Summary:

- AT&T deserves to be scrutinized and even criticised.

- Free Cash Flow based payout ratio remains my favorite metric to judge dividend safety.

- How does Verizon fare against AT&T using this metric? You will be surprised.

- Debt, Management Compensation, and Unrelated acquisitions are other factors I am watching.

Justin Sullivan

One of my favorite things to do with my spare time on weekends is reading Seeking Alpha articles by authors I follow on stocks I own. This helps me both as an investor as well as a contributor myself. I find myself agreeing with some and disagreeing with some. All is fair in love and investing. I just submitted a rebuttal article on another stock, but this article on AT&T Inc. (NYSE:T) is more like an addendum to another Seeking Alpha article I agree with.

David Alton Clark (“DAC”) threw a curveball with his recent article on AT&T, with the title suggesting a possible dividend cut but the actual article negating the concerns. Goes to show it is never safe to judge a book by its cover! I am presenting this article to add a few more points to the discussion about AT&T’s dividend safety. Let us get into the details.

Free Cash Flow Strength

I’ve stated in many of my articles that I prefer using Free Cash Flow (“FCF”) over Earnings Per share (“EPS”) for the following reasons:

- Earnings tend to be up and down depending on rare events and write-offs. This applies more to capital-intensive businesses like AT&T.

- Earnings are more prone to GAAP-related fluctuations.

- Cash flow is king.

Let’s now evaluate AT&T’s dividend coverage based on free cash flow.

- AT&T’s current total shares outstanding: 7.127 Billion

- AT&T’s current annual dividend: $1.11 per share

- Annual FCF required to cover dividend: $7.91 Billion (7.127 Billion share times $1.11 per share)

- AT&T’s reported TTM FCF: $13.091 Billion

- AT&T’s Payout ratio using TTM FCF: 60% ($7.91 Billion divided by $13.091)

I think most of us will agree that a 60% payout ratio is comfortable enough, especially when you factor in the near 6% yield and a forward earnings multiple of 7. But how does AT&T’s closest competitor, Verizon Communications Inc. (VZ) fare using the same metrics? Since the world of investing is all about picking the best option available, it makes sense to compare with the closest alternatives.

- Verizon’s current total shares outstanding: 4.20 Billion

- Verizon’s current annual dividend: $2.60 per share

- Annual FCF required to cover dividend: $10.92 Billion (4.2 Billion share times $2.60 per share)

- Verizon’s reported TTM FCF: $10.881 Billion

- Verizon’s Payout ratio using TTM FCF: 100% ($10.92 Billion divided by $10.881)

Earnings Matter Too

Although I prefer FCF, let us look at EPS as well to ensure all bases are covered. AT&T’s forward EPS of $2.61 means the payout ratio is an even more comfortable 42.50%. Verizon’s payout ratio using forward EPS is 50%. Although the difference here is not as stark as with FCF, AT&T still trumps Verizon. Overall, if AT&T’s dividend is at risk, then Verizon is in an even bigger danger based on Free cash flow and earnings.

Business Fundamentals

On a stand-alone basis too, AT&T seems to be heading in the right direction. The CFO recently updated shareholders, highlighting the strong demand in wireless, their continued focus on cutting costs while continuing to invest in related growth areas like 5G and fiber. In what should be a reassurance to investors, he mentioned the company “expects to use cash after dividends to reduce debt until that time“. By “that time”, the CFO referenced their target to bring net debt-to-adjusted EBITDA target to 2.5, while the generally accepted ratio for this is 3.

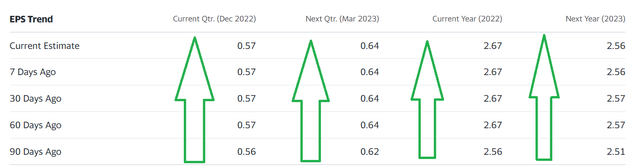

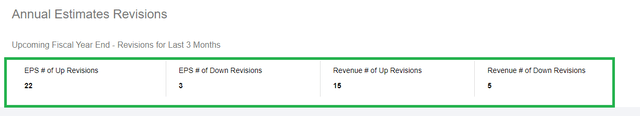

All these changes have not gone unnoticed as AT&T’s earnings estimates have been revised to the upside quite frequently as shown below. This also underlines the fact notion that the stock market is in a period of rotation where undervalued players like AT&T get their dues while the high multiple players get their due shellacking.

AT&T EPS (Yahoo Finance) ATT EPS Revisions (Seekingalpha.com)

The Three Things I Monitor

AT&T did and does have some problems that I am highlighting below. Trust is paramount in the world of investing. It is safe to say AT&T’s management has lost quite a bit of investor trust over the last decade or so at least with their mindless acquisition spree leading to debt and an eventual dividend cut (or spin-off if you want to call it that). Hence, an addition to free cash flow based dividend coverage, I will be watching three other factors with AT&T.

- Debt: As stated in a few of my recent articles, AT&T’s debt has stayed constant over the last 6 months or so, which is a welcome sign given their history. A recent announcement by the company that it boosted its credit facility did raise some yellow flags but let’s wait and watch if and when the company uses it.

- Management Compensation: If the point about is focusing on “if and when” additional debt is taken, this point and the one below are about the “what”. As stated in this article, AT&T’s CEO is already at the top of the list when it comes to pay disparity between CEOs and the average worker among Telecoms. If this continues, especially while debt goes up, that’s another yellow card (which could mean a red flag in entirety).

- Diworsification: This is once again related to the debt and management situation. AT&T’s dismal acquisition history does not only involve the recent media and content debacles but also the failed T-Mobile US, Inc. (TMUS) merger attempt more than a decade ago. The company has just gotten back to its basics of being a telecom company. Focusing just on this should serve the company and its investors well in the long run.

Conclusion

AT&T surprised investors with a relatively strong performance in 2022. I expect 2023 to be a reasonable year as well as the stock is still undervalued fundamentally, and the business fundamentals are lining up as well. While a dividend increase will be the cherry on top, the combination of FCF strength, earnings strength, and business fundamentals make it unlikely that a dividend cut is on the cards.

What other factors are you watching with AT&T? Please leave your comments below.

Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.