Summary:

- AT&T’s decision to re-focus on core connectivity services is starting to pay off, with noticeable improvements in top and bottom-line performance in recent quarters.

- AT&T’s $8B dividend is safe with a more than reasonable cash dividend payout ratio of ~48%.

- In our view, AT&T stock is undervalued and offers an attractive risk/reward profile for patient dividend investors.

DKosig

Introduction

Back in September 2021, I issued a “Buy” rating on AT&T Inc. (NYSE:T) at $20.81 per share (adjusted for WarnerMedia spinoff) citing the potential for an upward re-rating in the telecom giant’s stock:

AT&T’s stock has been dead money for years. However, once the company gets out of its self-created debt spiral through ongoing divestments of its media assets (CrunchyRoll (sale closed), DirecTV (sale closed), Vrio (sale announced), and WarnerMedia (sale announced)), we could see significant share price appreciation. AT&T is moving out of the entertainment industry to focus on its mobility, fiber, and wireless broadband businesses. With the right capital structure, AT&T will now be able to reinvest in its communications business to drive solid (single-digit) revenue growth over upcoming years. The divestitures of media assets will lead to a simplified business model that could attract a much higher trading multiple. If AT&T were to re-rate to Verizon’s (VZ) multiple, the stock could nearly double in the near future. AT&T’s fundamentals are now nearly identical to Verizon, and so, I believe the stock will get re-rated higher, sooner or later.

Source: AT&T: A Re-Rating Is Inevitable

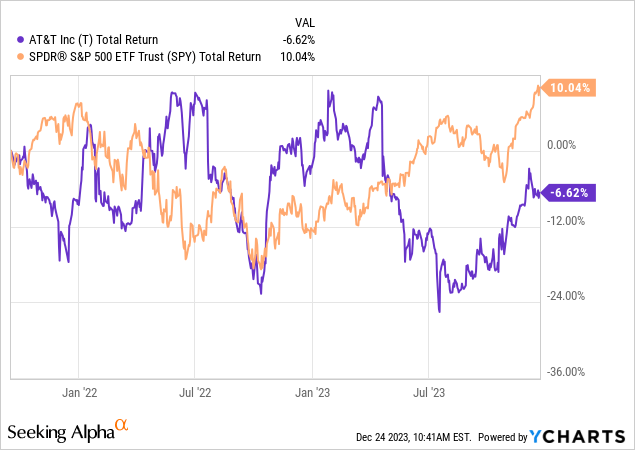

While going back to its core roots of connectivity [by focusing on 5G and Fiber] has driven improved top and bottom line performance at AT&T in recent quarters, T stock hasn’t quite lived up to expectations after an expected dividend cut in early 2022. From the publication of my bullish recommendation, AT&T’s total return is negative and T stock has significantly underperformed the market [S&P-500 (SPY)]:

In today’s note, we shall re-assess our view of AT&T’s business and examine its dividend safety. Furthermore, we will run T stock through TQI’s Valuation Model to make an informed investment decision.

Reviewing AT&T’s Business Trends

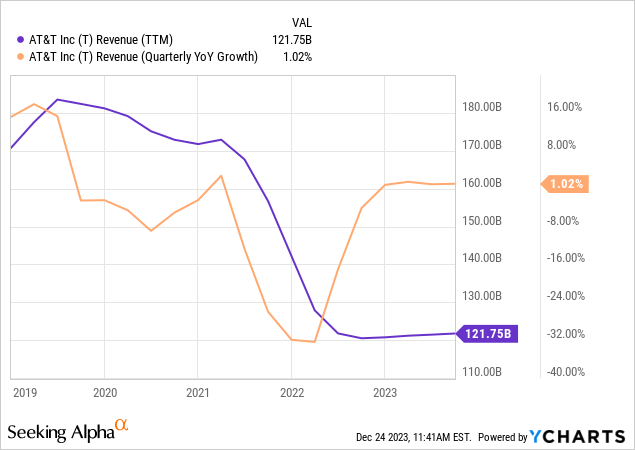

With the sales of DirecTV (late-2021) and WarnerMedia (mid-2022), AT&T exited the entertainment business to focus on its core roots of connectivity services. Since then, AT&T’s growth rates have returned to positive territory, with the telecom giant’s business set to grow at ~1% y/y in 2023.

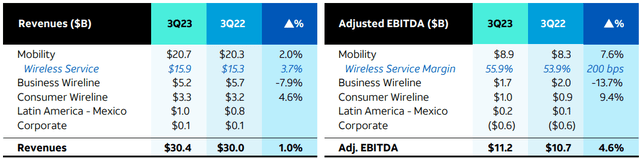

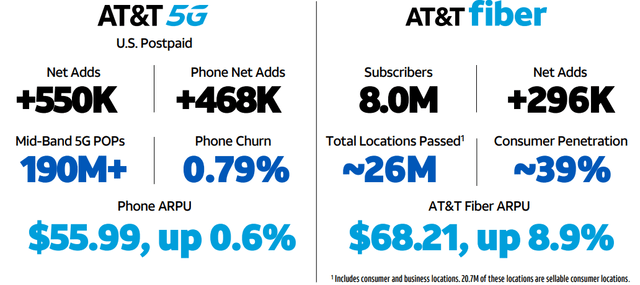

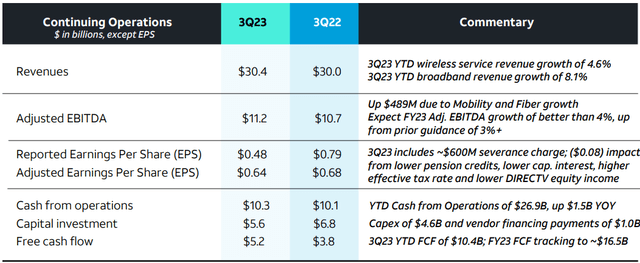

In Q3 2023, AT&T showed continued strength in 5G and Fiber offerings with robust customer additions and healthy ARPU expansion. The business wireline segment remains a drag on top-line performance; however, I am pleased with management’s progress in improving AT&T’s profitability [Q3 2023 adj. EBITDA up by 4.6% y/y to $11.2B].

AT&T Q3 2023 Investor Presentation

AT&T Q3 2023 Investor Presentation

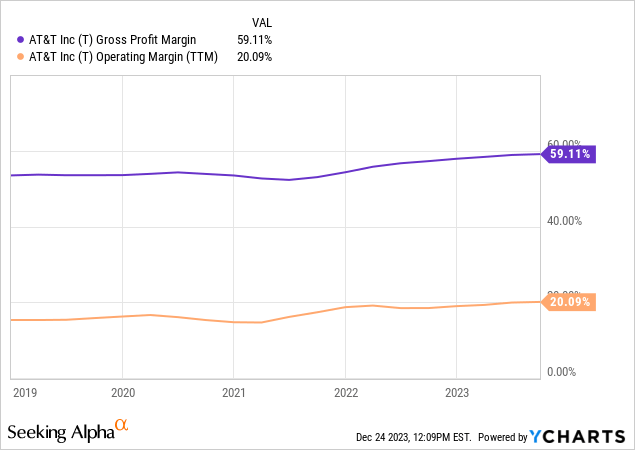

Since early 2022, AT&T’s gross and operating margins have expanded significantly, as you can see on the chart below. In Q3 2023, AT&T’s gross margin [TTM] stood at ~59.1%, whilst operating margin rose to ~20%.

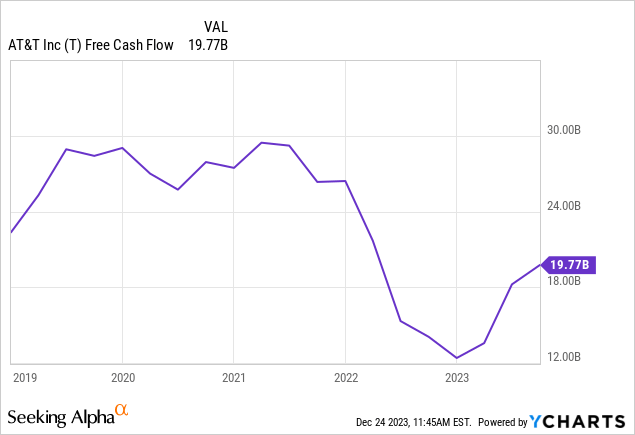

While AT&T’s top-line growth is nothing worth writing home about, ongoing margin expansion and reduced CAPEX spending (capital investments) are driving T’s free cash flows higher.

AT&T Q3 2023 Investor Presentation

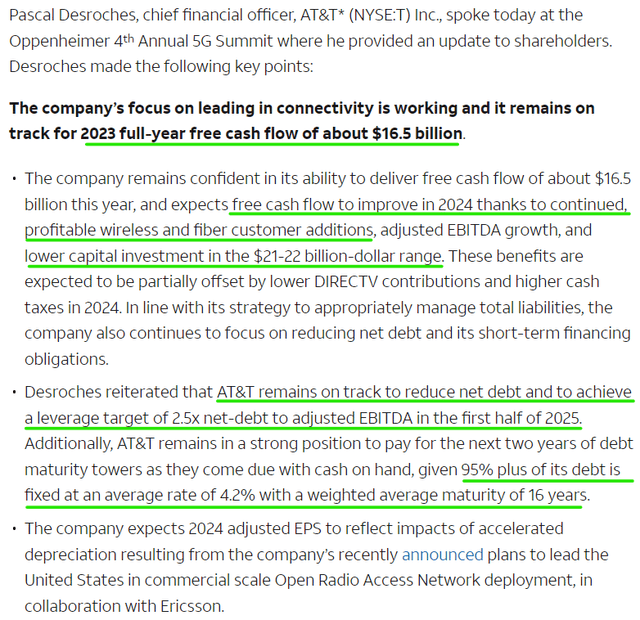

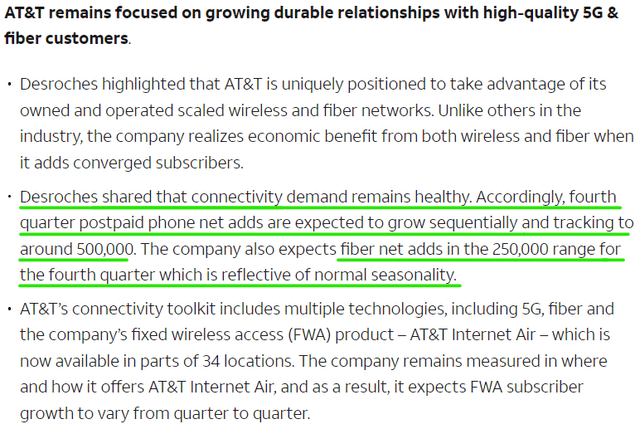

According to Pascal Desroches [AT&T’s CFO], AT&T is on track to produce ~$16.5B in free cash flow during 2023, with further improvements in the cards for 2024. Here are some key remarks Desroches made at a recent Oppenheimer summit:

AT&T Investor Relations AT&T Investor Relations

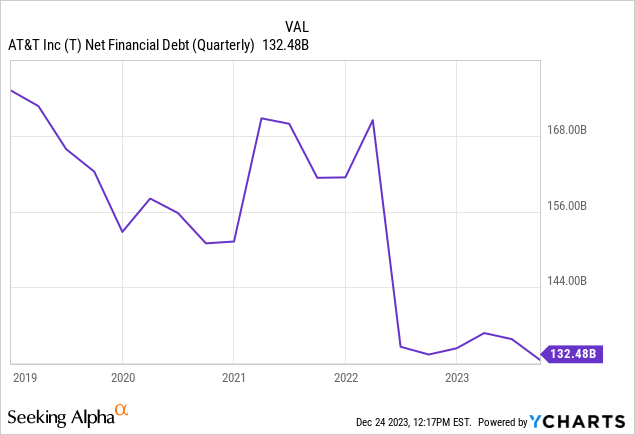

While AT&T still has a whooping ~$130B debt mountain, ongoing deleveraging efforts raise optimism about AT&T achieving management’s target capital structure sooner rather than later.

Now, let us assess the safety of AT&T’s dividend.

Is AT&T Dividend Safe?

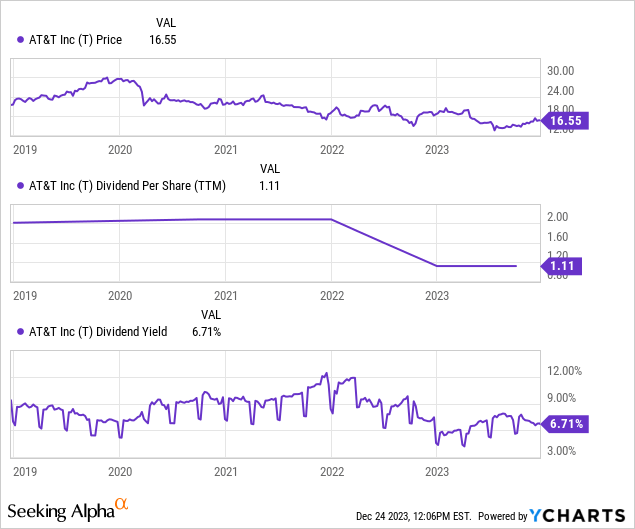

In early 2022, AT&T broke a 35-year streak of dividend increases by cutting its annual dividend from $2.08 to $1.11 per share (roughly $8B), which translates to a dividend yield of 6.7%. Considering its 2023E free cash flow of $16.5B+, AT&T boasts a very reasonable cash dividend payout ratio of ~48%.

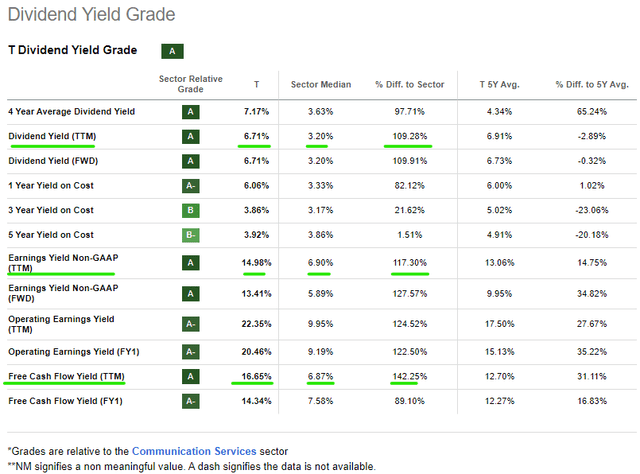

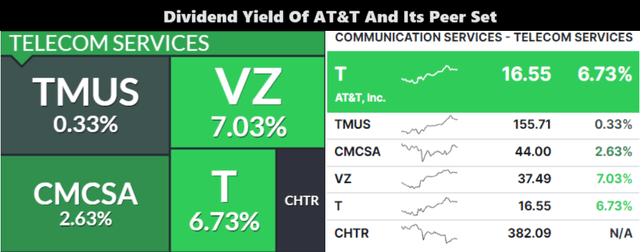

Now, compared to its peer set, AT&T’s dividend yield is an outlier. As you can see below, the median dividend yield in the communication services sector stands at 3.20%, i.e., AT&T’s dividend yield is 109% higher than the sector median. That said, AT&T’s current dividend yield is slightly below its 4-year average of 7.17%.

SeekingAlpha Verizon’s Dividend Yield Relative To Peers (Author and Finviz)

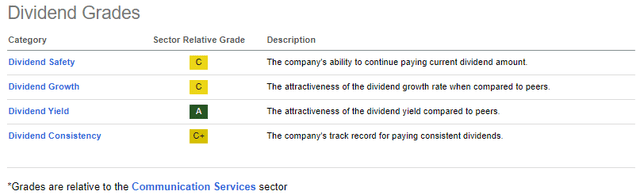

According to Seeking Alpha’s rating system, AT&T has a strong “Dividend Yield” rating of “A”, and based on its peer set, I think this rating makes a lot of sense. Given AT&T’s significant dividend cut in 2022 and no subsequent raise, I believe the “C” and “C+” grades for “Dividend Growth” and “Dividend Consistency” are fair.

AT&T Dividend Grades (SeekingAlpha)

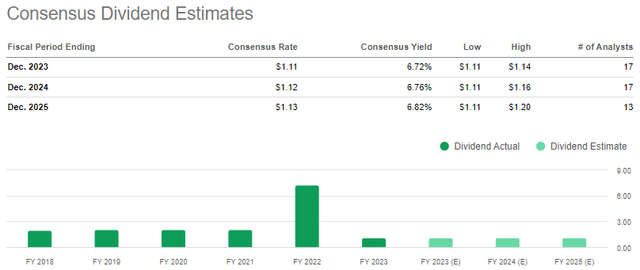

Over the last twelve months, AT&T has paid total dividends of ~$8B ($1.11 per share), and consensus analyst estimates suggest that AT&T’s annual dividend will rise marginally to $1.12 in 2024, and then grow to $1.13 in 2025. We know AT&T’s dividend is well covered by its free cash flows, and the range of dividend estimates validates the idea that there will be no dividend cuts or pauses at AT&T in the foreseeable future.

AT&T Dividend estimates (SeekingAlpha)

While AT&T remains a heavily indebted company, a ~2.6x debt-to-adjusted EBITDA ratio is more than manageable for a cash flow machine like AT&T. In 2023, AT&T is expected to generate more than $16.5B in free cash flow, which is ample cover for its ~$8B annual dividend. With the management’s commitment to maintaining a competitive dividend amid deleveraging, I don’t see an imminent dividend cut or pause for AT&T. Hence, in my view, AT&T’s 6.7% dividend yield is safe.

AT&T Fair Value And Expected Returns

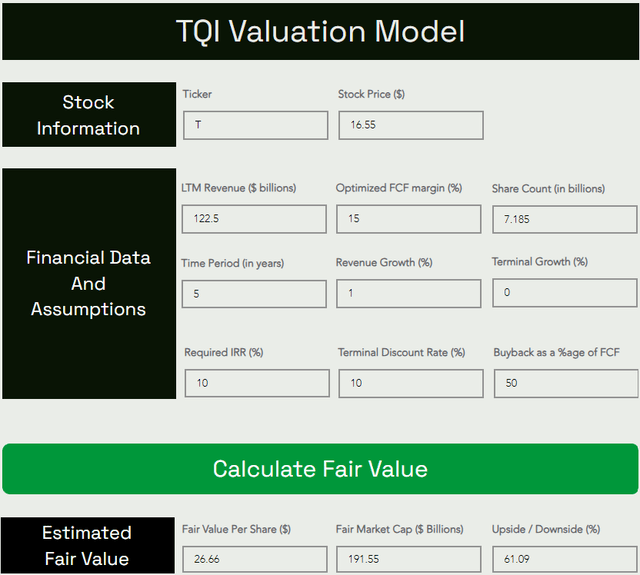

At ~7x (forward) Price-to-earnings and ~16x Enterprise-value-to-earnings, AT&T looks relatively cheap compared to the S&P 500 (SPX) that’s currently trading at ~20x (forward) Price-to-earnings. Yes, AT&T’s growth days are probably in the rearview mirror; however, the stock looks undervalued even after using conservative assumptions for our model (shared below):

TQI Valuation Model (TQIG.org)

As you can see above, AT&T is worth ~$26.7 per share (or $191.55B in market cap), i.e., the stock is undervalued at current levels. Please note, I haven’t factored in AT&T’s [net] debt load of ~$130B because I expect the company to carry a big chunk of this debt for many, many more years (potentially decades) to come (any deleveraging will be done using future free cash flows at management’s discretion). Furthermore, we have factored AT&T’s dividend into our calculation using it under “Buyback as a % of FCF” and effectively treating it as a drip reinvestment. The model assumptions are pretty straightforward, but if you have any questions, please share them in the comments section below.

TQI Valuation Model (TQIG.org)

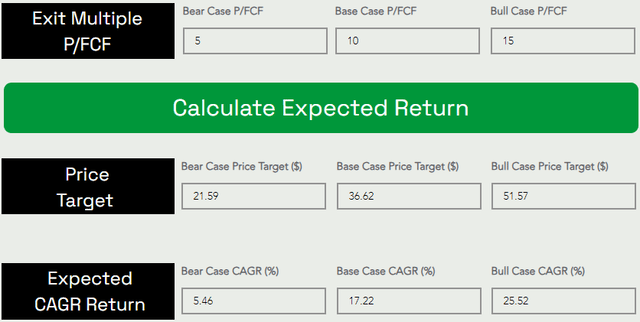

Assuming a conservative exit multiple of 10x P/FCF for 2028, we get a $36.6 price target for AT&T. This price target implies an expected CAGR return of ~17.2% over the next five years, which is slightly ahead of my investment hurdle rate of 15% per year. Therefore, AT&T stock is a buy right now.

Concluding Thoughts: Is AT&T A Good Dividend Stock To Own?

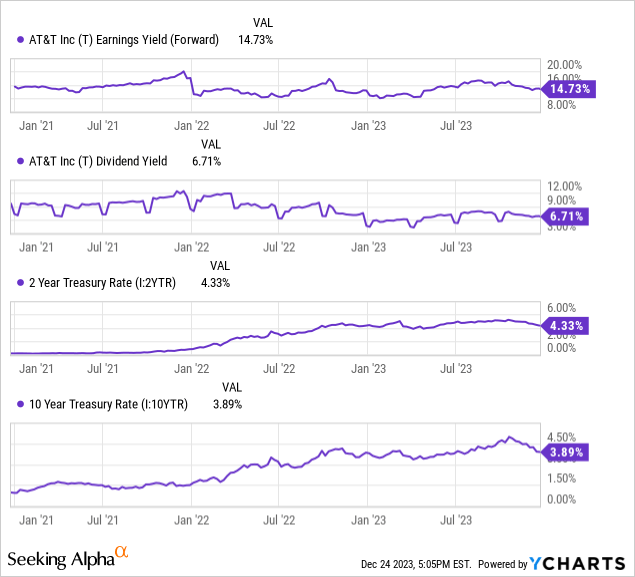

With its earnings (~14.7%) and dividend (~6.7%) yield being greater than short-term (2-yr: 4.33%) and long-term (10-yr: 3.89%) treasury yields, AT&T is undoubtedly an enticing dividend investment. As we saw in this note, AT&T’s above-industry average dividend yield of 6.7% is well covered by its free cash flows. Given management’s commitment to the dividend and robust cash generation potential of AT&T’s connectivity services business, another dividend cut (or pause) seems very unlikely for the foreseeable future.

Despite AT&T’s highly leveraged balance sheet, I view AT&T as a good hideout for investors looking to safeguard themselves from violent market gyrations in the next 1-2 years. AT&T is a (utility-like) reliable cash flow generator that will continue to produce tons of free cash flow even during recessionary periods. From a valuation perspective, AT&T is currently undervalued, and the risk/reward is attractive enough to warrant a new long position. In my view, T’s 6.7% dividend yield is safe, and there’s a very good chance of significant capital appreciation in AT&T’s stock in 2024-25. Henceforth, I continue to rate AT&T a “Buy” for dividend investors.

Key Takeaway: I rate AT&T a long-term “Buy” at $16.5 per share

Thanks for reading, and happy investing. Please share your thoughts, concerns, and/or questions in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

How To Invest In This Environment?

In order to navigate this tricky economic period, we are pursuing “Bold, Active Investing with Proactive Risk Management” at our investing group – “The Quantamental Investor“. With a laser focus on valuations, profitability, and balance sheet strength, we are buying the winners of tomorrow! Furthermore, we are utilizing index-based options to guard against significant broad-market declines. Join us today to prepare for whatever the market may throw at you in 2024!