Summary:

- AT&T believes there is a possibility of litigation on the lead issue, but management feels they are in a good position.

- Back end loaded Free Cash Flow concerns the market the most.

- The accounting disclosures at Warner Bros. Discovery is an “elephant in the room” that no one talks about.

- Not pursing any acquisitions is essential to restoring some faith in management and guidance.

- The stock is likely to pop on the earnings announcement for the third and fourth quarters if management meets the guidance it has repeatedly reiterated.

Justin Sullivan

At a recent conference, the CFO, Pascal Desroches, updated investors about the latest AT&T (NYSE:T) official position on the things that concern investors. AT&T believes that there is a good possibility of litigation on the lead issue that made the headlines a little while back. But management also believes that they are in a good position. The cash flow concerns the market the most because there is a new pattern emerging. Until the market gets used to that pattern, there is likely to be a trading opportunity to sell the stock at a seasonal high point around the third quarter report (during or after) and then buy the shares back when free cash flow is seasonally low in the first quarter. The stock is very likely to pop on an earnings announcement in the third and fourth quarters that management has met its guidance. Meanwhile the long-term turnaround story appears to be intact for buy-and -hold investors.

The Lead Issue

Mr. Desroches appeared to reassure investors that AT&T was on top of the lead story that appeared in the Wall Street Journal.

Pascal Desroches

Sure thing. Look, I’m going to be fairly brief. As you know, in all likelihood, there will be litigation here at some point. So, I want to make sure that I’m pretty measured in what I say. But let me try to break it down for you. But first and foremost, when the journal made allegations of a public health crisis, clearly that got our attention because we are really proud of our long history of employee safety protocols. And, the health and welfare of our employees and the communities we operate in is always forefront in terms of what we’re trying to make sure we never compromise.

With that said, we tested some of the sites that the journal alleged were problematic and didn’t find that there were any issues. Perfectly safe. Third-party experts who are reputable went out and did this. New York State has gone out and done this in one of the sites. West Orange, New Jersey, another site. So, so far, you have we and Verizon who have tested sites independently and have found that those are not problematic. You have the EPA, New York State also finding it not problematic. And the journal has refused to share their testing results with us.

So, could we all be wrong? I don’t think so. And so, look, this is going to play out over time. And — but feel really good about our safety record, and we’ll see how this unfolds over time.

Something like this would be listed as a “normal course of business issue” in the footnotes of the quarterly and annual statements because management is telling you that they do not see a liability issue at the current time. Therefore, in the footnotes, the item may well not be listed as a separate item until something more substantial emerges. Even then the company would have to be found liable of something before there would be an amount on the balance sheet. Right now the chances of that are small.

This should imply that “when the dust settles” and any threat of litigation has terminated, there should be nothing material for the market to worry about. That could mean at some point in the future, the stock price will reverse the action of the stock when this news originally came out (if it has not already).

Accounting

This CFO has stated that he has been on the job for two years. If that is the case, then he is in the position of restoring some of the reputation that got lost in the Warner Bros. Discovery (WBD) sale. In short, the CFO is getting the lead out and there may be plenty of lead to remove here. Warner Bros CFO found that the billing was not done promptly, and the collection was lax:

And we have talked about this in the past, cash was never an objective in 3/4 of this company. And so, when we went in and looked at the enormous amount of uncollected receivables, the enormous delays and even sending out invoices, the willingness to just pay our suppliers before even payments are due, it was just never a focus area. The discussion of a 10% margin business or a project, is that a good project? Could be but it could be a bad project if it takes 3 or 4 years to get the cash in after you deploy the capital.

This quote comes from Gunnar Wiedenfels (Chief Financial Officer)

In the second quarter, Gunnar Wiedenfels talked about straightening out the accounting for the acquired properties from AT&T. When this happens, then every perceived “miss” whether justified or not will likely put the AT&T accounting system “front and center” as the reason until AT&T proves otherwise.

Growth

One of the things management has stated time and again is that the business can and will grow. More importantly it will grow as they have guided. This is another area of market uncertainty based upon the questions answered that will likely only be “put to rest” with a track record that corresponds to what management is stating.

Large companies like this one will grow more slowly. But the recovery potential of the stock is substantial as management proves out its guidance. After that a long-term return in the low teens from the dividend and stock price appreciation appears to be a conservative outlook.

Free Cash Flow Guidance Effect

Sure enough, there was a question about the lack of free cash flow in the first half. The problems with the accounting in the sold division will logically leave the market wondering how far a problem like that spread. Then when cash flow meets management guidance but does not meet market expectations, then the accounting system will be suspect as well management guidance until the new cash flow (and free cash flow) pattern repeats itself often enough. Unfortunately this will affect the stock price.

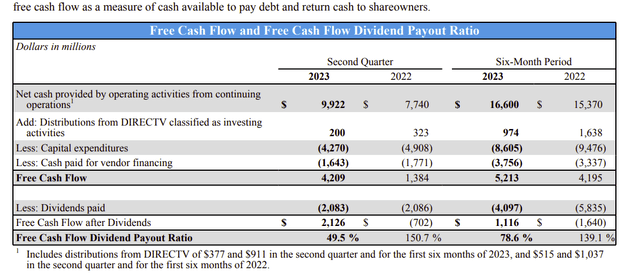

AT&T Second Quarter 2023, Free Cash Flow Calculation (AT&T Second Quarter Financial Schedules Release)

The fact that management is in a defensive posture having to reiterate the full year guidance during the second quarter conference call and at every public appearance since then is really no surprise.

Of course, it does not help the nervousness when the dividend coverage is as high as it is at the current time. Given human nature it would be far better if the first quarter was the Free Cash “Flood”, and the company coasted the rest of the year on that first quarter. The uncertainty after the slow start is just making Mr. Market worry about all kinds of catastrophes between now and the reporting of that cash flow.

Nonetheless, if the market reviewed the cash flow statement, the GAAP cash flow from operating activities is actually up year-to-date. That is the GAAP number. The expenditures and the timing of those expenditures is 100% controllable by management. Since management guided to front end capital expenditures. All that has to happen is for Cash Flow From Operating Activities to continue that trend while the cash-paid items fall as management has projected. That will also do wonders for the dividend payout ratio.

Management is projecting a big fourth quarter along the terms of the last fiscal year. But anyone in the retail business (which cell phones essentially are) will tell you how important the fourth quarter is as well as the payments that follow in the first quarter of the following year. This company no longer has the television business nor the divisions sold to Warner Brothers Discovery to influence the GAAP cash flow number.

The other item of concern is the DIRECTV cash flow. On the one hand, the declining cash flow has held up far better than Mr. Market expected. The CFO” also mentioned that the company has so far received approximately $15 billion (by the end of this fiscal year) in distributions from its share. That was surprising as the market expected that cash flow to dry up “yesterday” because “everyone” knows cable is doomed and doomed fast.

For those who think that cable will be gone fast, the trends so far are not supporting that based upon the AT&T experience so far.

Acquisitions

To demonstrate how the logic of Mr. Market is somewhat lacking, after all the fears expressed about DIRECTV and the cell phone business, there was concern about AT&T possibly accepting a proposal to acquire some properties that came on the market.

This is a big deal because AT&T has long promised to repay debt and because the acquisition binge was seen by the market as really not working out. Therefore, an acquisition is very likely to hamper management’s efforts to restore confidence and predictability to management guidance. That alone could make any possible acquisition impossible in the eyes of management.

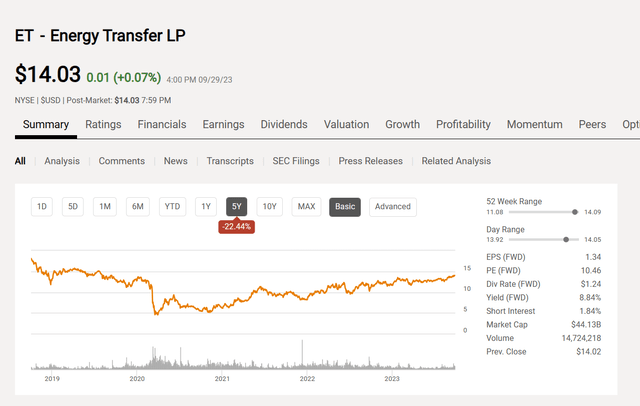

We have all seen companies reverse course on this. I covered this years ago when Energy Transfer (ET) acquired SemGroup (SEMG). I stated at the time this broke a promise by management to repay debt as SemGroup had a fair amount of capital requirements in addition to whatever came with the acquisition.

Energy Transfer Common Unit Price History And Key Valuation Measures (Seeking Alpha Website October 1, 2023)

Since this acquisition happened towards the end of 2019 and was finished late in the fourth quarter, investors can see that the stock weakened around the time of the announcement, bounced back somewhat and is really close to the same price as when the acquisition was made. The stock price has yet to show any significant benefits from the acquisition.

This deal was part of a long-term trend of risk taking that has held the stock back for some time. Clearly AT&T is going to avoid that trend and all the market nervousness that goes with it.

Key Ideas

The CFO is tackling any accounting concerns that showed up at Warner Bros. Discovery by noting he is on the job 2 years. That is a roundabout way of stating that accounting issues are being addressed and will not appear in the future.

Similarly, the lead issue could lead to litigation. However, so far there is no “smoke” and so there is probably not an issue for shareholders and the market to worry about. Management has done what it can to put the issue to rest as have several regulating agencies.

Cash flow and particularly Free Cash Flow have yet to be resolved in the eyes of Mr. Market. The market has never bought the idea that the first quarter will not have much free cash flow going forward because cash expenditures are loaded in the front half of the fiscal year (particularly the first quarter). Yet that is exactly what management stated what would happen. Similarly, the market does not buy the future quarterly guidance for the fiscal year. It will therefore be particularly important for management to meet its GAAP cash flow and free cash flow goals.

The market wants to know that the debt can be repaid from free cash flow. So far that evidence is lacking. If you believe management, then the stock will likely “pop” when the earnings report comes out for the third and fourth quarters. That would be a trading opportunity for those that trade.

As management meets guidance more times in the future, the stock should recover a lot from the current pricing levels. Therefore, the current price remains a strong buy. Even long-term buy and hold shareholders can likely benefit from the current price. The longer management can go before missing guidance, the less damage a missed guidance will do for the stock price and the faster the stock will bounce back.

This is an investment grade opportunity, and those kinds of stocks will usually turnaround as long as the turnaround remains focused. That appears to be the case here. The future of AT&T stock appears to be much better than the past.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclosure: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.