Summary:

- T stock is undervalued and has the potential for significant upside.

- Q1 financial results fell short of expectations, but growth areas such as subscriber numbers and broadband revenue offset weak spots.

- Despite missing forecasts, AT&T’s profitability metrics improved, and the company remains on track to reduce debt and achieve its forecasts for the year.

wdstock

Those who follow my work closely know that one of my favorite companies happens to be telecommunications conglomerate AT&T (NYSE:T). As of this writing, it’s actually the third-largest holding in my portfolio, accounting for 13.9% of total assets. Why are my total return on my investment could be better, I don’t mind collecting the nearly 7% yield that I get on my shares. However, it’s my view that the stock is significantly undervalued and deserves to move up materially from where it’s at.

While this will undoubtedly require some time to bear out, management did just announce financial results covering the first quarter of the 2024 fiscal year. And the data there, despite falling short of analysts’ expectations, further solidified in my mind just how undervalued the stock is. So long as management can achieve guidance for this year, shares should see some really nice upside. Because of that and how strong cash flows currently are, I have no choice but to rate the business a ‘strong buy’. This is even in spite of the fact that shares are down about 0.6% from the last time I wrote about the business in January of this year. That compares unfavorably to the 3.6% increase seen by the broader market over the same window of time.

A look at headline items

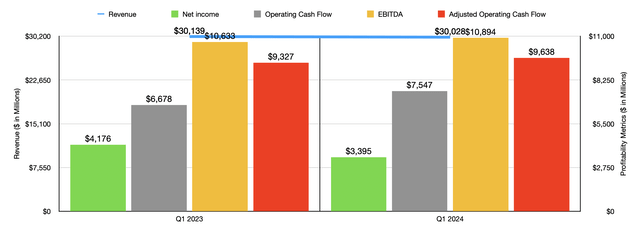

Before we get into some of the more exciting details, we should touch on the headline news that management reported. Revenue for the company came in at $30.03 billion for the quarter. That’s down $111 million from the $30.14 billion that management reported for the first quarter of 2023. In addition to this, it happened to be about $510 million less than what analysts were expecting. On its own, this is incredibly disappointing. But at the same time, I don’t find it to be always surprising.

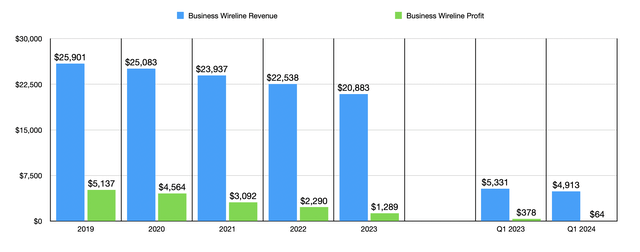

I say this because there are some parts of the business that are in perpetual decline. As an example, we need only look at the Business Wireline portion of the company’s Communications segment. Revenue for the quarter dropped 7.8% year over year, falling from $5.33 billion to $4.91 billion. Management attributed this drop to a reduction in demand for legacy voice and data services, as well as to product simplification. In the chart below, you can see exactly how this type of revenue has been trending (for both revenue and profits) for quite some time now. Meanwhile, under the larger Mobility unit within the same segment, revenue inched up only slightly from $20.58 billion to $20.59 billion. However, this was only because of a 3.3% increase in service revenue. Equipment sales actually fell 9.8% year over year, dropping from $5.10 billion to $4.60 billion.

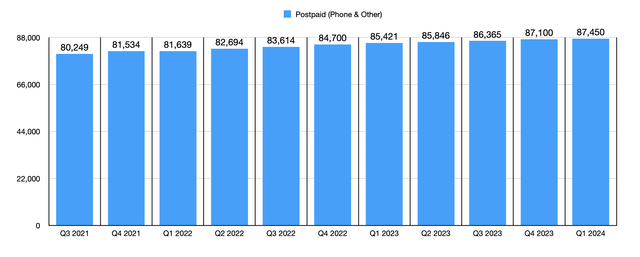

These weak spots were offset largely by the true growth areas for the company. As I mentioned already, service revenue associated with the Mobility unit jumped 3.3%, climbing from $15.48 billion to $15.99 billion. This was driven largely by a growth in the number of subscribers. Total postpaid subscribers, for instance, expanded by 2.4% from 85.42 million to 87.45 million. In the course of a single quarter, the company added 389,000 subscribers. But when focusing on just postpaid phone subscribers alone, the increase was 349,000, taking the company up to 71.56 million in all. Even more impressive were the firm’s reseller subscribers. It skyrocketed 26.8% for the quarter, hitting 7.85 million compared to the 6.19 million reported the same time in 2023. In just a single quarter, the company added 351,000 subscribers on this front. I am very sad because, historically speaking, I’ve always liked to look at growth associated with the company’s Connected Devices. Although only a relatively small portion of revenue came from these devices, the rapid growth that the space achieved was always impressive and signaled to me great potential for the company and its investors. However, management recently made the decision to do away with this metric.

Author – SEC EDGAR Data Author – SEC EDGAR Data

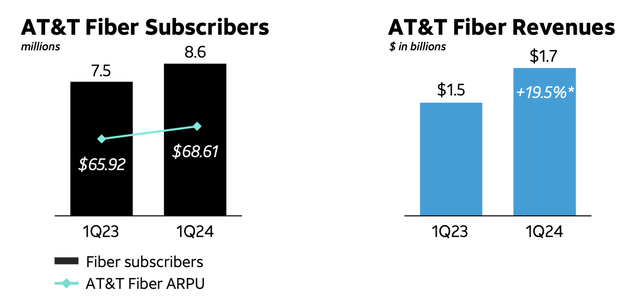

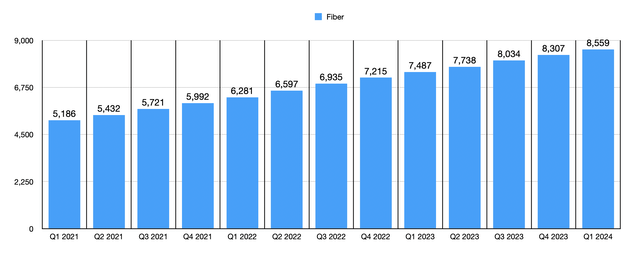

There were some other growth areas for the company. For instance, while the Consumer Wireline segment reported sales growth of only 3.4%, this was because of a 13.6% drop in legacy voice and data services and a 9.5% drop in other service and equipment sales. However, broadband revenue under this unit jumped 7.7% year over year, climbing from $2.53 billion to $2.72 billion. Even as the number of broadband connections only inched up modestly, the number of fiber broadband connections jumped 14.3% from 7.49 million to 8.56 million. The fiber broadband additions for the quarter alone totaled 252,000. This growth allowed the company to grow fiber revenue by 19.5% year over year, with the metric climbing from $1.5 billion to $1.7 billion. But it wasn’t just the increase in subscribers that aided on this front. The company also benefited from a growth in ARPU (average revenue per user) from $65.92 per month in the first quarter of 2023 to $68.61 per month the same time this year.

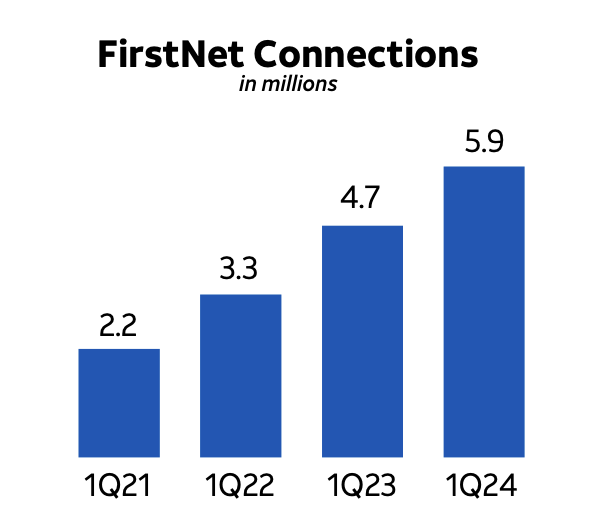

Another impressive growth area for the company as of late has been its FirstNet service, which is an emergency communications network to be used during natural disasters and other horrific events. Working in conjunction with the US government, the company has built out a rather extensive network. During the quarter alone, the company added 320,000 connections to this, bringing the total connections up to 5.9 million. That’s up from the 4.7 million seen in the first quarter of 2023, and it dwarfs the 2.2 million seen in the first quarter of 2021. In all likelihood, this trend will continue.

AT&T

On the bottom line, AT&T did experience some weakness. Earnings per share came in at only $0.47. That’s down from the $0.57 per share reported one year earlier, and it translates to the company missing forecasts by $0.02 per share. The dip in revenue had a slight impact on this. However, there were other contributors as well. During the quarter, the company incurred $159 million involving asset impairments, abandonment, and restructuring activities. It also saw a nine percent increase in depreciation and amortization costs. Most of the pain, however, came from equity in net income of affiliates plunging 45.2% from $538 million to $295 million, and in other income dropping 51.8% from $935 million to $451 million. The fact that the big contributors to the company’s bottom-line pain are non-core activities brings me comfort.

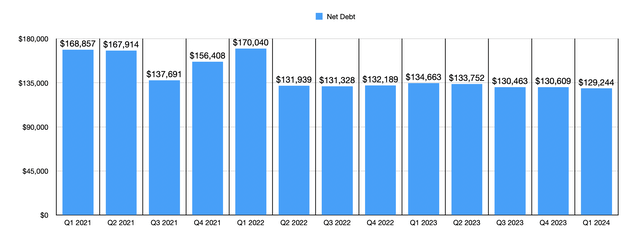

Other profitability metrics, meanwhile, actually improved nicely year over year. Operating cash flow jumped 13% year over year, climbing from $6.68 billion to $7.55 billion. If we adjust for changes in working capital, we get him a more modest 3.3% rise. But it’s from a much higher base of $9.33 billion to $9.64 billion. Meanwhile, EBITDA for the company rose marginally from $10.63 billion to $10.89 billion. In the grand scheme of things, I consider these positive developments. These cash flows allowed the company to pay down debt further, with net debt falling by $1.37 billion from $130.61 billion at the end of last year to $129.24 billion today. Management says that they are still on track to hit a net leverage ratio of 2.5 next year.

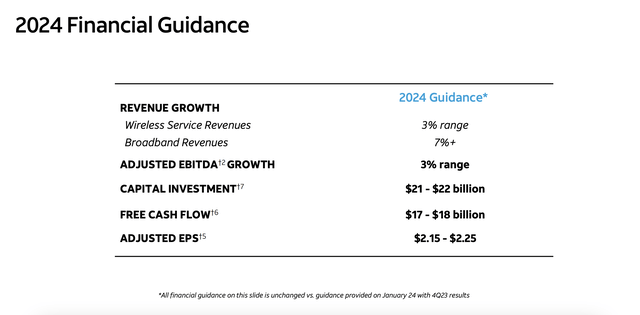

For the current fiscal year, management has reiterated forecasts. This means that EBITDA should come in at around 3% higher than what it was last year. After making some necessary adjustments, this should translate to an increase from $42.24 billion to $43.51 billion. With operating cash flow expected to be around $39 billion for the year, adjusted operating cash flow should be roughly $41.50 billion. That stacks up nicely against the $40.77 billion generated in 2023.

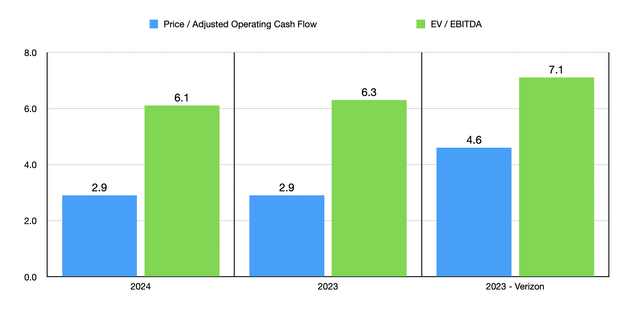

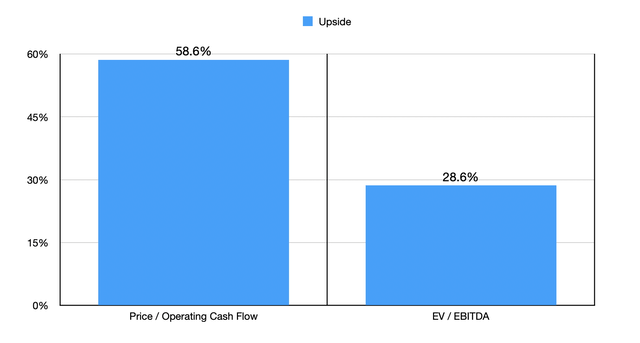

Using these figures, I was able to value the company as shown in the chart above. As you can see, the stock is cheap no matter the way in which we look at it. As part of my analysis, I then decided to compare it to rival Verizon Communications (VZ), as shown in the same chart. On both an absolute basis and relative to its competitors, shares are attractively priced. As an experiment, I created the chart below, which shows what kind of upside potential AT&T should achieve if it trades at the same multiples that Verizon currently is. From looking at it, you should be able to see that upside should range from between 28.6% and 58.6%.

Takeaway

Based on all the data provided, I understand why investors might be disappointed at AT&T falling short of forecasts when it came to both revenue and profits. However, the company continues to grow nicely where it matters most. Add on top of this continued net debt reduction and how cheap shares are, both on an absolute basis and relative to Verizon, and I cannot possibly rate it any lower than the ‘strong buy’ I assigned it previously.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is in cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!