Summary:

- AT&T’s stock price is near 52-week lows despite reaffirming its free cash flow guidance and strong performance in its broadband core business.

- The company’s subscriber base and broadband revenues are growing, driven by investments in its broadband business.

- AT&T’s dividend is safe and well-covered by free cash flow, and the company has the potential to gradually reduce its debt burden over time.

Brandon Bell

AT&T Inc. (NYSE:T) is trading near 52-week lows despite reaffirming its free cash flow guidance and producing robust momentum in its broadband core business in the second quarter.

AT&T’s stock price weakness is hard to explain considering that the company reaffirmed its $16 billion free cash flow target and that AT&T is set to make more progress moving forward in terms of debt reductions.

Previously, I judged AT&T’s dividend to be safe, though some investors disagree with this assessment. However, I am more confident than ever that the dividend is safe and expect AT&T to make considerable progress in terms of balance sheet repair in the coming years.

Thus, I think investors have reasons to be optimistic as AT&T gradually pays down its net debt, and I have increased my position in AT&T by 150% near 52-week lows.

Rating History On AT&T

I consistently believed AT&T has been, and still is, a good deal for passive income investors purely based on the company’s rather good dividend coverage which is why I have consistently evaluated AT&T as a Buy.

In my February article, AT&T Proves The Market Wrong, I pointed to the company’s strong value proposition for passive income investors despite growing fears about the company’s dividend. Since February, AT&T has lost about one quarter of its market value, largely because of investor concerns about the company’s free cash flow. While I was mistaken about an entry into AT&T’s stock, I think that the underlying arguments still favor an investment in AT&T.

Furthermore, I think that AT&T could make considerable progress in the coming years in terms of repaying its net debt which is yet one more reason to scoop up AT&T near 52-week lows.

Passive Income Investors Should Sleep Well After AT&T Reaffirmed Its Free Cash Flow Forecast

AT&T is a much better deal than many passive income investors realize, and the stock price trend of the last 4 months hasn’t really changed this.

The main reason is that AT&T’s guidance for 2023 should have reduced uncertainty and investor skepticism after 2Q-23, but the company has not achieved this, despite reaffirming its $16 billion free cash flow target.

With $16 billion in estimated free cash flow this year, AT&T has, with its present annual dividend of $1.11 per share, approximately 200% dividend coverage. Since AT&T has mentioned that it seeks to seek out another $2.0 billion in incremental cost savings (in addition to the $6 billion already achieved), I think AT&T’s free cash flow guidance could have some upside.

What I think could drive a change in investor sentiment and a re-rating of AT&T’s stock price is progress in terms of debt repayments.

Net Debt Could Fall Closer To $100 Billion In The Next Five Years

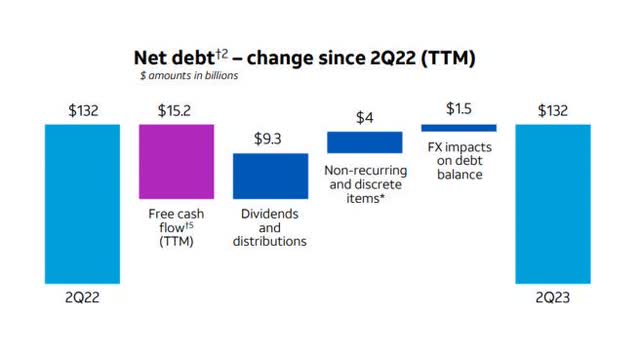

AT&T is set to lower its debt burden which is starting to be a real thorn in investors’ sides. Large debt overhangs imply dividend uncertainty, but AT&T could throw as much as $4 billion at its net debt in 2023, with more to come in the following five years.

In the last three years, AT&T has lowered its net debt by more than $20 billion and I think a $4-5 billion annual debt repayment is realistic for AT&T moving forward.

Planning with $16 billion in free cash flow annually, AT&T could pay the dividend of $8 billion, keep $3-4 billion for capex which would leave the company with $4-5 billion in excess free cash flow that could be thrown at its net debt.

As such, AT&T could lower its net debt from presently $132 billion to $105 billion by 2028, a decline of 20%+, without reducing its dividend. AT&T could surely decide to prioritize debt repayments over its dividend payments and cut the dividend, but it would only further alienate passive income investors. I, therefore, think that management would not choose this route unless it had no other options.

AT&T’s large amount of debt comes at a heavy price that the company is paying today. In the first six months of 2023, AT&T paid $3.3 billion in interest expenses. A 20% reduction in net debt, as I discussed above, could lead to more than $1 billion in run-rate annual interest savings by 2028. Hence, AT&T would not only deleverage its balance sheet but also enhance its free cash flow position which in turn could lead to better dividend coverage and a safer dividend.

This back-of-the-envelope calculation, however, does not consider incremental improvements made to the cost structure and does not consider organic free cash flow growth, meaning AT&T could ultimately throw much more cash at its net debt problem than now seems feasible. AT&T guided for $2 billion in additional cost savings in July which comes in addition to the $6 billion in cost savings that have already been realized.

To put it simply, AT&T has considerably more potential to deleverage its balance sheet than the $4-5 billion that I used for illustration purposes. Hence, I would not consider it implausible if AT&T’s net debt dropped to below $100 billion in the next five years.

AT&T‘s Dividend Is A Steal

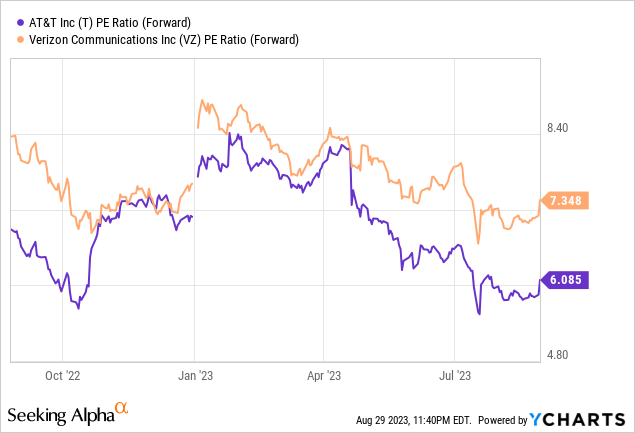

AT&T’s low P/E ratio has attracted investors in the past, including me. As passive income investors have lost confidence in AT&T’s dividend, the yield has surged to 7.6%.

Since I don’t think that the dividend will be on the chopping block in the near term and AT&T’s P/E ratio has fallen to 6x, I think AT&T makes an impressive valuation proposition in spite of the broad deterioration of investor sentiment.

Both Verizon (VZ) and AT&T look like appealing yield bets at the moment. Taking into account that AT&T’s dividend is even cheaper than Verizon’s, AT&T remains my top telecommunications bet.

Why My Assessment About AT&T Might Be Wrong

AT&T cut its dividend last year by nearly half to $1.11 per share in light of the WarnerMedia spin-off, so the company does have an incentive to avoid a second dividend cut as it would undoubtedly hurt the company’s standing in the passive income investor community.

If AT&T failed to cover its dividend with free cash flow or lowered its forecast, leading to weaker dividend coverage, I would have a good reason to revisit my investment thesis about AT&T.

My Conclusion

Considering that AT&T is still seeing substantial revenue and subscriber growth in the Fiber segment and reaffirmed its free cash flow forecast for 2023, I cannot understand why passive income investors would drive the stock near 52-week lows. In my view, the dividend is safe and well covered by free cash flow.

Though the company has to deal with a lot of debt, I think passive income investors underestimate AT&T’s potential to gradually and systematically lower its net debt over time without putting the dividend on the chopping block.

With $4-5 billion in annual net debt reductions moving forward, AT&T could lower its total net debt by 20% until 2028 and unburden its balance sheet considerably.

The technical setup is also negative, which I, as a contrarian investor, like very much. The P/E ratio is 6x and the yield has risen to 7.6%. Taking into account the reaffirmed free cash flow target, I think selling now would be a big and regrettable mistake.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.