Summary:

- With a current yield of 6.7% and a payout ratio of 45%, the dividend remains well-covered for the time being.

- AT&T’s mixed financial and management results over time has resulted in lower confidence on the possibility of a strong recovery.

- Although undervalued from a DCF perspective, we stay cautious here to see how the next few quarters play out.

Justin Sullivan

Overview

AT&T (NYSE:T) is a global provider of telecommunications and technology services, operating through two key segments: Communications and Latin America. The Communications segment delivers wireless voice and data communication services, retailing handsets, wireless data cards, computing devices, and related accessories through its company-owned stores, agents, and third-party retail outlets.

Additionally, it offers Virtual Private Networks, AT&T Dedicated Internet, Ethernet, data services, security, cloud solutions, outsourcing, and managed and professional services to multinational corporations, small and mid-sized businesses, governmental, and wholesale customers.

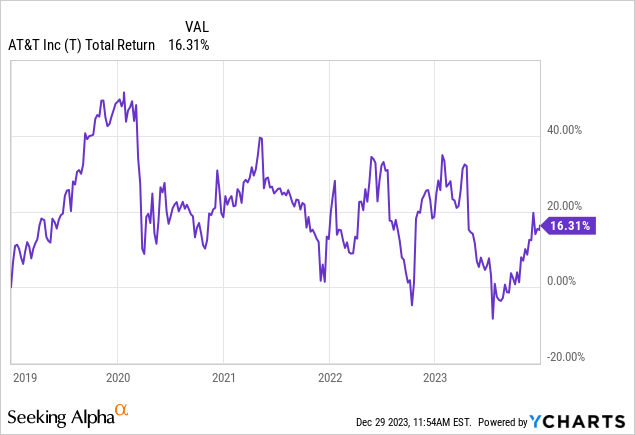

For full transparency, AT&T has been in the red within my portfolio since the day I initiated a position. Despite this, I maintain a position because of the cash flow it continues to provide. Including distributions, I am up slightly, but this isn’t the ideal performance for most investors who are looking to capture a superior total return. I utilize this stock as an income machine and throw distributions into better quality positions. As long as the dividend remains safe, there is no reason for me to sell.

Financials

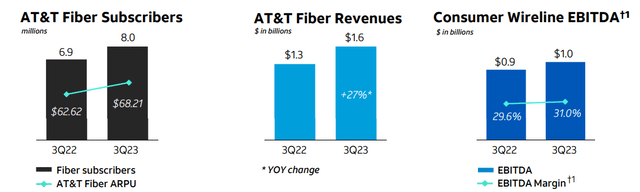

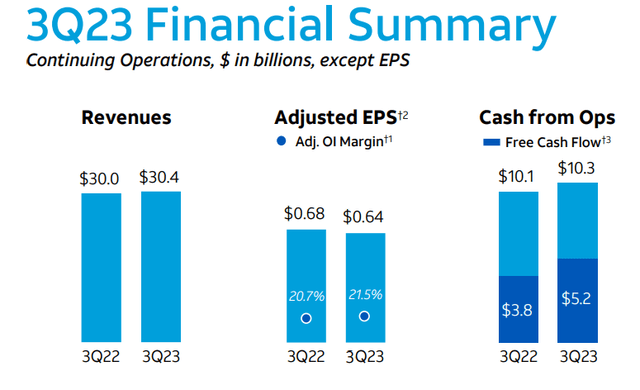

The growth in AT&T’s revenue is attributed to gains in subscribers and average revenue per user. The reported revenues stand at $30.4 billion, reflecting a $0.3 billion increase. Mobility service revenue witnessed a growth of 3.7%, contributing to a year-to-date increase of 4.6%. Additionally, there was notable growth in consumer broadband revenue, reaching 9.8%, and an 8.1% year-to-date growth.

The free cash flow, including $0.9 billion from DIRECTV, amounted to $5.2 billion. Capital expenditures stood at $4.6 billion, with a total capital investment, including $1.0 billion in vendor financing payments. The year-to-date free cash flow for 2023 is reported at $10.4 billion, up by $2.4 billion, with $0.9 billion lower DIRECTV cash.

T posted a revenue of $30.35 billion, with a year-over-year increase of 1.0%. The company reported a notable 2.4% rise in cash from operating activities, reaching $10.3 billion. The company’s operational execution remains consistent and disciplined, resulting in profitable customer growth, evidenced by the addition of 468,000 postpaid phone subscribers. The low postpaid phone churn rate of 0.79% underscores the resonance of AT&T’s value proposition. T strategically focuses on high-value customers through deliberate segmentation, reinforcing its commitment to sustainable growth.

I think despite the mixed results, AT&T has some potential here. The recent earnings highlights are characterized by strong revenue and EBITDA growth, primarily driven by gains in high-quality subscribers. Still, I remain cautious because when is the last time you remember AT&T’s cash flow not being the main focus of the company?

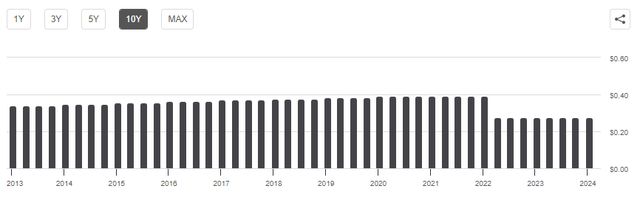

Dividend

As of the latest declared dividend of $0.2775/share, the current dividend yield now sits around 6.8%. Thankfully, the payout ratio remains around 45% which doesn’t yet raise any concerns of the sustainability of the dividend. Although the dividend was cut back in 2022, I believe they are in good shape to continue with the current payout. Despite AT&T’s substantial debt burden, I consider it a decent option for investors seeking protection against market fluctuations in reaction to future rate changes, since the price has range has been relatively stable.

According to estimates, the company’s annual dividend is anticipated to experience a slight increase to $1.12 in 2024 and further grow to $1.13 in 2025. The assurance that AT&T’s dividend is well-supported by its free cash flows is reinforced by the range of dividend estimates, affirming the likelihood of no dividend reductions or halts from AT&T in the foreseeable future. While AT&T bears a substantial debt load, the debt-to-adjusted EBITDA ratio of approximately 2.6x is deemed manageable for a robust cash flow entity like AT&T.

Valuation

There are several metrics that point to a current under valuation with T. For example, a quick reference to the P/E ratio shows that the current P/E is 6.75x compared to the 5-year average P/E of 7.96x. Also, T is trading at a 14% free cash flow (FCF) yield. Over the next 18 months, the company intends to utilize excess FCF to reduce debt and reach their targeted leverage of 2.5x. In the long term, they have indicated a mid-teens capital intensity, significantly lower than current spending.

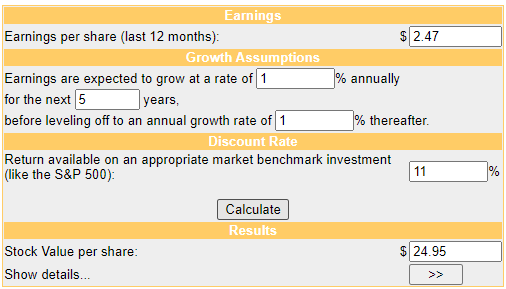

We can try to come up with a rough estimate of a fair price value by implementing a discount cash flow model. Using next years projected EPS total of 2.47x, we can combine this with average 5-year EBITDA YoY growth of 1.6%. With these inputs, we can determine that an estimated fair value for T sits around $25/share. This represents an approximate 48% upside towards the end of 2024, but this weighs heavily on management’s ability to grow at a minimum of 1%. Management has been terribly inconsistent, though, so I remain with a hold rating to see how the next few quarters play out.

Money Chimp

Risks

The burden of AT&T’s debt seems to be a topic of debate. Let’s put the question of whether it’s manageable or not aside for a moment. Between the costly spectrum auctions, investment and development in a digital infrastructure/ecosystem, and acquisitions have fueled a substantial increase in AT&T’s long-term debt. The debt has nearly doubled over the last decade, reaching a current total of $138 billion.

This places AT&T among the most heavily indebted companies in the world. The weight of this debt is reflected in an annual interest expense exceeding $6 billion. Older debt, initially secured at more favorable rates, now faces the challenge of being refinanced at considerably higher costs. This is because despite the Fed’s anticipated rate cuts, we will remain in an environment with a higher average rate range.

Takeaway

AT&T (T) stands as a global telecommunications and technology services provider, navigating through its key segments of Communications and Latin America. Despite a challenging performance within my portfolio, the company continues to be a reliable income generator, leveraging its cash flow even amid market volatility.

The financial overview reveals commendable revenue and EBITDA growth, driven by quality subscriber acquisitions. Notably, AT&T’s strategic focus on disciplined execution and high-value customer segments has contributed to consistent profitability. The company’s commitment to sustaining a competitive dividend, supported by robust free cash flows, instills confidence in its long-term stability.

While acknowledging the substantial debt burden, the undervalued status, secure dividend yield, and potential capital appreciation present an enticing risk/reward proposition for investors. However, it’s essential to recognize the associated risks, including elevated debt levels and potential challenges in refinancing. Despite these considerations, AT&T remains positioned for growth, and its current valuation suggests an attractive investment opportunity for those willing to navigate the complexities.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.