Summary:

- AT&T shocked the market with slowing mobile phone subscriber growth for 1Q-23.

- Unfortunately, AT&T also did not earn its dividend with free cash flow in the first quarter.

- I am warning against buying the drop until investors have a clearer picture of AT&T’s post-paid phone growth.

Brandon Bell

Last week, the market slashed 10% off the market value of AT&T Inc. (NYSE:T) after the company disappointed the market with weaker-than-expected first-quarter results. AT&T’s stock plummeted after the market was taken aback by slowing growth in post-paid and broadband, two key areas of growth for the telecommunications behemoth in recent years.

More importantly, because AT&T did not cover its dividend with free cash flow in 1Q-23, the market is concerned about a dividend cut in 2023. Since dividend risks have increased since my last AT&T update, my new AT&T rating is ‘Hold’.

At this point, I do not believe a dividend cut is likely, but I would be cautious about investing in the stock until free cash flow risks have been addressed. The 6% dividend may still be appealing to investors seeking passive income, but dividend risks clearly increased last week.

Slowing Growth In Key Businesses Is A Problem

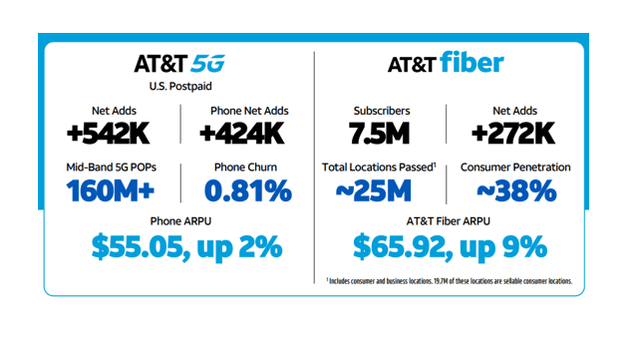

In 1Q-23, AT&T added 424K postpaid phone subscribers to its business, a significant decrease from the previous year. AT&T added 691K post-paid phone subscribers in 1Q-22. Growth in AT&T’s broadband segment slowed as well, with 272K net additions.

Broadband also showed signs of weakness, with net additions falling to 272K YoY, down from 289K net additions. Broadband and 5G are AT&T’s fastest growing businesses, so the slowdown is concerning, especially given the company’s soft free cash flow.

Slowing Growth In Key Businesses (AT&T Inc)

Weak FCF Is A Problem For The Company And The Stock

AT&T’s 1Q-23 free cash flow was a disaster, coming in at only $1.0 billion and demonstrating to the market that the dividend was not covered, and I believe the drop in AT&T’s market value can be largely explained by AT&T’s inability to cover its dividend with FCF. Though the telecom giant stated that it will maintain its 2023 guidance (for the time being), the FCF miss is a major issue, primarily because many AT&T stockholders are looking for passive income.

A dividend cut, which I believe is becoming more likely, would almost certainly force a rethinking of AT&T’s valuation proposition. AT&T has a coverage ratio of 200% based on current free cash flow expectations (estimated FCF for 2023 is $16 billion), but if the company changes its priorities and focuses on capital redeployment or debt repayments, AT&T may decide to reduce its payout.

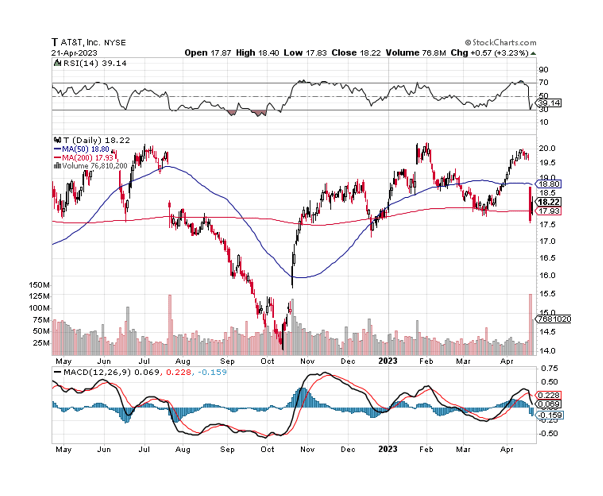

Technical Analysis: Taking A Look At AT&T’s Present Chart Situation

AT&T took a beating last week, losing more than 10% of its market value as key performance metrics in post-paid phone and broadband growth disappointed. The resulting selloff drastically altered AT&T’s chart picture, as both the 50-day and 200-day moving average lines were broken, resulting in a massive gap in the chart.

While an upside retracement is possible, significant negative momentum was created last week that I believe the stock will struggle to recover from in the short term. AT&T saw a minor rebound on Friday, but the overall chart picture is now profoundly bearish, suggesting further downside potential.

Moving Averages (Stockcharts.com)

AT&T’s Valuation Is Reflecting Growing Dividend Risks

The market currently expects only 3% YoY growth in profits per share, and while the stock is cheap based on earnings, the valuation clearly reflects the expectation that the dividend has become more risky.

AT&T is trading at 7.3x earnings for 2024, compared to a forward P/E ratio of 13.4x for Lumen Technologies, Inc. (LUMN) and 7.9x for Verizon Communications Inc. (VZ). Considering the company’s dividend risks, I am not convinced that the current valuation reflects an attractive level.

Earnings Estimate (Yahoo Finance)

Why AT&T Might See A Lower/Higher Valuation

AT&T’s stock price prospects are directly related to the company’s ability to defend its dividend. Even though I don’t believe a dividend cut is imminent, the risk of such a cut increased significantly last week.

If AT&T reduces its dividend payout in 2023, I expect the stock to suffer significant pain and downside momentum, potentially harming investors both in terms of dividend income and potential capital losses.

My Conclusion

The market has generally been unkind to AT&T in recent years, as investors worried about the consequences of ill-timed acquisitions such as DirecTV, as well as the company’s large amount of debt.

Because AT&T embarked on an acquisition spree in the decade preceding the pandemic, the company is saddled with billions of dollars in debt, which increases free cash flow risks. The 1Q-23 free cash flow miss is significant for the company and, in particular, passive income investors who purchased the stock primarily for the dividend.

Because AT&T’s FCF fell short of its dividend pay-out, the company’s dividend risks have significantly increased, and I am downgrading my rating to ‘Hold’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.