Summary:

- AT&T delivered mixed Q2 2023 earnings, missing revenue estimates by $30 million but beating EPS estimates and exceeding its free cash flow projection.

- Despite being seen as a troubled company, AT&T added 2 million postpaid phone subscribers and grew its average revenue per user, indicating growth in its core communications segment.

- The company is focused on reducing debt, increasing profits, and returning additional capital to shareholders through buybacks and dividend increases.

Anne Czichos

On Monday, 7/24, I wrote an article (can be read here) discussing why I wasn’t throwing in the towel on AT&T (NYSE:T) and what I was looking for in their Q2 2023 earnings report. I had outlined what AT&T would need to set the stage for to have any chance at changing the market’s perception. AT&T has been a troubled company, and as I indicated in the article from the 24th, it’s debt load creates a negative impression without any due diligence being conducted about AT&T’s ability to service the debt. AT&T delivered mixed earnings in Q2, but there were many positive aspects. AT&T missed revenue by $30 million while beating EPS estimates by $0.03. Two of the highlights in Q2 were that AT&T exceeded its free cash flow (FCF) projection and committed an additional $2 billion in cost savings over the next three years. AT&T has been a lackluster investment that has been written off by many investors, but AT&T is still a cash-producing machine. I think there is still a lot to be excited about, even though AT&T isn’t considered an exciting company in 2023.

AT&T

AT&T came in with strong Q2 earnings

Companies headed down the path of irrelevancy lose the ability to grow revenue, increase their customer base, and generate future profits. I am certain that there will be comments left on this article that AT&T is dead money and that there are better places to invest. I won’t argue the point around other opportunities more likely to generate capital appreciation. I am a shareholder of AT&T, and I am a shareholder of Alphabet (GOOGL), and if you asked me to speculate as to which company would deliver more capital appreciation over the next several years, I would pick GOOGL. That doesn’t mean that AT&T is irrelevant or that it isn’t undervalued.

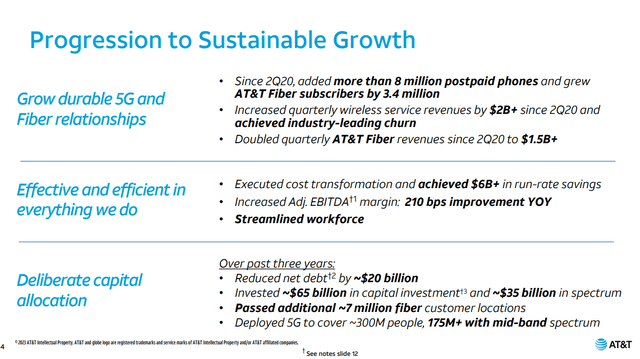

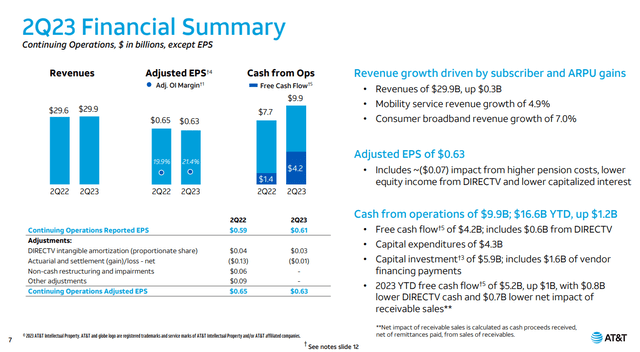

AT&T may have missed the consensus revenue estimates by $30 million, but that doesn’t tell the story of the underlying business. AT&T is no longer trying to build a conglomerate and is focused on its core segment, communications. Dying companies don’t grow; they deteriorate and see internal metrics decline. Over the past year, AT&T has added 2 million postpaid phone subscribers and grew its average revenue per user (ARPU) by $0.82. This drove the mobility unit to generate $15.7 billion of revenue in Q2 2023 compared to $15 billion in Q2 2022, while the EBITDA generated from mobility increased from $8.1 billion to $8.7 billion. On the AT&T fiber side, subscribers increased by 1.1 million while the ARPU increased by $5.05 YoY. The total amount of revenue generated from fiber in Q2 2023 was $1.5 billion, an increase of $300 million YoY, while EBITDA grew $100 million to $1 billion.

AT&T may be disliked, but nobody can dispute its ability to generate profits. Looking at Q2 2023 compared to Q2 of 2022, AT&T increased its cash from operations by 28.57% ($2.2 billion) from $7.7 billion to $9.9 billion. AT&T’s free cash flow (FCF) increased by 200% ($2.8 billion) from $1.4 billion in Q2 of 2022 to $4.2 billion in Q2 of 2023. In Q1 of 2023, AT&T generated $1 billion in FCF, significantly lower than the analyst estimates of $2.6 billion. This left many questioning AT&T’s ability to generate the $16 billion of FCF they guided for in 2023 after the WarnerMedia spinoff. AT&T just beat their projections, generating $4.1 billion in FCF for Q2, and indicated they would be generating roughly $11 billion in the 2nd half of 2023. After paying $5 billion in dividends and distribution and having $2 billion allocated toward spectrum clearing costs, AT&T sees around $4 billion in net debt reduction from the remaining FCF.

AT&T

AT&T’s management is delivering on most of what I want to see

On the 24th, I had indicated that for AT&T to have any chance at reversing the market’s perception on its company, it would need to deliver on the following key performance indicators:

- Growth in subscribers across mobility and fiber

- Reduce expenses as a percentage of revenue

- Increase profits

- Reduce Debt

- Buyback shares

- Annual dividend increases

I follow AT&T closely and wanted to see specific things because I feel the market will respond well to this over time. AT&T delivered several of the things I was looking for. I wanted to see growth across mobility and fiber and AT&T delivered. I wanted profitability to increase, and it did. AT&T grew its FCF by 200% and its net income by 4.96% YoY in Q2. I also wanted to see expenses as a percentage of revenue decline, and it did. AT&T reduced its total operating expenses by -$1.18 billion YoY bringing its percentage of revenue down -5.64% to 78.59%. AT&T is reducing expenses, improving margins, and becoming more profitable.

| In Millions | Q2 2022 | Q2 2023 | YoY difference | |

| Total Operating Revenue | $29,643.00 | $29,917.00 | $274.00 | 0.92% |

| Total Operating Expenses | $24,687.00 | $23,511.00 | -$1,176.00 | -4.76% |

| Operating Income | $4,956.00 | $6,406.00 | $1,450.00 | 29.26% |

| Net Income | $4,537.00 | $4,762.00 | $225.00 | 4.96% |

Pascal Desroches (AT&T CFO) discussed the net debt position on the Q2 conference call. AT&T has generated $15.2 billion in FCF over the TTM and paid $9.3 billion in dividends and other distributions. The net debt didn’t decrease by $5.9 billion, which was the remaining FCF left over because they had approximately $4 billion of one-time items and discrete obligations to payoff, including WarnerMedia post-closing adjustment payment, the final NFL Sunday Ticket payment and redeeming $8 billion preferred interest. A critical aspect of the commentary was that he stated AT&T’s capital investment will decline from all-time levels, which will increase cash and allow AT&T to allocate additional cash to reduce debt. From now until the first half of 2025, AT&T expects to use its FCF after dividends and distributions to reduce debt at a quicker pace, and by the end of 2023, it will have reduced the debt load by around $4 billion. The trajectory is to achieve a 2.5 times net debt to adjusted EBITDA level by the end of Q2 2025.

AT&T isn’t an investment for people with a short time horizon. Shares have barely moved on the strong earnings AT&T posted, and the valuation is still inexpensive compared to the market. I think it’s going to take some time for the market to warm up to AT&T. Over the next several years, AT&T needs to grow the FCF produced, reduce debt, and find a way to allocate additional capital through buybacks and dividend increases. If AT&T can find a way to further improve margins and utilize that capital to reward shareholders, there will be nothing left for the bears to complain about.

Conclusion

AT&T is not a company in distress, and while it may still be unpopular, it’s an FCF machine. I explained the debt situation in the article from 7/24; debt is not the problem some make it out to be. AT&T can service the debt while allocating more than $8 billion annually to shareholders. I want to see AT&T stay the course and not go off on tangents. Their goal should be reducing debt, decreasing its leverage ratio, and putting AT&T in a position to create value for shareholders through capital allocation. I believe the market will respect AT&T much more if they hit their internal financial targets and shift gears to returning additional capital to shareholders in the form of buybacks and dividend increases. Suppose AT&T can grow revenue and FCF, reduce debt to 2.5x or lower net debt to adjusted EBITDA level, and conduct dividend increases and buybacks annually. In that case, there will be limited things for the bears to discuss. AT&T would be looked at as a company that corrected its mistakes, and the commentary around past decisions should decline. I think it’s going to take some time, but I am sticking with AT&T for the long haul, and I will compound my dividends for years to come.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.