Summary:

- AT&T’s Q2 2024 earnings met EPS expectations but slightly missed on revenue, leading to a positive trajectory for the stock.

- AT&T is making progress in strengthening its balance sheet, increasing free cash flow, and rewarding shareholders with stock appreciation.

- Despite past missteps, AT&T’s focus on core business and debt reduction could lead to significant growth potential, including share buybacks and dividend increases.

jetcityimage

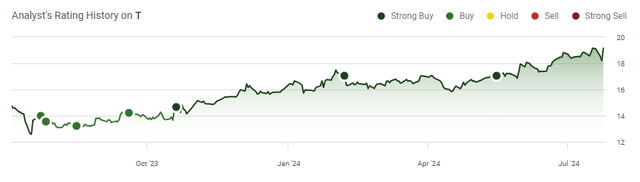

Shares of AT&T (NYSE:T) continued higher after releasing their Q2 2024 earnings as their EPS matched expectations of $0.57 while the top-line slightly missed by $180 million. Shares of AT&T are finally on a positive trajectory after being left on the sidelines for far too long. Many shareholders stuck with AT&T for the large dividend, but after failed mergers and a declining share price compared to the S&P 500, which appreciated by 181.52% over the past decade, some shareholders threw in the towel. The bears have been sticking to the narrative that AT&T’s balance sheet was too levered with debt, but all of that is changing. AT&T’s balance sheet is getting stronger, free cash flow (FCF) is increasing, and the market seems to be rewarding AT&T for its turnaround. Over the past year, shares of AT&T are up 28.16%, and in 2024 shares have appreciated by 16.39%. AT&T still has to climb significantly higher to make up for a decade of lost growth, but it’s likely that shares bottomed when they briefly slid under $14. I believe that AT&T will break through the $20 level and gradually make its way into the mid-twenties before 2024 is finished. I don’t believe AT&T’s story is over, and the market could continue rewarding shareholders as more progress is made. Over the next several years, we could see management implement a dividend growth strategy as their debt levels continue to decline.

Following up on my previous article about AT&T

In my previous article that I wrote in May (can be read here) I discussed how AT&T was getting more attractive as they continued to retire debt. Since then, shares of AT&T have appreciated by 13.05% compared to the S&P 500, which has gained 3.05%. When AT&T’s dividend is factored in, its total return increases to 14.75% over this period. It hasn’t been easy to remain a shareholder of AT&T as there have been many missteps by senior leadership, but that doesn’t mean a turnaround is impossible. I believe we’re witnessing the beginning of a long-term trend higher for AT&T as the bear case is losing a lot of steam. The latest quarter was strong from a financial aspect, and I am looking forward to the second half of 2024 as AT&T should continue to retire more debt and position the company for future growth in 2025.

Risks to investing in AT&T

While AT&T is a large-cap company generating over $120 billion in annualized revenue, there are still significant risks to the investment thesis. AT&T’s has one of the most recognizable brands, but when it comes to the investing world, AT&T is synonymous with negative returns. AT&T has a negative stigma for making bad decisions when it comes to M&A activity and severely underperforming the market. AT&T had to reset the dividend when it spun out Warner Media, and the decades of annualized dividend increases instantly came to a screeching halt. The large dividend that was on the higher end in the mid-single-digit range was the only saving grace for many investors.

There is a chance that the recent appreciation in shares will fizzle out as there may not be enough investors interested in adding AT&T to their portfolio based on its prior history. AT&T doesn’t operate in an exciting area, so it will be hard to get incoming capital compared to companies such as Amazon (AMZN). AT&T also faces competitive risks from Verizon (VZ) and T-Mobile (TMUS) in the wireless category, while they experience increased competition from local carriers for broadband interest. AT&T still has more than $100 billion in debt on its balance sheet, and if its profitability declines, we could see the bears highlight AT&T’s ability to service the debt as a resurrected negative to the stock. Ultimately, AT&T comes with a black cloud hanging over it, as it hasn’t rewritten its past just yet. At any moment, the market could turn on it, and there is a large segment of the investment community that has already been scorned by AT&T.

AT&T continues to make forward progress, and while they missed on the top line, earnings were a positive nod to the future

An argument can be made that AT&T’s earnings were a mixed bag after reporting a -0.4% YoY decline in Q2 revenue. AT&T generated $29.8 billion in revenue during Q2, but it ended up being a slight miss of -$180 million, as the street was looking for a bit more. AT&T produced in-line results, having generated $0.57 of non-GAAP EPS, which allowed them to come out of Q2 earnings season unscathed as it wasn’t a double miss. I think too many people glance at headlines while skimming through the top and bottom-line results without actually digging into the actual report. The market is always correct as it represents the going rate for the underlying equity of publicly traded companies, but that doesn’t mean these numbers are set in stone. The devil is in the details, and after going through AT&T’s earnings report, I believe shares are going higher as I am seeing strength across their products and financials.

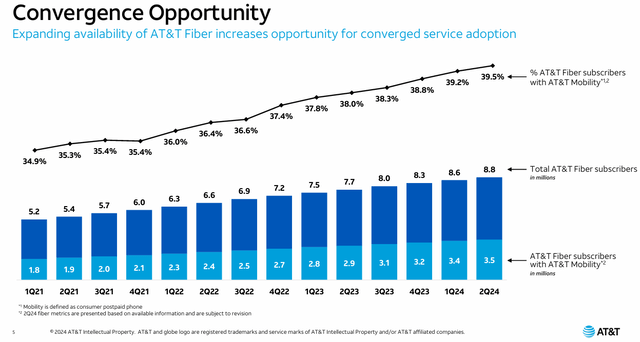

When it comes to a company’s products, I care about customer retention because that translates to the outcome in revenue. Anything else is hearsay, and I form my investment decisions based on metrics and financials. AT&T is now operating a core communications business without having to allocate resources to other endeavors. The key metrics revolve around postpaid phone, and AT&T fiber subscribers. AT&T’s user base continues to expand as both of these segments are still adding users. AT&T postpaid phone subscribers, which is their mobility segment, recognized a 2.28% YoY increase as they added 1.6 million users. Over the past year, AT&T has also driven their average revenue per user (ARPU) higher as they added $0.79 to each user spend on average.

AT&T fiber is also experiencing strong growth as they have added 1.1 million users YoY, which is an increase of 14.29%. AT&T’s ARPU in fiber also expanded by $2.30 per user. The critical key performance indicator (KPI) in my mind is AT&T’s ability to convert its users to bundle AT&T’s services. Since Q1 of 2021, AT&T has grown its fiber subscribers who also have a postpaid phone subscription, by 1.7 million. There are now 3.5 million subscribers who have both fiber and postpaid phone subscriptions. In Q1 of 2021, 34.9% of fiber accounts had a postpaid phone subscription, and this has grown to 39.5% in Q2 of 2024. These achievements have allowed AT&T to grow its revenue and EBITDA.

AT&T delivered $29.8 billion in revenue, and while this was slightly lower than the $29.9 billion they generated in Q2 2023, their Adjusted EBITDA Margin increased from 36.9% to 38%. AT&T is still a cash cow, and the difference is they’re utilizing their cash to strengthen their balance sheet these days rather than going on tangents with acquisitions that don’t fit in their business model. AT&T’s EBITDA produced from mobility increased by 5.3% YoY to $9.2 billion, and their consumer wireline business generated a 7.1% YoY increase of $1.1 billion. Overall, AT&T delivered $11.3 billion in adjusted EBITDA, which was up 2.6% YoY.

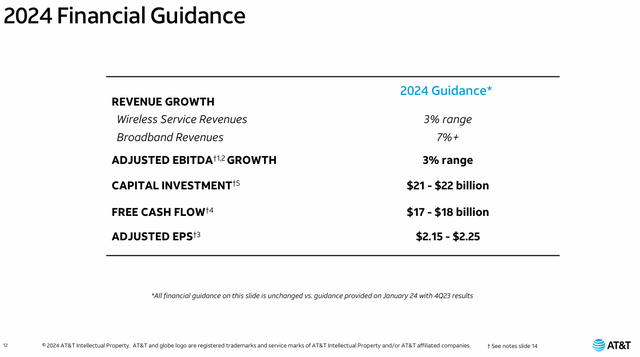

Their profitability is dropping down to my favorite metric of FCF, as AT&T grew its FCF by 8.7% YoY to $4.58 billion. In the first 6 months of 2024, AT&T has delivered $7.72 billion in FCF, compared to $5.21 billion in 2023. After paying $4.13 billion in dividends, AT&T retained $3.58 billion of its FCF, which has helped it continue deleveraging its balance sheet. While AT&T may have the same name and same logo as it did a decade ago, this is a leaner and more focused AT&T that is extremely profitable. AT&T is still projecting that the back half of 2022 will be very strong, and they will finish the year with growth across the board.

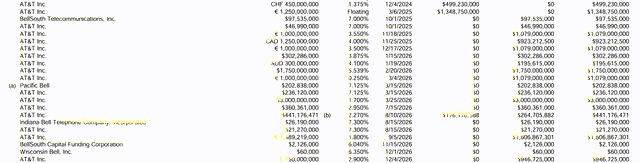

AT&T is doing the right thing with its FCF and continues to deleverage the balance sheet

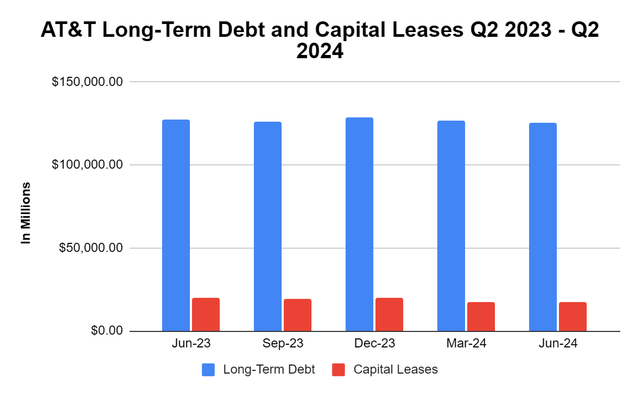

When AT&T finished the 2nd quarter in 2023 they had $127.61 billion in long-term debt and $20.12 billion in capital lease exposure. Debt has always been at the forefront of the bear argument, but in recent years, AT&T has done a lot to change the narrative. Prior to spinning out Warner Media, AT&T had $179.79 billion in long-term debt and $22.43 billion in capital leases. A tremendous amount of progress has been made, and AT&T is still sticking to its commitment to reduce the debt load from its balance sheet. Over the past year, AT&T has eliminated $2.26 billion of the long-term debt on its books, in addition to reducing its capital leases by $2.95 billion. AT&T still has $3.09 billion in cash on hand, and is expected to generate at least another $9.28 billion in FCF during the back half of 2024. I am bullish on how the market could interpret the financials over the next year, as AT&T is in a position to continue changing the narrative.

Steven Fiorillo, Seeking Alpha

In the first half of 2024, AT&T has generated $7.71 billion in FCF, paid $4.13 billion in dividends, and retained $3.58 billion in FCF. If AT&T pays another $4.13 billion in dividends during the 2nd half of 2024, they should retain at least another $5.15 billion of FCF, considering they’re projecting their annualized FCF will come in at $17 – $18 billion. AT&T has $3.09 billion in cash and $499.23 million maturing in debt by the end of 2024. After the remaining maturing debt in 2024, AT&T would still have $4.65 billion in retained FCF in the 2nd half of 2024 if they come in at the low end of their annual projection. The retained FCF of $4.65 billion would exceed the $4.57 billion of debt AT&T has maturing in 2025, so if they continue on this trajectory, they could theoretically repurchase all of the 2025 commercial paper due at the beginning of 2025 without tapping their current cash pile. Assuming that AT&T could replicate the amount of FCF generated in 2024, they could put themselves in a position to retain $8.73 billion in FCF during 2025 after paying $8.27 billion in dividends. They could enter 2026 with a cash stockpile of around $12.5 billion, which exceeds the $10.17 billion of debt maturing in 2026. AT&T is in a position to significantly reduce its debt without having to refinance it from its FCF run rate. I think that the market will look favorable on AT&T as another $15 – $20 billion in debt rolls off the balance sheet.

Conclusion and why I am excited for the next several years

AT&T has gained almost 30% over the past year and is still trading at less than 9 times 2024 earnings. This isn’t the same AT&T that was looking to complicate its business. Focusing on its core business is paying off, and there is a lot of potential for AT&T over the next several years. AT&T is allocating roughly $8.27 billion towards dividends on an annual basis, and based on $17 billion in FCF they are able to retain $8.73 billion in FCF after paying the dividend. AT&T can outrun its debt and put itself in a position where its long-term debt is less than $100 billion by the end of the 2026 fiscal year. This could put AT&T in a position to start repurchasing shares and increasing the dividend each year going forward as less capital will be needed to reduce debt in the future, and after rates get back to 3%, they could even refinance existing debt at more attractive levels. I think that AT&T has been in the penalty box for too long, and they are about to start flexing their muscles based on how FCF is allocated. Over the next several years, I expect AT&T to have less than $100 billion in long-term debt, implement a buyback program, and start increasing the dividend again. If this occurs, I see AT&T trading between $30 – $40, as there will be nothing left of the bear case.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.