Summary:

- AT&T Inc. will be reporting Q1 FY23 results before markets open tomorrow, April 20.

- Investors may want to keep a close eye on AT&T Inc.’s segment revenue, churn rate, subscriber growth and management’s outlook.

- AT&T continues to be relatively undervalued and is a good buy for long-term investors.

RiverNorthPhotography

AT&T Inc. (NYSE:T) is scheduled to report its Q1 FY23 results before markets open on Thursday April 20. Investors would be curious to see how its revenue fluctuates given that we’re in a recessionary environment. But in addition to monitoring its headline revenue figure, investors may also want to keep a close eye on its churn rate, subscriber additions, segment financials and management’s outlook for the year ahead. These items will better highlight the company’s near-term prospects and are likely to influence where its shares will head next.

Operating Metrics to Watch

Let me start giving credit where it’s due. AT&T has maintained one of the highest levels of capital expenditures in the telecom industry over the past decade, paid out steady dividends and grown its business along the way. They’re now aggressively rolling out 5G services nationwide and it’s blowing relatively smaller competitors, out of the water. This is a commendable feat and an enviable position to be in.

But with that said, we’re on the cusp of a recession and personal disposable incomes are trending down of late. The first order of business, for investors, should be to assess whether AT&T is affected by this ongoing macroeconomic turmoil. We can start by looking at AT&T’s churn rates to get a sense of that.

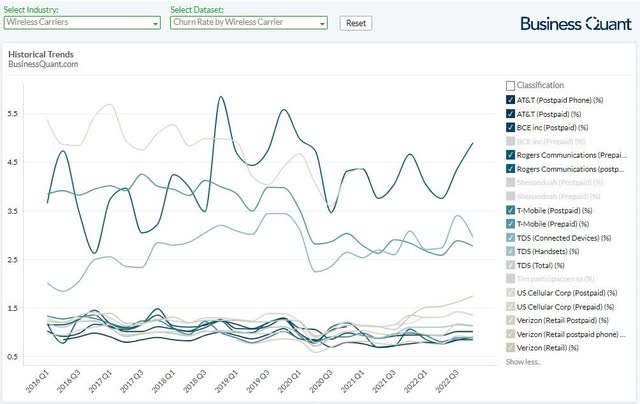

For the uninitiated, churn is basically the rate at which existing subscribers disconnect their services with a telecom company. Higher levels of churn indicate that subscribers are leaving in hordes as, perhaps, the network quality isn’t compelling enough. Conversely, low levels of churn indicate that subscribers are quite content with their telecom service provider and aren’t actively disconnecting their connections.

Ideally, it’s in the best interest of AT&T and its shareholders that their churn rate remains low. But with inflationary pressures weighing down on customer budgets, 5G rollouts heating up competition and some companies hiking their prices, churn rates rose for most wireless carriers in the last quarter. AT&T’s postpaid churn, for instance, rose to 1.01% in Q3 FY22 and remained elevated in Q4 FY22.

My guesstimate is that AT&T’s churn rate would remain elevated, or it’ll decline by 2-5 basis points at best sequentially in Q1 FY23. My rationale is that the broad swath of disgruntled price sensitive subscribers would’ve disconnected their connections by now so there’s room for up to 5 bps improvement in churn. But it’d be a pleasant surprise to the Street if AT&T is able to lower the churn by a greater magnitude in Q1. It would signal that the worst is over for the telecom giant and that its existing subscriber base is now very stable.

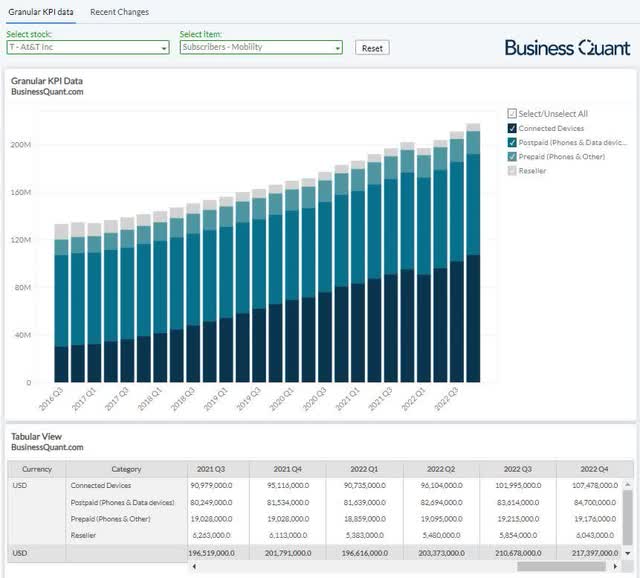

Secondly, pay close attention to AT&T’s subscriber count as well. The telecom giant has been investing aggressively to expand its 5G wireless network nationwide with the expectation that it would grow its subscriber base rapidly and bring in windfall revenue. The company has been successful in this area, with wireless subscriber base expanding by leaps and bounds over the past few quarters. So, I expect this momentum to continue in believe that AT&T will add 5-10 million wireless subscribers during Q1 FY23.

At the same time, any material slowdown in its subscriber growth trajectory would imply that its 5G rollouts aren’t as lucrative as the company and its shareholders are perceiving, which could trigger a sharp selloff in the stock. So, look for official subscriber figures in AT&T’s upcoming earnings report.

With that said, let’s now shift focus to AT&T’s financials.

Bifurcated Financials

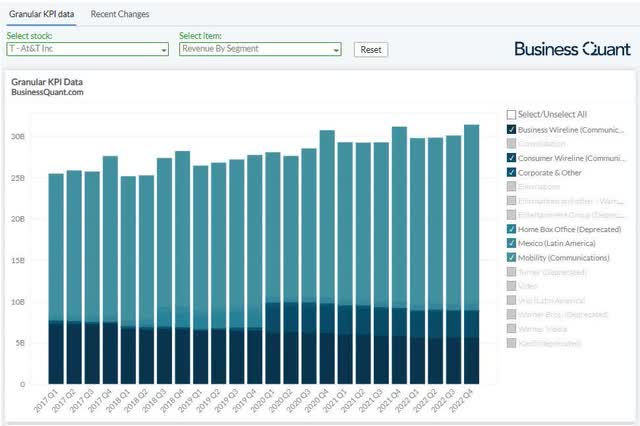

It’s worth noting that AT&T generates revenue from 5 sources altogether. Its Mobility division is by far the largest in terms of revenue generation, accounting for nearly 69% of the company’s total revenue last quarter. This segment includes revenue from nationwide wireless services as well as handset sales, wireless data cards, wireless computing devices and phone accessories.

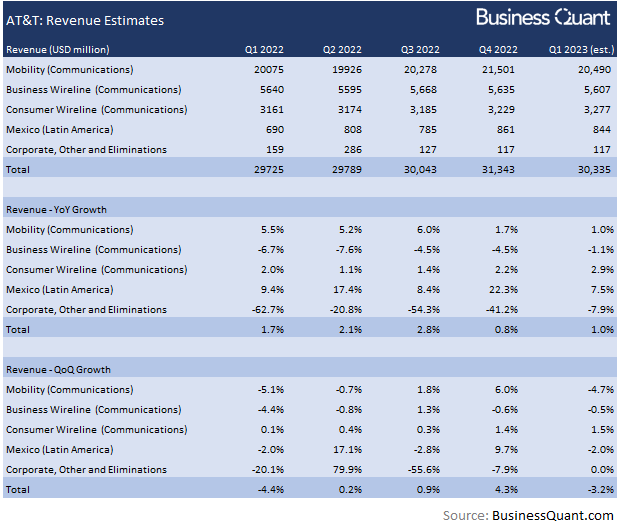

As handset business is cyclical in nature, typically peaking around the holiday season in Q4 each year, AT&T’s mobility revenue fluctuates in tandem with this underlying industry dynamic. To put things in perspective, AT&T’s mobility revenue has dropped between 4.8% and 9.5% sequentially in prior Q1’s of the past 5 fiscal years. I expect to see a similar revenue drop on the mobility side this time around as well, with mobility revenue down 4.7% sequentially and the actual figure coming in around $20.49 billion for the quarter.

Moving on, AT&T’s Business Wireless segment is the second largest source of revenue for the company, with sales contribution to the overall top line approaching nearly 18% last quarter. This segment has been registering sequential sales declines for the past several quarters and there aren’t any material catalysts at play that would drastically alter the trajectory. At best, I estimate the pace of sequential sales decline to slow down to just 0.5% during Q1, with revenue amounting to $5.6 billion, driven by greater geographical footprint and better pricing mix.

Its consumer wireline business, on the other hand, might very well post a sales acceleration. The segment has seen sequential revenue growth accelerating from 0.1% in Q1 2022 to 1.4% in Q4 2022 largely on the back of aggressive fiber broadband rollouts in existing and new geographical markets. I expect this trend to continue and drive AT&T’s sequential revenue growth higher to 1.5%, with revenue amounting to $3.27 billion during Q1 FY23.

AT&T’s Mexico and Corporate segments contributed just 3.1% to the overall top line last quarter and they don’t have any catalysts at play that would fundamentally make them material revenue drivers anytime soon. So, I’m estimating their sales to more or less remain flat sequentially.

This brings us to a company-wide revenue estimate of $30.33 billion for Q1 FY23, up 1% year over year and down 3.2% sequentially. My estimate is coincidentally within the Street’s estimate range that currently spanning from $30.26 billion and $30.72 billion for the quarter.

BusinessQuant.com

Lastly, we don’t know if the telecom giant will be able to justify its pricey fiber and 5G offerings for long, amidst intensifying inflationary and recessionary pressures that are straining consumer budgets every month. So, pay close attention to AT&T management’s outlook for Q2 FY23 and for FY23 in general.

Final Thoughts

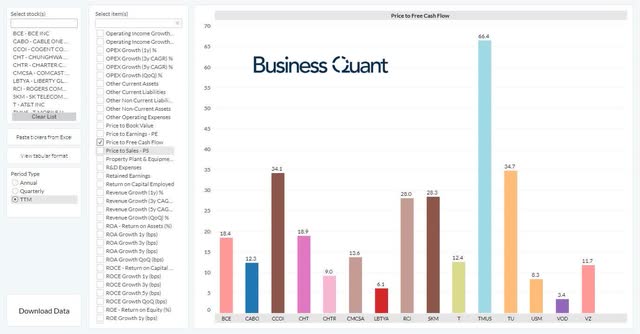

AT&T Inc. shares are trading at 12-times its trailing twelve-month free cash flow. This may seem high in isolation, but it’s actually quite low when compared to other prominent telecom companies. This relative undervaluation suggests that AT&T is fairly and even undervalued at current levels, with limited downside potential and ample headroom to rally.

Having said that, bear in mind that AT&T is the first major telecom company to report Q1 CY23 results which means we don’t have any industry comparables to use as benchmarks. This makes it all the more important for investors to track AT&T’s bifurcated financials, churn rate, subscriber additions and management outlook to gauge its operating performance and near-term prospects. As far as I’m concerned, I remain bullish on AT&T Inc. as outlined in my prior article here. Good Luck!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.