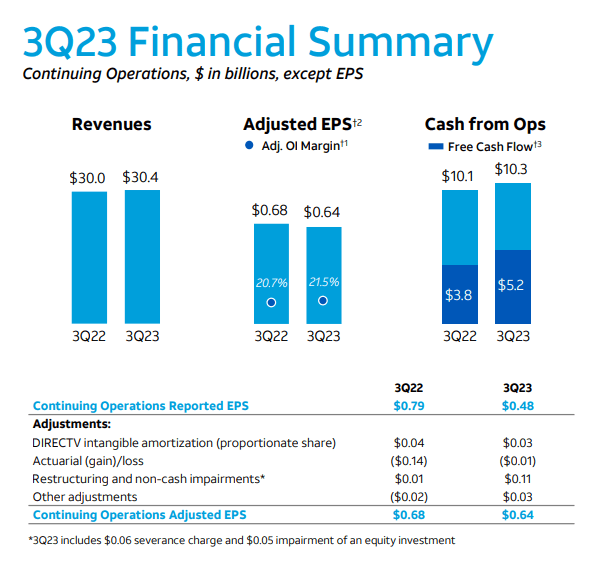

Analysts are generally predicting earnings per share of $0.55, indicating a 9.8% YoY decline, while revenues are expected to be around $31.46, roughly in line with the previous year.

Now, let’s assess whether one should buy AT&T shares.

Q3 Recap

AT&T has undergone substantial changes in the past few years. Since John Stankey assumed the role of CEO in 2020, he spearheaded a shift in the company’s focus, steering it away from its entertainment dominance by spinning off WarnerMedia and returning to its core telecom roots.

The company has a history of investing billions in building its entertainment empire, a strategy that saw significant setbacks under Stankey’s leadership. The spin-off was accompanied by a 28% dividend cut, indicating past operational missteps that took a toll on shareholders’ trust.

The question now is whether AT&T has learned valuable lessons from these mistakes and if they are back on the right track.

AT&T’s shift away from the entertainment industry was a necessary step to save both money and resources. Building a robust 5G wireless network demanded a significant investment running into billions of dollars. Returning to its telecom roots, AT&T seems poised to solidify its position as the leading US telecom carrier, in terms of wireless subscriptions.

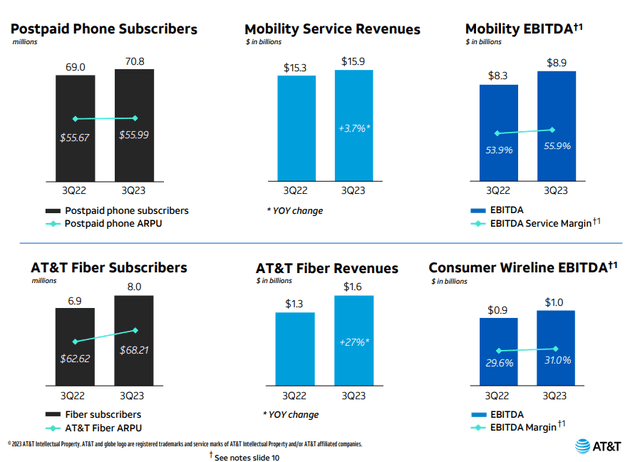

With the new leadership in place, AT&T has achieved a streak of 13 consecutive quarters of net growth in its postpaid phone subscriptions. The telecom giant is not only growing its wireless phone customer base but also retaining them effectively.

The company’s postpaid phone subscriber churn, indicating the percentage of customers leaving AT&T, is currently at historically low levels. Notably, customers who have chosen both AT&T’s mobile phone service and fiber optic internet show the lowest churn rates and the highest customer lifetime value.

This highlights the significance of AT&T’s emphasis on expanding its fiber optic internet service.

The fiber segment is showing robust growth, with Q3 marking the 15th consecutive quarter of acquiring over 200,000 net new fiber customers. This surge resulted in a noteworthy 27% year-over-year increase in fiber revenue.

Shifting focus to AT&T’s primary mobile business, it played a substantial role in the company’s Q3 sales, contributing $20.7 billion out of the total $30.4 billion. The mobile business is performing well, with Q3 wireless service revenue experiencing an almost 4% rise compared to 2022, totaling $15.9 billion.

Q3 Financial Summary (T IR)

Q4 Outlook

For Q4, analysts predict earnings per share of $0.55, reflecting a 9.8% YoY decline, while revenues are anticipated to reach around $31.46, marking a 0.4% increase from the previous year.

At first glance, these expectations might not seem promising, and it’s safe to say they are rather subdued.

However, AT&T is currently experiencing growth in both revenue and customer numbers. As the company wraps up expenditures related to the development of its 5G network in the coming months, there’s an expectation that FCF will improve over time.

This improvement should allow AT&T to reduce debt while still supporting its dividend.

For 2023, AT&T estimates FCF to reach $16.5 billion, surpassing the initial guidance of $16 billion at the beginning of the year and representing a significant increase over the previous year’s $14.1 billion.

In the first three quarters of the year, AT&T generated $10.4 billion in FCF, suggesting an expected Q4 FCF of at least $6.3 billion. This projection would easily make it the best quarter for FCF since the spin-off of WarnerMedia.

Looking ahead, AT&T foresees a revenue boost in the long term due to the growing adoption of electric vehicles, as they utilize wireless bandwidth for features such as software updates. AT&T provides wireless services to various car manufacturers, including Tesla (TSLA) and Ford Motor Company (F).

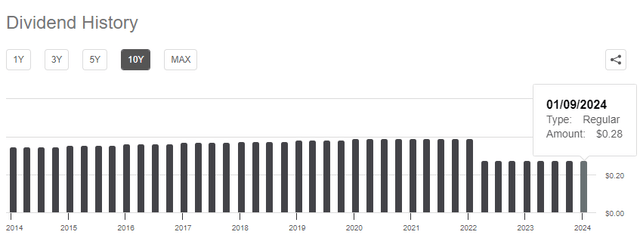

While some investors express concern about the sustainability of the dividend, which was reduced from $0.52 per share to $0.2775 with the WarnerMedia spin-off, the expected record FCF for 2023 suggests a positive outlook.

With 7.15 billion shares outstanding and a dividend per share of $1.11, the total annual dividend expense is $7.92 billion. AT&T’s anticipated FCF covers the dividend 2.08x, indicating a very secure distribution.

Dividend History (Seeking Alpha)

However, it’s crucial to temper expectations regarding any dividend growth following the recent cut.

AT&T currently grapples with a significant net long-term debt, amounting to $126.7 billion. At this juncture, the business’s priority lies in repaying a portion of this debt to create more financial flexibility and reduce risk on the balance sheet. It’s vital to point out that over 95% of AT&T’s long-term debt carries a fixed interest rate, mitigating the impact of elevated rates on interest expense.

In the trailing twelve months, the interest expense totaled $6.5 billion, marking the second-lowest figure since 2018. This reflects the company’s ongoing deleveraging efforts, supported by an additional $7.54 billion in cash reserves.

AT&T is actively working towards reducing its net debt to EBITDA ratio to the 2.5x range by the first half of 2025. This strategic move aims to bring the company’s debt burden to a more manageable level.

Net Total Long-Term Debt (Seeking Alpha)

A potential threat to AT&T’s de-leveraging progress is the lead-cable issue, which hasn’t received extensive attention in recent quarters but resurfaced when the EPA expressed interest in meeting with AT&T regarding health risks associated with these cables.

While there isn’t an immediate financial danger if AT&T is mandated to eliminate the lead-sheathed cables, the estimated removal cost for approximately 60,000 miles of cables not submerged underwater falls in the range of $2 billion to $4 billion, according to Goldman’s estimates. This doesn’t factor in any additional litigation costs stemming from affected individuals.

Valuation

Now, this is where things get intriguing.

AT&T’s growth trajectory isn’t set to be rapid; it’s a mature business with limited potential for market share expansion.

As we’ve established, it offers a secure dividend, which contributes to a reliable return.

However, what makes it particularly interesting is its current stock valuation, which is surprisingly low.

Telecom businesses haven’t garnered much favor in recent years, and while a return to the average isn’t guaranteed, you can still count on a 6.6% return through dividends.

Presently, the stock is trading at a blended PE of 6.78x, a considerable 53% below its 20-year average of 12.91x.

Understanding the growth over the past two decades reveals a less-than-stellar performance, with only a 1.69% annual growth in EPS.

Looking ahead, the anticipated growth for the next three years remains in a similarly modest range, hovering around 1.15% for EPS:

- 2024: EPS of 2.47E, 2% growth

- 2025: EPS of 2.50E, 1% growth

- 2026: EPS of 2.52E, 0% growth

What this implies is that historical growth has been consistently low and is expected to remain so. The current valuation doesn’t result from diminished expectations; it’s more about telecom businesses being somewhat “out-of-favor” with investors.

While a return to the average valuation isn’t a certainty, investing in AT&T today offers a substantial margin of safety and peace of mind, given the conservative outlook for the company.

In the event that investor sentiment shifts and there’s a resurgence of interest, the potential returns could be around 29.6% annually over the next three years.

However, it’s crucial to note that this isn’t guaranteed. Purchasing the stock at present should be driven more by the appeal of income and the attractive valuation rather than the expectation of the stock trading at 12.91x again in the next few years.

Takeaway

AT&T has undergone a significant strategic shift in the last three years. The appointment of a new CEO led to the spin-off of the entertainment segment, redirecting the company’s focus to its core business of telecommunications.

This realignment has proven successful, marked by a streak of 13 consecutive quarters of net growth in its postpaid phone subscriptions and a robust expansion in the fiber segment. The latter has seen a 15th consecutive quarter of acquiring over 200,000 net new fiber customers.

I anticipate this strong momentum to persist into Q4, which will be reported on Wednesday, despite analysts’ modest expectations.

The stock looks attractive trading at more than 50% below its historical valuation, coupled with the expectation of low EPS growth in the next three years and FCF covering the dividend expense more than 2x.

While there is no guaranteed return to the historical valuation, buying AT&T today as an income vehicle seems like a promising investment with a good margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.