Summary:

- AT&T’s dividend yield is currently lower than Verizon’s, and its valuation is higher than historical averages, reducing its income appeal.

- Despite a strong share price rally, AT&T’s financial performance has been lackluster, with limited growth prospects and declining equipment sales.

- AT&T’s focus on reducing debt and investing in 5G and fiber infrastructure is positive, but its dividend growth is expected to remain minimal.

- Verizon offers a higher dividend yield and appears to be a more attractive income investment compared to AT&T at this time.

Anne Czichos

AT&T (NYSE:T) is offering a lower dividend yield than its closest peer Verizon and its valuation is not cheap right now, thus AT&T’s income appeal is much lower than it was in the recent past.

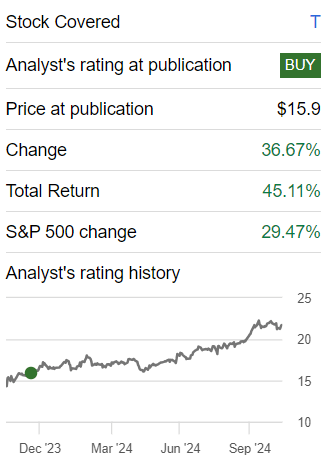

As I’ve covered in previous articles, historically AT&T has been a good income pick due to its high-dividend yield and attractive valuation, trading at a relatively low earnings multiple compared to peers and its own historical average. Since my last article on AT&T, almost one year ago, its shares are up by more than 45% (including dividends), beating the market by a good margin during the same time frame.

article performance (Seeking Alpha)

This performance has been quite good, and above my own expectations considering that AT&T has a mature business with relatively low growth prospects, showing that its shares were clearly undervalued at the time.

Taking into account this share price rally, I think it’s now a good time to analyze its most recent financial performance and investment case, to see if AT&T remains a good income play, or not, for long-term investors.

Financial Overview & Dividends

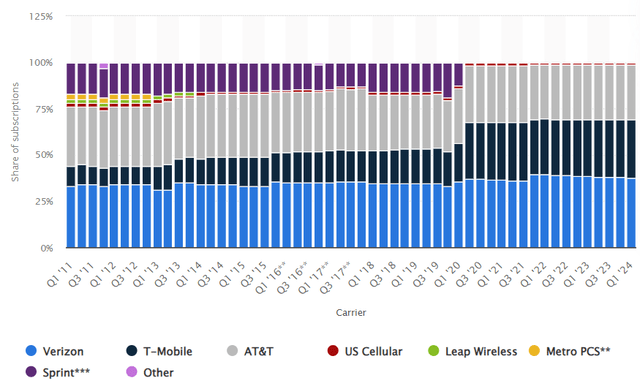

AT&T is one of the largest telecom operators in the U.S., having exposure both to fixed and mobile telecommunications across the country. Due to its large size and the industry’s high penetration in the U.S., growth prospects come mainly from market share gains over its competitors. However, as seen in the next graph, AT&T’s mobile market share has been rather stable in recent quarters at about 30%, while Verizon (VZ) has been the main loser (39.3% market share in Q4 2021, to 37.6% in Q1 2024) and T-Mobile US (TMUS) has increased its market share by about 10 basis points during this period.

U.S. wireless market share (Statista)

This means its net customer gains in the mobile segment have been somewhat low over the past few years, even though the company has been investing in its 5G infrastructure to remain competitive in the industry, which is not a great achievement considering that wireless is an important part of its business.

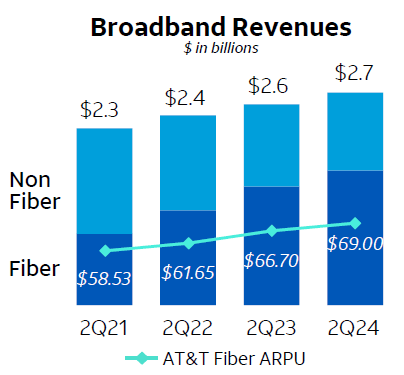

Nevertheless, AT&T’s growth strategy has also been focused on investing in its fiber rollout to offer convergent offerings and gain more broadband customers, which has been successful in recent quarters. Indeed, as shown in the next graph, AT&T has been able to report stronger growth in its broadband business, supported by increasing fiber customers and average revenue per user (ARPU). Its broadband revenues increased to $2.7 billion in Q2 2024 (+7% YoY), which is much better than other business segments, and represented about 10% of total AT&T revenues in the last quarter.

Broadband revenues (AT&T)

However, while service revenue has been trending positively due to the company’s efforts to improve its commercial positioning, equipment sales have been weaker due to a tougher economic backdrop as high inflation has led to a rising cost of living, putting pressure on discretionary spending by consumers. Given this background, it’s not surprising that equipment sales declined by 5.4% YoY in Q2, to slightly below $4.8 billion in the quarter.

This was the main reason why AT&T’s overall revenues were slightly down compared to Q2 2023, to $29.8 billion in Q2 2024. Despite soft top-line, AT&T has made a good job regarding controlling cost growth and achieve higher efficiency in some units, for instance it has gained some operating leverage in the broadband segment, namely by the transition from legacy networks to advanced broadband infrastructure, leading to expanding margins.

Despite the inflationary environment and pressure on wage growth and other administrative costs, its operating expenses amounted to $24 billion in Q2, representing an increase of 2.2% YoY, which is an acceptable outcome considering the challenging operating environment and general cost pressures.

Due to the combination of slightly lower revenues and higher costs, its EBITDA declined by 2.2% YoY to $10.8 billion, and its EBITDA margin declined by about 60 basis points (bps) to 36.4%.

Investors should be aware that AT&T likes to highlight its adjusted EBITDA, which was higher by about $500 million compared to reported EBITDA, while in Q2 2023 there wasn’t a material different between the two metrics. Given that this is a non-GAAP metric, I think investors should consider its reported EBITDA as the best metric to be more conservative and take into account all costs to analyze its profitability, as reported EBITDA includes all gains and losses incurred by the company, even if they aren’t recurrent in future quarters.

Moreover, over the past few quarters, adjusted EBITDA has always been higher than reported EBITDA, being another sign that investors should take adjusted figures with a grain of salt, as there are always some expenses that don’t repeat in future quarters, but are still expenses that should be reflected in the company’s accounts and should be considered, in my opinion, to analyze its operating performance.

Therefore, while AT&T says that it was able to achieve margin expansion in recent quarters, this is only true when looking at adjusted EBITDA, which excludes restructuring costs and intangible amortization related to DirecTV.

Regarding DirecTV, at the end of last September, AT&T announced that it has reached an agreement to sell its 70% stake in DirecTV to its partner TPG Inc., exiting from the pay-tv business. AT&T will receive about $7.6 billion in cash payments through 2029, which will be an important contribution to reduce its debt levels and help finance its investments in 5G and fiber infrastructure.

Regarding its net income, AT&T’s profit in Q2 amounted to $3.5 billion, representing a decline of about 20% YoY, due to higher depreciation & amortization, increasing interest expenses, and lower other income. Despite lower earnings, its cash flow from operations remained quite good at $9.1 billion in the quarter, and its capital expenditures amounted to $4.4 billion. Its free cash flow was about $4.6 billion in Q2 2023, up by 9.2% YoY, showing that AT&T’s capacity to generate cash remains quite good.

For the full year, the company’s guidance can be considered positive given that AT&T expects some pick-up in consumer activity due to seasonal patterns and new services and features being launched in the second half of the year, which should be important to achieve service revenue growth of about 3%, and grow its EBITDA on an adjusted basis.

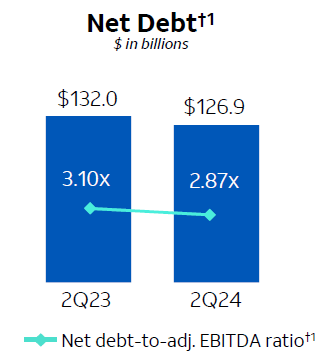

Regarding its balance sheet, AT&T continues to prioritize leverage reduction and is using a great part of its free cash flow generation to strengthen its balance sheet, aiming to achieve a net debt-to-EBITDA ratio of about 2.5x by mid-2025. At the end of Q2 2024, its net debt position was nearly $127 billion and its leverage ratio was 2.87x, thus AT&T still needs to cut its indebtedness over the coming quarters to reach its leverage ratio, assuming that its EBITDA growth should be limited over the coming quarters.

Net debt (AT&T)

During the past twelve months, the company was able to reduce its net debt by about $5 billion, mainly through retained free cash flow, a strategy that is not expected to change much in the near term. Nevertheless, its recent decision to sell its stake in DirecTV is also a supporting factor for lower debt ahead, thus AT&T seems to be on the right path to achieve its desired leverage ratio in the next six to nine months.

What this means for its dividend and potential share buybacks is that AT&T is not much likely to change its shareholder remuneration policy in the next few quarters, but it may become more aggressive regarding capital returns during the second half of 2025.

However, this doesn’t seem to be currently expected by the street, given that AT&T’s dividend is not estimated to grow much over the next few years. AT&T’s quarterly dividend has been unchanged at $0.2775 per share (or $1.11 per share annually) since its significant cutback in 2022, and is currently expected to grow by less than 1% annually, over the coming three years, to $1.15 per share by 2027.

This seems to be quite conservative and represents a dividend payout ratio of only 50% (vs. 56% in 2023), thus I think there is room for the company to become more aggressive regarding its shareholder remuneration policy and beat dividend estimates easily in the coming years.

Moreover, its current quarterly dividend outflow is about $2 billion, which is way below its free cash flow generation, thus this is another factor supporting a higher dividend in the future, especially when AT&T reaches its leverage goal of a net debt-to-EBITDA ratio around 2.5x.

Regarding its dividend yield, AT&T is currently offering a yield of around 5.1%, which is way lower than compared to when I last covered it (it was yielding close to 7%), thus its income appeal is somewhat lower, even though it remains interesting for income-oriented investors. However, this yield is lower than compared to its closest peer Verizon, which is yielding above 6% and also offers a sustainable dividend over the long term as I’ve covered in a previous article, thus AT&T’s income appeal seems to be much less attractive than it was one year ago.

Regarding its valuation, following a strong share price rally over the last year, AT&T is currently trading at close to 10x earnings, which is at a significant premium to its historical valuation of 7.1x earnings over the past five years. This multiple is also much higher than when I last covered AT&T (was trading at only 6.4x earnings at the time), thus its shares seem now to be somewhat overvalued. This multiple is also higher than compared to Verizon right now (it’s trading at 9.4x earnings, and its historical average is 9.7x), being another signal that AT&T is not properly cheap nowadays.

Conclusion

While AT&T offers a sustainable dividend yield above 5%, this is lower than compared to Verizon, and its valuation seems to be somewhat stretched following a strong performance in recent months. Moreover, its financial performance has not been much impressive in recent quarters and growth prospects aren’t great, thus AT&T’s income appeal doesn’t seem to be great and Verizon may be a better income alternative right now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.