Summary:

- AT&T shares have lost nearly half their value over the past decade, with the company’s large dividend being the only positive aspect for investors.

- The company’s decision to spin off WarnerMedia and reduce its dividend has not been well received, with shares continuing to fall and no value unlocked for shareholders.

- Despite AT&T’s large debt load, I argue that the company is still profitable and capable of meeting its future obligations, and suggest that buying back shares, reducing debt, and reinstating annual dividend increases could improve market perception.

Brandon Bell

AT&T (NYSE:T) has been a tragic investment that has cost myself and others’ time and money. Over the past decade, shares of AT&T have trailed the market, losing almost half their value, declining by -45.99%. For years the large dividend was the only bright spot, as many blamed management for AT&T’s troubles. When AT&T spun off WarnerMedia and resized the dividend, many commented on my previous articles that they were unhappy with the decision. AT&T’s dividend, with decades of annualized increases, was reduced from $2.08 per share to $1.11. Since the spinoff occurred, management has yet to unlock value for shareholders as AT&T has fallen from roughly $20 to the mid-teens, and shares of Warner Bros. Discovery (WBD) have declined by -46.40% since their $24.08 price on April 11th, 2022. Shares of AT&T have been hit with a barrage of bad news going into earnings, including their CFO, indicating that subscriber growth could come in under estimates, while the entire telecom industry fell upon the release of the Wall Street Journal article discussing the lead-sheathed copper cables. While AT&T has been toxic for shareholders, I am buying more going into earnings and dollar cost averaging as the reduced dividend is now yielding over 7.5%. I have been incorrect on AT&T, but I still believe there is light at the end of the tunnel, and I will continue to reinvest the dividends and add additional shares on dips.

I have been incorrect and AT&T has been a lackluster investment

I have written many articles on AT&T, and despite my optimism, this investment has been a dud. The dividend has padded the losses, but the market has never responded well no matter what AT&T has done. There were periods where AT&T would start to rally, only to be met with what seems like the inevitable, as shares ultimately have declined. Despite previous profitability, free cash flow (FCF) generated, or forward projections, many see AT&T as a company saddled with too much debt without robust growth aspects.

Over the past several years, I have been incorrect on which direction shares of AT&T would go. Value has not been unlocked from the WarnerMedia spinoff, and it feels like shareholders have taken up permanent residency in the house of pain. The market’s perception of AT&T isn’t bullish, and at this point, it’s going to take a lot to get investors excited about investing in AT&T. Nobody can predict the future and hopefully, shares of AT&T bottomed last week when they reached $13.43. I still feel that AT&T is a deep-value stock with a forward P/E of 6.03, but if the sentiment doesn’t change, it could be a very long time until we see shares approach the $20 level.

AT&T’s debt load has been a major concern for many investors, but it isn’t as scary as some believe

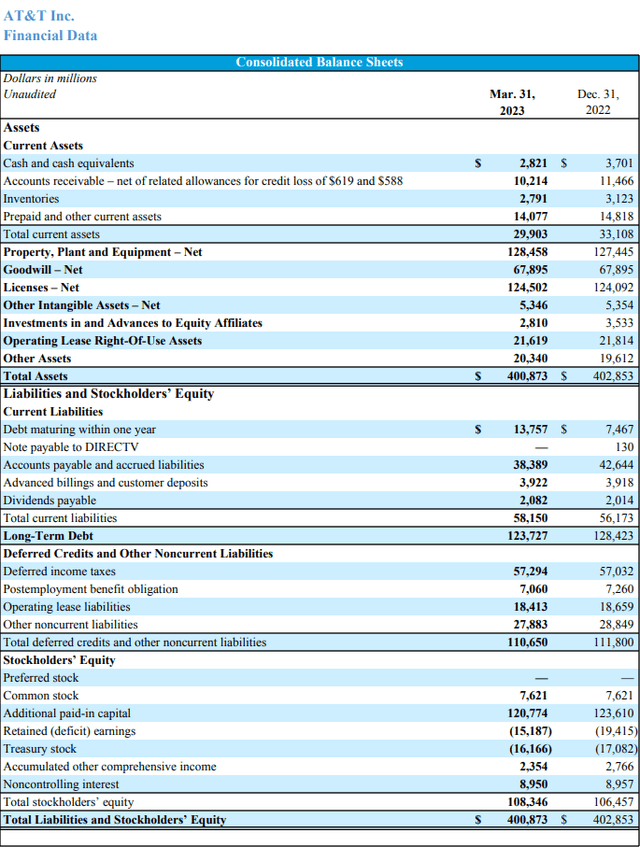

The most common bear case I see is regarding AT&T’s debt level. I am not going to sugarcoat it, AT&T has a lot of debt on the balance sheet. There is $169.56 billion in total debt as of the Q1 2023 filing. There is $123.73 billion in long-term debt on the balance sheet, with $13.76 billion of debt maturing within one year. As we can see, AT&T pays just over $2 billion per quarter in dividends, so I will account for $8.4 billion in capital being allocated to the dividend on an annual basis.

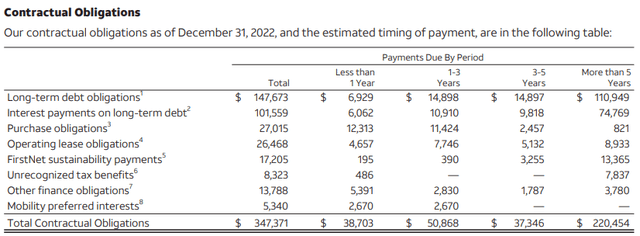

The 2022 annual report provides a summary of AT&T’s debt obligations and maturities. At the end of 2022, AT&T had $147.67 billion in long-term debt on the balance sheet, and the interest payments on this debt would amount to an additional $101.56 billion. In Q1 of 2023, AT&T paid $1.71 billion in interest expenses and still generated $4.43 billion in net income. While the interest eats away at the profit margin, it isn’t crippling the company. AT&T is still a profitable company that has continuously met its interest and repayment obligations.

The question becomes, can AT&T meet its future obligations? In Q1 2023, free cash flow (FCF) came in at $1 billion, significantly lower than the analyst estimates of $2.6 billion. The combination of the lowered FCF and revenue miss spooked the market, and shares declined from $19.70 on April 19th to $17.65 on April 20th. On the conference call, Pascal Desroches (AT&T CFO) stated that despite the miss on FCF in Q1, AT&T was on track to generate $16+ billion in FCF throughout 2023 and is confident in the full-year outlook. He indicated that the timing on capital investments, device payments, and incentive compensation peaked in Q1, and AT&T had anticipated lower FCF due to working capital impairments.

AT&T did retire debt in Q1, and rather than having $147.67 billion in long-term debt due, as the balance sheet read at the end of 2022, their obligations declined to $123.73 billion. AT&T still has $13.76 billion in debt maturing over the next year, so I will overestimate and use the payment schedule from the 2022 annual report. Over the next 5-years, AT&T has $29.8 billion in long-term debt obligations maturing. Returning to the earnings call, Mr. Desroches indicated that AT&T expects net debt to decline further in 2023 and thereafter while saying that AT&T expects to generate more cash from operations. If AT&T’s cash generation remained flat and they hit the targeted $16 billion in FCF for 2023, they would have roughly $7.6 billion of FCF remaining after the dividends are paid. This would amount to $37 billion of remaining FCF over the next 5 years after dividends are paid, which is $7.2 billion more than the long-term debt coming due.

AT&T has a large debt load on the balance sheet, but the debt is extended out decades with 95% fixed at an average rate of 4.1%. In Q4 of 2022, AT&T generated $17.77 billion in gross profit and in Q1 of 2023, AT&T generated $17.81 billion which leaves a lot of room to absorb the quarterly interest expenses in their remaining operating income. I believe that investors see AT&T’s debt load and think it’s a sinking ship without digging through the maturity schedule and the income metrics. The debt is large but AT&T can service the debt and currently it’s not an issue.

What I think we need to see from Q2 2023 and what I think it will take for the market to positively respond to AT&T

The market hasn’t responded well to anything AT&T has done, even reducing its debt load. AT&T is considered a dead money business and is looked at as a utility at this point. In Q2, I want to see AT&T’s cash from operations exceed $7.5 billion and generate at least $4 billion in FCF. AT&T needs to generate $15 billion in FCF over the next 3 quarters to reach their targeted $16 billion. AT&T can’t come in with $1-$2 billion in FCF otherwise, the market will completely dismiss their FCF-generating capabilities, and being able to retire maturing debt will come into question. I also want to see growth in postpaid phone subscribers, fiber subscribers, and overall EBITDA.

AT&T had made the mistake of trying to diversify from its core business in the past and paid for it with declining shareholder value. There are six things AT&T needs to do to have any chance at reversing the market’s perception of the company.

- Growth in subscribers across mobility and fiber

- Reduce expenses as a percentage of revenue

- Increase profits

- Reduce Debt

- Buyback shares

- Annual dividend increases

AT&T is never going to be an exciting tech company at the forefront of the latest innovations. Communication just isn’t exciting, and many take it for granted regardless of the advances. At this point, the only way for AT&T to change the perception of the company is by becoming more profitable and having better margins. AT&T has been viewed as a company that people invest in for dividends, so they need to play to this strength. Nothing has worked, and the market isn’t responding to the spinoff the way management thought it would. I think deleveraging the balance sheet by retiring debt, providing value to shareholders by buying back shares, and getting back to annual dividend increases may be the only way for the market to get excited about AT&T again.

Conclusion

AT&T has been a disappointment to many shareholders, including myself. I still feel AT&T is undervalued, but they have been stuck in a perpetual downtrend that is becoming harder to eliminate. I think many investors see the amount of debt and run for the hills without understanding the maturity structure or AT&T’s ability to service its obligations. I believe that if AT&T accepted that it would always be a communications company and worked on further deleveraging the balance sheet and returning additional capital to shareholders, the market would reward them. Nothing has worked, and the only way for AT&T to create shareholder value is to buy back shares, reduce debt and reinstate annual dividend increase. This all starts with hitting their $16 billion in FCF number for 2023 and increasing their FCF going forward. Hopefully, management can get the job done because the current valuation is astonishing.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Disclaimer: I am not an investment advisor or professional. This article is my own personal opinion and is not meant to be a recommendation of the purchase or sale of stock. The investments and strategies discussed within this article are solely my personal opinions and commentary on the subject. This article has been written for research and educational purposes only. Anything written in this article does not take into account the reader’s particular investment objectives, financial situation, needs, or personal circumstances and is not intended to be specific to you. Investors should conduct their own research before investing to see if the companies discussed in this article fit into their portfolio parameters. Just because something may be an enticing investment for myself or someone else, it may not be the correct investment for you.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.