Summary:

- AT&T investors have good reasons to feel disappointed or even despair as its stock prices tanked to all-time low levels.

- In the meantime, the company is involved in an investigation regarding its use of lead cables.

- The investigation, if materialized into a lawsuit, could potentially cause substantial litigation costs and remediation expenses.

- However, I will take a contrarian view here and argue that market sentiment has swung too far in the fear extreme.

- The current valuation is so compressed that all the negatives have been priced in, but all the positives are ignored.

wildpixel

Bridgewater stepped in near all-time low prices

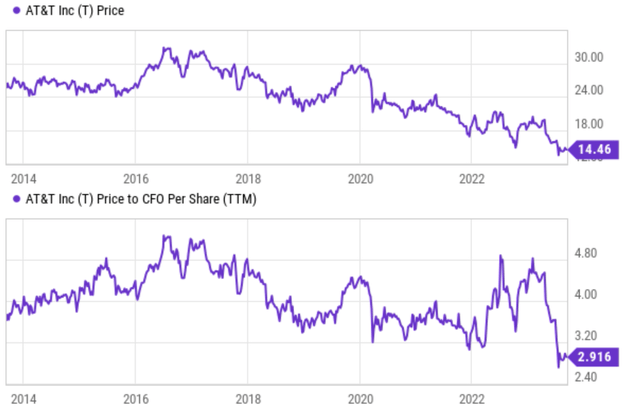

It’s an understatement to say that AT&T (NYSE:T) has disappointed its shareholders. As you can see from the chart below, T’s stock price has been in decline for the past decade from ~$26 to the current ~$14. To make things even worse, the overall market went through one of the most spectacular bull runs in history during this period. The stock has suffered a series of setbacks in recent years and there does not seem to be a clear ending to these setbacks. As mentioned in my earlier articles, it has been facing stiff pricing pressure, deteriorating free cash flows, and high capex requirements in order to remain competitive. Recently, it also was involved in a lawsuit regarding its use of lead cables (more on this in the next section).

Source: Seeking Alpha

Yet, at the junction, Bridgewater Associates started a new position in the company with 1.98M shares. Bridgewater Associates, founded by billionaire investor Ray Dalio, is well known for its contrarian investing style. And the thesis of this article is precisely to argue for such a contrarian play. In the remainder of this article, I will argue that market sentiment has swung too far in the fear extreme. As seen in the bottom panel of the chart, the stock is now trading at a dirt-cheap valuation (2.9x CFO). I view such an absurd multiple as a sign that the market has priced all the downside risks already while ignoring the positives.

EPA and Justice Department investigate its lead cable exposure

Let me start with the main driver for its recent price decline leading to the current record low level. In my view, this was largely caused by the investigation initiated by the U.S. Environmental Protection Agency (“EPA”) regarding the use of lead-clad telecom cables. In late July, the EPA requested T (and Verizon (VZ) too) to provide inspections, investigations, and environmental sampling data about their lead cable exposure. At the same time, the U.S. Justice Department started the early stages of an investigation about whether the T knew of potential risks to their workers and the environment from the lead cables. These investigations, if materialized into a lawsuit, could potentially cause substantial litigation costs and remediation expenses.

However, these types of investigations and the potential lawsuits could take years, if not a decade, to settle. Therefore, I view the current market reactions to be largely speculative. In my view, the main risks associated with the stock, both in the negative and positive directions, are the profitability in the foreseeable future.

And as I will explain next, the business fundamentals and profitability seem very stable or even improving to me.

Fundamentals are stable/improving

T recently reported its 2023 Q2 earnings. Its EPS dialed in at $0.63 (on a non-GAAP basis) a share, beating consensus estimates by $0.03. Revenues came in at $29.9 billion, slightly missing consensus estimates (by $30M) but representing a 0.9% growth YoY. I’m not too concerned about such slight misses (and I do not suggest you be concerned either). Simple seasonality could have caused such small fluctuations. The overall picture I see here is very stable profitability, or even improving profitability.

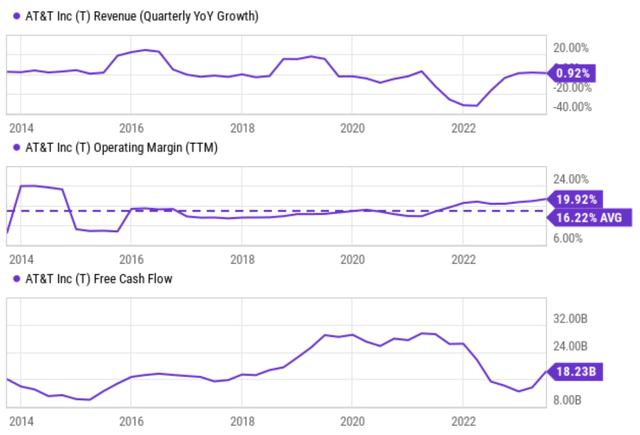

To put things in a better context and see the trendline rather than the random noises, the chart below shows its revenue growth (top panel) and operation margin (mid panel) in the past 10 years.

As seen, after suffering negative revenue growth during most of 2021 and 2022 (partly due to its Warner Media spinoff), its revenues are now stabilizing. In the meantime, its operating margin has been on an upward trajectory. It now sits at about 20%, far better than the long-term average of 16%.

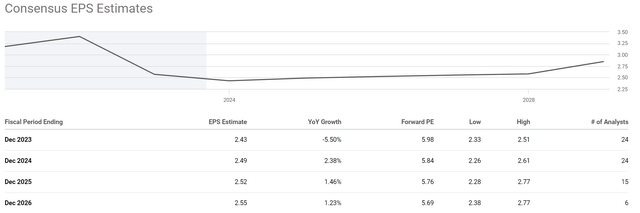

Thanks to the combination of stable top line and improving margins, its free cash flow also has recovered dramatically from the bottom (see the bottom panel). In 2023 Q2 alone, it reported a free cash flow of $4.2 billion, compared to $1.0 billion in Q1. It also reaffirmed its target of generating $16 billion or better in free cash flow in 2023. Looking beyond 2023, consensus estimates also expect healthy bottom-line growth as seen in the second chart below.

Looking further ahead, I expected such healthy profitability and free cash flow to be sustained. My view is that the Warner Media spinoff has put T in a much better position in terms of capital allocation flexibility and strategic focus. T now has much better odds of accomplishing its strategic goals on the 5G and fiber fronts, reaching the pivotal point earlier, and staying ahead of the competition curve.

Source: Seeking Alpha

Source: Seeking Alpha

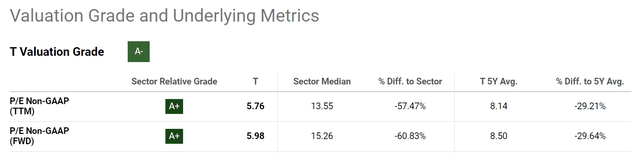

Valuation has all negatives priced in

As such, my view is that the current valuation has completely ignored these positives and only focused on the negatives. As mentioned, the stock trades at 2.9x of its CFO. In terms of P/E, as seen in the chart below, it’s trading at a P/E ratio in the range of 5~6x. It’s less than half of its historical average P/E of around 12.5x and about 60% discounted from the sector median. To me, the combination of stable (or even improving) fundamentals and extremely compressed valuation creates a highly skewed return/risk profile.

Source: Seeking Alpha

Other risks and final thoughts

There are a few other risks worth mentioning in the downside direction. First, for the EPA and Justice Department investigation, I want to be perfectly clear that I’m not pretending that I know the outcome. My point is that any prediction at this point is purely speculation and yet the market has responded in the negative direction already. As acknowledged by other analysts, the investigation could turn into a drawn-out issue, with a potential impact for T ranging from near-zero to tens of billions of dollars. Although there are ongoing lawsuits against T, which could create a more immediate and significant impact. For example, there’s an ongoing class-action lawsuit alleging that the company misled investors about its financial performance. On the business front, it’s facing competition both from traditional players such as Verizon and also newer technologies such as streaming and Google Fiber. As a result, its traditional businesses, such as landline phone service and pay TV, have been in secular decline, losing market share to wireless and streaming services. It remains to be seen whether its 5G and fiber can advance quickly enough to offset the decline in these traditional segments.

All told, my overall conclusion is that the current valuation discount is more than sufficient to compensate for these risks. At the same time, I see signs and fundamental driving forces for stable or even improving margins and profits. The combination of a large valuation discount and stable/improving fundamentals translates into an asymmetric return/risks profile, the kind of contrarian opportunities that Bridgewater likes to bet on.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Join Envision Early Retirement to navigate such a turbulent market.

- Receive our best ideas, actionable and unambiguous, across multiple assets.

- Access our real-money portfolios, trade alerts, and transparent performance reporting.

- Use our proprietary allocation strategies to isolate and control risks.

We have helped our members beat S&P 500 with LOWER drawdowns despite the extreme volatilities in both the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too. You do not need to pay for the costly lessons from the market itself.