Summary:

- Shares of AT&T have been on a downtrend and, despite improving, more recently sold off with the broader market.

- The communications sector, in particular, has been hard hit as competition is intense in the sector.

- T’s dividend is well covered and debt is coming down, which can potentially provide a brighter future for the company.

- I highlight a recent covered call trade, and recap what we’ve been doing with shares of T.

Brandon Bell

Written by Nick Ackerman. This was included originally in a post to members of Cash Builder Opportunities on March 4th, 2023.

With continuing to hold AT&T (NYSE:T) shares, it’s important that it makes sense to continue holding on to them. We don’t want to hang onto shares from the puts we wrote previously and then never pay attention to the fundamentals.

In this case, T seems to be heading in the right direction after transforming over the last couple of years. That’s quite refreshing, as they’ve made a series of missteps with expensive acquisitions that they’ve now ultimately unwound.

All that resulted in the stock cutting its dividend, but it was mostly expected as a huge portion of the company was divested. A portion that contributed significantly to cash flows for the company. It was essentially “right-sizing” the dividend. With a mountain of debt, it also made financial sense to strengthen their balance sheet. Competition isn’t going away, so being a bit more flexible is a sensible attribute for this company.

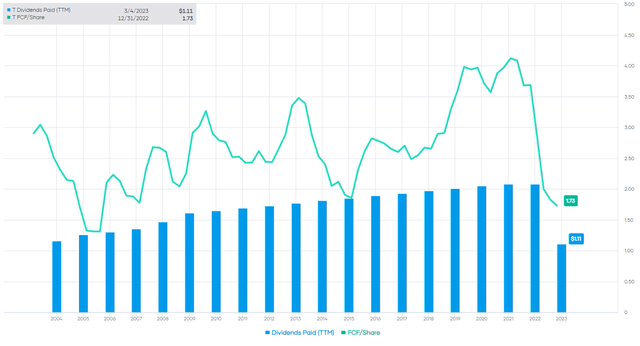

T FCF/share vs. Dividends Paid (Portfolio Insight)

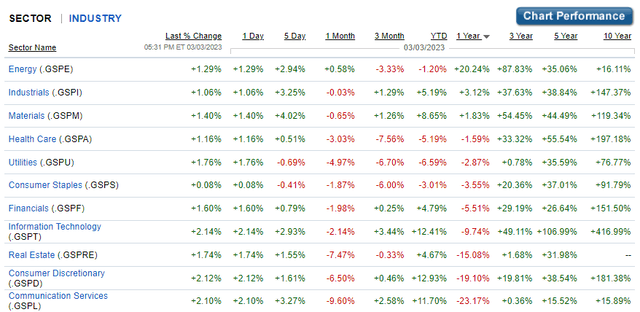

With the economy’s headwinds as the Fed is tightening and that competition, the outlook is pretty unclear for companies such as T. The communications sector has been the worst performing for the last year.

Going back further, it has actually been the worst performing now for the last 3, 5 and 10 years. That’s right, even energy which had been a perennial loser before the last couple of years, has now beaten the communication services sector in returns.

I think this helps highlight the struggles that the sector has been going through clearly enough. It isn’t just T; the whole space has been facing significant challenges. Their share prices have simply been acting accordingly. For what it is worth, T shares are up 4.17% in the last year, bucking the trend of its sector.

Earnings, Dividend, Debt

For T specifically, their last earnings were mixed, but shares received a bump after they were announced nonetheless. They beat non-GAAP EPS estimates but missed revenue estimates.

Free cash flow, an important metric for covering the dividend and paying down debt, as well as growth initiatives, was up considerably. It came in at $6.1 billion for the fourth quarter, bringing the full-year consolidated FCF to $14.1 billion.

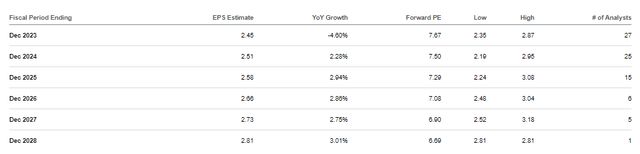

For the 2023 outlook, they aim to hit FCF of $16 billion with an adjusted EPS of $2.35 to $2.45. Notably, that is a decline from the adjusted EPS of $2.57 hit for 2022. They aren’t alone, though; plenty of companies are expecting a mild to a slightly deteriorating year in terms of earnings. So the increase in FCF year-over-year is actually encouraging.

Analysts are on the higher side of their estimates, so they need things to go well for them or risk missing analyst expectations. Of course, which can be detrimental to the share price if we see misses.

T EPS Estimates (Seeking Alpha)

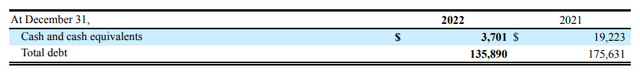

There had been some talk of T needing to cut their dividend again. Given the payout ratio of 46.25% at the mid-point of their adjusted EPS and the FCF payout ratio of around 50% for 2023, I don’t think it is necessary. It would only make sense if they wanted to accelerate further paying down their debt. Which, they have a mountain of debt, but it has been decreasing more recently. A good portion of this debt was reduced primarily by putting it on Warner Bros. Discovery (WBD).

The average interest rate for long-term debt increased from 3.8% to 4.1% year-over-year. This was impacted by higher interest rates impacting the portion of their variable rate debt. However, the jump wasn’t that substantial as the majority of their debt is fixed-rate.

Valuation

Shares of AT&T remain cheap, with a fair value estimate of $27.25. However, their historical P/E range is quite large, so the fair value range is anywhere from $21.47 to $33.04. Earnings are expected to decline in the coming year but recover after that.

T Fair Value Estimate (Portfolio Insight)

All that being said, we are seeing shares trading well below this range – though shares have been trading cheaply for several years now. With uncertainty going forward, expecting a sharp recovery in the immediate future is probably improbable. This can be more of a long-term play as they work through their issues and pay down debt.

Recent Covered Call Trade

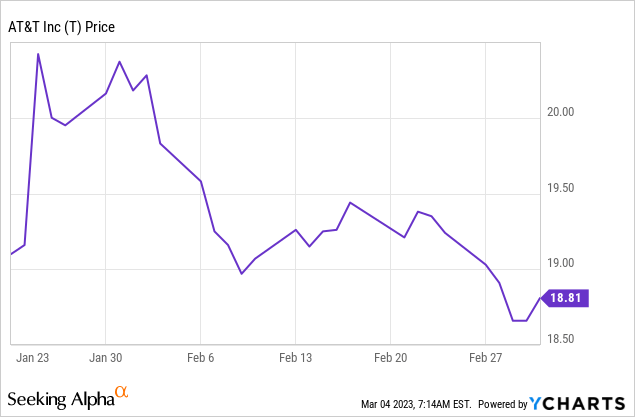

We originally wrote the calls on January 23rd, 2023. We went with the $20 strike price when we had previously taken assignment of shares that were put to us at $19. So we were also looking to cash in on some further capital gains via the appreciation of the shares.

In this latest trade, we collected $0.32 in premium over the course of 39 days. That works out to a potential annualized return of nearly 15% and nearly 16% when factoring in the original assignment price.

Shortly after the trade was entered, shares of T rallied after a good earnings report. This was a ‘risk’ when taking this initial trade. Covered calls, like any investment strategy, carry their own risks and rewards.

However, that jump was short-lived, and the weight of the broader market declining in the latter half of February saw the shares sent lower. Even entering into the last week, where the broader markets showed strength, T wasn’t able to get traction.

Ycharts

These weren’t the only options we’ve been able to write on this latest series of trades. As mentioned, we took the assignment of shares at $19 back in August 2022. At that time, we collected $0.24 in options premiums. We also sold calls in September to collect $0.19. We now have a total of $0.75 in options premiums. That’s over 204 days so far, so we’ve collected this in addition to the two $0.2775 dividends that were paid out.

Conclusion

T has been a highly unpopular stock due to mismanagement over the years. However, they seem to be making the right steps now. The dividend cut was a sting to income investors, but it is looking well covered now. While I don’t anticipate T will blast higher any time soon, I’m happy to continue to hold and write covered calls as the opportunities present themselves.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: May initiate a covered call position on T in the next 72 hours.

Interested in more income ideas?

Check out Cash Builder Opportunities where we provide ideas about high-quality and reliable dividend growth ideas. These investments are designed to build growing income for investors. A special focus on investments that are leaders within their industry to provide stability and long-term wealth creation. Along with this, the service provides ideas for writing options to build investor’s income even further.

Join us today to have access to our portfolio, watchlist and live chat. Members get the first look at all publications and even exclusive articles not posted elsewhere.