Summary:

- AT&T’s postpaid phone additions for Q2 2023 are expected to be lower than analysts’ estimates, causing a 1.7% decline in share prices.

- Despite this, the company’s ARPU continues to grow and management expects free cash flow for the current fiscal year to be $16 billion or higher.

- AT&T’s CFO, Pascal Desroches, dismissed rumors of a deal with Amazon for cheap or free phone service for Prime members, stating “there is nothing to the rumors”.

Brandon Bell

Those who follow my work closely know that one of my major holdings at this time is none other than telecommunications conglomerate AT&T (NYSE:T). In fact, at present, it is my largest holding, accounting for just over 20% of my portfolio’s assets. As shares of the business declined, I added to my stake. This has allowed me to reduce my effective weighted average purchase price on the stock quite a bit. Although I am reaching the point where I do not feel comfortable allocating anymore of my portfolio to the business because of how much of it is already placed with the firm, I do take the opportunity to pick up shares from time to time when the market offers a chance to bargain buy.

One such opportunity that popped up occurred on June 20th when T stock closed down 1.7%. This decline was in response to news breaking that postpaid phone additions are likely to come in quite a bit below analysts’ estimates for the second quarter of the company’s 2023 fiscal year. In a vacuum, this kind of development is most certainly a negative. It also represents a departure from what the company has historically achieved from quarter to quarter. But when you dig deeper into the data provided by management, it becomes clear to me that the enterprise is still every bit as attractive as it was when I first started picking up shares of it in March of last year.

Reading beyond the headline news

On June 20th, Pascal Desroches, the CFO of AT&T, presented at and took questions at the Bank of America C-Suite Technology, Media and Telecommunications Conference. The primary focus of this conference was to focus on the company’s 5G and fiber growth, free cash flow, and long-term growth goals. The headline item that caught the attention of the market was that, for the second quarter of the company’s 2023 fiscal year, the conglomerate is expected to add postpaid phone editions that will be in the ‘low’ 300,000 range. Although this is a sizable number for a large company operating in a mature industry, it did leave a negative impression on market participants. This represents a significant departure from the 476,000 that analysts have been anticipating.

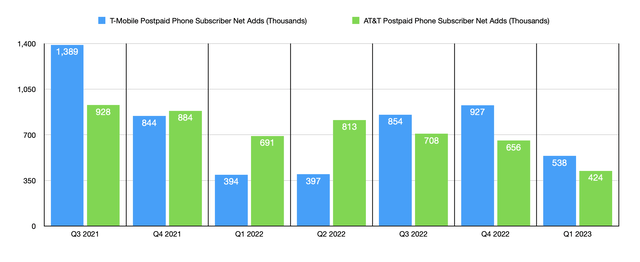

To put this 300,000 number into perspective, it would be helpful to look at what the company has historically achieved over the past several quarters. In the chart above, you can see data not only for it but also for larger rival T-Mobile US (TMUS). Starting from the third quarter of 2021 and extending through the first quarter of 2023, we have seen AT&T report net additions ranging from a low of 424,000 to a high of 928,000. There does seem to be a general trend whereby the number of net additions has been weakening. But, to a lesser extent admittedly, a similar trend can be seen when looking at its aforementioned rival.

While it is true that there are many working parts of AT&T that each generate revenue, its Mobility segment, which includes its postpaid phone revenue, is undeniably the largest portion of the enterprise. During the first quarter of this year, for instance, this segment accounted for an impressive 68.3% of the company’s overall sales. Already, AT&T catches a lot of hate because revenue growth is not particularly strong. From the first quarter of 2022 through the first quarter of 2021, for instance, overall sales for the company expanded by only 1.4%. So to see a key growth metric guided lower than previously anticipated is bound to catch the market’s attention, and not in a positive way.

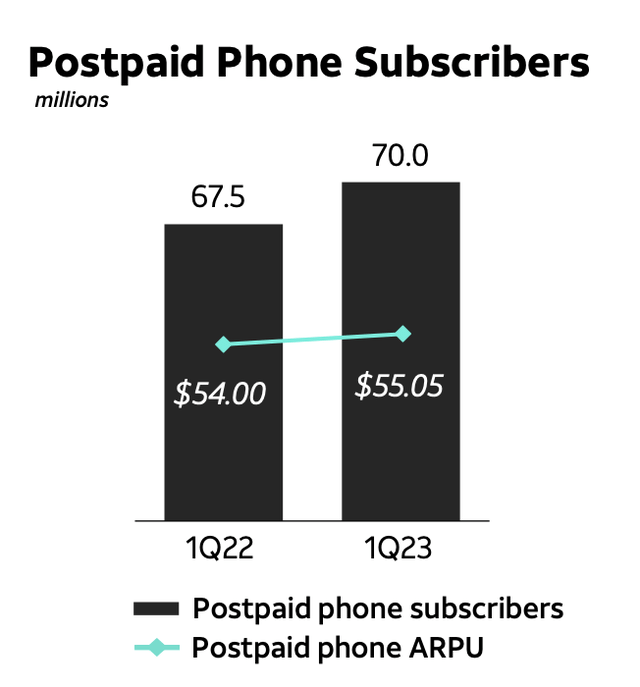

When you look beyond just this single data point, however, you start to see a lot of positive data points pop up. For instance, at the event, Desroches stated multiple times that the company’s ARPU continues to grow. In the first quarter of 2023, for instance, ARPU came in at $55.05. That’s up from the $54 reported one year earlier. This change, when applied to the total number of postpaid phone subscriptions as of the end of the most recent quarter, translates to nearly $900 million in additional sales each year. Even though weakness is expected in the second quarter of the current fiscal year, management did say that it’s likely that the number of postpaid subscribers will be 400,000 or higher for the third quarter of this fiscal year. That compares to the 390,000 that analysts have been forecasting.

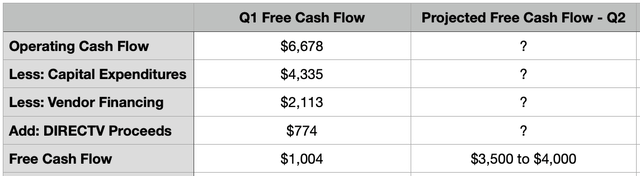

All of this is positive in and of itself. But what’s most important to me is that management claimed that free cash flow for the current fiscal year should still come in at $16 billion or higher. At the event, analysts pressed on this matter, especially since the company’s measure of free cash flow came out to only $1 billion during the first quarter of the year. That, however, was driven by a variety of factors that will not repeat themselves. For starters, the company had to contend with an elevated level of capital expenditures, as well as with $2.1 billion worth of cash paid for vendor financing. During the second quarter, management is forecasting free cash flow of between $3.5 billion and $4 billion. This is expected even as management is guiding toward lower contributions that the company should receive from DirecTV compared to the $774 million that the business was entitled to during the first quarter of the year.

Some might be worried that management to his going to get creative in order to get to the free cash flow that they are targeting. This was, once again, an issue that analysts poked out. However, management said that this will occur even though its capital budget is remaining flat at $24 billion. When you strip out all spending from the equation, such as around $8 billion on dividends, $2 billion on preferred dividends, and other items, the company is still forecasting enough free cash flow this year to bring net debt down to approximately $128 billion. For context, that number currently comes out to $134.7 billion. This implies a reduction from the second quarter of this year through the end of this year of $6.7 billion and it would bring the company’s net leverage ratio down to a solid 3. With capital spending expected to drop naturally starting next year, debt should continue to fall from this point on.

One other item that I think is worth mentioning involves some recent concerns in the space. Early this month, I wrote an article about Amazon (AMZN) whereby I discussed rumors that the ecommerce giant was in talks with the nation’s largest mobile phone service providers in the hopes of striking a deal so that Amazon Prime members could have cheap or free phone service moving forward. Desroches was unequivocal in his response. At one point, he likened the rumors to an episode of Seinfeld in that ‘it’s a show about nothing’. He went on to explain that the big three players, which are AT&T, T-Mobile, and Verizon Communications (VZ), have no real incentive to enter into any sort of arrangement with Amazon to this effect. And the prospect of DISH Network (DISH) does not make sense strategically because it does not have its own network and it is, in their words, ‘unproven’. He closed this vein of thought by saying that ‘there is nothing to the rumors that have been discussed,’ regarding this matter.

Takeaway

One of the most exciting things about the market is that perception can have a significant impact on share prices in the short run. In my opinion, what occurred on June 20th was an example of the market latching on to one specific and unfavorable data point and using that as a proxy for how the company as a whole is performing. Yes, it is unfortunate that postpaid phone additions will be so low for the second quarter. But when you dig deeper into the data, you find that there are a number of extremely positive things that management is saying. If you’re going to believe the bad things that management says, you should also believe the good things. When the market refuses to operate this way, investors who believe in the stock in question should use the opportunity to bargain buy.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!