Summary:

- AT&T is set to reduce network equipment costs and boost cash flows through a new Open Ran equipment deal with Ericsson.

- The deal could potentially lower costs by up to 30% and allow AT&T to invest more in growth initiatives.

- The stock remains appealing with a nearly 7% dividend yield and the potential for a cash flow boost to lower the payout ratio to a very attractive level.

Toby Jorrin

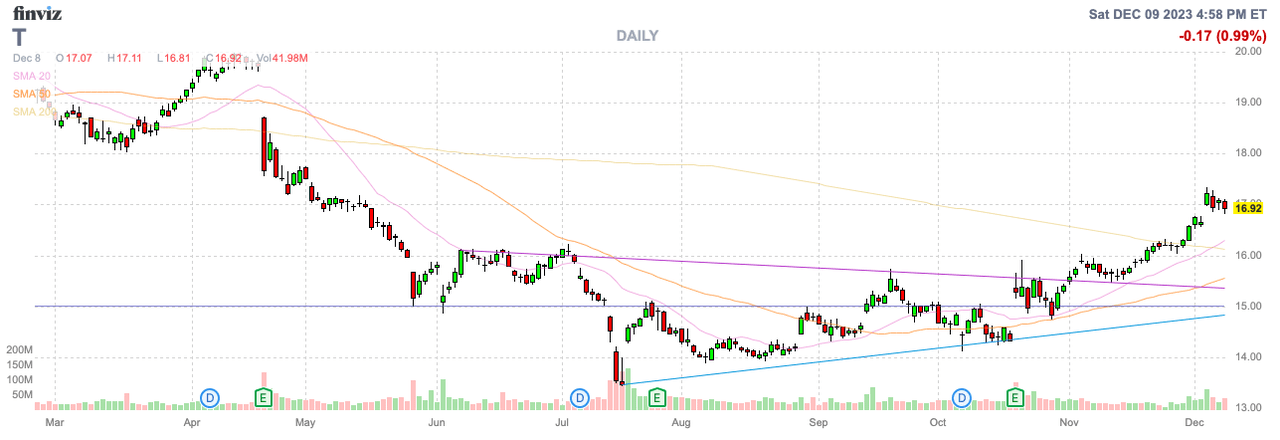

A key to any business is to make transactions that set the company up for success. For a long time, AT&T (NYSE:T) has been trapped into paying escalating prices for wireless spectrum that provided the company no real economic benefit. My investment thesis remains Bullish on the stock, as the telecom giant appears set to reduce network equipment costs and boost cash flows in the years ahead.

Source: Finviz

ORAN Solution

AT&T forecasts mobility service revenues to grow a minimal amount this year after a 3.7% gain in Q3’23, yet the company is forecasting $24 billion in capital spending this year. The company will spend ~20% of its revenues on capex without generating much, if any, revenue growth.

A big problem with the current business model of the wireless giant is the required spending to maintain and even upgrade the network with a limited revenue boost. In essence, the majority of the spending AT&T does is to maintain the current revenue base with limited investment in areas where the revenue base would expand.

The new Open Ran (or open radio access network) equipment deal for up to $14 billion with Ericsson (ERIC) promises to help AT&T dramatically reduce equipment costs. ORAN allows interoperation between telecom network equipment from different vendors offering lowering costs with some suggestions of a 30% reduction in cost of ownership.

The deal is a potential boon for AT&T and a huge negative for Nokia (NOK). AT&T has the ability to lower costs while providing the same wireless services to customers after the last decade of spending more on spectrum and network equipment without meaningful sales boosts.

AT&T forecasts spending $24 billion on capex this year and the ORAN deal with Ericsson is potentially up to $14 billion over five years. The plan is for capex to fall to between $21 billion and $22 billion next year before ORAN even kicks in materially, but the open network concept sets the wireless giant up for more flexibility with building out a future 6G network, or whatever form the next infrastructure buildout takes.

The lower capital intensity from ORAN should allow AT&T to invest more in other growth initiatives, such as expanding the fiber footprint. At the UBS Global Media & Communications conference, CEO John Stankey made the following statement:

I think as we just discussed, things like ORAN what we’re doing to get more efficient in other parts of our capital spend, open up opportunities to continue to do that within the envelope of how we’ve been operating this business.

In essence, AT&T should be much more efficient with capital spending going forward leading to better financial outcomes. A 30% lower TCO could lead to cost reductions of up to $5 billion that the company is able to either save or invest elsewhere to grow the business.

Net Debt Goals

The move to improve capital efficiency follows AT&T continuing to not hike the dividend. The company should actually be on a path now to cut debt down to the 2.5x leverage ratio.

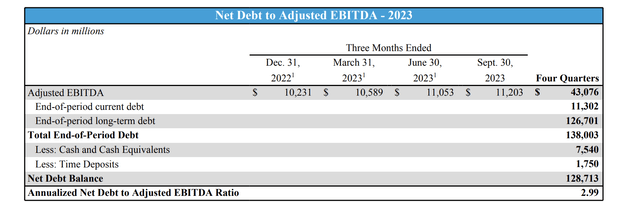

With the Q3’23 results, the wireless giant got the net leverage ratio down below 3x to 2.99x adjusted EBITDA. Net debt was down to $129 billion, down over $3 billion from the prior quarter.

Source: AT&T Q3’23 financials

With adjusted EBITDA at $43 billion, AT&T would need to cut the net debt by over $21 billion to reach the leverage goal. If the wireless giant could actually cut net debt by $10 billion per year, the stock would see a massive boost and the dividend yield would collapse from the current elevated level of 6.6%.

The company would be in a far better financial position without the massive debt load that was stuck above $150 billion for years. With the forecast for capex to dip another $2 to $3 billion in 2024, AT&T could easily see free cash flow jump from the boosted $16.5 billion target in 2023. In addition, the company will further cut massive interest expenses still costing $1.7 billion in Q3 alone.

Due to the large dividend payouts of over $8 billion, AT&T has far less excess cash to repay debt. Any additional FCF while holding the dividend payouts flat allows the company to accelerate debt repayments leading to a lower dividend payout ratio. If the company can boost FCF meaningfully, the payout could dip towards only 40%.

Investors will get a near 7% yield while the stock would offer more capital appreciation considering the massive FCFs could actually be utilized to reward shareholders. The company could potentially return to hiking dividends after a few years of pauses and continue paying down large amounts of debt.

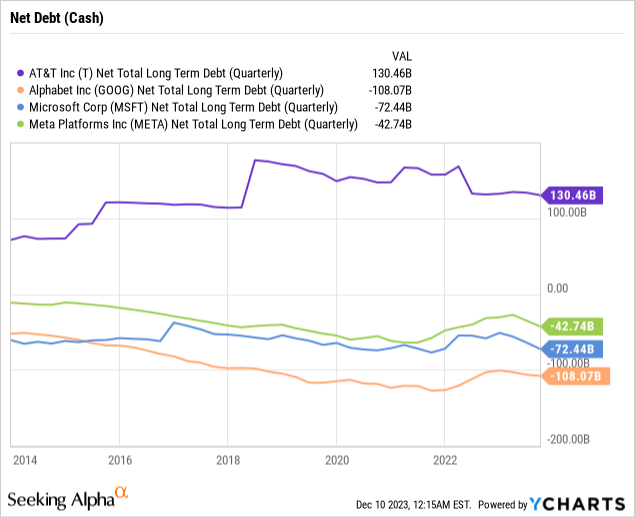

However, one negative is the hard focus of AT&T on only achieving a 2.5x net leverage ratio. The most valuable stocks in the world have large cash positions. Alphabet (GOOG), Microsoft (MSFT), and Meta Platforms (META) all have large cash positions listed in the below chart while Apple (AAPL) has returned massive amounts to shareholders and still has a net cash position of over $50 billion.

These companies have aggressively invested in cloud services, AI and the metaverse with limited financial restraints. Naturally, investors favor companies with large cash flows while also investing in growth drivers for the next decade. Unfortunately, AT&T has struggled for the last decade due to a lack of financial flexibility with the burden of a large net debt position.

In addition, AT&T could still end up facing major lawsuits and potential liabilities from the toxic lead cable issue. These lower debt levels will help alter any fear with the company paying large amounts to resolve those problems.

Takeaway

The key investor takeaway is that AT&T is finally making the types of moves to financially position the company in a better position. The telecom giant has to get away from the mindset of spending massive capital to only maintain the current business and the ORAN path helps address this issue.

If AT&T can significantly grow the FCF levels in 2024 and head towards a path of lower capital intensity, the stock should see solid appreciation over the next year while rewarding shareholders with a nearly 7% dividend yield. As interest rates fall, investors will find the stock even more appealing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.