Summary:

- AT&T released Q1’23 earnings yesterday, causing the stock price to slide by more than 10%.

- Concerns over free cash flow are weighing on AT&T’s valuation as is slowing subscriber growth.

- Shortly after I sold AT&T, I am issuing a strong buy recommendation again as I believe the stock is attractively priced and investors overreact to a Q1’23 FCF shortfall.

Ronald Martinez

Shares of AT&T (NYSE:T) sold off more than 10% after the telecom released results for the first-quarter yesterday. AT&T is seeing slowing subscriber growth in its broadband business and although the company beat EPS estimates, the market was widely disappointed with AT&T’s first-quarter performance. Revenue growth year over year was barely positive and the company unfortunately disappointed regarding its free cash flow results in the first-quarter. However, I believe the market overreacts to AT&T’s earnings release, creating a potential buying opportunity especially for dividend investors looking to take advantage of the higher yield that the market is presenting again!

Changing recommendation (rating upgrade)

On April 10, 2023 my work on AT&T was published — AT&T: Sell The Rally (Rating Downgrade) — in which I argued that shares were a sell because they were rapidly up-trending, the yield compressed to below 6% and AT&T was being overbought based on the RSI. Just about one and a half weeks later and the sell-off in shares of AT&T has created a new buying opportunity.

A new buying opportunity for AT&T

AT&T reported first-quarter results on Thursday that led to a 10%-plus sell-off in shares of the telecom. While AT&T’s Q1’23 results were better than expected regarding earnings, AT&T once again only saw very low single-digit year over year revenue growth of 1.4%. Revenue growth was chiefly driven by gains in average revenue per user as well as subscriber growth.

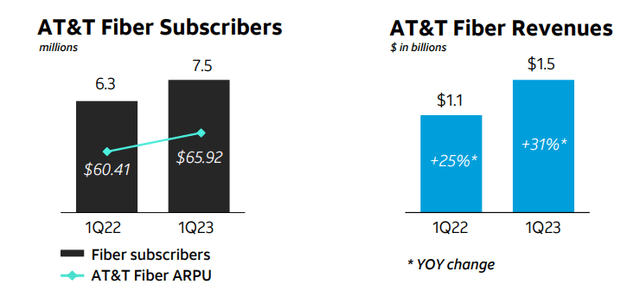

However, AT&T’s subscriber growth is also showing signs of a slowdown, especially in the fiber segment which has been a bright spot for the telecom company throughout the COVID-19 pandemic. AT&T said that it signed up 272 thousand fiber subscribers in Q1’23 compared to 289 thousand subscribers in the year-earlier period. AT&T’s fiber revenues are still growing quickly as revenues soared 31% year over year to $1.5B. However, consolidated top line growth remains challenged and this is unlikely to change in FY 2023 due to a saturated market and headwinds to consumer spending in a high-inflation world.

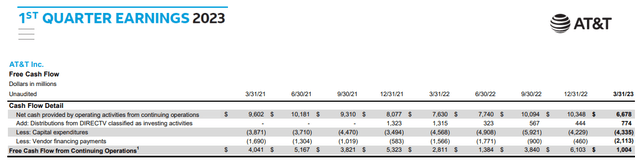

AT&T: Q1’23 free cash flow shortfall

In the first-quarter of FY 2023, AT&T did not earn its dividend with free cash flow and this explains the severity of yesterday’s market reaction. The company earned $1.0B in free cash flow in Q1’23, but distributed $2.0B in dividends, meaning AT&T had a $1.0B free cash flow shortfall in the first-quarter. However, AT&T reaffirmed that it sticks to its guidance for FY 2023 which still calls for $16B in free cash flow. Assuming that AT&T doesn’t make a change to its dividend policy, AT&T is still on track to achieve a dividend payout ratio of ~50%… which means the dividend itself should not only be covered, but also reasonably safe.

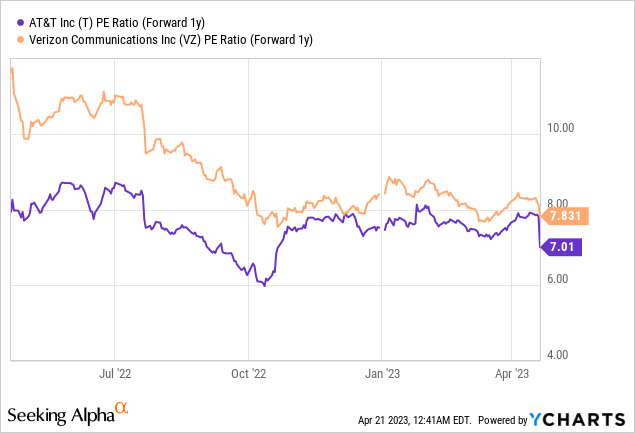

AT&T offers a much more attractive valuation and dividend yield again

Investors should understand that, as long as the firm supports its FY 2023 guidance, AT&T is still expected to cover its dividend with free cash flow on a projected full-year basis. Given yesterday’s sell-off, AT&T offers now a much better deal for dividend investors, in my opinion, as the stock just received a major price cut. As a result, shares of AT&T are again trading at a P/E ratio of 7.0X which they last did in October 2022. AT&T also now has a valuation advantage relative to Verizon Communications (VZ) which is valued at 7.8X (FY 2024) earnings.

Besides a more attractive valuation relative to VZ, AT&T offers a compelling dividend yield again. Due to yesterday’s sell-off, AT&T pays a 6.3% dividend yield compared to a dividend yield of 5.8% earlier this month. Since the dividend is supported by free cash flow, I consider AT&T’s dividend yield to be of excellent quality… despite the fact that the firm is seeing only moderate top line growth and a slowing expansion of its fiber network roll-out.

Risks with AT&T

The risk matrix just changed. Two weeks ago I said that AT&T’s share price was rising too rapidly and now I argue that the stock price has fallen too much. The big risk I see here is for dividend investors to miss out on a high-quality dividend. The biggest commercial risk for AT&T is that the business will continue to lose some of its broadband momentum and that is may have to reduce its FCF guidance if consumer spending slows.

Final thoughts

Looking back, I sold AT&T just at the right time, but I am not taking any credit for it due to superior market timing. Sometimes, it is just luck that helps one out a little bit. I believe the market is overreacting to AT&T’s earnings release yesterday because the telecom is still growing subscribers in its fiber business quickly, just not as quickly as in the year-earlier period. I also believe investors are overreacting to the Q1’23 free cash flow shortfall, as the company still expects $16B in full-year FCF… which implies a payout ratio of only 50%. With shares now trading again at a lower earnings multiplier, I believe investors should take action and buy the drop as well as AT&T’s higher yield!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.