Summary:

- There are no reasons to believe that AT&T Inc. will cut its dividends to significantly decrease its debt anytime soon.

- The company generates more than enough free cash flow to cover its dividend payments, pay interest expenses, and grow its business at the same time.

- There are also reasons to believe that AT&T would be able to thrive and create additional shareholder value in the post-Warner Media era despite all the macroeconomic challenges that it faces.

Ronald Martinez

Shortly after Intel Corporation (INTC) decided to cut its dividends to have more resources to execute a turnaround, concerns were raised about whether other companies like AT&T Inc. (NYSE:T) would do the same thing given the higher cost of servicing debt due to the rising interest rates. However, AT&T’s relatively decent performance in Q4 shows that the business is likely to successfully navigate through the current challenging market environment as various fiber and 5G opportunities could help the company to thrive and create additional shareholder value in the post-Warner Media era. At the same time, there are all the reasons to believe that AT&T would stick with its current dividend policy and won’t decide to cut the payments to shareholders to decrease the company’s debt levels due to the company’s ability to generate substantial levels of free cash flow that more than cover the dividend payments and help grow the business. As such, it’s safe to say that AT&T continues to be a relatively safe blue-chip stock for passive investors with a long-term horizon that once again trades at relatively attractive levels.

Thriving In The Post-Warner Media Era

It’s been nearly three years since John Stankey assumed the role of the CEO of AT&T and began the transformation of the business which included the spinoff of the Warner Media, LLC assets which was completed last year via Warner Bros. Discovery, Inc. (WBD). The focus of the management all those years was to stick with growing AT&T’s core business, and it seems that so far things are going pretty well for the company. The latest earnings report showed that AT&T’s revenues in Q4 increased by 0.7% Y/Y to $31.3 billion while its non-GAAP EPS of $0.61 was above the street estimates by $0.04. At the same time, Q4 was the 10th consecutive quarter of postpaid phone net adds, as AT&T managed to increase its postpaid phone base by almost 7 million to nearly 70 million subscribers by the end of December.

Going forward, there are reasons to believe that AT&T would continue to improve its overall performance, which would ensure that the business is growing and is able to cover its interest and dividend payments at the same time. Last year alone, AT&T managed to increase the number of its mid-band 5G points-of-presence to 150 million, significantly above its initial targets that were set at the beginning of the year. On top of that, AT&T has been consistently adding over 1 million fiber net adds, and it’s safe to assume that it will continue to do so in the future, as the demand for fiber internet is increasing and the number of its fiber subscribers already outnumber non-fiber DSL subscribers.

One of AT&T’s biggest advantages is the fact that it’s part of an oligopoly that has high barriers to entry, which makes it possible for the business to constantly expand at a small but predictable rate with little competition. At the end of 2022, AT&T already had 24 million fiber locations passed and it’s currently on track to increase that number to 30 million by the end of 2025. There are two ways how AT&T is likely to achieve that target.

First of all, AT&T’s management has stated numerous times that it’s interested in participating in the federal BEAD program, which was passed as a part of the Infrastructure Bill in 2021 and has a budget of $42.45 billion that’s expected to be funneled to telecom network operators this year to bring connectivity to millions of additional households. BEAD program alone could help AT&T fund the construction of broadband networks in parts of the country where it has a limited presence. At the same time, AT&T’s deal with BlackRock, Inc. (BLK) could help the company to deploy fiber to 1.5 million additional locations and cut the costs of the expansion, as BlackRock is expected to provide funding as well.

Considering all of this, it’s safe to say that AT&T is on track to continue to expand its business and thrive in the post-Warner Media era, especially since the cooling of the inflation in the U.S. gives reasons to be optimistic about the business’s future in the current environment.

Dividends Are Here To Stay

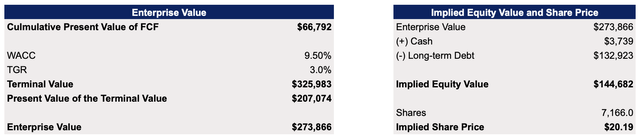

The biggest downside of AT&T without a doubt is the high debt level, as the company had $132.9 billion in long-term debt and only $3.7 billion in cash at the end of December. However, despite all the chatter about how the rising interest rates could lead to the cutting of dividend payments to decrease debt, there are reasons to believe that that’s not going to happen anytime soon.

First of all, AT&T has a much better debt profile than in the past. If in 2021 its interest expense was $6.7 billion, then in 2022 it was only $6.1 billion despite the increase in rates in recent quarters. At the same time, AT&T managed to reduce its net debt by ~$24 billion last year, while in 2022 its net debt to adjusted EBITDA ratio was 3.19x, down from 3.56x in 2021. The management continues to aim for the 2.5x net debt to adjusted EBITDA ratio by early 2025 even in the current environment, which implies that the debt could become much less of a threat in the foreseeable future.

On top of that, with an interest coverage ratio of 3.71x, the company generates more than enough funds to cover its obligations and reward its shareholders at the same time. Considering that during the latest conference call AT&T’s management once again reiterated its commitment to stick with an attractive dividend policy, it becomes obvious that it’s unlikely that we’ll witness a cut in dividend payments anytime soon. Unlike Intel Corporation, which generates negative free cash flow (“FCF”) and can’t sustain paying dividends over the long-term, AT&T is in a much better position. Despite high debt levels, the management expects to generate $16 billion in FCF in FY23, which would be more than enough to reward its shareholders and cover its commitments at the same time. As such, it’s safe to say that dividends are here to stay.

In addition to that, there’s a case to be made that AT&T’s stock is undervalued and could potentially grow further in the foreseeable future, which would make it possible for shareholders not only to benefit from generous dividends but also from the potential growth of the share price. I’ve recently updated my DCF model, which initially was published before the Q4 results came in and showed AT&T’s fair value to be $19.68 per share, by adding new assumptions that better reflect the company’s growth opportunities.

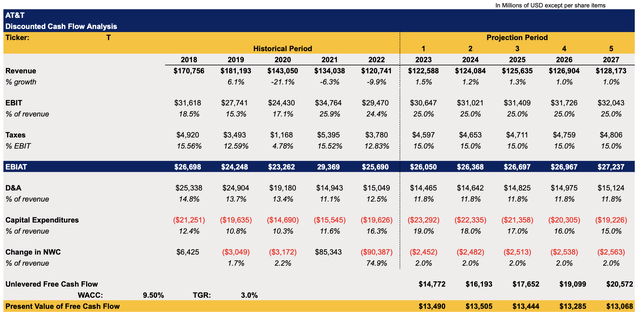

In the updated model below, the revenue assumptions are mostly in-line with the street estimates, while EBIT as a percentage of revenue is capped at 25%. The tax rate is decreased to 15%, as there’s a case to be made that various subsidies and government programs could help the business pay less than previously expected. At the same time, the 15% rate is still above the FY22 rate of 12.8%. The D&A as a percentage of revenue in the future is the average rate of the previous few years, while CapEx in FY23 increases and is closely in-line with the management assumptions after which it gradually decreases. The change in NWC as a percentage of revenue is capped at 2%, which is in-line with the previous model, as the Time Warner-related changes would no longer be present in the following years since the spinoff is now completed. The WACC in the model stays at 9.5% while the terminal growth rate stands at 3%.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

The updated model shows AT&T’s fair value to be $20.19 per share, which is above the current market price of ~$18.5 per share.

AT&T’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

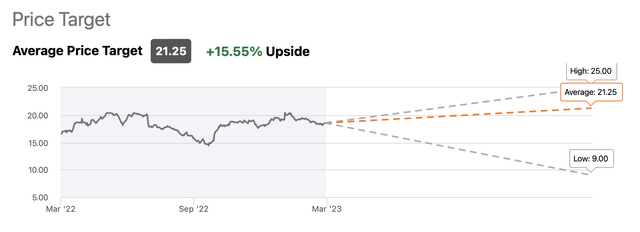

Considering that the street expects an even higher upside and gives the company a consensus price target of $21.25 per share, it makes sense to believe that AT&T’s shares still have more room for growth.

AT&T’s Consensus Price Target (Seeking Alpha)

The Bottom Line

While the debt issue will continue to haunt AT&T Inc. for years to come, it’s highly unlikely that the management decides to cut or fully eliminate the dividends and use the available resources to substantially decrease the company’s debt levels. The company’s performance in 2022 shows that the business is able to grow, cut its debt levels, and reward its shareholders at the same time, and there are no reasons to believe that that won’t be the case in the future, as the expected $16 billion in FCF in FY23 are likely to more than cover AT&T’s commitments and obligations. As such, AT&T Inc. remains a decent stock to own, especially since there are reasons to believe that it still has a decent upside even at the current levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Bohdan Kucheriavyi and/or BlackSquare Capital is/are not a financial/investment advisor, broker, or dealer. He’s/It’s/They’re solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Brave New World Awaits You

The world is in disarray and it’s time to build a portfolio that will weather all the systemic shocks that will come your way. BlackSquare Capital offers you exactly that! No matter whether you are a beginner or a professional investor, this service aims at giving you all the necessary tools and ideas to either build from scratch or expand your own portfolio to tackle the current unpredictability of the markets and minimize the downside that comes with volatility and uncertainty. Sign up for a free 14-day trial today and see if it’s worth it for you!