Summary:

- AT&T has continued to outperform the S&P 500 after forming its capitulation lows in October.

- Savvy investors have likely anticipated a mild recession at worst and not a debilitating one. Consumer spending remains despite worsening macro headwinds.

- With T’s valuation normalized, investors need to ask whether they should remain patient and not chase its recovery.

Justin Sullivan

AT&T Inc. (NYSE:T) bears must be wondering what it would take to force T back to the lows seen in October, even as we approach a potential recession. With the major banks announcing their earnings last week, the prognosis is for a “mild recession” rather than a debilitating one that could cripple highly-indebted companies like AT&T.

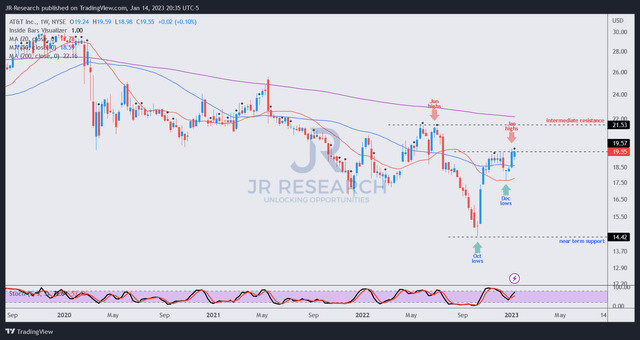

Accordingly, T rallied nearly 37% from its October lows, significantly outperforming the S&P 500 (SPX) (SPY). While it has struggled to break decisively above its November highs to reverse its bearish bias, it has also consolidated robustly.

AT&T is slated to announce its FQ4 and FY22 earnings release on January 25. Investors will likely be keen to parse the company’s FY23 outlook after CFO Pascal Desroches promulgated positive commentary around the company’s H2’22 operating performance. Management indicated that the company had not seen a significant worsening in inflationary impact or weaker consumer spending. Coupled with the mitigation from its pricing action taken earlier, the company seems optimistic heading into its upcoming release.

Commentaries from the major US banks also demonstrated that the US consumer base remains highly resilient. Moreover, the IMF recently updated that the US economy could still dodge a recession after a more downcast outlook from the World Bank earlier. As such, while the macro risks remain vague as economists and strategists jostle to communicate their thesis, it’s much better than the doom and gloom just a few months ago, when fund managers were highly pessimistic.

As such, it should augur well for AT&T as it looks to reduce its debt load. Moreover, the company is also committed to its dividend strategy to placate long-term and income investors who have stayed by its side. Notwithstanding, T’s NTM dividend yield of 5.7% had also normalized from the panic in October when it reached 7.3%. As such, savvy investors have likely anticipated that the company could report a positive Q4 card, in line with management’s recent commentary.

AT&T is also optimistic about its recently announced partnership with BlackRock (BLK) to expand its fiber network coverage outside its 21-state footprint. Desroches articulated that the program is noteworthy as it leverages a constructive regulatory outlook, given the $100B in federal funding to build AT&T’s competitive advantage. As such, the company expects to reach 30m fiber locations by 2025, up markedly from its Q3’22 update of “18.5 million consumer locations pass and about 3.5 million or so of business locations passed.”

What’s critical in the BlackRock partnership is that it leverages the asset manager as its funding partner, allowing AT&T to deploy a “capital-light” model. BlackRock is also confident about the partnership, as discussed in its recent Q4 earnings. BlackRock management articulated:

We recently announced an agreement to form Gigapower, a joint venture with one of our diversified infrastructure funds and AT&T, which upon closing will provide fiber networks to customers and communities outside AT&T’s traditional service area. The network will advance efforts to bridge the digital divide and ultimately help spur local economies and the communities in which Gigapower operates. (BlackRock FQ4’22 earnings call)

T price chart (weekly) (TradingView)

T’s recent price action appears to have drawn breakout investors/traders into capitalizing on a potential recovery of its momentum.

However, we gleaned that such setups after a massive surge are susceptible to a deep pullback, coupled with T’s overbought momentum. Moreover, T’s November highs have not been resolved, suggesting investors need to be wary about market operators using these levels to take profit/cut exposure.

With T’s valuation normalized after its surge from its October bottom, we encourage investors to stay patient on the sidelines and wait for a deeper pullback first.

Rating: Hold (Reiterated).

Disclosure: I/we have a beneficial long position in the shares of BLK either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Do you want to buy only at the right entry points for your growth stocks?

We help you to pick lower-risk entry points, ensuring you are able to capitalize on them with a higher probability of success and profit on their next wave up. Your membership also includes:

-

24/7 access to our model portfolios

-

Daily Tactical Market Analysis to sharpen your market awareness and avoid the emotional rollercoaster

-

Access to all our top stocks and earnings ideas

-

Access to all our charts with specific entry points

-

Real-time chatroom support

-

Real-time buy/sell/hedge alerts

Sign up now for a Risk-Free 14-Day free trial!