Summary:

- The management team at AT&T will be announcing on April 20 financial results covering the first quarter of the company’s 2023 fiscal year.

- Investors should pay attention to headline news items, but a good amount of emphasis should also be on the company’s growth initiatives.

- The stock is very cheap at this time and debt is likely to decline, making the company a great prospect to consider.

Tim Boyle

Earnings season for any company marks one of the four times of the year that the firm in question provides a significant update regarding how things are progressing operationally. It’s during these times that investors have the best chance to generate upside. Simultaneously though, it’s also during these times when the greatest risks typically arise. What a firm reports will serve as a barometer of its overall health and it will often set the stage for how investors view the company over the next few months. Right around the corner, one company that is slated to announce financial results covering the first quarter of its 2023 fiscal year is telecommunications conglomerate AT&T (NYSE:T). As a massive player that has undergone a significant transformation in recent years, a great deal of attention will be levied on the company, from investors and the investment community more broadly. Leading up to that point, I do believe that investors have a lot of good things to look forward to. The firm is incredibly healthy at this moment, even though it does have a good deal of debt on its books. Absent something significant popping out of the woodwork, I do believe that investors are likely to benefit from whatever management does detail.

A look at expectations

I run a very concentrated portfolio that currently consists of 10 different stocks. My fourth-largest, accounting for 10.9% of my holdings, happens to be AT&T. Since acquiring my initial stock in the company in March of last year, shares have generated upside for investors, including dividends, of 22.4%. Of course, I bought shares over a window of time as cash came in and that has brought my return down since I was buying during its ascent. But in all, I’m doing just fine, especially compared to the market more broadly. Of course, this picture can change at any moment. So you can imagine both my excitement and the sense of caution that I bear as we near April 20th. After all, before the market opens on that day, the management team at the business will report financial results covering the first quarter of its 2023 fiscal year.

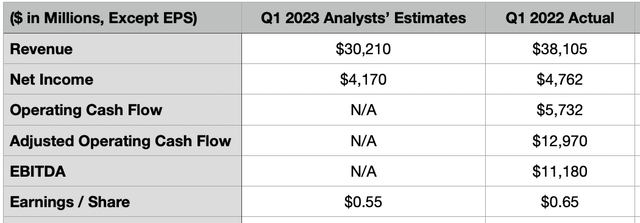

The primary focus, at first, of the investment community will likely be on the headline news. This will naturally center around revenue and earnings per share. On the revenue side of things, analysts believe that the company will report results of $30.21 billion. This actually would mark a significant decline from the $38.11 billion that management reported for the first quarter of the 2023 fiscal year. Although this may seem ominous, it is also important to keep in mind that the company has undergone significant changes over the past year or so. The most significant change was the company’s decision to spin off WarnerMedia and to merge it with Discovery to form Warner Bros. Discovery (WBD). In the first quarter of 2022, WarnerMedia was responsible for $8.74 billion worth of sales.

Although there were other changes to the picture, these would be harder to track and some may even be impossible to strip out of the company for the purpose of comparability. But if we just remove WarnerMedia from the fray, we would get revenue during the first quarter of last year totaling $29.57 billion. So if analysts are correct, that would translate to a year-over-year increase of about 2.2%. This may not seem impressive to many investors. But for such a massive enterprise in such a mature market, this would be considered quite appealing.

On the bottom line, analysts are anticipating earnings per share of $0.55. That would work out to roughly $4.17 billion in net profits if the company’s share count has not changed materially from what it was at the end of the 2022 fiscal year. For context, earnings per share in the first quarter of last year totaled $0.65, translating to net income of $4.76 billion. Again, changes to the corporation are likely most responsible for this. After all, WarnerMedia on its own was responsible for operating profits of $1.32 billion at that time. Analysts have not provided guidance when it comes to other profitability metrics. But there are some that investors should pay attention to. For context, operating cash flow for the company in the first quarter of 2022 was $5.73 billion. Though if we adjust for changes in working capital, it would come in at $12.97 billion. Meanwhile, EBITDA for the company was $11.18 billion.

Keep an eye on growth

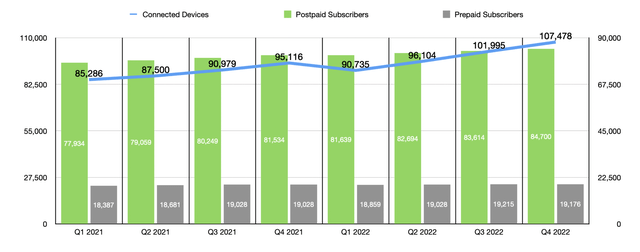

In my opinion, the key drivers behind any upside in revenue for the company would involve a few pieces of its core operation. One of these will be the Connected Devices unit, which largely centers around the sale of and subscription services for IoT (Internet of Things) devices like hotspots, modems, and more. Although specific financial data has not been provided regarding these specific operations, we do know that it has been a source of growth for the company in recent years. Even after losing several million devices because of its decision just stop supporting 3G customers, the company has continued to show remarkable growth in this area.

At the end of 2022, it boasted 107.48 million connected device subscriptions. That was up from about 102 million one quarter earlier and was 13% higher than the 95.12 million subscribers the company had the one quarter before the 3G connections were cut. If we strip out those 3G devices, year-over-year growth would have been 23.8%. Investors might say that this is an area where the company could see some weakness ahead. This is because of two primary things. First, it is undeniable that the COVID-19 pandemic accelerated the purchase of various connected devices because of the increase in demand for work-from-home solutions. Given that the economy is no longer being affected by that, and since much of that demand would have essentially been front-loading it from future years, it wouldn’t be surprising to see weakness moving forward. The other potential driver is the economy more broadly. As the economy shows signs of instability, consumers and companies might be less likely to pay for services like this.

Personally, I believe that any concerns on this front are overblown. The fact of the matter is that IoT is almost certain to continue growing for the foreseeable future. According to one source, the number of connected devices, globally, should have been about 13.1 billion last year. That compares to just 8.6 billion seen in 2019. And by 2030, that number is expected to expand to 29.4 billion. Though not exactly high growth, both postpaid and prepaid subscriber data will also be important for the company. For context, in the fourth quarter of last year, the company boasted 656,000 net additions under its postpaid phone activities. This was a rather significant increase compared to what analysts anticipated.

Other areas of growth for the firm will include its 5G and fiber networks. According to a speech given by the company’s COO, Jeff McElfresh, the company ended 2022 with 24 million fiber locations passed, with four million of those being business locations and the rest being consumers. The firm remains on track, management asserts, to hit 30 million by the end of 2025, with five million of those being business locations. And when it comes to 5G, the firm currently has the potential to reach over 290 million people across the US. Building up its customer base on this front will be incredibly important for its long-term trajectory.

Shares still look cheap

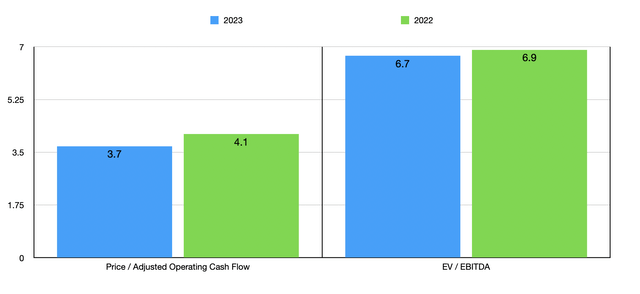

Despite shares rising nicely over the past year or so, the stock still looks very cheap in my opinion. Using the same calculations that I used the last time I wrote about the company, but factoring in its current market capitalization and enterprise value, I figured that the firm is trading at a forward price to adjusted operating cash flow multiple of 3.7 and at a forward EV to EBITDA multiple of 6.7. By comparison, using the data from 2022, would give readings of 4.1 and 6.9, respectively. To put this in perspective, rival Verizon Communications (VZ) is currently trading at a price to adjusted operating cash flow multiple of 4.5 and at an EV to EBITDA multiple of 6.4. These prices are similar to one another, but I would argue that both companies are attractively undervalued.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| AT&T | 4.1 | 6.9 |

| Verizon Communications | 4.5 | 6.4 |

Naturally, the picture for the firm could change based on guidance. For instance, the most recent guidance available called for operating cash flow this year of roughly $40 billion and free cash flow of $16 billion. In addition to potentially impacting the firm’s valuation, it could also impact the firm’s overall leverage. At the end of the 2022 fiscal year, AT&T had net debt of $132.32 billion. Although $16 billion in free cash flow is a great deal to work with, about $8.4 billion of this is slated to be used on distributions for shareholders. Assuming the company allocates all of this excess, which would be roughly $6.4 billion after stripping out non-controlling interests, it would allow overall net debt to hit $125.95 billion by the end of this year. That would imply a net leverage ratio of roughly 2.95, which isn’t great but is far from bad.

Takeaway

At this point in time, AT&T remains one of the top prospects in my portfolio. The company has done well over the past year or so and it remains in solid financial condition. Shares are pretty close to being fairly valued compared to rival Verizon Communications. But I would make the case that the space as a whole looks to be much cheaper than it should be. Given these factors and given that I don’t see anything significantly negative coming around the corner, I do believe that the stock is still materially undervalued. And because of that, I’ve decided to keep my ‘strong buy’ rating on the firm for now.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!