Summary:

- AT&T’s post-earnings surge last week was quickly reversed, leading to a selloff and catching late buyers off-guard.

- The pullback may provide investors with a more favorable risk/reward opportunity to add exposure to AT&T.

- Despite concerns about its topline growth and leverage ratio, the company’s strong Q3 performance suggests that the worst may be over.

- I explain why this week’s selloff is justified, as AT&T’s growth normalization phase carries higher execution risks.

- Despite that, I argue why the risk/reward profile has improved with the selloff, providing a better opportunity for dip-buyers to buy more shares.

Anne Czichos

What a week for AT&T (NYSE:T) investors, as its post-earnings surge last week was quickly digested by astute sellers. Accordingly, AT&T reported its third-quarter or FQ3 earnings on October 19, as management upgraded its FY23 free cash flow or FCF and adjusted EBITDA guidance.

As such, it led to a momentum spike and a bull trap (false upside breakout), as astute AT&T sellers forced a selloff at the $16 level, stemming further upside. Accordingly, T has fallen below the lows of its post-earnings surge, catching last week’s late buyers off-guard as they turned bullish at the worst possible moment.

With T inching closer to its early October lows, I believe it’s opportune to update investors about whether the pullback this week provides a more favorable risk/reward opportunity to add exposure.

I last updated AT&T holders in late August, urging them “not to lose sight of the prize.” As the market was still relatively pessimistic then, I gleaned that it was timely to buy more shares, as T’s price action turned more constructive.

As such, I’m increasingly confident that T struck its long-term bottom in July 2023, as investors fled to the hills following the Wall Street Journal’s disclosure of its lead-sheathed cables challenges. However, that capitulation also led to a sharp bullish reversal, attracting high-conviction dip-buyers confident that the fears were overstated.

Moreover, AT&T posted a solid Q3 earnings scorecard bolstered by a solid growth momentum in the consumer business. Accordingly, AT&T delivered a 9.8% growth in its consumer broadband business, supported by its Fiber revenue increase of nearly 27%.

In addition, AT&T also garnered a 3.7% increase in wireless service revenue while posting robust postpaid net adds of 468K, up from 326K in Q2. As such, the resilience in its consumer business has likely given management confidence to upgrade its FY23 FCF guidance to $16.5B. The company also revised its adjusted EBITDA growth outlook upward to “at least 4%.”

The company’s strong performance has given me more confidence that we have likely seen the worst in T’s most significant battering in years, as it bottomed out in July 2023.

Despite that, last week’s bull trap suggests dip buyers weren’t keen to maintain their exposure, using momentum spikes as opportunities to take profit. However, considering T’s nearly 13% surge from its early October lows through last week’s highs in price-performance terms, I believe the selling is justified. Why?

Although AT&T is embarking on a more profitable growth phase as it aims to improve the quality of its customers, it could also affect its topline growth. Seeking Alpha’s “D-” growth grade corroborates my concerns. While the company’s best-in-class “A+” profitability grade should help defend against its competitive advantage, AT&T remains in the investment phase.

Analysts’ estimates suggest that AT&T’s CapEx spending could slow to $18.3B in 2024 before decelerating to $18.1B by 2025. However, it still represents nearly 15% of its FY25 estimated revenue, suggesting that spending remains elevated. Although management is confident that its FCF profile is expected to improve further, given the lower CapEx effect, it’s under pressure to further reduce its adjusted EBITDA leverage ratio.

As such, with a much slower topline growth, I still expect T to be placed in the penalty box as investors assess its ability to reduce its leverage ratio to 2.5x by FY25 while mitigating the higher cost of capital as part of its CapEx buildout. In other words, I expect T to remain relatively undervalued, as execution risks are expected to remain elevated.

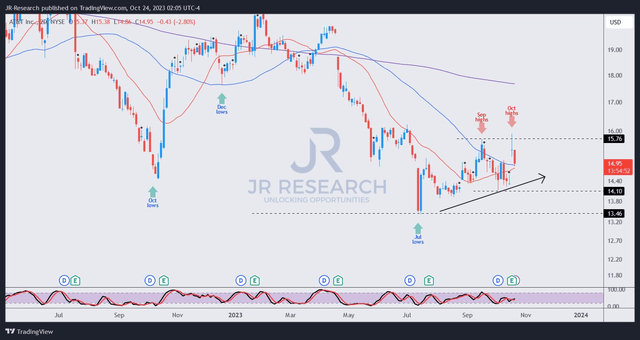

T price chart (2-Day) (TradingView)

As seen above, T formed its July 2023 lows at the $13.5 level and hasn’t looked back.

I gleaned that its buying sentiments have improved over the past three months as T buyers attempt to regain control of its short-term uptrend.

Last week’s bull trap at the $16 level has likely digested some near-term buying optimism, helping to improve the risk/reward for dip buyers looking to add.

Despite that, I must highlight there’s no price action validation of an optimal entry zone. However, I expect T’s October lows ($14 level) to hold if the uptrend recovery thesis remains intact. I will revisit my thesis if that level is breached decisively by intense selling pressure.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!