Summary:

- AT&T Inc. is the largest holding in my portfolio, with a 6.6% yield and undervalued shares.

- The Business Wireline division of AT&T is in decline, with revenue and profits falling over the past five years.

- Management is addressing the decline by focusing on growth in other parts of the company, such as fiber and mobile operations.

Brandon Bell

Those who follow my work closely understand that telecommunications conglomerate AT&T Inc. (NYSE:T) is the largest holding in my portfolio, accounting for just over 19% of my invested assets. I regularly rate the company a “strong buy” in the articles that I write about it and, whenever shares do drop, I do my best to dollar cost average lower. All the while, I sit back and collect the 6.6% yield that I have baked into the stock. Although I am currently down on this position, I remain adamant that shares are drastically undervalued, and I believe that the long-term outlook, given the tremendous cash flow the company generates, should be quite appealing. But this is not to say that everything about the company is great.

As a massive and old telecommunications conglomerate, the company does have certain assets that are past their prime. These are entire lines of business that are in secular decline and that will continue to see their financial results worsen from year to year. It is because of this decline that the business ekes out only modest growth on an organic basis. To put this into context, during the second quarter of its 2023 fiscal year, the $29.9 billion in revenue the company generated from continuing operations represented an increase of only 1% compared to the $29.6 billion the firm generated one year earlier.

But I digress. For now, these legacy assets are something that the company is stuck with. And they certainly do serve as a negative for shareholders who want growth and growing cash flows. One really good example here is the Business Wireline unit of the enterprise. And for anybody focused on the long-term outlook for the company, this is a piece of the business that should continue to be under observation.

A dying operation

Operationally, AT&T only has two different segments. It used to have more, but management has worked to divest certain operations, such as the WarnerMedia segment that has been split off and merged with Discovery to create Warner Bros. Discovery (WBD). The largest of the two remaining segments is the Communications segment, while the smaller is the Latin America segment. Beneath the umbrella that is the Communications segment, AT&T has three separate business units.

The first of these is the Mobility division, which focuses on the company’s nationwide wireless service and equipment activities. Next in line, we have the Consumer Wireline division. This part of the company provides broadband services to its residential customers, and it also offers legacy telephone voice communications services. Although this might seem like a dying part of the company, revenue has actually increased over the past three years and, while lumpy, profits have at least avoided consistent year-over-year declines.

While a great deal could be written about either of these two divisions, neither one is the focus of this article. Our focus lies in the third, which is called the Business Wireline division. Through this unit, the company provides its business customers with Ethernet-based fiber services, IP voice and managed professional services, and traditional voice and data services. Any equipment that is necessary for these operations is also included in this division.

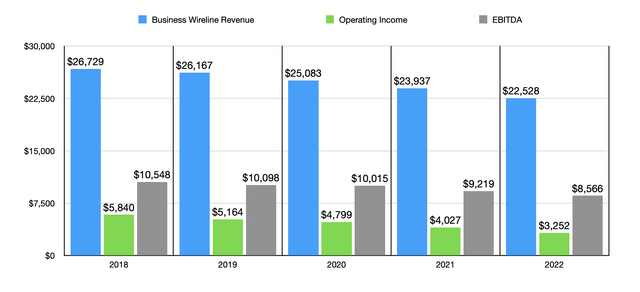

It’s probably not too difficult to imagine that the Business Wireline division of AT&T will likely be doomed at some point in time. However, operations have proven to be fairly resilient when you look at how they have performed over the past few years. Take revenue as an example. In each of the past five years, revenue has fallen compared to the year before. Back in 2018, for instance, the division generated revenue of $26.73 billion. By 2022, it had fallen to $22.54 billion. Along the way, profits have also taken a beating. But the decline on that front has been far greater. Operating income, for instance, fell from $5.84 billion to only $3.25 billion over the same five-year window. Meanwhile, EBITDA managed to drop from $10.55 billion to $8.57 billion.

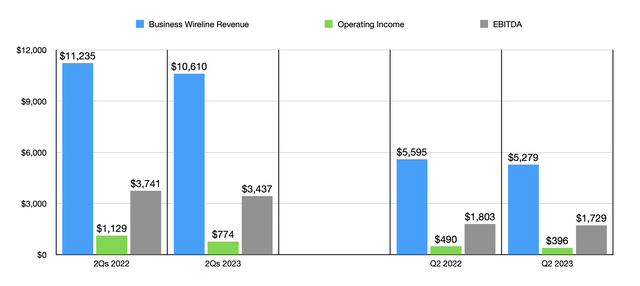

That weakness has continued into the current fiscal year. In the first half of 2023, revenue associated with the Business Wireline division totaled $10.61 billion. This represented a decline of 5.6% compared to the $11.24 billion generated one year earlier. Operating income went from $1.13 billion down to $774 million. And over that same window of time, EBITDA dropped from $3.74 billion to $3.44 billion. In the chart below, you can see not only this data, but also data for the second quarter of 2023 on its own. Truly, there is no reprieve in sight.

Management has been very open and honest regarding this segment. Back in 2022, for instance, CEO John Stankey said that there was a lot of secular pressure being put on this division, largely because of Legacy voice and data services, and how the demand for them was changing. Competition from mobile-focused platforms like Zoom and Teams also served to eat away at the company’s lunch. Even on the data front, there was an impact when it came to VPN services and related offerings because of technology transitions in the direction of software-based solutions. And at that time, about half of that division’s revenue came from those types of services.

To some investors, seeing such a large and permanent decline in such a significant part of the company might be one reason to be bearish on the business. However, there are some bright spots here to look at. For starters, in the most recent earnings conference call, management stated that the Business Wireline division’s decline is being addressed by growth in other parts of the firm. Though a specific financial breakdown has not been provided, the company has said that its business solutions wireless service revenue jumped 9.1% in the most recent quarter compared to the same time last year. The company’s FirstNet initiative, which is something I have written about in prior articles, was a big driver of growth during this time, with total connections growing around 350,000 on a sequential basis.

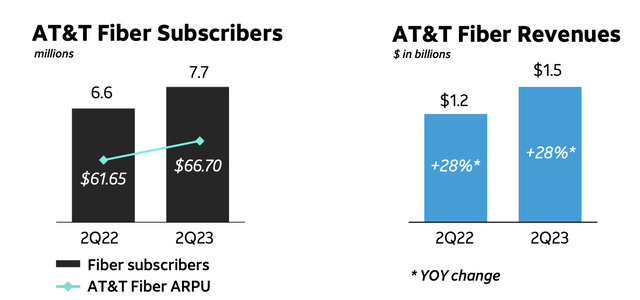

As a whole, management’s plan is to continue funneling its Business Wireline customers over to its fiber and mobile operations. Fiber has been a particularly fast-growing part of the conglomerate. As of the end of the most recent quarter, there were 7.7 million subscribers to these operations. That was up from the 6.6 million reported one year earlier. In addition to seeing growth from a user perspective, ARPU, or monthly average revenue per user, jumped from $61.65 last year to $66.70 this year. That helped overall fiber revenue expand from $1.2 billion to $1.5 billion year over year.

Of course, the company is lumping together business and non-business customers into its operations now, so we won’t fully know what this transition will be like for business customers on the whole. But the important point to take away from this is that the old, dying legacy businesses within the conglomerate, while serving to drag down growth, are being wound down in an orderly manner as the company uses its newer, more exciting, and frankly more valuable, operations to keep those customers as part of its ecosystem.

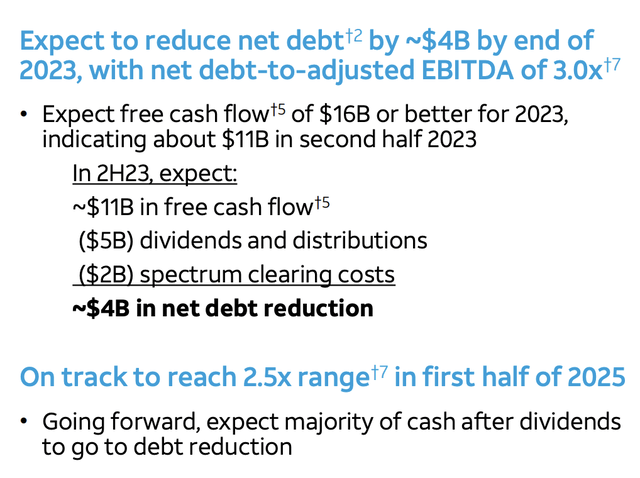

As a testament to the company’s health as a whole, its CFO, Pascal Desroches, recently reiterated the company’s goal of hitting or exceeding its $16 billion free cash flow target for the 2023 fiscal year. And while capital expenditures are still expected to hit around $24 billion this year, the company is moving to decrease this spending in the not-too-distant future, targeting capital expenditure rates that will be in the mid-teens. That should leave even more cash flow for shareholders to enjoy, whether in the form of increased dividends, share buybacks, or additional debt reduction.

Takeaway

All things considered, I still remain incredibly bullish on AT&T. It is a very healthy company that generates tremendous amounts of cash. Leverage is far from being out of control and, absent anything unexpected occurring, I fully expect the company to go on to create real value for its investors down the road. Yes, the Business Wireline division is a problem and that picture is set to continue. But there are other parts of the company that are doing the heavy lifting and making up for this. Eventually, this division will wind down entirely, though that will take some time. In the meanwhile, enjoying the company’s stable growth and robust cash flows is a great way to spend time.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!