Summary:

- AT&T refocused its portfolio by spinning off unrelated assets like DirecTV and TimeWarner, leading to a new business model for stronger shareholder returns.

- The company’s priorities include growing 5G, reducing debt to maintain a 6% dividend yield, and achieving the long-term net debt-to-adjusted EBITDA target by 2025.

- AT&T has seen YoY growth in all business segments, particularly in its fiber business, with strong revenue and EBITDA margin growth.

Sundry Photography/iStock Editorial via Getty Images

AT&T (NYSE:T) made the classic mistake of attempting to become a mega conglomerate. The company invested in wholly unrelated assets such as DirecTV and TimeWarner, both of which it was forced to spin-off. As we’ll see throughout this article, the company’s recent earnings highlight the strength of its new business model, which will help shareholder returns.

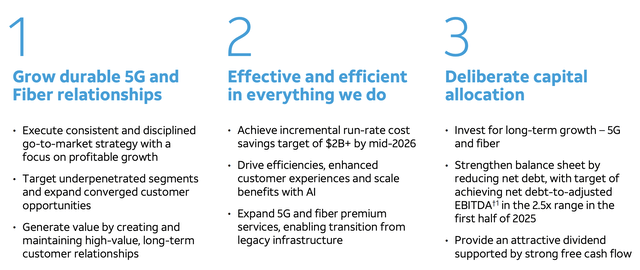

AT&T Business Priorities

The company has a number of business priorities we’d like to see it focus on with its refocused portfolio.

The company’s first goal is to grow 5G, now that the major investment and spectrum purchase cycles are done. The company will hopefully be able to grow revenue and keep expenses low. The company is combining this with run-rate cost savings expected to be in the billions, and synergies between its infrastructure.

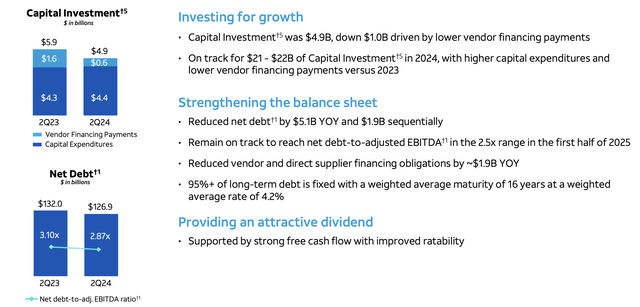

The company has been punished by the market for a long time by its debt load. The company expects to achieve its long-term net debt-to-adjusted EBITDA target of 2.5x in 1H 2025. That will enable the company to maintain its dividend of almost 6% and drive overall shareholder returns.

AT&T YoY Growth

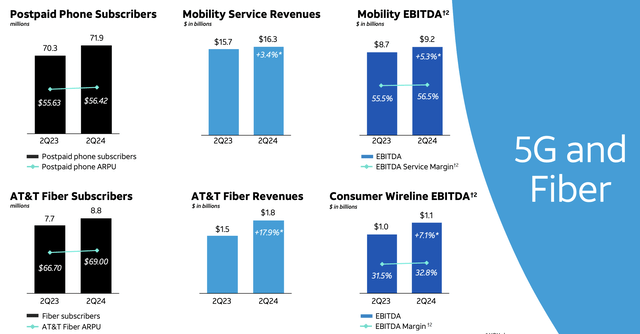

The company has seen strong quantifiable YoY growth among all of its business segments.

The company saw postpaid phone subscribers increase by 2% along with a similar 2% growth in ARPU. That growth lines up with inflation for ARPU, but it shows the company’s ability to continue getting subscribers in a saturated market. This enabled the company to both grow its revenue and EBITDA margin.

The company’s fiber business, which we’ll discuss in more detail below, has also remained incredibly strong, with fiber revenues growing almost 18% YoY. That led to strong top line EBITDA and EBITDA margin growth.

AT&T Fiber Growth

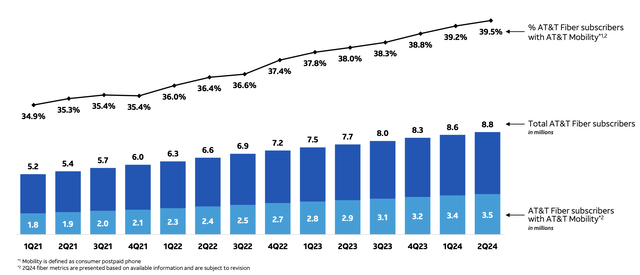

AT&T has been a major source of growth in its fiber business, something it’s continued to chase.

The company has managed to grow to 8.8 million total fiber subscribers, as average fiber revenue has gone up to almost $2 billion quarterly. As someone who’s anecdotally used both AT&T fiber and major competitor Comcast fiber, AT&T is substantially more reliable, offers symmetric up and down bandwidth, and has no data caps. That makes it a much more pleasing experience.

The company has worked to chase synergies with its AT&T mobility business, with not only fiber subscriptions growing, but the % of customers with AT&T mobility has grown as well. That ratio is now almost 40% for the company. The company’s focus in both these segments will help long-term revenue growth.

AT&T Financial Performance

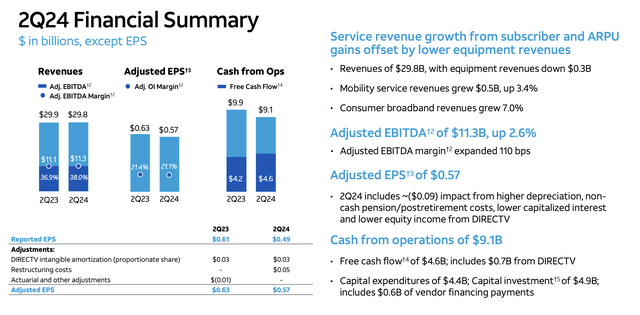

The company had reasonably strong performance through the quarter, even though CFFO declined.

Financially, the company’s overall business remained strong. The company’s revenue remained roughly flat, however, the company’s EBITDA margin grew by 1% to more than $11.3 billion in adjusted EBITDA. The company benefited from strength across the board. EPS of $0.57 declined slightly YoY, but most of the impact was from various depreciation and retirement costs.

The company’s FCF remains strong, and the company continues to generate strong FCF from DirecTV despite the business’ declining nature. The company’s FCF yield annualized is ~15% which will enable massive shareholder returns.

AT&T Capital Allocation

The company’s capital allocation continues to be supported by FCF and its ability to turn that into shareholder returns. This is versus the company’s modest $135 billion market capitalization.

The company has continued to manage its investing while betting on its future and growth. The company spent $4.9 billion in capital investment, annualized at almost $20 billion. The company expects $21.5 billion in capital investment for 2024, with lower vendor financing payments. That enables the company to invest more directly into its business.

The company has managed to reduce net debt by $5.1 billion while growing its EBITDA. The company remains on track to hit 2.5x in the next year. This has come with reduced vendor and financing obligations as well, and the company’s average interest is a mere 4.2%. That means the company is paying only ~$5.5 billion in annual interest, well below market rates, and it’s something it can comfortably afford.

The company’s cash flow enables strong continued shareholder returns.

AT&T Shareholder Returns

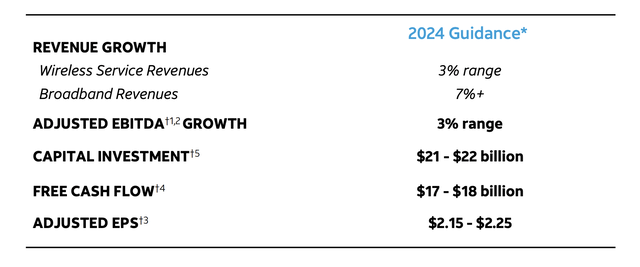

The company’s 2024 guidance shows the company’s ability to continue driving shareholder returns.

Overall, AT&T can drive strong shareholder returns. Even if the large company isn’t growing like crazy, it’s still growing. The company is seeing 3% adjusted EBITDA growth and continued revenue strength. Capital investment is remaining hefty as the company is continuing to invest in its business for the long term.

The company’s adjusted EPS puts it in the solid single-digit P/E ratio range, and the company’s FCF is $17.5 billion. That’s FCF that can comfortably cover the company’s almost 6% dividend yield and support share buybacks and other forms of returns as well. For patient investors, we expect shareholder returns to continue growing.

Thesis Risk

The largest risk to our thesis is AT&T management’s history of lofty ambitions and spending on poor investments. The company has worked hard to clean up its portfolio of assets and drive future returns, however, there’s no guarantee that management doesn’t get carried away in the future and make more poor decisions.

Conclusion

AT&T has recovered by 40% from its 52-week lows set last August. Despite that massive recovery, the company has room to grow as investors accept what we’ve argued for a while. The company’s debt is not a concern, with its long-term duration and 4.2% average weighted rate. That, combined with growing EBITDA, can enable the debt to be paid down easily.

At the same time, the company is continuing to generate strong FCF. It’s maintaining its dividend yield of almost 6%, and it has the ability to drive hefty shareholder returns through repurchases, debt pay down, and dividends. All of that together helps make the company a valuable long-term investment opportunity.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.