Summary:

- We cited three worries for 2023 in our last update.

- Free cash flow was one of them and the market ran amok on the Q1-2023 results.

- All said and done, the company did actually deliver better results than what we expected and the numbers were solid.

Joe Hendrickson/iStock Editorial via Getty Images

On our last coverage of AT&T (NYSE:T), we did point out there were a few worries for 2023. Free cash flow was number two on the list and we addressed it as follows.

The second thing that AT&T has to address is the free cash flow outlook in the face of what has been a scintillating run of inflation. Our thinking is that AT&T held the line on overall capex in 2022, but got less bang for its buck, thanks to inflation. That bill will come due in 2023 and if they can deliver in the $14 billion ballpark, we could see the stock move higher.

Source: 3 Things To Watch For 2023

Our number of $14 billion for free cash flow was $2 billion below management guidance and hence we were least setup to be surprised if things went bad. Well, the market reaction still caught us off guard after Q1-2023 results.

We look at what happened and tell you why you need to stop obsessing with what was delivered.

Q1-2023

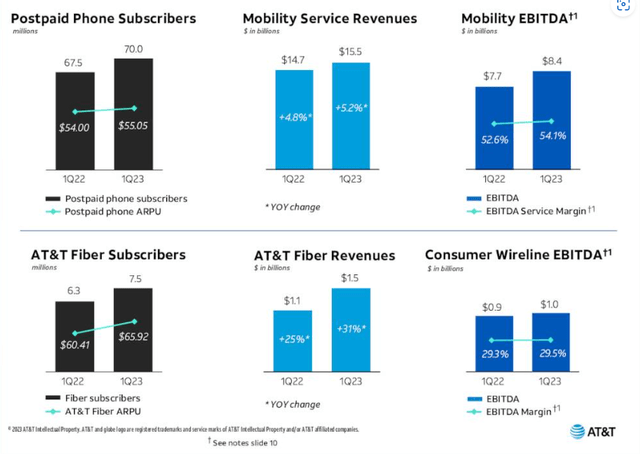

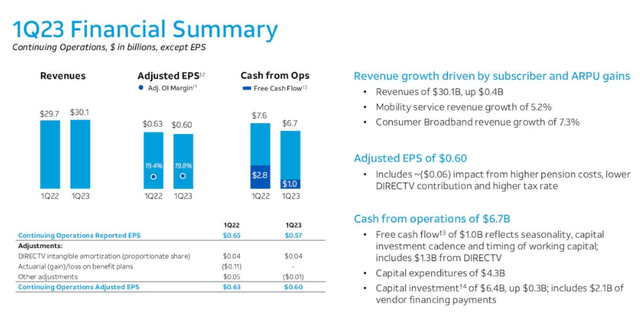

The first big number that came forth was the growth in postpaid customer adds and this was at 424,000 during the quarter. There is a palpable slowdown from the near down from 700,000 added a year ago. That is to be expected as the economy nears a recession. Overall year-over-year postpaid phone subscription numbers were pretty solid with a 2% growth in revenue per subscriber as well.

In fact, in the numbers above, we could not see anything wrong anywhere. Customer defection was relatively low and the company continues its oligopolistic dominance.

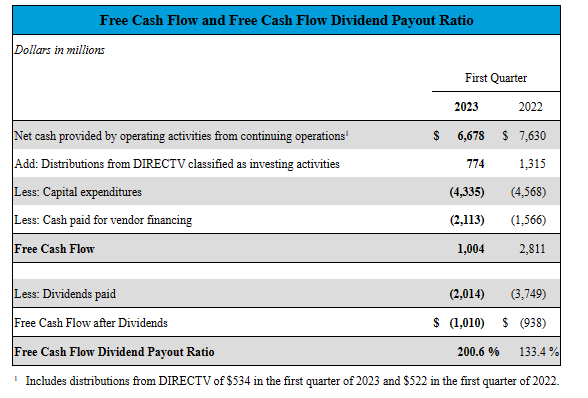

Of course the excitement was on the free cash flow and yes there was a notable drop versus last year. Free cash flow came in at $1.0 billion, missing every estimate out there and was notably below the almost $3.0 billion generated last year.

Our Take

AT&T had already hinted in Q4-2022 that free cash flow would be heavily weighted towards the back half of the year.

Similar to last year, we expect greater free cash flow generation in the back half of the year based on higher capital investment levels and device payments in the first half of the year as well as the timing of the annual incentive compensation payout. We will use our free cash flows to pay out our dividend and to pay down debt as we continue to progress towards our target of 2.5x net debt to adjusted EBITDA, which we anticipate will take place in early 2025.

Source: Q4-2022 Transcript

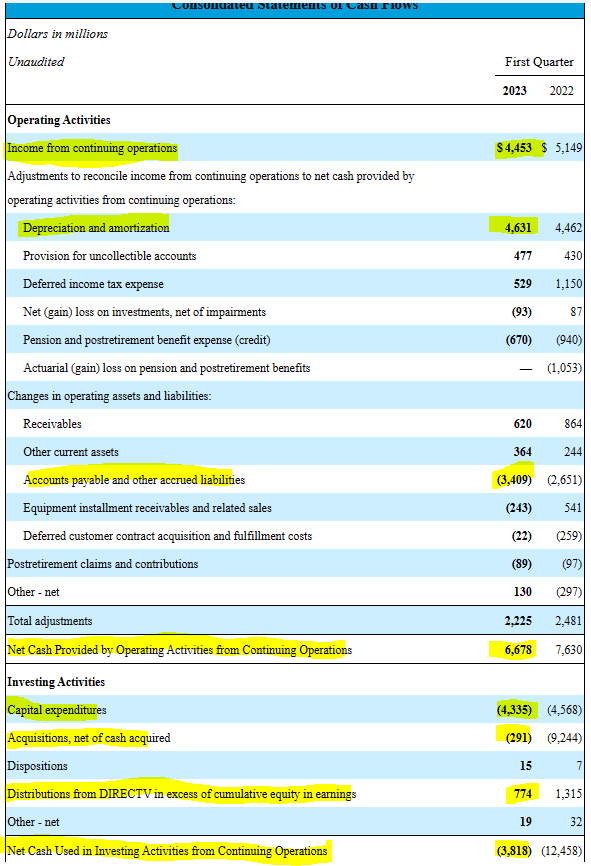

But let’s look at the Q1-2023 numbers anyway. AT&T provides a free cash flow calculation for investors.

AT&T Q1-2023 8-K

What’s great about the above number is that AT&T directly starts off from the cash flow statement and uses the “net cash provided by operating activities.” While there are many movements to the free cash flow equation, over time there is one equation that should generally hold true for AT&T.

Net income + depreciation + distributions from DIRECTV – Capex= Free Cash Flow.

We are deriving this from the sum of non-working capital movements in operating and investing activities. Keeping that in mind, let’s look at what we have highlighted below.

AT&T Q1-2023 8-K

First using our equation, free cash flow would be a gigantic $5.25 billion ($4.45B+$4.63B-$4.33B-$0.29B+0.77B).

Key detractors from our equation were the changes in working capital, notably the $3.4 billion paydown of accounts payable and accrued liabilities. The key thing to keep in mind is that these should net to zero over time. AT&T’s “cash paid for vendor financing” is included under financing activities. This too is unlikely to be a long term detractor, especially in a recession.

Pascal Desroches

Dave, here’s what I would point you to. Within the first quarter, as I mentioned in my prepared remarks, there is — we are at the high watermark of our device payments. And it’s the only quarter that has our annual incentive compensation. Those two things, coupled with our elevated CapEx relative to our full year guide, hurt Q1 to the tune of $3 billion to $4 billion, and we expect that to turn during the course of the year just mechanically. It really isn’t much harder than that. Like based upon our spend, what we expect to spend in those categories, those should turn mechanically. So we feel really good about being able to deliver $16 billion or better.

Source: Q1-2023 Transcript

Verdict

Adjusted EBITDA was up 3.9% versus the 3.0% guided for at the end of last year. That really should be what we need to primarily focus on. AT&T control on capital expenditures is the next area. Considering that management really has no brownie points to burn through, we think they will keep things tight on the capex front. They are likely to deliver on their free cash flow outlook, even if it means cutting back on their capex. The most likely impact of this is going to be felt in the tower REITs like Crown Castle Inc. (CCI) and American Tower Corporation (AMT) as we likely head into a recession later this year.

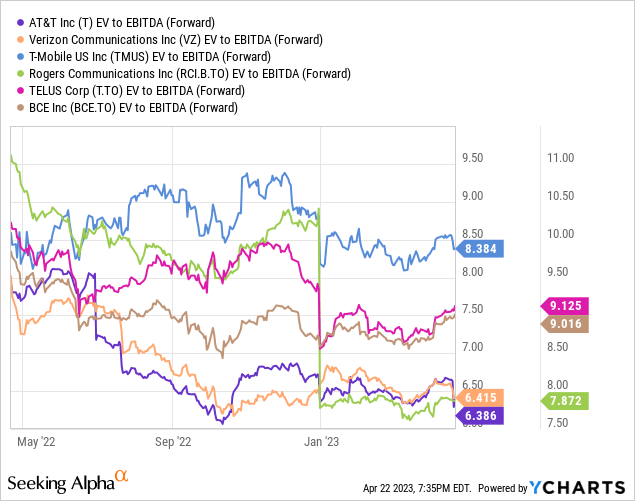

As for the A&T stock, the company is slightly on the cheap side relative to our fair value and extremely cheap relative to its three neighbors to the north.

It also offers the second highest dividend yield after Verizon Inc. (VZ). So if you had to get some communications sector exposure, we think you could do far worse than AT&T. We currently own AT&T (and VZ for that matter), and have sold the $20 covered calls for January 2024 against that position. We don’t think you are going to get a runaway move here, but the option premiums plus the dividends should provide a solid income.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T,VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility? Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Give us a try and as a bonus check out our Fixed Income Portfolios.

Explore our method & why options may be right for your retirement goals.