Summary:

- AT&T’s management team announced financial results covering the first quarter of the company’s 2023 fiscal year.

- Shares tanked in response because of weak free cash flow, and possibly due to the debt increase, but this move was far greater than it should have been.

- The company’s overall health looks great and investors should see this as an opportunity to back up the truck.

Brandon Bell

April 20th was a truly dark day for shareholders of telecommunications conglomerate AT&T (NYSE:T). After the company announced financial results covering the first quarter of its 2023 fiscal year, shares of the enterprise plunged, closing down a massive 10.4%. This was one of the worst declines in the company’s history. In fact, it has been roughly 23 years since we saw a percentage decline this large for the business. This decline came as the company announced some mixed results. But the real driver behind the push lower seems to have been weak cash flow. Although this is less than ideal, management remains confident in their forecast for the year and shares of the business look incredibly cheap. Moving forward, I expect that shares of the business will go back to outperforming the broader market. And for that reason, I ended up significantly increasing my own exposure to the company. After all, what else are you supposed to do with a ‘strong buy’ candidate that declines materially in such a short window of time?

A look at the news

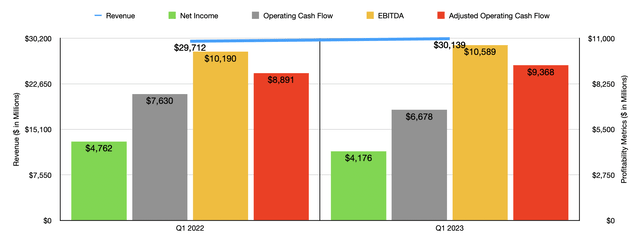

In my view, it would be helpful to touch on the headline news of the company before we do anything else. During the quarter, revenue for the company came in at $30.14 billion. After adjusting for divestiture activities, this represents a modest improvement over the $29.71 billion reported one year earlier. Unfortunately, however, it did fall short of analysts’ expectations by roughly $80 million.

On the bottom line, the company actually outperformed on an adjusted basis. Non-GAAP earnings per share came in at $0.60. That is $0.01 higher than what analysts forecasted. Meanwhile, official earnings per share of $0.57 was lower than the $0.65 per share in earnings from continuing operations that the company reported for the first quarter of its 2022 fiscal year. This translated to a net profit of $4.18 billion, which was down from the $4.76 billion reported only one year earlier. What really seemed to have gotten the attention from investors was cash flow. Free cash flow for the company was around $1 billion compared to the $2.6 billion that analysts anticipated. I don’t pay much attention to free cash flow since management has a great deal of control over growth-oriented capital expenditures. But it is true that operating cash flow took a beating, falling from $7.63 billion to $6.68 billion. Though if we adjust for changes in working capital, the metric actually would have risen from $8.89 billion to $9.37 billion, while EBITDA for the company expanded from $10.19 billion up to $10.59 billion.

The picture is actually stellar

Those who follow my writing regularly know that I am a huge fan of AT&T. I like the company so much from a fundamental perspective that it is one of only 10 holdings that I currently have in my portfolio. You would think that I would be distraught by this latest development. But that couldn’t be further from the truth. I actually took the opportunity to load up on the stock even more, increasing my stake in the company by 71.5%. I did, unfortunately, after sell some shares in Ingles Markets (IMKTA) and General Electric (GE) in order to accomplish this. To be clear, once AT&T recovers back to what it was before the decline, I likely will sell some of this increase. Because after all, it is currently my second largest holding, accounting for 16.8% of my portfolio. I am glad that I made this move though. Because with the increase that the company experienced on April 21st, the greater exposure that I now have to the company resulted in my successful recovery of 51% of the loss I experienced on April 20th.

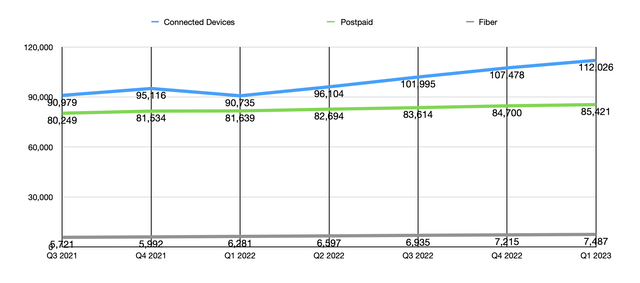

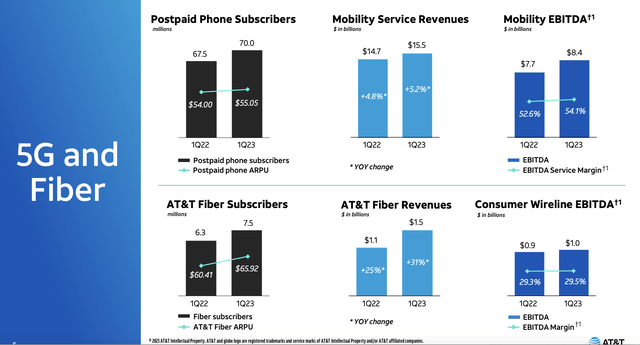

In my opinion, the move higher in the company’s share price on April 21st was driven by the market’s realization that the initial move lower was a drastic overreaction. To see what I mean, we need to dig a bit deeper into the company’s financial performance for the first quarter. In a prior article that I wrote leading up to the firm’s earnings release, I mentioned that there were a few growth areas that investors would be wise to pay attention to. One of these involves the Connected Devices portion of the business, which focuses around the firm’s IoT (Internet of Things) subscriptions. The number of subscriptions under this category ballooned to 112.03 million. That’s up from the 107.48 million reported only one quarter earlier. And it’s 23.5% higher than the 90.74 million subscriptions that the company had only one year earlier.

This is perhaps the fastest growing portion of AT&T. But there are other areas better showing attractive upside. During the quarter, the company had 85.42 million postpaid subscribers. This was up from 84.70 million reported only one quarter earlier. More specifically, the number of postpaid phone subscribers grew by 424,000 on a net basis. This represented the 11th straight quarter of net additions that the company has experienced under this category. Meanwhile, the firm reported around 272,000 net additions to its fiber network, translating to 13 straight quarters of growth. At present, the company has around 7.49 million subscribers on fiber. This is significantly higher than the 6.28 million reported for the first quarter of 2021. It is also worth noting that the ARPU generated by the company’s fiber operations has also been on the rise. In the first quarter of 2022, the number totaled $60.41. Today, that number is $65.92.

As I mentioned earlier in the article, the market seemed to be unhappy with free cash flow. But as I demonstrated already, operating cash flow, on an adjusted basis, was actually higher than it was last year. The difference between that and free cash flow involves capital expenditures. So quite frankly, I am surprised the market is paying much attention to it. We do know that management is still forecasting free cash flow this year of $16 billion. So the fact that guidance has not changed is encouraging. Perhaps another driver behind the move lower involves the company’s leverage situation. At the end of the most recent quarter, management reported net debt of $134.66 billion. That’s actually up $2.34 billion compared to the $132.32 billion reported only one quarter earlier. Management has been focused a great deal on reducing leverage. So it is somewhat discouraging to see a reversal in that regard. But so long as management can come close to delivering on their promise for cash flow for this year, overall debt by the end of the year should fall substantially.

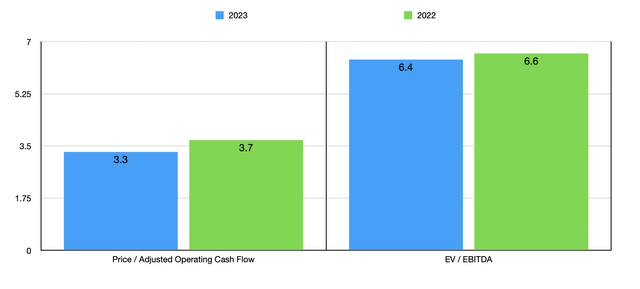

Given that guidance provided by management has not changed, I will use the same assumptions that I used in a prior article in order to value the company. On a forward basis, the price to adjusted operating cash flow multiple of the firm should be about 3.3. This is down from the 3.7 reading that we get using data from 2022. Over that same window of time, the EV to EBITDA multiple of the company should fall from 6.6 to 6.4. These numbers are quite low on an absolute basis and indicate attractive upside in my view.

Takeaway

Based on all the data that I can see, AT&T remains a truly stellar prospect that has tremendous upside potential. Frankly, I am shocked by how the market reacted to this earnings release. Although there were some things that could have been better, the overall health of the enterprise is robust and that picture is likely to continue for the foreseeable future. Because of these reasons, and because of how cheap shares are, I cannot help but to keep it rated the ‘strong buy’ I had it rated previously.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, GE, IMKTA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!