Summary:

- AT&T’s recent stock price drop has created a high dividend yield of approximately 7%, attracting investors seeking passive income.

- The company’s dividend appears to be safe due to its strong free cash flow and focus on core business operations.

- AT&T’s unwinding of previous acquisitions and focus on efficiency may lead to slow revenue growth and increased profitability in the future.

jetcityimage

AT&T (NYSE:T) has gone through a fairly significant drop as of late. This drop in stock price has caused some pain for the shareholders, but it has also caused another effect. It has created a high yield on the dividend payout. Currently yielding approximately 7% it is enticing for anyone looking to get themselves some passive income.

There are a few questions that come up when looking further at AT&T. Most of this relates to the points raised above. The company stock price has seen a decline in recent weeks, what caused the drop and is it going to continue to fall? A continued share price drop will erase any benefits from a higher yield. Does the company have growth prospects or is it a declining legacy business? Similar to the other question, I don’t want my dividends being eroded by a large loss on the share price. I also want to make sure the company will be able to pay the dividend going forward. This brings up the biggest question for me, is the dividend safe? A high payout is great but can the company sustain that payout or is there going to be a dividend cut?

That Dividend

What can you say bad about a 7% dividend yield? It is a high return from a regular operating company. Maybe you say, well that is a waste of capital or bad capital allocation by the company. I would say that is dependent upon the type of business it is. I do know that it is hard to not take a closer look when you see a dividend return such as that.

I do not typically invest in a stock only for its dividend. The keyword there being, only. I think dividend stocks have a place in most portfolios, at least to some percentage of the portfolio. I don’t want to invest in a declining business even if they pay a dividend. Now it does not have to be a high growth stock. Companies use cash in different ways depending on their business. Growth companies use cash for just that, growth. While more established companies in non-high-growth markets tend to use their steady cash flow to return capital to investors through dividends or share repurchases. There is always the trade off in capital allocation and what is the best use of cash. If the company has some growth and is not in decline it can help assure that my dividend gains won’t be eroded by a declining stock price, if I am to sell.

There has been a lot happening with AT&T over the past few years that has caused the stock price to decrease and in the process increase the dividend yield. COVID obviously caused a lot of volatility. The company also made some large acquisitions that did not work out. It tried to expand its scope of business and become a media conglomerate with the acquisitions of DIRECTV and Warner Bros. This was a change from the normal steady business. This business change increased volatility for the company. The company ended up spinning off both DIRECTV and Warner Bros during the last two years. Not what I would call a win with either of those acquisitions. The company has not exactly generated capital gains for shareholders. In fact the company has had a return of approximately -31% since the start of 2020.

The company has historically been a strong dividend payer. The yield has not historically been so high on that dividend though. This increased yield has been due to a drop in the stock price as discussed above. The yield has also seen a spike this year. In April the yield was 5.5% and it has recently climbed to over 7%. The chart below outlines the historical yield for T stock. You can see the increased volatility and increased yield starting around 2020. Also the most recent increase in yield can be seen.

What Caused the Recent Sell-off?

The company has seen a decline of over 19% in the last two months. This decline has driven the yield from 5.5% to over 7%. What caused this decline? Is the stock going to continue its decline? The company saw a significant drop following its earnings report in April. The company saw a drop of 10.4% in a single day. Since then the company has continued to trend down.

It seemed that the single biggest factor for that stock decline was due to the low free cash flow number reported by the company for the first quarter. Analysts had expected FCF of $2.8 billion and the company only reported $1 billion. This is obviously significantly below estimates, enough to spook dividend investors. Many investors in AT&T are invested for the dividend. If they become concerned about that dividend then they have no reason to own the stock. The company has projected an estimated $16 billion in FCF for the year, and it maintained that estimate despite the lower amount in Q1. The company had $14 billion in FCF during 2022. The company expects higher FCF this year. Albeit it is a decline from the $18 billion in 2021. It is expecting cash flow to be more loaded into the back half of the year. Not sure if it was a disconnect between analysts and the company but during the earnings call the company CFO stated:

“Free cash flow for the quarter was $1 billion. This was consistent with our expectations and accounts for several seasonal and anticipated working capital impacts. We remain confident in our full year outlook for free cash flow of $16 billion or better. This expectation is largely due to the timing of capital investments, device payments, incentive compensation, which all peaked in the first quarter.”

The CEO stated the following concerning the lower FCF in Q1 and the maintained guidance for the year.

“One, it’s the highest quarter of device payments. Recall, Q4 holiday sales is the heaviest volume for devices; we pay for those in Q1. You saw our capital spend is elevated relative to the annual guidance that we gave. And Q1 is the quarter we pay incentive comp … When you factor all those things in, along with our expectations that we will continue to grow EBITDA, we feel really good about delivering $16B or better.”

In other words it is a timing issue. This seems like a very logical explanation for the reduced FCF for Q1. To help verify his statements we can look at the prior year FCF and see if there was a similar trend of loading the FCF into the back half of the year due to timing issues. The chart below shows the FCF for the past year. You can see that last year there was a similar trend with more FCF loaded in the second half of the year.

|

Free Cash Flow |

|||||

|

(in millions) |

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

2022 |

2,811 |

1,384 |

3,840 |

6,103 |

14,138 |

|

2023 |

1,004 |

||||

A big part of FCF is Capex. The company has stated that they expect to spend approximately the same as last year, $24 billion. In Q1 they spent almost $6.5 billion which means they will have to run at a lower rate going forward or they will shoot well above their goal of $24 billion for yearly capex. The table below shows the capex spend for the past few years and how that is more front loaded.

|

Capital Expenditure |

|||||

|

(in millions) |

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

2021 |

5,723 |

5,014 |

5,489 |

4,077 |

20,303 |

|

2022 |

6,314 |

6,679 |

6,821 |

4,689 |

24,503 |

|

2023 |

6,448 |

||||

I don’t think it is wise to just take management for its word. In this case I am going to believe them. Their reasons are backed up by the data. We see a similar trend that we saw in prior years. I am going to give them the benefit of the doubt on this one. I think it was a market overreaction to the low FCF in Q1. The number was in line with company expectations and the company maintained its full year FCF estimate.

Is the Dividend Safe?

The FCF discussion naturally leads us into the question of the safety of the dividend. You only lose money on a stock price decline if you sell the stock. I know many people, myself included, who would be happy holding the stock for a 7% dividend for the foreseeable future. It is a solid return in almost any market. That is only the case though if the company is able to maintain its current dividend payout. If it is not in the financial position to do so then it will have to cut that dividend and eat into your yield. Most likely cause a decline in the stock price as well and leave you with a double whammy on the losses.

The company spun off WBD in April of 2022. The spin off resulted in AT&T not having the large media assets, which meant less revenue and cash flow. In conjunction with this the company cut the dividend from $2.08 a share to $1.11 a share. When you are looking at the dividend payout you will see this large drop off in dividend payment starting in Q2 of 2022.

We have 4 quarters of dividend payments at the new amount of $1.11. We also have 4 quarters of FCF data following the spinoff. I think the best way to see the dividend payout ratio would be to take the last 4 quarters and see the payout ratio. It also takes into account the seasonality discussed by the company. The charts below show the dividends paid over the last 2 years along with the payout ratio for the last 4 quarters.

|

Dividends Paid |

|||||

|

(in millions) |

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

2021 |

3,741 |

3,830 |

3,748 |

3,749 |

15,068 |

|

2022 |

3,749 |

2,086 |

2,010 |

2,014 |

9,859 |

|

2023 |

2,014 |

||||

|

FCF Payout Ratio |

|

|

TTM FCF |

12,331 |

|

Dividend Payout |

8,124 |

|

Payout Ratio |

65.9% |

If FCF is to hit their estimate of $16 billion then this number becomes much lower as well. The FCF payout ratio would only be 50%. This is a sustainable FCF payout ratio and does not make me concerned about the ability of AT&T to continue to pay its dividend. Even if the company were to miss that estimate and only reach the $14 billion it did last year then it would be a FCF payout ratio of 58%.

I think the dividend is safe. The company has taken a lot of risk off the table with investments into other business ventures. It can focus on its core business and generate more FCF and secure that dividend.

Financial Position Going Forward

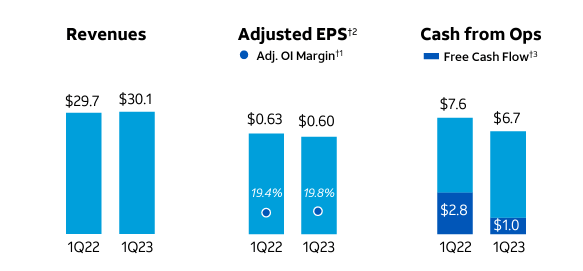

I don’t want to invest in a declining business even if it pays a dividend. The numbers don’t necessarily look great for AT&T. The company experienced a decline in FCF from 2021 to 2022. Revenues were for the most part flat with growth of 1.4% in the latest quarter. Operating income did see an increase of 8% while net income saw a decline of 13%. The company is not a growth story. The results can be seen in the graph below from the company presentation.

Company Filing

These comparisons are difficult though as we are comparing AT&T now to a company that owned DIRECTV and WBD previously. The company has refocused on doing what it does best. I think this was a smart move. The unwind of prior acquisitions is a little painful but necessary. The company is now focused on its operations and being more efficient there. It expects that it can save $6 billion in costs by the end of the year. This operational efficiency is important going forward.

The phone segment continues to carry the bulk of the weight for AT&T. It has been maintaining its performance as well. Despite some headwinds from the macro economy they continue to add new users. It had 424k postpaid phone net additions in the latest quarter. I do not expect the mobility unit to see a dip. This is a steady state business, people are not going to go without their phones and there are only a few carriers to switch between. Usually the cost of switching is not worth the hassle either. While it is a mature business and you don’t expect to see high growth rates, you can count on it to provide strong EBITDA.

The growth for the company has come in the form of its fiber business. This business has grown revenues 30% year over year. This is a capital intensive business but the company has seen good EBITDA returns. This does make up a small portion of revenues so it is not enough out of the gate to move the company as a whole. It does provide a good growth line of business for the company.

Overall the financials have not been in the best spot. The company has seen profitability decline and revenues grow at a slow rate. That being said, the company has continued to produce FCF. I think that the unwinding process will allow the company to be more efficient and increase margins. It will continue to see slow revenue growth as a company as a whole. Fiber will be the bright growth spot for the company. It will have opportunities to increase its EBITDA and income through efficiencies.

Risks

The company may not achieve the cash flow estimates that it has outlined. The company has a very large amount of debt on the books. It needs strong free cash flow to pay down debt and still pay its dividend. If it is not able to produce high enough cash flow then the company is at risk of cutting its dividend. This would equate to a drop in share price.

The company has made some bad investments in the past. It has strapped itself with lots of debt. It is now in the process of unwinding from that previous structure. The company needs to be smart with its capital. There is the risk that it will do what it has in the past and misuse its capital and diminish the return for investors.

There is always a threat from competitors. Most recently there has been talk about Amazon (AMZN) wanting to jump into the wireless market. There are large costs to get into the wireless market as you need to own the rights. Amazon would partner with a carrier out of the gate. This may or may not be AT&T. It could provide some additional pricing pressure and competition on AT&T. Amazon has not confirmed these speculations, and in fact has denied them. Regardless, there is still always a potential for additional competition entering the space.

Conclusion

I think AT&T has seen an unwarranted drop in share price. Following the Q1 report it dropped over 10% in one day. I think this was an overreaction to a low FCF number. The company expected the low number and maintained its outlook on FCF for the year.

I think the dividend is safe with AT&T. They have strong enough cash flow to pay the dividend. I think AT&T has a steady business that is not in jeopardy of significant declines. It is in the process of becoming more efficient in its operations as it unwinds its previous acquisitions. I do not see strong growth coming from the company. I do expect to see it continue to grow revenue at a slow rate overall and increase its profitability. Especially as it focuses on becoming more efficient.

I entered a small position on the stock based upon my analysis above. I think the dividend rate provides a good return. I do not see it threatened. I also think the drop in stock price has put it in a position to see an increase in the stock price going forward. If it is able to achieve its FCF estimates for the year I think you will see an increase in the price of the stock. I would not chase the stock up as I see it as a dividend play more than a price appreciation play. Although that can depend on what you consider to be a high enough yield to invest. If 6% is high enough then there is room for the stock price to climb and still get that yield. If you are looking for an increase in the stock price then there are better options available. We all love a big yield. AT&T provides that while having a solid business behind it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.