Summary:

- AT&T’s Q2 results were in line with market expectations, showing stability and slight growth.

- The company delivered strong FCF performance, redeeming itself from a weak prior quarter.

- While AT&T is a stable dividend stock, its prospects for material growth and capital appreciation are low.

Anne Czichos

In the past couple of months I have digged deep to provide you with my analysis and views on AT&T’s (NYSE:T) dividend play and the Company’s growth prospects to potentially capture some incremental gains from price appreciation on top of the ~8% yielding dividend.

In the article “Demystifying The Sustainability Of AT&T’s Dividend” I made it clear that despite temporarily excessive dividend distributions relative to the FCF generation, T can be safely viewed as a stable dividend stock, where yield-seeking investors can count on the ~8% distributions.

However, in the follow-up article “AT&T: Bad Choice For Rational Investors” I made a well-rounded assessment indicating that the prospects of multiple expansion and stronger earnings are rather weak due to T’s focus on de-risking of its balance sheet, while the need for CapEx is rising. In addition, the competitive landscape in both the conventional telco and promising 5G space is getting more intense due to T’s peers stepping up their investment ambitions, potential entrance of Amazon (AMZN), and already weak positioning in the 5G market relative to the other operators.

(P.S., there are a lot of more details backing my thesis outlined in the article that I have not mentioned here.)

All this boiled down to my final conclusion that T is nothing more than just a pure-play income stock without any material growth component attached.

Now, a few days ago T circulated its Q2 earnings and since the publication of my aforementioned articles there have been some interesting news. So, I think that it is worth contextualizing these items with my thesis and give you a color on how, in my opinion, T should be viewed by long-term investors.

I am certainly staying away from speculative or short-term trade ideas, which are based on technical indicators or general macro dynamics.

Synthesis of Q2 results and the corresponding implications on T’s equity story

In a nutshell, Q2, 2023 results of T were very much in line with the expectation of the market. If we look at the underlying performance, we see that T has managed to maintain stability and register some tiny growth that is sufficient to offset the consequences of higher interest costs.

Revenues were up by ~1% compared to Q2, 2022, which was mostly driven by the mobility service segment. The continuing operations EPS increased by ~3%, which signals that T has managed to keep the costs balanced and exercised its operational leverage.

An additional positive element (albeit which was already backed into the cake) was a positive rate of change in the quarterly FCF generation.

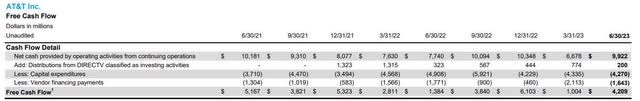

AT&T Investor Relations

In Q2, T delivered ~$4.2 billion in FCF before dividend distributions marking a second strongest quarterly performance since the beginning of 2022. It was very critical for T to redeem itself after shockingly weak FCF figure in the prior quarter that temporarily rendered FCF payout ratio considerably above 100%.

Nevertheless, as already mentioned, the Management had already guided the market that the Q1 situation was really just a temporary deviation due to the front-end loaded CapEx and vendor financing. Hence, we saw no major price reaction from seemingly tripled FCF number.

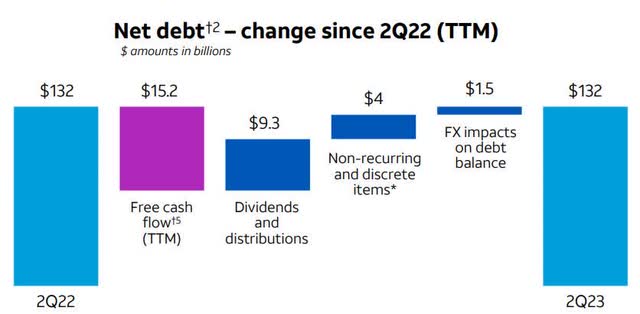

Plus, it is worth paying attention to the interest cost dynamics and how they evolve against the backdrop of restrictive interest rate environment and T’s ~$132 billion of net debt (or ~$143 billion gross debt).

Here, if we compare Q2, 2023 interest costs to those of Q2, 2022, we can notice the value of having well-structured debt maturities with a notable fixed rate component. Over this period, the interest costs have increased by only 7% or ~$100 million, while the SOFR has more than doubled.

AT&T Investor Relations

As we can see in the table above, T has managed to spread out its debt maturities well into the future at relatively attractive interest rates, having very limited pressure on the refinancing front.

This coupled with T’s aggressive intentions to de-leverage its balance sheet should make dividend-seeking investors comfortable that the future dividend streams are protected from higher interest rate environment.

Up until now I think it is clear that T has proven that it can deliver stable streams of dividends and that the risk of cutting current dividend of 8% is extremely distant.

However, on the growth side for investors who perhaps are considering T as an investment play to capture additional gains stemming from multiple expansion or earnings growth, the story does not look so promising. In fact, I would say that Q2 results have once again confirmed that the probability of T’s capital appreciation is rather low.

There are several reasons for this, but the main three ones are the following:

First, while performance-wise T registered a positive movement in the rate of change terms, on an absolute level these QoQ improvements did not really move the needle. This just shows how difficult it is in this industry to achieve meaningful growth, when peers are investing heavily and the prospects of 5G value-creation are still unclear.

Second, at the same time consensus estimate on the 2023 and 2024 EPS implies a growth of ~4% (relative to H1, 2023) and ~2.5% (relative to EPS estimate). For T to generate solid total returns for its shareholders it has to exceed this growth trajectory, which in the context of the most recent quarterly results and very tough competition seems rather challenging.

Third, maybe adding on top of the second reason, we have to remember that T is consumed with the efforts to optimize its balance sheet. As elaborated in my previous article, this per definition will put a cap on T’s ability to make accretive investments at a large scale to maintain its market share and tap into the 5G IoT potential.

Plus the movement in the net debt dynamics really is not that promising despite T’s efforts to decrease leverage. The key reasons for this have been the extraordinary items associated with the divestitures processes. Granted, these should not occur going forward, but it does not change the fact that there is still a long way to go (until H1, 2025 according to the Management) to reach a state of equilibrium in its balance sheet.

AT&T Investor Relations

While writing this article an interesting news popped up pertaining to the US Cellular (NYSE:USM) plans to potentially sell all or a portion of its assets to strategic investors such as T and Verizon (VZ), T-Mobile US (TMUS), and DISH (DISH). Accessing and consolidating some of the wireless infrastructure would most certainly enhance the competitive positioning of any major telco player.

Given T’s publicly announced commitments to its dividend policy and balance sheet optimization, I do not see how T could enter such transaction without sacrificing any of the two objectives. It is too early to speculate, but my base case is that T will just avoid this opportunity due to already poor reputation on delivering on its promises.

Final words

Q2 has not delivered any surprises to investors and has not changed my thesis on T’s equity story. The stock remains a hold for dividend-seeking investors, but investors who are more opportunistic and seek better total returns in the long-run should avoid committing any part of their portfolios to T’s stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.