Summary:

- I have been bullish on T since late 2023.

- T recently decided to divest its DirecTV segment.

- This move creates another potent positive catalyst for my bull thesis.

- In the near term, I anticipate the DirecTV deal to catalyze further margin expansion.

- In the longer term, I anticipate it improve its cash flow andspur growth in its core areas such as fiber and wireless.

hapabapa

T stock and DirecTV

As you can see from my writing history, we have turned bullish on AT&T stock (NYSE:T) stock in later 2023 when the stock was trading around $14.6 per share and the FWD P/E was only about 6x. A working bull thesis eventually defeats itself. As prices advance, risks are heightened, and the reward/risk curve shifts. However, in the case of T, I do not think my bull thesis has run its course yet. As a matter of fact, about a month ago (in August 2024), I published another bullish article on T. In that article, I argued that “AT&T’s high dividend yield (5.6% at the time of my writing) understated its upside potential. Its Total Shareholder Yield (“TSY”) is a lot higher with its recent share buybacks and debt paydowns.”

Since that analysis, there is another material development surrounding the company that is worth updating: the divestiture of its DirecTV business. The detail of the divestiture is quoted below.

CBS News (September 30, 2024): AT&T is lowering the curtain on its foray into the entertainment business, selling its majority stake in satellite TV provider DirecTV to private equity firm TPG for $7.6 billion. “This sale allows AT&T to continue to focus on being the leading wireless 5G and fiber connectivity company in America,” AT&T said in a statement on Monday.

In the remainder of this article, I will argue why the divestiture of DirecTV creates another potent upside catalyst for the company both in the near term and also longer term. In particular, I will analyze:

- How this divestiture could help to further expand T’s profit margins and strengthen its competitive position.

- How this divestiture could further help to reduce its debt burden and make the company much more attractive when priced in terms of enterprise values.

T stock: margin expansion potential

For readers unfamiliar with the background. AT&T bought DirecTV for about $48 billion about 10 years ago. The doomed acquisition was soon hit by the unstoppable rise of streaming services. Millions of customers, or cord-cutters, canceled their DirecTV subscriptions and switched to streaming providers such as Netflix (NFLX). In 2021, T decided to divest 30% of its DirecTV stake (to TPG) in a deal valued at $16.2 billion. Thus, the DirecTV business is a sizable investment for T, and its divestiture is a significant strategic move for T (with a current equity of around $120 billion on its book). I expect the divestiture to enable T to better focus on its core growth areas, improve its margins, and further pay down its debt.

Speaking of core growth areas, the top two on my mind are wireless service and broadband. In the past quarter, its wireless revenue increased 3% and broadband growth was particularly robust, with its top line growing more than 7% YOY. I anticipate the momentum to continue given the progress of digital life. T’s management anticipates more than 30 million consumer and business locations with fiber by the end of 2025 and I totally share the optimism.

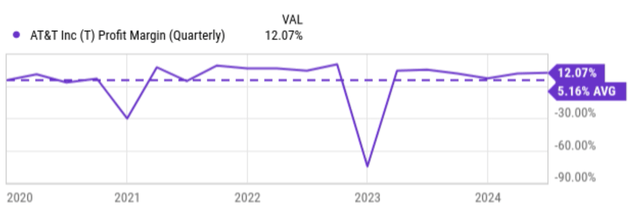

Thanks to robust demand, T’s margins continue to expand. Notably, its operating margin jumped 180 basis points year over year to 38.8% in the past quarter. This marks the fifth consecutive period where the operating margin has improved on a YOY basis. Net profit margin (as you can see from the chart below) improved in tandem too, currently hovering around 12%, more than double its 5-year average of 5.16%.

Looking ahead, I expect such trends to continue for several reasons. Going forward, I expect T further benefit from the economies of scale from the increasing number of subscribers and thus further widen its margins. I also anticipate a good portion of the proceeds from the DirecTV divestiture to be used to further lower its debt and interest expenses, which would also help to improve its margins, as elaborated on next.

T stock: balance sheet and cash flow improvement

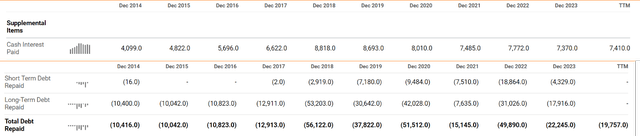

T has been improving both its balance sheet and cash flow at a good pace in recent quarters. As you can see from its cash flow statement below, T has repaid more than $22 billion of debt in 2023 and nearly $20 billion of its debt as of TTM. Overall, the current debt level is very manageable here in my view.

Furthermore, the weighted average interest rate of its remaining debt is about 4.2% only based on my estimation. And about 95% of the debt is fixed rate, so investors do not need to worry about rate uncertainties in the next few years. As a result, as you can also see from the cash flow statement, its cash interest payments have been decreasing at a rapid pace in recent years. The interest payments peaked at $8.8 billion in 2018 and have shrunk to $7.3 billion in 2023. Going forward, I anticipate the DirecTV divestiture to further lower its debt and improve its cash flow.

T stock: EPS growth outlook and valuation

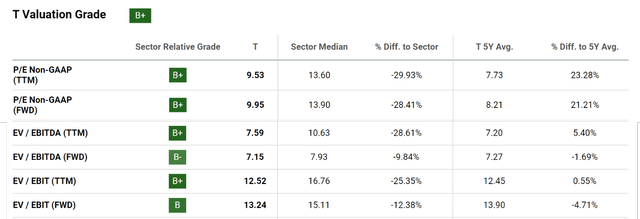

Due to the large price rallies since I started my bullish thesis (again, when it traded at 6x FWD P/E), the stock is not that attractively valued anymore. Price-based metrics, such as the P/E ratio, show that T stock is trading at a sizable premium compared to its historical averages. As seen in the next chart below, its current P/E ratio (non-GAAP TTM) is 9.53, while its 5-year average is only about 7.73x.

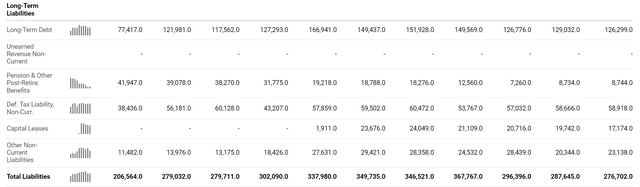

However, my view is that price-based ratios are misleading in this case because they ignored the debt paydowns mentioned above. More specifically, as you can see from its balance sheet below, its long-term debt has decreased from nearly $150 billion in 2021 to the current level of $126 billion only. A lower debt level lowers the enterprise value (“EV”) and makes the company more attractively valued with everything else being equal. Thus, when examined in EV-based metrics, such as EV/EBITDA and EV/EBIT, the valuation picture is dramatically different. As seen in the chart below, both its FWD EV/EBITDA ratio and EV/EBIT ratio still suggest a moderate level of discount compared to its historical average despite the large expansion in its P/E ratios in the past 1~2 years.

Other risks and final thoughts

An article on T won’t be complete without a mention of its generous dividend yield, which provides another upside risk. The stock currently yields 5.07% as of this writing. Such a yield not only provides considerable downside protection but also makes its valuation very attractive in terms of the PEGY ratio that Peter Lynch promoted: below:

For dividend stocks, Lynch uses a revised version of the PEG ratio – the PEGY ratio, which is defined as the P/E ratio divided by the sum of the earnings growth rate and dividend yield. The idea behind the PEGY is very simple and effective (most effective ideas are simple). If a stock pays out a large part of its earnings as dividends, then investors do not need a high growth rate to enjoy healthy returns. And vice versa. And similar to the PEG ratio, his preference is a PEGY ratio of 1x or below.

For T, as aforementioned, its FWD P/E is about 9.9x currently. Consensus forecasts project an annual EPS growth rate of 4.76% as seen below. With a dividend yield of 5.07%, the PEGY ratio works out to be exactly 1.0x.

As a popular stock on the Seeking Alpha platform, the risks generic to T and also the telecom sector have been frequently discussed by other authors. So I will not repeat these discussions here. Instead, I would just point out a risk that is more particular to the DirecTV divestiture. The parties anticipate the deal to be closed in H2 of 2025. Given the time frame and the size of the deal, there is a chance that the deal is delayed or even suffers a miscarriage. Recognizing these uncertainties, both the seller and the buyers have the right to walk away if the deal is not finalized by the end of October 2025.

Although my overall assessment is that the deal will go through as planned. As such, I see an asymmetric return/risk curve ahead under current conditions. To recap, I anticipate the deal to be a positive catalysts for T both in the immediate term and also in the longer term by catalyzing further margin expansion and spurring growth in T’s core areas such as fiber and wireless.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.