Summary:

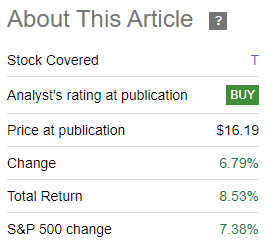

- AT&T’s Q4-2023 non-GAAP earnings per share missed estimates by 2 cents, but revenues exceeded estimates by over $0.5 billion.

- The company achieved higher-than-expected full-year free cash flow of $16.8 billion and reduced short-term obligations.

- 2024 guidance was a tad lighter in a couple of spots but the company is delivering where it matters most.

Justin Sullivan

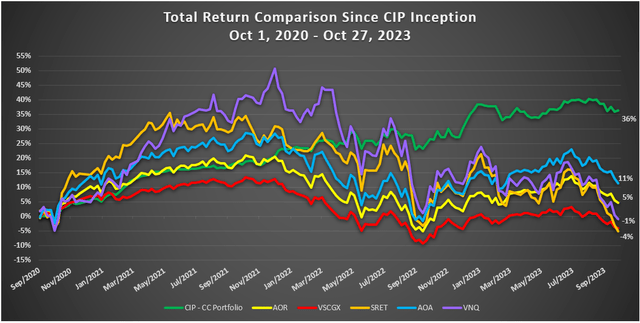

On our last coverage of AT&T (NYSE:T) we made a bull case for the company, while turning slightly sour on tower REITs that depend on the company’s capex cycle. Specifically we said,

We think the capex cuts in the pipeline and the ones yet to come during the recession, will make AT&T (6.7X earnings) a superior play over overhyped tower REITs like American Tower REIT (AMT) at 19.5X FFO. We remain long AT&T with a $21 price target. This is an increase over the $20 we had previously and reflects primarily the debt reduction flow to equity from debt.

Source: Exodus At The Bottom

The stock has delivered a good performance since then.

Seeking Alpha

We look at the Q4-2023 numbers and update our outlook.

Q4-2023

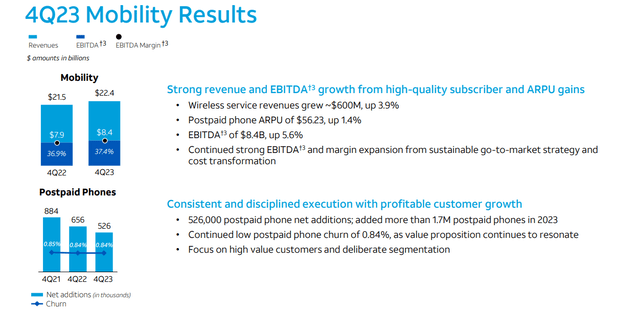

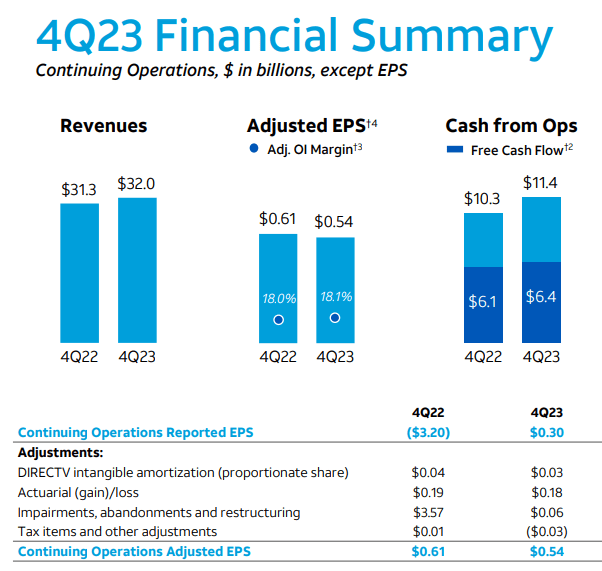

AT&T’s non-GAAP earnings per share missed estimates by 2 cents, while revenues came in far stronger (exceeding estimates by more than $0.5 billion). There is some signals buried in an EPS miss for sure as management teams work hard with analysts to set the bar low enough to clear. So a miss is a signal, and should not be dismissed. But the revenue beat was a good enough offset here. Breaking down the results, we saw all aspects of top-line related growth come in strong. Postpaid phone subscribers growth, while trending down, was still robust.

AT&T Q4-2023 Presentation

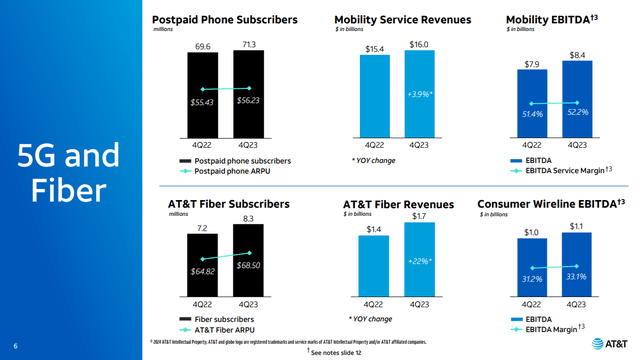

Mobility service revenues were up 3.9% and EBITDA hit $8.4 billion with stellar margins.

AT&T Q4-2023 Presentation

AT&T managed to expand even wireline EBITDA in the consumer section. If you remember the big discussion about their free cash flow after their Q2-2023 results, you would remember that AT&T had stuck to their line that they would hit their targets. Well they just did.

AT&T Q4-2023 Presentation

Even with our elevated levels of investment, we delivered better-than-expected full year free cash flow of $16.8 billion, which is above our previously raised guidance.

Furthermore, we achieved this significantly higher free cash flow while simultaneously reducing our short-term obligations. We reduced our vendor financing obligations by $3.3 billion in 2023, all while making more than $2 billion of nonrecurring spectrum clearing payments. With a year-end net debt to adjusted EBITDA ratio now below 3x and the improved flexibility in 2024 to dedicate more cash to debt reduction, we are confident in our path to achieve the 2.5x range in the first half of 2025

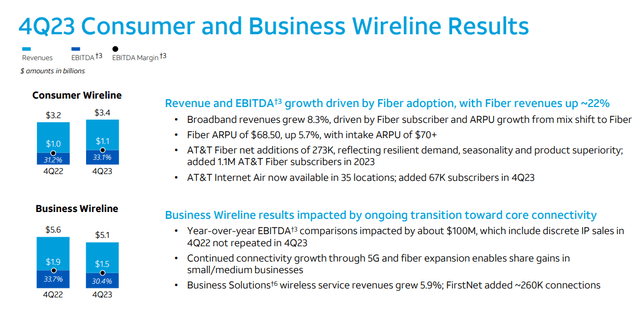

As usual the relative weak spot was the dying business wireline. No shocker there as revenues dropped from $5.6 billion to $5.1 billion and margins continued to churn lower. Whatever case you make for AT&T, you have to know that this will eventually whittle down year after year.

AT&T Q4-2023 Presentation

But as it does get smaller, the relative impact moves lower

2024 Outlook

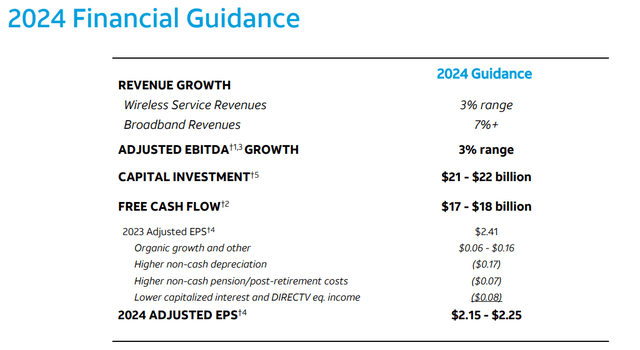

The 2024 financial guidance likely spooked some bulls as the stock initially moved lower on the announcement. The sticking point likely was the drop in adjusted EPS relative to where analysts had pitched their tents. But how did we get there? After all, if AT&T was going to give you 3% EBITDA growth AND reduce debt, surely adjusted EPS should move up at least that briskly. There were specific detractors identified and the biggest one was a higher level of depreciation being charged.

AT&T Q4-2023 Presentation

Keep in mind that this is adjusted EPS (not GAAP) and AT&T has some leeway as to what it charges where. It could have also “adjusted” these numbers lower if it deemed necessary. But the higher charge was likely felt as a correct treatment and this pushes EPS down about 10% at the midpoint. Of course the number any real analysts was concerned with was the free cash flow figure. Here there were a few headwinds relative to our own forecast. We expected capital expenditures to be dialed down substantially, and we had not anticipated the higher taxes. Nonetheless, the overall figure was still pretty solid.

Turning to free cash flow. Here’s what to consider for 2024. First, we expect adjusted EBITDA growth in the 3% range. We also expect cash taxes to be up about $1.5 billion based on current tax law. As we look out to 2025, we would anticipate cash taxes to increase around $1 billion over 2024.

We expect 2024 capital investment levels in the $21 billion to $22 billion range.

When you combine all these factors, we expect to deliver free cash flow in the $17 billion to $18 billion range this year. This is greater than 2x our current annual common dividend and more than enough to cover other commitments. As we discussed in recent quarters, we continue to make progress on improving the ratability of our free cash flow. Last year, our free cash flow was about 70% back-end loaded to the second half. We expect that to be closer to 60% this year.

Source: AT&T (Q4-2023 Conference Call Transcript)

Verdict

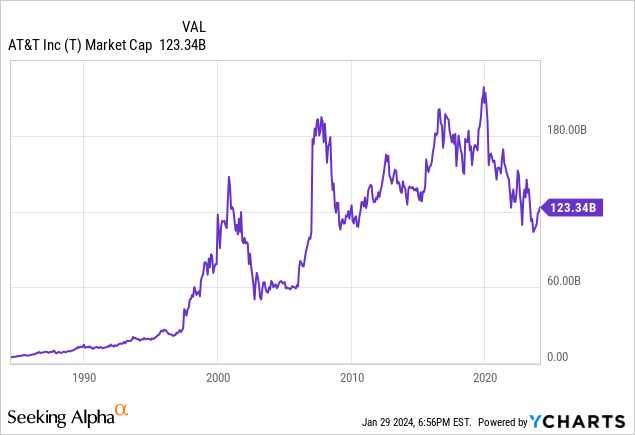

That is the market capitalization and you have the free cash flow amount above.

That would be an exceptional free cash flow yield and likely would draw crowds if it were not for two factors. The first being that AT&T did cut its dividend and even if it was a stealth cut, it did alienate most of the income crowd. The second factor is that the debt load is still a tad high, even for an oligopoly. On that note, we actually don’t expect AT&T to reach the 2.5X debt to EBITDA by middle of 2025, but it will get there eventually and the execution has been really good so far. We continue to rate the shares a buy and are sticking to our earlier fair value of $21 per share. In the shorter term the stock has had a nice run and we expect some pullback. For new positions we would aim to buy in the $15.50-$16.00 range.

The Preferred Shares

AT&T has two sets of preferred shares.

1) AT&T Inc. 5% DEP RP PFD A (NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:T.PR.C)

We had previously looked to buy both if they did have a stripped yield over 7%. Both came close, but neither hit the mark. Currently, they are yielding around 5.76%, an amount we think makes them insanely expensive. We actually rate both of them as a Sell, on relative valuation. There are far better prospects in preferred land and securities rated higher, actually yield more than these.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with a 11 month money guarantee, for first time members.