Summary:

- Institutional investors purchased over 111 million of AT&T Inc.’s shares in the last 13F reporting cycle.

- Although this class of investors was bearish on the telecom services industry, they grew bullish on AT&T.

- There are broadly 3 reasons behind this heightened bullishness on AT&T.

Justin Sullivan

AT&T Inc. (NYSE:T) shares have risen nearly 30% from their October lows and investors are now wondering if this is a good time to exit their positions and book profits. Where some investors believe T stock is no longer undervalued and offers minuscule upside potential from current levels, others feel the telecom giant doesn’t have enough fundamental growth catalysts to drive shares any higher.

Amidst this confusion, however, institutional investors have quietly accumulated over 111 million of AT&T’s shares in the last 13F cycle. This bullish institutional stance suggests AT&T’s shares have plenty of upside from current levels and should come as a reassuring sign for its investors.

Institutions Turning Bullish

Let me start by saying that institutional investors are large investors that are prone to making mistakes like the rest of us. However, they do have access to certain resources – such as access to company managements, research teams, supply chain connections, clear investing mandates and ample capital – that gives them an edge over retail investors. So, tracking the trading activity of these sophisticated investors can sometimes provide us leading insights about how the Street’s sentiment is evolving for any given stock.

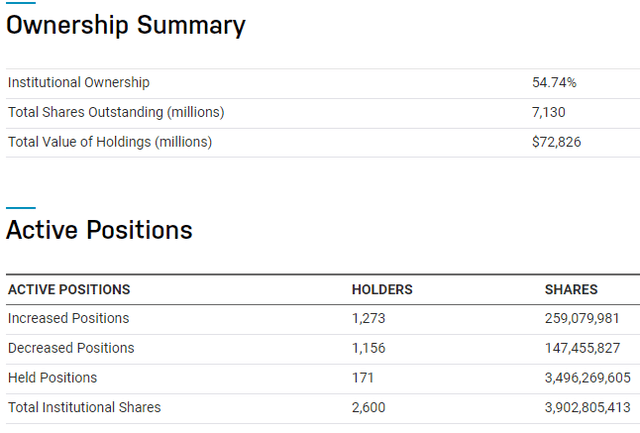

As far as AT&T is concerned, a group of 1,273 institutions purchased roughly 259 million of the company’s shares, whereas another group of 1,156 institutions sold nearly 147.45 million shares in the last 13F cycle. This resulted in a net institutional buying of approximately 111 million shares in AT&T. To put things in perspective, the telecom giant has over 7.13 billion shares outstanding, which meant these institutions accumulated nearly 1.3% of the company’s entire share total in just 1 quarter.

In addition to that, note how the number of institutions that purchased AT&T’s shares significantly outnumbered those that reduced their positions in the name. This indicates that the institutional buying in AT&T wasn’t limited to just a handful of entities, but was rather spread out across the majority of these investors. For the record, the data being referenced in this article is from the 13F cycle spanning from October through December, and the data was fully disseminated less than 2 weeks ago. This makes the data fresh and relevant to our discussion here.

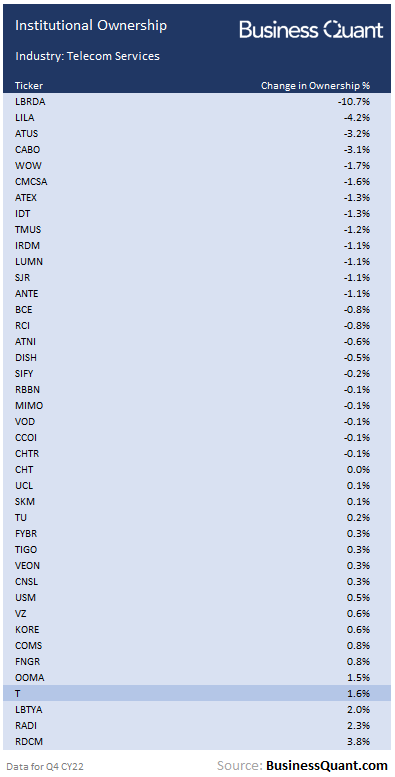

But coming back to our original discussion, I wanted to be sure if institutions grew bullish specifically on AT&T or if this was an industry-wide trend. After all, if most of the major telecom companies saw a rise in institutional ownership, then AT&T doesn’t stand out and our discussion ends right here. So, to get clarity on the matter, I pulled institutional trading data for 40 other telecom stocks.

BusinessQuant.com

The results were rather interesting. Per our database at Business Quant, institutional investors cut their holdings in the majority of stocks that are present in our study group. AT&T, on the other hand, was amongst the top 4 favorites for this class of sophisticated investors. This is a clear indication that institutions grew bullish on AT&T in the last 13F cycle. But it begs the question – what’s the basis for this growing bullish sentiment?

Reasons For Optimism About AT&T

There are broadly three reasons, in my opinion, that are driving institutional investors bullish on AT&T. For starters, the telecom giant has a gargantuan debt pile of $164.37 billion, which is approximately 11.6-times its trailing twelve-month free cash flow, and it bore an interest expense of $6.1 billion in the last year. With interest rates on a meteoric rise, investors were concerned that the telecom giant’s interest expenses would soar to unmanageable levels and eventually eat nearly all of its net income over the years to come.

But AT&T’s management made a rather bold decision a few months ago to slash their dividends in a bid to pare down their debt to 2.5-times their adjusted EBITDA, down from the current level of 3.19-times. This would significantly deleverage AT&T, reduce its interest expenses, expand its bottom line, and free up capital for growth initiatives gradually over the next 2 to 3 years. So, I believe this balance sheet transformation is one of the major reasons behind this institutional buying.

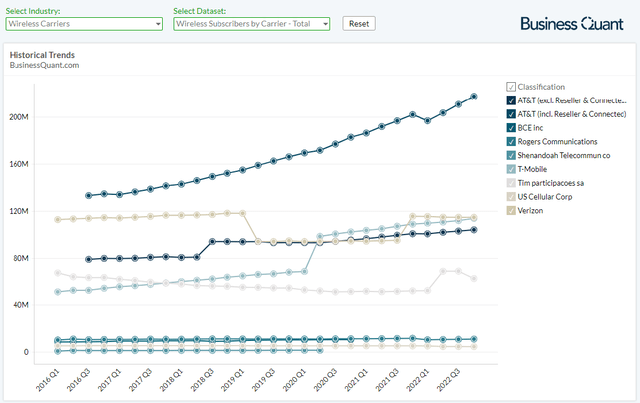

Secondly, AT&T has accelerated its 5G rollouts in recent quarters. The company reached 150 million 5G POPs (or Points of Presence) by the end of 2022 which was more than double its initial guidance for the year. This should, at least in theory, significantly boost the network quality, bandwidth and comfortably accommodate traffic growth in the months to come. These improvements, in turn, provide for a better customer experience and should aid in expanding its wireless subscriber base as well as wireless revenue at the expense of competitors.

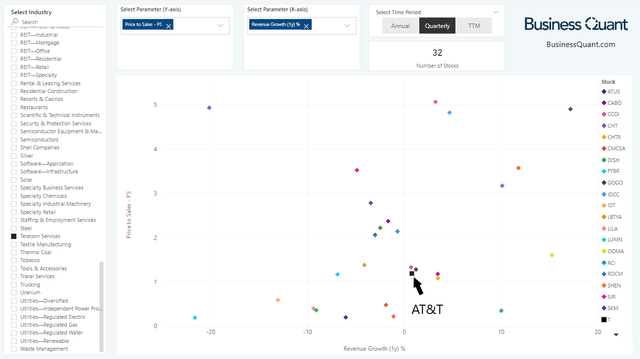

Besides, the chart below reveals that AT&T’s shares are attractively valued at current levels, especially when stacked against industry comparables. The Y-axis plots the Price-to-Sales multiples for over 30 telecom stocks that are trading on U.S. bourses. Note how AT&T is vertically positioned much lower than a broad swath of its mentioned peers, which indicates that its shares are trading at a discount relative to industry levels.

Now, let’s shift attention to the Y-axis, which plots the quarterly revenue growth rates for the same set of companies. Note how AT&T is horizontally positioned towards the right side of the chart, thereby indicating that its pace of revenue growth is much higher than many of its industry comparables. The collective takeaway from both the axes is that AT&T’s shares are growing faster than industry average levels and yet, they’re trading at a relative discount. So, it’s really no wonder why a broad swath of institutions has been growing bullish on AT&T of late.

Final Thoughts

I’d like to add that institutional ownership data is based on trades that have already taken place in the past and it isn’t necessarily indicative of future price action. But having said that, if there were legitimate risk factors at play that posed a credible threat to AT&T’s growth prospects in the near future, these institutions would have exited or at least actively trimmed their holdings in the name. But what we see here is that these institutions grew bullish on AT&T instead. This goes to show that the Street is bullish on AT&T’s growth prospects and it isn’t too concerned about the bearish narratives surrounding the company.

This should reassure AT&T Inc.’s shareholders that their investment has ample upside potential in store for them. The company is paring down debt, ramping up its growth initiatives and the stock is relatively undervalued. So, on these grounds, investors with a multi-year time horizon may want to accumulate the telecom giant’s shares on potential price corrections. Needless to say, I’m bullish on AT&T Inc. Good Luck!

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.